My wife and I are financially independent. We live in an average home, in an average town, and we take an occasional vacation. Last winter we spent a week in Key Largo. The prior year, we spent 3 days in the Red Roof Inn (near) Newport, RI off of a highway with a striking view of the Stop and Shop parking lot.

Credit Goes to Our Parents

My dad was a school adjustment counselor. A role he invented, but basically he spent his entire career in the public school system. My mom was a teacher. She took 18 years off to raise her 3 children and then returned to teaching. We lived with hand-me-downs and turkey dinners that lasted a month.

First there was the turkey dinner on Thanksgiving. Then the turkey casserole, then the turkey sandwiches. When there was nothing left but bones, we had turkey soup for a couple of weeks. Yum. Enough turkey til’ next Thanksgiving.

We lived like kings compared to my wife’s family. She was born in Cambodia during the Khmer Rouge. Her family escaped, spent 3 months walking to Thailand and then spent 7 years in various refugee camps until the Mormon church and a relative in Utah helped them come to the US.

Imagine showing up in Utah, not speaking a word of English and having to go to school and find work. I’m guessing not one person in Utah spoke their language.

After years of the whole family working several jobs, and all proceeds going to the family, they bought their own home, which they now own outright.

Today my wife does most of her shopping at a consignment shop called Savers. She furnished a room for under $100 and one day I mentioned I needed shorts and she came home with 5 like-new pairs for under $25.

Saving is in our DNA. Read more here.

Making Saving a Priority

It was unspoken. We just did it.

I remember setting up my first 401k at my first real job. I contributed the max because that’s just what we did. Save as much as you can – even if it hurts.

All of my friends at that time were competing to build the biggest house. I had a small unfinished cape. I spent nights and weekends for about a year finishing the second floor myself.

Every Sunday night, I made 5 sandwiches and put them in the fridge. That was lunch for the week. Tuna was not the best on Friday, but it worked.

Why Does This Matter?

But the point is that I was lucky. This is in my DNA because of the habits my parents had and the way our family operated. I am especially lucky that my wife shares this DNA because finance discussions can be difficult when spouses have different ideas on spending.

It’s Easier for Savers

Read the posts on compounding and the secret to building wealth. In the secret to building wealth, you’ll hear the story of Sylvia, a secretary who amassed an $8 million fortune. In compounding, you’ll read about how this can happen.

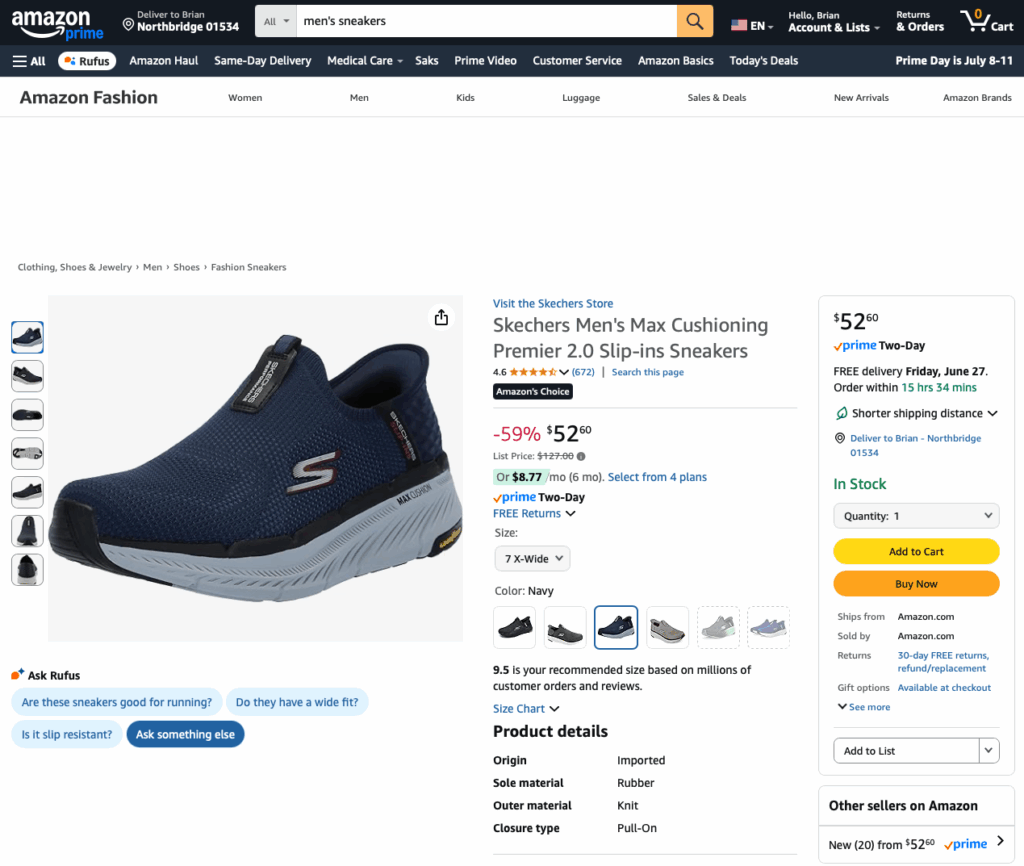

But today with easy access to loans, credit cards, and buy-now-pay-later, it’s harder than ever to be a saver. We’re not growing as many new savers because we don’t have to. I can buy a new pair of sneakers on Amazon and finance it. I don’t even need a credit card.

Only $8.77 a month!!

In an earlier post on saving, I wrote about the wonderful feeling of accomplishment that I had after getting a paper route and putting away money each week to buy a bike. When I finally had enough, my parents took me to the bike shop and I made my purchase.

Saving for something seems to have become a lost art.

Financial Independence

I taught a class on this. Those who came said they appreciated the insights. Most of what I talked about you’ll find in various posts here on the website.

But I believe many left thinking that this is interesting, but impossible.

My daughter and her husband will pay more this year in daycare for 2 kids than I made in 2 years at my first job. The amount floored me. How do you save when a huge chunk of your disposable income goes to daycare?

And never mind housing. Whether you rent or buy (assuming you can even find something) my daughter, her friends and my niece and nephews are faced with astronomical housing costs.

Given this, I think many people give up. The goal of financial independence seems unachievable.

Why We Need to Persevere

I think this discussion is a lot like the global warming discussion. For years, there have been those warning us that this is our last chance. After how many last chances do we stop listening?

It’s hard for us to imagine the future. Especially when we’re struggling to get by today.

My squirrels have learned over many generations that they need to stockpile acorns for the winter. I often find them tucked under the burners in my gas grill. They don’t impart the smokey taste I had hoped. Both the squirrels and I are disappointed.

But take a page from the squirrel’s book. We do need to save and let’s talk about why.

Retirement

Just kidding. I’ve talked about this. This is the “global warming” of finance. As much as I talk about the need to save and the impact over time of small investments, this is out of reach for many. We read about how the US population is unprepared for retirement and we imagine that the government will need to step up.

It’s funny. This is the same government that has amassed a $37 trillion debt. Funny sad, not funny ha ha.

Risk Management

There’s a great Seinfeld episode where George has to make a presentation on risk management. It was boring for George and it’s boring for us. But please, stick with me for a second.

My mom has Alzheimers. For years, we struggled with this while she was living at home. She had nurses in to help and she spent some time with her sons, but when my younger brother found a slice of pizza burning on the stove and my mom wandering the garden, we knew we needed something more.

Because my mom was a saver, she could afford home nursing. This gave her an additional 3 years in her home. She’s now in a private memory care facility. She likes the people, the food is great and she’s kept busy and engaged.

I sometimes think about where we would be if my mom were not financially independent. She has a pension (hers and my dad’s) and she owns her home, and she has a good-sized investment account balance. She’s saved and invested conservatively throughout her life.

What would we do otherwise?

I watch my granddaughter a couple of days a week. She’s 9 months old. I need to have eyes on her constantly so she doesn’t get into trouble. But she also naps every couple of hours so I get a break.

My mom is at a point where she needs that level of care. What makes it more difficult and emotional is that she is as sharp as ever. She just has no memory. She doesn’t know she’s struggling. Sometimes she doesn’t understand why she needs help.

As we live longer, it becomes more likely that we’ll need some level of care.

Wrap Up

There are many reasons we’ll need financial resources – far beyond providing for food, shelter and entertainment in our golden years.

My mom’s situation is just one of many we may face. I have friends who are retired and providing childcare regularly for grandkids. Others are taking care of parents and grandparents in their own homes.

I’ve written about Umbrella Insurance in a few posts. What if Rosco bites someone? I’ll likely get sued and my home coverage may not be enough. Umbrella insurance is a risk mitigation step to prevent us from financial ruin based on a mostly unlikely accident.

Financial independence is not just about living comfortably. It’s about having the financial resources to provide options when the unexpected, or unplanned occurs.

The good news is that this is not as difficult as it may seem. Saving more is better, but sometimes we need to ignore the experts telling us how much we need to save, and what we’ll need for a comfortable retirement.

Take a cue from the squirrels. Very few of them have a spreadsheet that tells them how many nuts they’ll need to stockpile. They just know they need to have some in reserve. Same for us.

And if you’re not sure where to start, the homepage has an agenda for how to go about this. Go here, and click the red links to learn about budgets, saving, retirement plans and credit.