Past performance is no guarantee of future returns. We see this, or words to that effect in every mutual fund perspective or almost any investment advertisement.

Why?

It’s the law. It’s meant to protect investors like us. Read more here from thebalance.com

Can be Helpful…

I appreciate that the good folks at The Balance included the note that it can be helpful.

When you think about how we evaluate just about everything, we always look at past performance.

Looking for a job? They’ll ask you for a resume (that documents your past performance). The employer may call references to ask how you performed. At my last job, they did a background check before I started. Looking into my past performance.

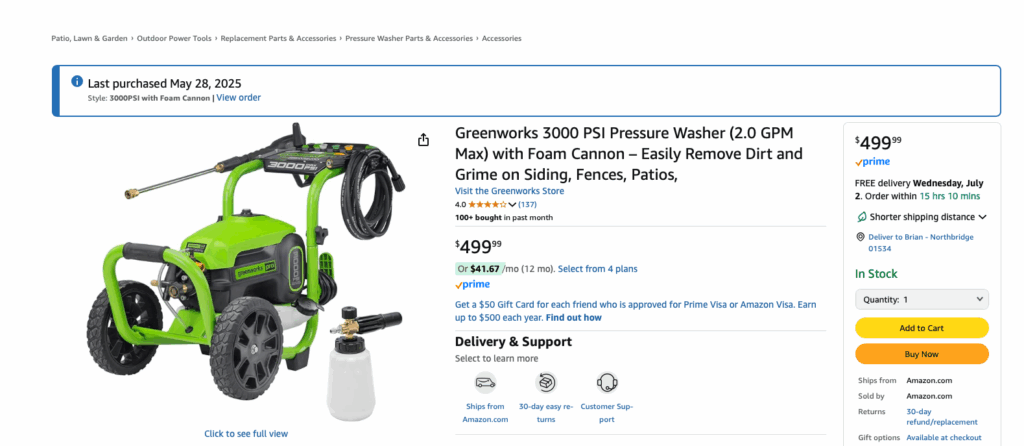

I bought an electric power washer recently. I read a lot before buying. I was interested in the performance of different brands. This was all past performance.

I bought this one and love it by the way.

I got a deal. More than $100 off. Sweet!

Evaluating Stuff

While I’d be excited to see some stats today on future performance, it just ain’t gonna happen. All we’ve got is past performance.

I understand why it’s the law that investments state that “past performance…” but we need to think a little about what that really means.

Past performance is all we have and it typically is a pretty good indicator of future performance for employees, pressure washers and for investments. But let’s dig in a bit.

Most Investors Make Poor Decisions

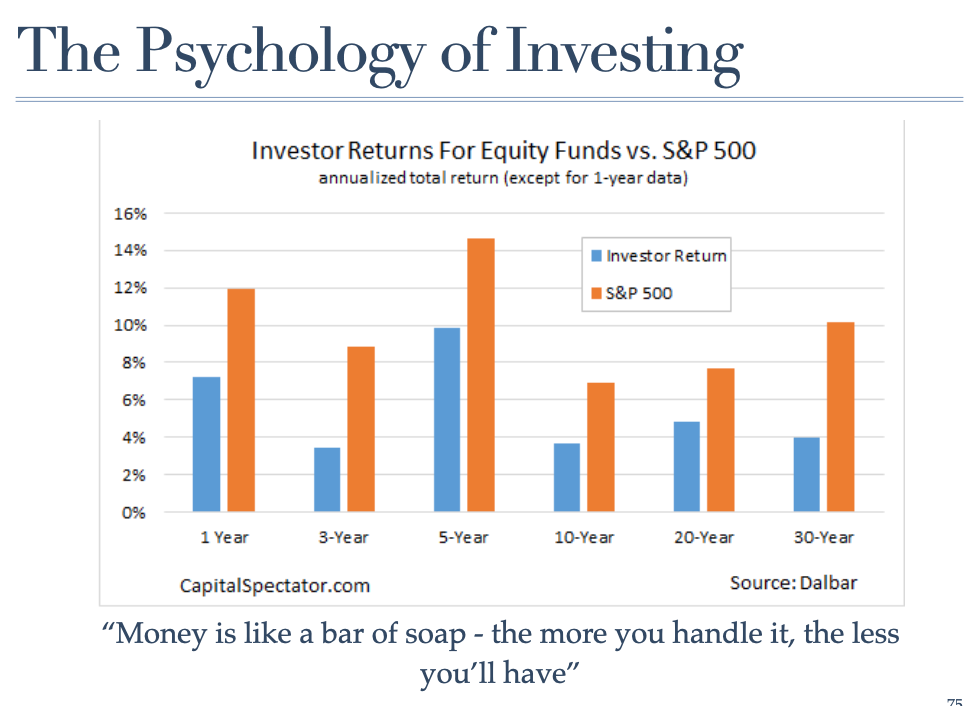

This is one of my favorite charts.

We’re not comparing the average investor to an experienced investor, we’re comparing the average investor to an index comprised of the 500 largest publicly traded US companies.

So if a “set it and forget it” strategy like buying an S&P 500 fund and walking away will perform better than all the work we put in to research and choose investments, what gives?

Here’s why, and this will help explain the “past performance…” law.

Humans are competitive by nature. We read a news story about a mutual fund that’s up 40% this year while the S&P is up 10%, we move our money. We’re at lunch and Fred happens to mention that his 401k is up 12% when ours is down. We find out what Fred is invested in and we move our money.

That’s why I added the quote “Money is like a bar of soap…”

Stop Moving!

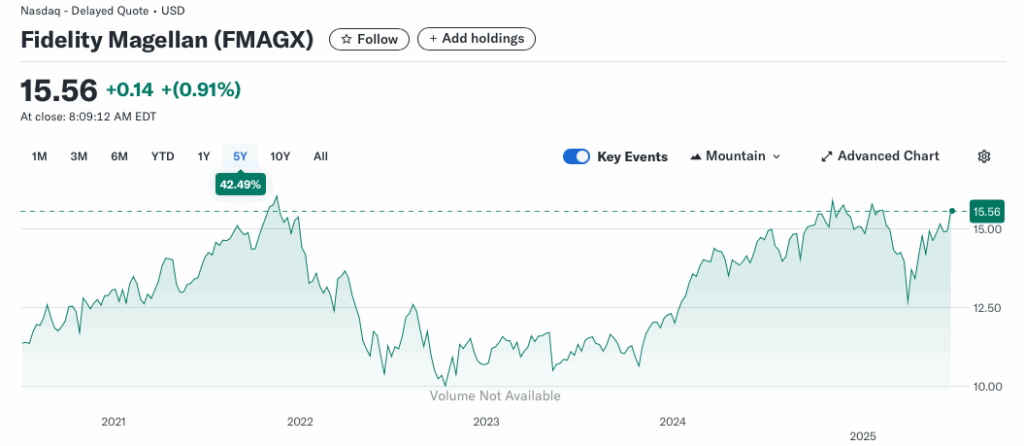

If we take a look at an investment’s performance, it usually looks something like this.

It’s up and down, but if we’ve chosen well, over long periods of time, we’re ahead.

If we bought Fidelity Magellan in 2023, we’re thrilled. If we bought in 2022, we are even, or maybe even down. Not cool.

Short Term Performance

The problem we see most often is that when we’re evaluating performance, we’re choosing too short of a time period.

The best performing investment last year is rarely the best performing this year. Sometimes an investment outperforms over several years, but must succumb to the typical investing cycles we see in the chart above. Some out-performance, some under-performance.

Fred’s 401k out-performance is no guarantee that you’ll match Fred’s return if you move today. So don’t.

Evaluating Performance

I love to invest in companies like Cummins (Ticker: CMI). It was founded in 1919.

Now there’s a lot of past performance to evaluate.

Over the last 106 years, Cummins has done pretty well. It’s had good times and bad but as an investor, I can see how it’s performed, its earnings, its ability to forecast earnings, the managers its chosen…

Cummins has been a good investment for me. I’m ahead now, but there have been periods where my purchases have lost money. In those periods where I had lost, it was easy to think about selling and buying more shares of Nvidia, which always seems to be up. But Cummin’s long-term performance suggests that it will continue to be a market-beater.

Wrap-Up

Past performance is no guarantee of future returns. This is stated for our protection. Last year’s darling will not likely be this year’s star. It could be, but often it’s not.

And the average investor’s tendency to follow the hot investment causes us to underperform.

That said, as investors we study an investment’s long-term performance (106 years is a great time period, but look at at least 10) to see how the investment has performed during different market cycles, what decisions management has made…

Until we figure out how to look into the future, all we have is past results. Use it wisely.