Today’s good news! Trump’s ‘big beautiful’ bill expands access to this ‘powerful, yet underutilized’ financial tool. Here’s the spoiler. A Health Savings Accounts, also known as an HSA, will be more readily available to us. I won’t go through the details – read the article, but more of us can get access to an HSA.

What’s so special about an HSA? Read here for details and why you should have one.

In general though, an HSA has a triple tax advantage.

- Money going into an HSA is pre-tax. It comes out of our paycheck pre-tax or if we’re retired like me, we get a tax deduction for HSA contributions.

- Money grows tax free. Not tax-deferred like a 401k or IRA where the gains grow over time, but we pay ordinary income rates for every dollar we take in retirement (unless it’s a Roth)

- Withdrawals for medical expenses are tax free. Take it out to pay for a prescription, for health insurance premiums, or a long-term care stay and it is tax free. Almost anything medical related qualifies.

Medical Expenses

Unfortunately as we age, medical expenses become a much larger share of our budget. We have more doctor visits, more ailments and aches and pains, more prescriptions, more, more, more.

I’m starting to see this for myself and my buddies at 62, but it is even more true for my mom, who is 88.

HSA

A big part of saving for retirement is saving for these medical expenses. We know they’ll come. Let’s be ready.

And while a 401k is a great way to save for retirement, an HSA is even better.

I’ve saved in my 401k since I was 22. Thanks to a strong overall market in 1985 – 2019, my working years, my 401k balance has grown.

I’ll tap into my 401k to pay for food, groceries, vacations and golf. But for every dollar I take out of my 401k, I’ll pay taxes. If I need $100, I’ll need to take out $115 to cover the tax due, assuming a roughly 15% rate.

But for my prescriptions, doctor’s visits and health insurance premiums, at some point I’ll start using my HSA. That’s because I will pay no tax. Need $100 for prescriptions. I take out $100.

But, I’m waiting as long as possible. I am building the tax free earning in this account for as long as possible.

Compounding

Re-read the post on Compounding. Compounding is interest on interest and it helps grow our wealth exponentially. I want as much of this growth to take place in my HSA as possible because I pay no taxes on that growth.

HSA Debit Card

When we sign up for an HSA, we are typically sent an HSA debit card.

This works exactly like our checking account debit card. We can withdraw money at an ATM or we can tap or insert the card at a pharmacy or doctor’s office to pay our bill or our co-pay.

Just Say No

Don’t do it.

Having the HSA account and the debit card makes it easy to spend the money we put in. That’s great. The money came out pre tax and we use it to cover our pills or today’s appointment.

But we missed out on 2 of the 3 tax advantages.

Maybe we can find another way to pay those bills.

It’s Not Your Fault

I was at my dermatologist for an annual skin cancer screening. Just one of the many additional appointments I have now that I’m old.

A guy was next to me paying his bill and he proudly proclaimed “I’ll pay that using my HSA debit card.”

It’s not his fault.

Insurers, our employer, and everyone involved with the whole HSA process have not been good about explaining the benefits and the trade-offs.

Often this is because they don’t understand them themselves.

Pay that $100 today from your HSA and you’ve saved $15 assuming a 15% tax rate, just for fun.

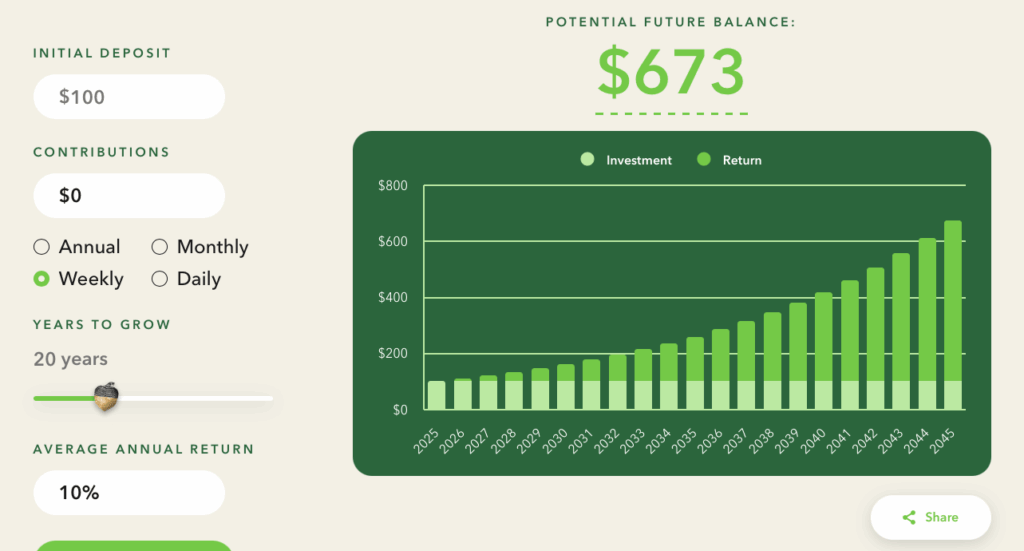

Put that $100 in an HSA and invest in an S&P 500 fund and under historical averages, you would likely end up with over $600 after 20 years.

That’s $573 in free money that we won’t have to pay taxes on!!

Yes, You Can Invest

Many of us also aren’t told that we can invest that money. Typically our employer adds the money to the account and it shows up in a cash position. Maybe a money market account or other interest-paying vehicle.

But we can choose to invest that money any way we’d like. And often an HSA is a standard brokerage account and will have many more investment options than a typical 401k, and often we’ll have access to lower-cost funds.

Be sure to check what your investment alternatives are. And as always, I like a nice low-cost S&P 500 fund.

Wrap Up

Retirement is expensive. And taxes eat away at our savings. In order to make our money last in retirement, we need to find ways to maximize our earnings and minimize our taxes.

An HSA provides a great way to do this.

To participate in an HSA, we need a High Deductible Health Plan (HDHP). These are typically great for folks with moderate to low health expenses, but may not be great for those with lots of expensive health needs.

An HSA comes with our HDHP and we’re allowed to make tax deductible contributions. In 2025, I can contribute $4,300 this year as an individual, or $8,550 if I have family coverage. I can contribute an extra $1,000 if I’m over 55.

There is no use it or lose it with an HSA. It can grow indefinitely. I plan to hold off spending mine until I’m in my 80’s. Let’s see if I can hold out.

And given how ill-prepared many are for retirement, I wouldn’t be surprised to see more loosening of requirements for HSAs as we have in the BBB.

Update 9/4/2025

This morning, I was reading about a Fidelity Investments survey that said a 65 year old retiring in 2025 can expect $172,500 in retirement healthcare expenses.

Grow your HSA now – don’t spend it and get the triple tax benefit to ensure you’re ready to cover this.