That’s a shame.

But it’s true.

Today’s post is a follow-on to yesterday’s post where I said that if the equity piece of your portfolio didn’t have a 24% return last year, you need to make some changes. Read it here.

And to be honest, you don’t have to make changes. The responsibility to choose investments is all yours. It’s your money and you should decide. I just want each of you to have the facts.

What Does Underperform Mean?

Let’s start here. My version of underperform is simple. For equities, I compare performance to the S&P 500. More on this later.

I believe that just about all of us are best served investing in a nice low-cost S&P 500 fund. And let’s talk about why for a sec and then we’ll get back to underperformance.

Why an S&P 500 Fund?

- Diversification – you’ll instantly own a small piece of 500 companies across just about every industry. Read more here.

- US based – The Securities and Exchange Commission (SEC) does a nice job regulating US companies to ensure they report truthfully. US companies mostly avoid a lot of the shenanigans that we see in other countries.

- International – While the companies are all US based, almost all receive a good piece of their revenue overseas.

- Large companies – these are the 500 largest publicly traded US companies. Most of these companies have gotten here by having a long track record of success.

- The S&P 500 has returned on average 10% per year with dividends reinvested over the last 100 years or so

Comparison

Because I believe that the S&P 500 is a great equity investment for most of us, I compare all other equity investments to it. Any of us can go out and buy an S&P 500 fund. It’s easy. And if we hold it many years, we’ll likely end up ahead.

That said, I’ve spent a good amount of time during my career at several different investing firms working on performance reporting.

Most firms have a comparison index for every fund. The S&P 500 is often the comparison for their large cap equity funds, but they’ve got a different comparison index for small caps, another for mid caps, another for emerging markets, for real estate…and on and on.

Firms tend to advertise their fund’s outperformance against the benchmark.

For example, a firm may say that their emerging markets fund outperformed its benchmark in the last 1 year, 3 year, 5 year and 10 year period.

Wow! that sounds like a great fund.

And in truth, it is no small task to beat the index in multiple time periods.

But the problem is often that the index, emerging markets for example, may have severely lagged the S&P 500. And while this isn’t a fair comparison for the fund because the fund has to invest in emerging markets companies, it is a fair comparison for us, who can choose any mutual fund that we like.

29 Prospectuses

I started helping my mom with her finances when she called and told me that on a regular basis, she received a pile of mutual fund prospectuses in the mail.

She wasn’t kidding.

I went to her house and she had a pile of 29 prospectuses on the hallway table.

Her investment manager had her invested in large caps, small caps, mid caps, international, REITs…on and on. 29 mutual funds. She couldn’t name them all and she certainly wasn’t reading the prospectuses.

We took her investments and put her in a nice mix of 80% iShares Core S&P 500 ETF (IVV) and 20% iShares Core U.S. Aggregate Bond ETF (AGG).

Underperformance (again)

Part of the problem is investment expert’s belief that we need to have a vast diversity in company size, and geographic location in order to capitalize on the next big wave.

This is partially true. Check this out from sectorspdrs.

No one sector is at the top every year, and we see examples like technology which is #1 for 2 years and then drops to 4, and then it’s down 27%.

But the S&P 500 has a pretty good spot in the upper middle most years.

Another View

Let’s take a look at the iShares Core S&P 500 ETF (IVV) v. a number of well-regarded mutual funds.

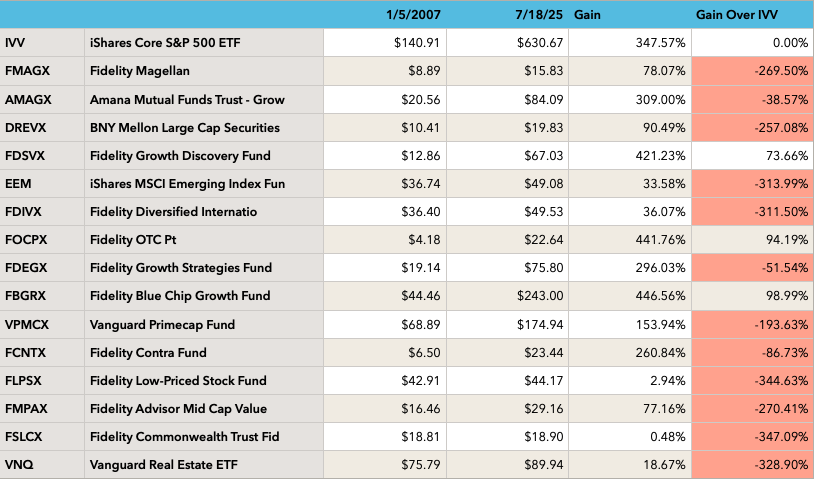

This chart shows the price on Jan 2007, the price on July 18, 2025, the % gain, and the funds gain as compared to IVV.

This will be fun.

3 of the 15 funds beat the S&P 500 index fund. The other 12 trailed. Most of them trailed significantly.

Why go through the heartache of researching a basket of geographically and industry diverse funds when you can pick an S&P 500 fund and beat most of them?

Yeah, But Does it Really Matter?

Imagine you pick up your paycheck on Friday. Yeah, I know, no one picks up a paycheck anymore it just shows up like magic…but what if you’re expecting $1,000 and your paycheck is $500? Do you say – well, $500, that’s not bad, at least I’m up. Or do you storm into the HR office and demand your full $1,000.

And yes, I know HR offices largely don’t exist, but you’ll call that 800# and after 15 prompts, you’ll get to a person and you’ll give them a piece of your mind.

The point is that you’re owed your full paycheck. You’ve worked for it.

Shouldn’t we feel the same way about our investments? Not that we’re owed a positive return every year, but we should expect our equity funds to do at least as well as the S&P 500. If they lag the S&P 500, aren’t we forfeiting money that could have been ours?

And let’s talk about real money. Let’s say we had $100,000 in equities in our 401k in 2007. If we invested in IVV, we’d be up 347% so we’d have a $347,000 gain for a total of $447,000. Compare that to the $78,000 gain of the Fidelity Magellan fund. With Magellan, we’d have $178,000.

$447,000 is a lot more than $178,000. And as those numbers compound in the coming years, the difference will grow exponentially.

Yup, it matters.

Wrap Up

We don’t know what will happen in the future.

“History Doesn’t Repeat Itself, but It Often Rhymes” – Mark Twain

The S&P 500 has beaten most equity funds over long periods of time. While we never know if this will continue, it seems likely to me.

I think many of us are told that we need to be diversified. We need to invest in emerging markets.

What is an emerging market? And what is it emerging from? And how will we know when it has emerged?

I’m sure there are many investors who have made a pile of cash on emerging markets. If you have a deep understanding of the countries, the economies and the business cycles, you can probably make a buck or 2. I don’t.

I have a pretty good understanding of the US economy. I see evidence in my daily life. I’m more comfortable with US companies. And with 500 diverse companies in the S&P 500, I’m feeling pretty good that I have all sectors covered.

Small caps may have a great year or 2 or 5, but over the next 10, I’m betting on the S&P 500.

In the end, where we each choose to invest is a personal decision. Just make sure you do some research and have the facts before you jump into unfamiliar waters.