It’s hard to go a day without reading a news story about Tesla’s struggles. Yesterday was Tesla’s quarterly earnings release so we saw:

I’m a Tesla shareholder, so what does this mean to me (and you)?

The Media

The media has turned on Elon. I won’t get into why and whether it’s warranted, but 2019’s media darling has fallen from grace.

Given that, I take what I read in the media with a huge grain of salt. Are the outlets reveling in the bad news for one of their favorite whipping-boys or is the company really in trouble?

My Thesis

So that’s why I’m refreshing my thesis for Tesla this morning.

Elon

My thesis for Tesla, as with most companies, is pretty simple.

Elon is a big part of it. Despite what you may think of him, I believe he’s a pretty sharp guy. Tesla, SpaceX, Neuralink, xAI, The Boring Company, Paypal…There aren’t many people who have been as instrumental in turning ground-breaking technologies into successful businesses.

I read Isaacson’s biography of Musk and I remember a part about Elon being on vacation in the early days of SpaceX. He had tracked down a couple of old Russian rocket manuals and was reading them cover to cover while sitting at the pool. Later at an investor meeting when he was asked who the lead engineer was, he replied “I am”

Elon is a big part of the thesis for me.

Supercharger Network

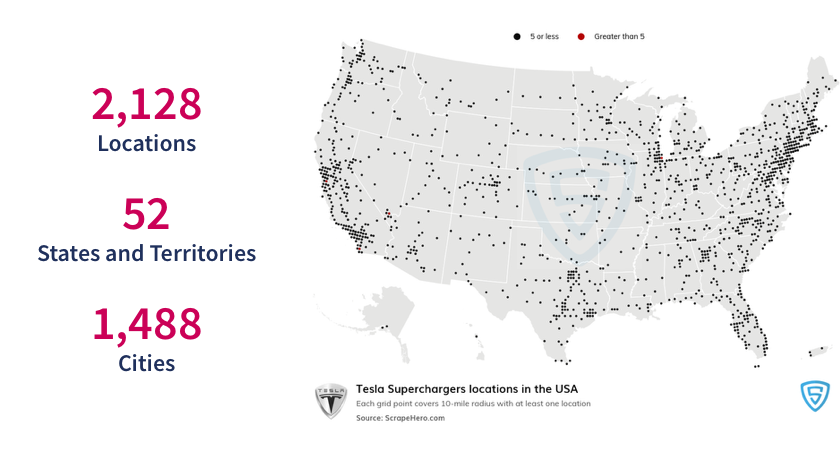

Charging is another big part. Tesla has over 7,500 stations with 70,000 charging ports throughout the world. In the US it has

While many folks charge at home, electric vehicles become a lot less viable if we can’t get a charge outside of the house.

And Tesla’s chargers work. While this may seem like a snarky comment, the stories of competitor’s chargers being out of order are everywhere. Tesla designed the North American Charging Standard (NACS) and car brands like GM, Ford, and Mercedes are transitioning to Tesla’s technology after difficulties with other chargers.

The supercharger network and proprietary technology are an important part of the thesis.

Ubiquitous

My goal today was to use at least one big word before 9am. Check.

Teslas are everywhere. I am not a huge fan of the vehicle design, but I’m constantly shocked at how many I see on the road. Certainly more than other electric vehicles, though Hyundai and Kia deserve props for their vehicles. I see lots of them as well.

But that’s just my experience. What sold me on Tesla was their 80% market share in the US. This has dropped to 50% so that’s concerning.

We’ll get to that in a sec, but selling 50% of the EVs in the US still ain’t bad.

Solar/Storage

In 2016 or so, Tesla purchased Solar City. The circumstances seemed a little sketchy. Musk was a major investor in Solar City and it was run by his brother. Some thought this was a bail-out.

But today, Solar and Storage have become a significant piece of Tesla’s revenue and after doing some research on storage, I bought 2 Tesla Powerwall 3 batteries because they seemed to be the clear leader.

Other Stuff

Strong balance sheet, limited debt, generous lead in self-driving – Tesla has billions of hours of vehicle camera footage to use to train its computer models. There was a lot to like.

Does the Thesis Still Hold?

So that’s today’s question.

Given the unending cycle of gleeful bad news from the media, and the decline in the stock price, is Tesla still a worthwhile investment for me?

Musk is still in charge and is apparently back from DC and sleeping in the office again. While he may not be love-able, I think he’s a smart dude and I’m optimistic now that he’s back.

The supercharger network continues to grow and is a model for dependability. If I’m driving out of state on Thanksgiving, I want to feel secure that I can stop on the way and charge up and not be stuck freezing in my depleted EV. I think this is an under-appreciated super-power for Tesla’s business.

And while 50% of the electric vehicle sales is not 80%, it’s significant. Chinese EVs are out there and are arguably ahead of Tesla in technology and are lower in price. Hyundai and Kia have flooded the market with many low-priced options. Ford and GM are getting into the game though their success seems to be limited.

Tesla’s position will likely continue to erode. But I didn’t buy Tesla with the expectation that there’d be no competition.

Same for Netflix. In 2009, they were the only streaming game in town. Today, streaming competition is ubiquitous (see there it is again!). But Netflix remains the clear winner.

Many years of successes and failures and having to deal with strong markets and weak either kill a company or make it resilient. I think both Tesla and Netflix have taken their vast experience and have made it a strong competitive advantage.

Solar and Storage are about 10% of revenue today, but given our energy needs, I see this as a growth area. I think the power-hungry data centers that AI is spawning will be a catalyst.

Stock Price

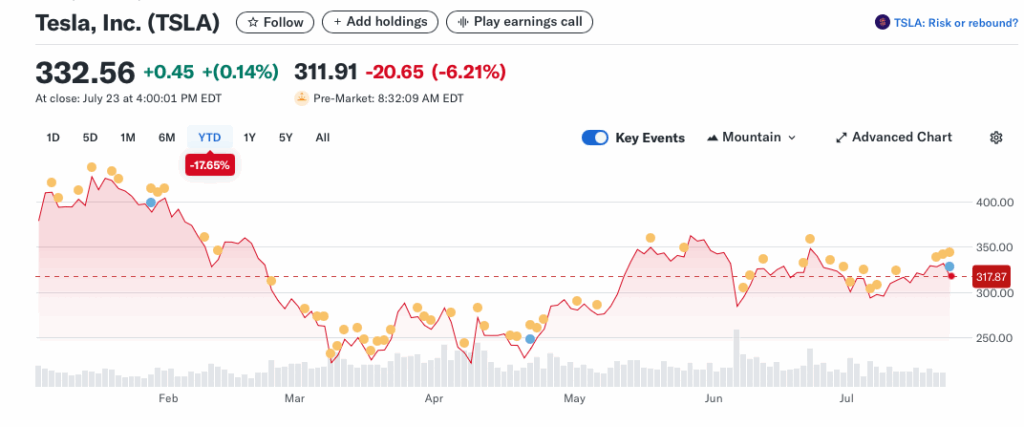

Tesla’s stock price is down year to date, but if you were a savy investor like reader Mike, you may have picked up some shares on a dip and be sitting on a profit today.

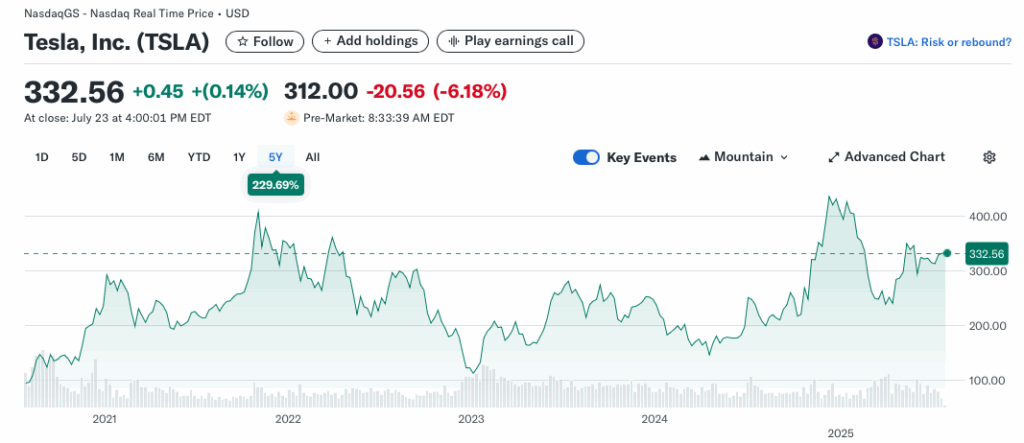

Zoom out to 5 years and we’re up over 200%, but it’s been a rocky ride.

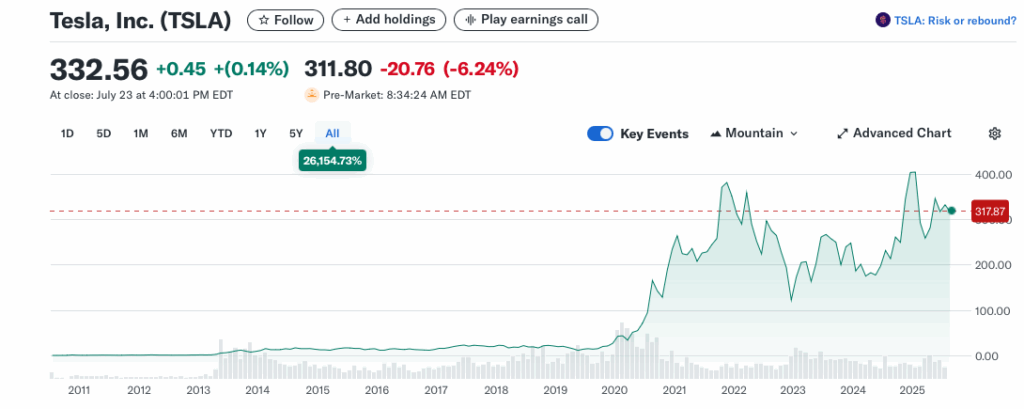

and zoom all the way out and it’s no contest. 26,000%.

Wrap-Up

I’ve bought shares of Tesla in 2020, 2021, 2023 and 2024. The 2020 shares are up over 400%. The others are all up but as the news media ramps up the hate, I decided it was time to revisit my thesis.

My thesis has largely remained intact. Tesla has a smaller percentage of sales, but I expected more competition. I believe that its years of experience in building and selling EVs will be a lifetime competitive advantage.

My Tesla stake is about 1.3% of my stock holdings so I’m not over-exposed.

I expect a rocky ride. While my original shares have remained positive, my subsequent purchases have all been negative at one point. I expect they may be negative again. But come 2035, I bet they’re way ahead.

And if not, I have other companies that I believe in that will easily offset losses in one holding.

Agree 100%, and also bought in for the long ride 🤞