I was reading an article the other day about saving. From the title, it looked like crap. Typical click-bait headline, but I had some time so I read. It was surprisingly right on the mark.

One stat that I found particularly interesting was that most people who describe themselves as wealthy or well off, and who didn’t get that way through family, typically save 30% of their income rather than the 15% we hear many financial experts recommend.

It’s Hard

I get it. Even a little is hard, never mind 15%, or gasp, 30%.

But people do it.

I read about a couple in Chicago who got tired of their debt. They decided to do something about it. They handed in their keys to a pricey apartment in the city and moved to a smaller and cheaper rental in the suburbs. They sold 2 cars and started biking to work. Quite a ride from the suburbs.

My wife and her family did it. They weren’t born in this country. They came here with nothing. After many years of extreme saving, they were able to buy their own home.

My family did it. My parents raised 3 boys and sent them to college on a single teacher’s salary. My mom stayed home and took care of us while my dad worked.

My wife and I got married in 2009. The market tanked in 2008 and I lost my job. And she married me anyway. Go figure.

I got a new job (after 12 months looking) at a much lower salary. Between that and the market melt-down and some poor panicky financial decisions on my part, we had some work to do.

I recently read a biography about Tiger Woods. Becoming a professional golfer for him was hard. Many courses wouldn’t let him play because of the color of his skin. And that on top of the difficulty to become one of very few talented individuals who make the cut.

Lots of stuff is hard. But if we’re committed, it can be done.

Saving

In thinking through the idea of saving, I had to question myself. Am I a reasonably well-off retired guy telling everyone else they need to save? Easy for. me right?

Sometimes I wonder, but as I think back to 2009, or my experience growing up in, or of my experience piling away savings in my 401k in my first real job, I realize that I’ve lived this.

Even today, here and here are some of the things my wife and I still do. My wife is playing golf today. She’s skipping dinner afterwards and is excited to stop at the nearby consignment shop.

Inventory

I’ve found that the best way for me to start saving more is to start with a spending inventory. Don’t worry, an inventory is just a list.

What do I spend?

Many don’t know. This is important.

A spending inventory is one of the most important finance tools, yet most people don’t have one.

I know what I spend on groceries, property tax, cell phone, streaming services, and everything in between. I know what I’ve spent on these year to date, last year, and in 2019 – and most other years as well.

I use an account aggregator which makes this easier. Read more here. But, it’s not that much harder to pull out credit card statements and checkbook ledgers and come up with this on our own.

I Spent How Much???

This is usually the first reaction after creating an inventory. When we look at what we’ve spent over the course of a year, we’ll be surprised.

Skipping a couple of Starbucks trips or shopping for gas on Fridays when fuel is typically its cheapest (did you know that?) may save a few bucks, which is great. But we need to go after the big numbers to really make a dent.

I annually attack cell phone and insurance because they are big numbers. I like to shop for alternatives and I can usually save big.

In the end, the decision is mine, but it is smart to look through where our money is going and make sone decisions about whether that makes the most sense.

Investing

Hopefully the exercise above gives us some ideas and nets us some savings. If we’re committed, I’ sure we’ll find plenty. It may mean downsizing the home and selling a car or 2, but if we’re serious…

As a side note, my coffee friend Rich dropped a vehicle 2 years ago. He and his wife share 1 car. He doesn’t feel like he’s suffered at all and he’s saved a ton on the car itself, insurance, maintenance, excise tax….

Before we get into investing, I want to put in a plug for an emergency fund. Read more here.

It’s helpful to have some cash set aside in an easily accessible spot in case of emergency. While we’ll grow this over time, some is better than none. Start now.

My wife took a good chunk of her salary every paycheck and put it into our emergency fund. Knowing we had a cushion, it was much easier for me to invest aggressively to meet our long term goals.

Investing…

Enough preamble…We need to invest.

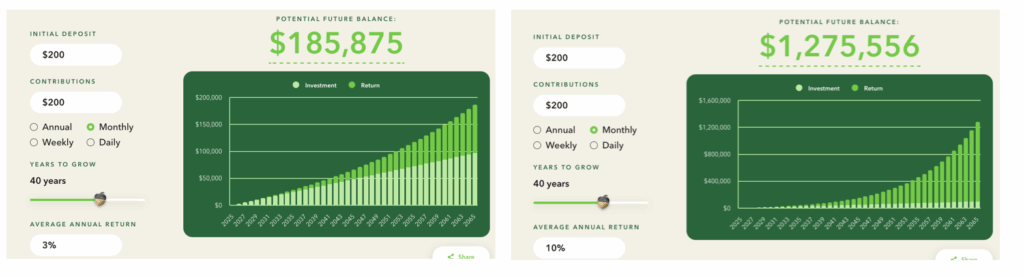

I love the acorns compound interest tool. It’s a great way to compare where we may end up at different saving and interest rates.

Here’s a brief demonstration of why we need to invest in equities v. a savings or high-yield account.

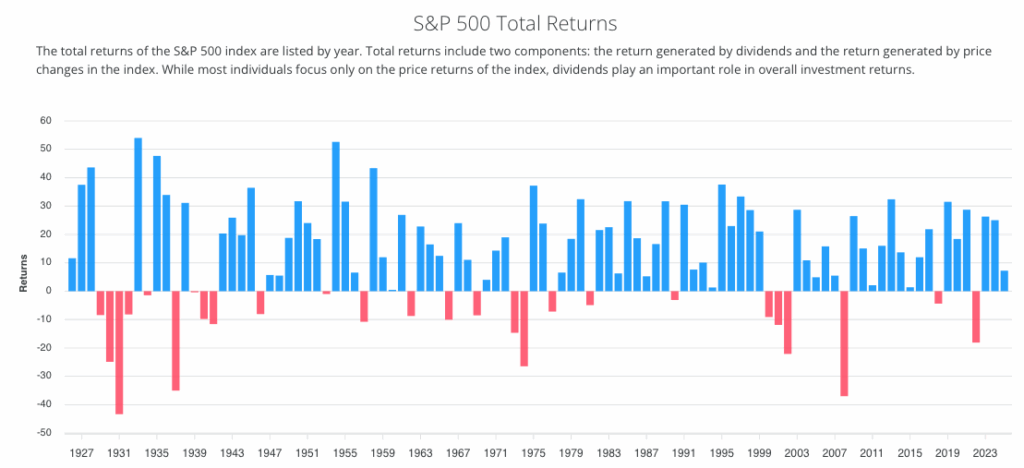

The S&P 500, an index of the 500 largest US publicly traded companies, has gained an average of 10% per year over the last 100 years.

It has been down 40% some years. There are periods where it has been down several years in a row.

The S&P 500 is up more than 20% in each of the last 2 years.

The S&P 500 does not guarantee us 10% every year. No equity investment is guaranteed. But the longer we hold, the more likely we’ll grow our wealth.

FDIC insured savings vehicles are offering relatively high rates today, but historically, they’ve averaged closer to 3% per year.

Let’s look at a comparison of both vehicles for building wealth.

I’m saving for 40 years. I start with $200, and I add $200 per month every month.

Investing comes with some risk. that’s the price of admission, but we need to invest to grow our wealth.

$185k is nice, but $1.2 million can really make a difference in our retired lives.

Time

Investing may not give you the results you want in the short term.

In Should I Wait for More Certainty to Invest. I show several views of the S&P 500 return.

Here’s the return for each calendar year.

The S&P 500, and equities in general, even the greatest stocks of our time, like Nvidia, Amazon and Alphabet, will have strong periods and weak periods. The secret to making money is to hold for long periods.

Read Sylvia’s story here.

Zoom In

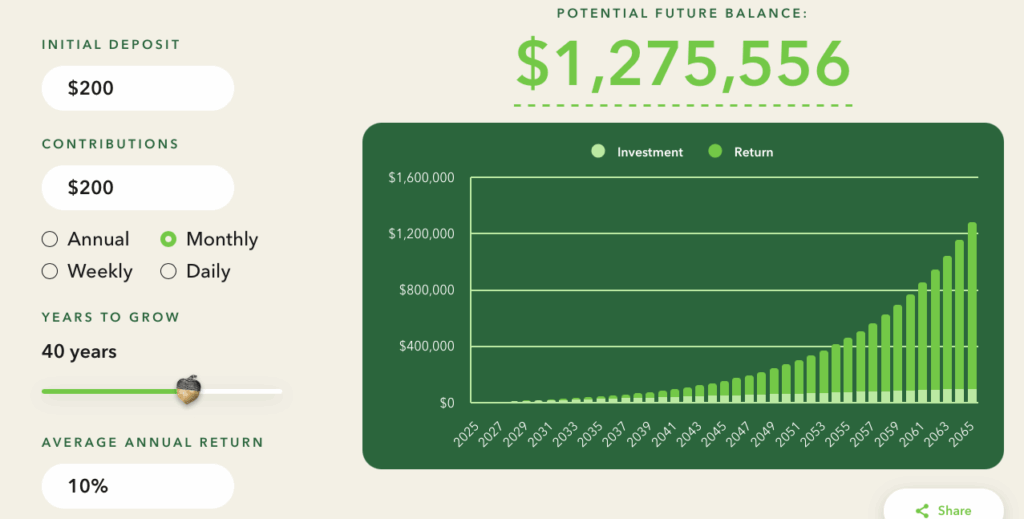

The interesting thing is that compounding really starts to have a huge impact after long periods of time.

Look at year 2065. The dark green return is huge compared to the light green investment. Whereas in 2045, they’re almost equal.

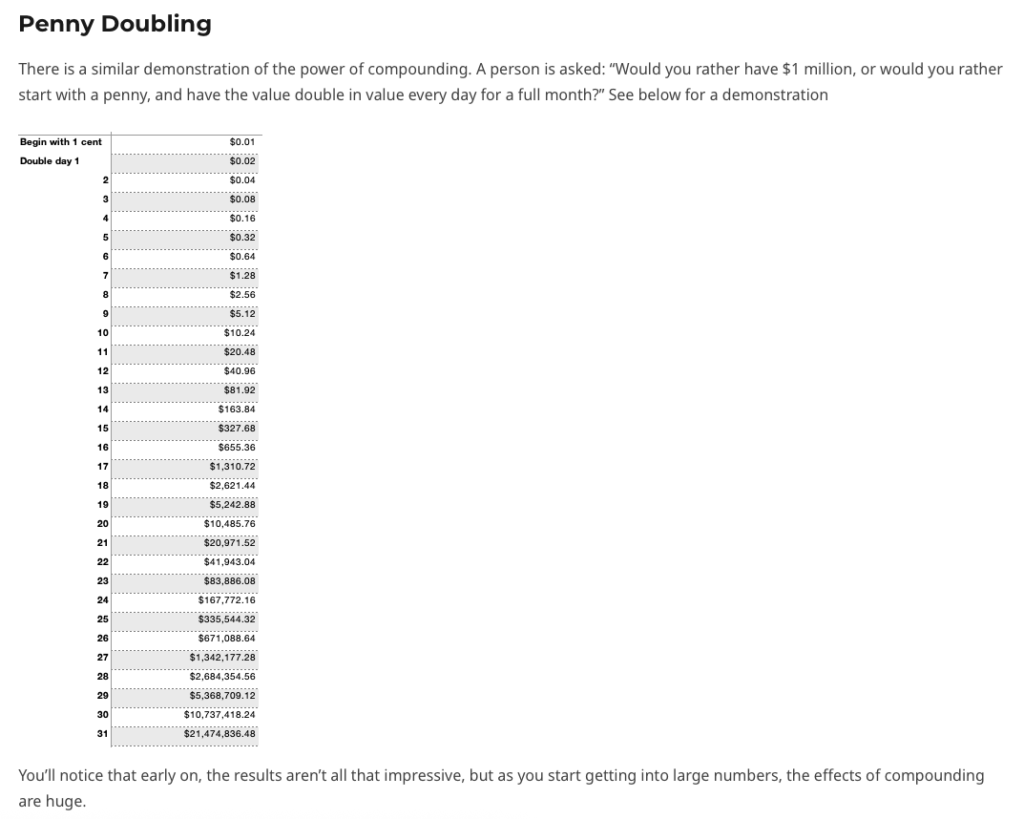

The penny doubling example in the post on compounding demonstrates this.

Wrap Up

Saving is hard.

My wife and I have found ways to save that don’t make us feel like we’re depriving ourselves, but early on when we didn’t have much, that wasn’t enough. Back then we had to cut out things we wanted, or that our friends and neighbors had, in order to build our wealth.

We created an emergency fund which gave us some comfort that we had a cushion against the unexpected and allowed us to put money aside for the long term and invest it in equities and low cost S&P 500 funds.

Investing grew our wealth exponentially through the magic of compounding.

We’re not rich. We have a modest house and we stick to our saving plan, but we believe we’re well positioned to survive retirement without having to eat cat food.

And we continue to invest. We put money into equities today that we’ll expect to need 20 years from now.

Saving, Investing and Time.

Start with a list and go from there.