Yesterday’s post was a refresh of my thesis on Tesla. I own shares and with a disappointing earnings report and lots of bad press recently, I decided it was time to check in on my thesis. The usual stuff – what were the reasons I bought in the first place, do they still hold true???

No need to rehash, you can read the original.

Media

The news media has been positively gleeful in reporting bad news in Musk-land. Just this morning, CNBC was taking delight in some Starlink challenges.

And on the quarterly Tesla earnings, WSJ reported

And in all honesty, Tesla is at a weak point. Their US market share has dropped from 80% to 50%.

Comps

But, If I rely on mainstream media to help me make my decision on whether to buy, sell or hold Tesla shares, I’m thinking Tesla is a dumpster fire and I should sell, sell sell.

But before I do, how’s the rest of the EV industry doing? All I read about is Tesla. Volkswagon, GM, Ford, Hyundai and Kia are also big players. I assume they are doing quite well because they must be wallowing in Tesla’s failure.

Let’s go to the charts.

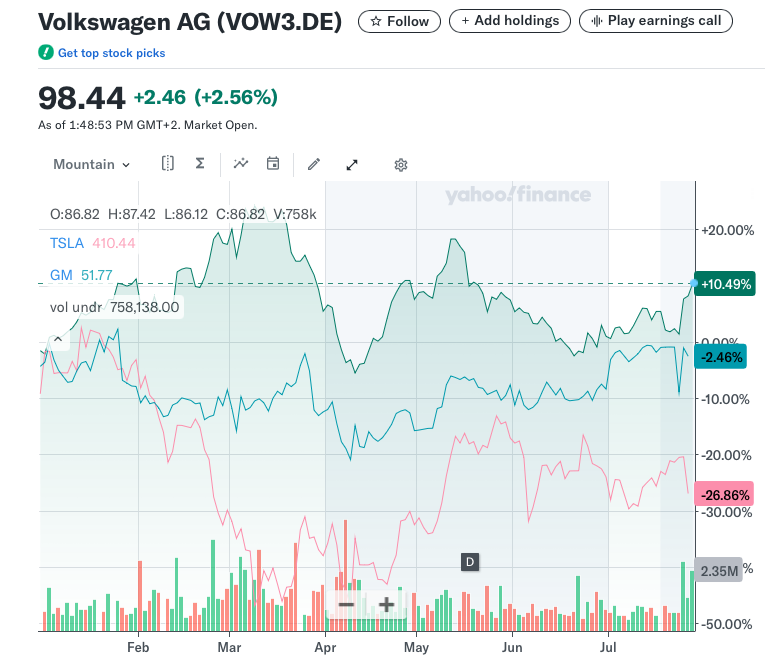

Year to Date

Yup, Tesla is last. Down 26%.

Here’s the 1 year stock price chart

Tesla is up 42% v Volkswagon at -6% and GM at 12%. Hmmm.

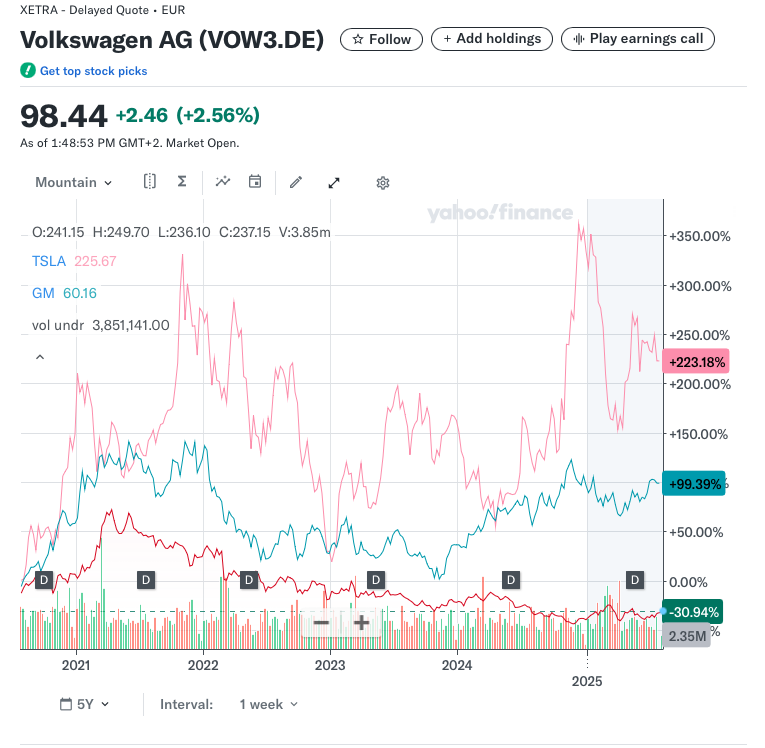

5 year

Tesla is quite a bit ahead.

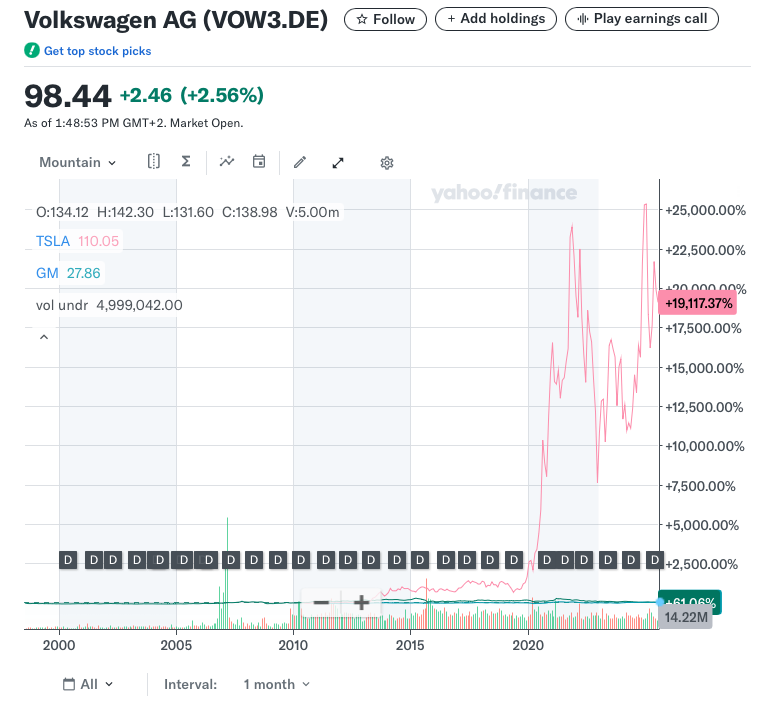

Or go back even further

Stock Price Isn’t Everything

As investors, we’re used to companies we own having huge pullbacks. Especially high-growth companies like Tesla, Amazon or Netflix.

But there is concern that Musk has damaged the brand with his political activities. Very few companies have fared well in taking political stands. The problem is you immediately alienate half of your current and prospective customers. Usually best to be the quiet company.

Flashback to the TV ad from my youth.

EVs

I think it is fair to say that EVs are taking it on the chin. Many car companies that went all-in on EVs are re-thinking. Toyota is doubling down on Hybrids.

The Big Beautiful Bill is anything but beautiful for EV companies. No more $7,500 tax break. EVs are pricey with the break, this will hurt the industry.

Wrap Up

First important point. Updating our thesis regularly is important. We spend 20 minutes looking at why we invested in the first place and see if the reasons still hold true.

But for me, the process continues. I updated my thesis yesterday, and I’m still thinking about it. Today I thought, “I wonder how other car companies are doing?” I spent 3 minutes doing some comparison.

This is another reason to invest in companies and industries in which you are interested.

Second point, don’t get wrapped up in the media story. Today it’s fun to hate Elon. Everyone is piling in. It’s worthwhile to investigate, but don’t react.

I touched on this with a post on Intel. A few years ago, Intel was a media darling. Intel was getting a huge check from the US government to jump-start manufacturing in the US. The media loved it. And then the business and the stock price (and the dividend) nose-dived. Everyone suddenly remembered that Intel was an aging tech company whose best years were in the prior century.

Third point is that Tesla has been an outstanding business over the last 20+ years. It has brought EVs into the mainstream. It has built a super-charger network throughout the world. It is a leader in autonomous driving. It makes robots – how cool is that?

Every great company has pullbacks and I expect more from Tesla. But I expect it will be a winner 10 years from now.

Final point. We should be investing some of our portfolio for the more distant future. While it’s great to buy shares of a company and see it pop 30% right away, that 30% really isn’t doing much for our wealth.

I bought shares of Axon Enterprises (the Taser company) in February. They’re up 20%. Yay. I invested about $7,000 and it is up about $1,400. Nice, but not life-changing. I’m holding on because I believe it will double many times over in the next 20 years.

I bought Amazon in 2010. I invested $2,500 and it is up 3,224%. My gain is $81,112. This is life-changing.

But guess what. The S&P 500 was at $1,186 per share in 2010 when I bought my Amazon shares. Today the S&P 500 is at $6,363 per share. It is up 436%. That means $2,500 invested in 2010 is worth $13,400 today.

And maybe $13,400 isn’t life changing but if we had $250,000 of our 401k money in an S&P 500 fund in 2010, it would be worth $1,340,000 today. That’s life changing.

I’m still leery of full electric vehicles. Too many risks of it becoming a paper weight. I like the concept of hybrids, but how big is the cost benefit? Especially if you hold on to the car for ten years or more: what about battery replacement?

Do the hybrids keep running without a battery?

I agree with you on the Muskrat: his intelligence is matched well with his ego, so he’s likely to keep going higher.

I’m with you Mike. I remember Energy secretary Granholme’s multi-state EV trip where she had an aid in a gas-powered vehicle drive ahead and scout out working EV chargers and then park in the spot until she showed up. And EVs are new – maybe 10 or so years of mass production? How was the gas-powered vehicle reliability in the early 1900s? Even in the 70’s it was iffy.