Today we’re going to poke fun at conventional wisdom. Saddle up!

A guy walks up to you on the street. He says he’s got a great deal on an over-valued stock. You:

- Run Away

- Run Away as Fast as You Can

- Buy Buy Buy

Conventional wisdom tells us 2 is the right answer. 1 is acceptable, and 3 is crazy talk.

That’s not just me sayin’. Look

Here’s what Ian Wyatt says (I don’t know who he is either)

and Investopedia says:

And as much as I’d like to, I’m not poking fun at either Ian or the good folks at Investopedia. Conventional wisdom says you don’t buy stuff that is over-priced a.k.a over-valued. Whether it’s a car, a breakfast cereal or a stock.

Buffet says so, so does Ben Graham in the Intelligent Investor.

We shop for bargains. Something over-valued is not a bargain.

Value

It’s pretty easy to tell if the car we’re shopping for is over-valued. We look at similar cars at other dealerships or use the tools on cars.com. Same for breakfast cereal. I check at Shaws, Market 32 and Market Basket and pick the lowest price.

Stocks, which are ownership shares in a company, are a little tougher to value.

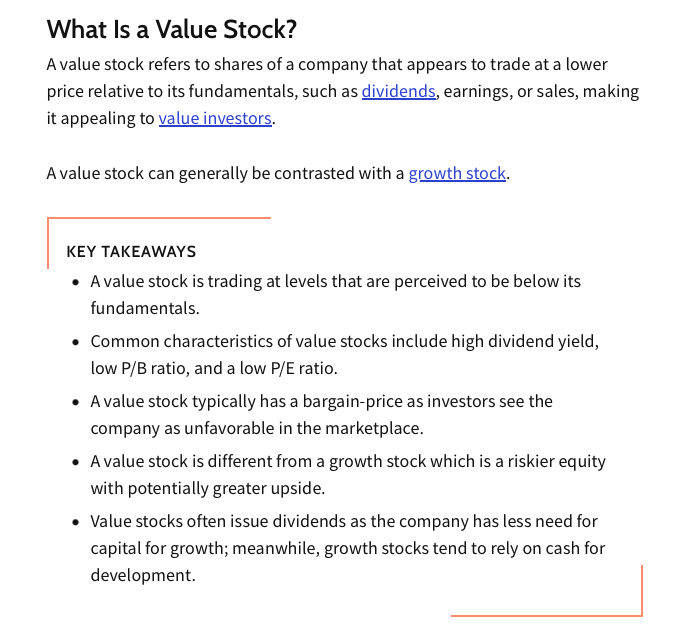

Interestingly, value stocks, the stocks preferred by both Graham and Buffet, are easier to value. They’re generally older, established companies with long track records of performance in up and down economies. It’s a mostly mathematical process to evaluate assets, liabilities, sales, earnings, and cash flow to determine the value.

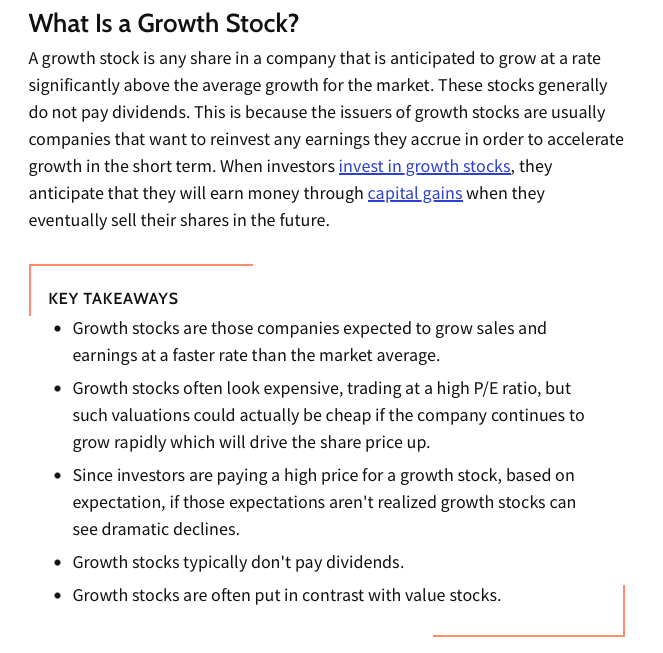

Here’s a summary from Investopedia

Growth stocks are a bit more tricky. We’ll get to them in a bit.

Growth Stocks

I was going off in a different direction, but why not jump in.

A growth stock is going to grow, right? Why not buy that instead of a boring value stock.

Important distinction. A growth stock company’s share price is based on the expectation of growth.

The Expectation of Growth

From Investopedia

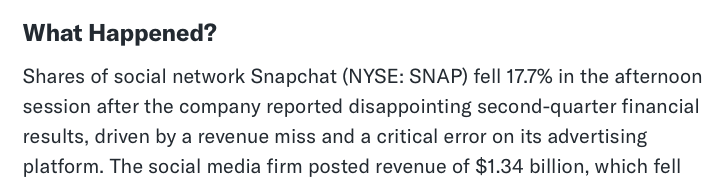

When a nice value stock like Fastenal misses quarterly earnings expectations, the stock is likely to fall a few percentage points that day. When a growth stock like Snap misses earnings expectations, we’ll see double digit price drops, like we saw earlier this week.

It’s been a wild earnings season. Many of my growth companies moved 20, 30, even 40% on earnings. And unfortunately, not all were up.

Growth companies that are able to sustain quarter over quarter high growth relative to peers will succeed. The majority can’t and don’t.

Not all growth companies grow.

Personal Inventory

I know this, I’ve read this, and I hear it regularly from experts, but as I look through my portfolio, I’ve made by far the largest share of my earnings from growth companies.

First important point is that I don’t trade a lot in my main account. Many of my positions are from 2008, 2009, 2010…up to 2016. There are some newer ones as I’ve added money to the account, but in general, I’ve bought and held.

No surprise for regular readers, but my biggest winners are Apple, Amazon and Netflix. For the better part of the 2000’s and 2010’s, these were considered over-valued.

Who Says?

My first question when someone says something is over-valued. Who says?

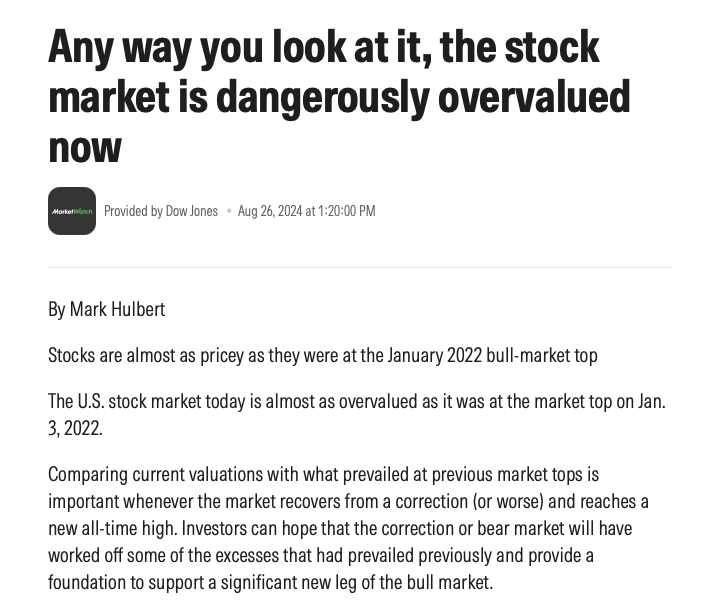

From Morningstar:

On August 24, 2024, when this was published, the S&P 500 closed at $5,616.84. Today it’s at $6,345.06. Up 12.96%.

Who’d’a thought.

Not Mark.

That’s not entirely fair. Without the ability to look into the future, it’s very hard to determine what over-valued is.

And That’s the Point

We don’t know. You don’t. I don’t. And the experts don’t.

I was listening to my favorite podcast yesterday, and they mentioned that in one of their services, being over-valued is a requirement for any recommendation.

Listening to that got me thinking about this post that had been running around inside my head for a week or so.

Reader Mike and I went back and forth last week. I was holding on a pullback day and Mike took the opportunity to buy more shares of one of his favorite companies. While I didn’t feel like it was a buying opportunity for me, I agreed with Mike that a few years down the road, it was highly likely that his purchase would be a market beater.

Even the greatest growth companies will put us on a hair-raising ride from time to time.

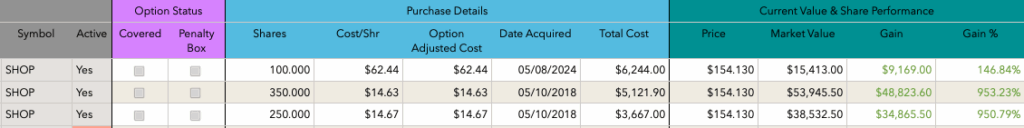

I’ve written about Shopify. It’s been a great holding for me.

I’ve bought shares 3 times. The shares from 2018 are up over 900%, and the ones from 2024 are up a cool 146%

Check out the chart.

It was a huge bummer when the shares dropped from $130ish to $70ish. The funny part was that the charts showed it as waaaaay overvalued in May 2024 at $64 when I bought more shares.

Zoom out.

Commitment (and diversification)

Growth companies are going to test us.

Every growth company I’ve owned has dropped 50% or more at one point. And many have stayed down for months and sometimes years.

None of us like to lose money, so we often sell at this point.

Comitment is the only thing that can keep us from ditching our shares. We need to go back to our thesis. Is the company over-valued? Yup. Was it over-valued when we bought it? Yup. But why did we buy? Did that change? If not, we need to hang tight.

This is easier if we don’t bet the farm.

$5,000 ain’t chump change, but it is a fairly small investment. 3 times I put this much (roughly) into Shopify.

I’m committed and I’m also not going to be eating cat food if this investment doesn’t pay off. I have over 60 other companies and a handful of equity and fixed income mutual funds in my portfolio.

Wrap Up

Overvalued Stocks – Stay Away at Your Own Peril. Let’s revise the post heading.

Looking back at my greatest winners. They’ve all been considered over-valued at some point. And I’ve continued to buy over-valued shares.

And while a company, or the market as a whole, may seem over-valued, who really knows? Unless we have a crystal ball that tells us how long this company will continue to grow, we just don’t know.

And this is where I should be telling you how to find the winning growth companies in the quagmire of over-valued stocks.

Sorry.

I don’t know. But here’s my take:

- I start with an idea – “hey, this company looks cool”

- I do some research – read articles, look at an analyst report or 2, check what my favorite investing newsletter has to say

- I decide if it’s worth buying shares. Often I decide that it’s not. Read here.

- I come up with a thesis

- I watch, read and wait. If I can’t wait 3 years this company isn’t for me.

- I make sure I have other holdings, including low-cost S&P 500 funds to shield me from excessive losses from a small number of companies

Over-valued. Says who? Don’t be afraid.

Update 8/8/25

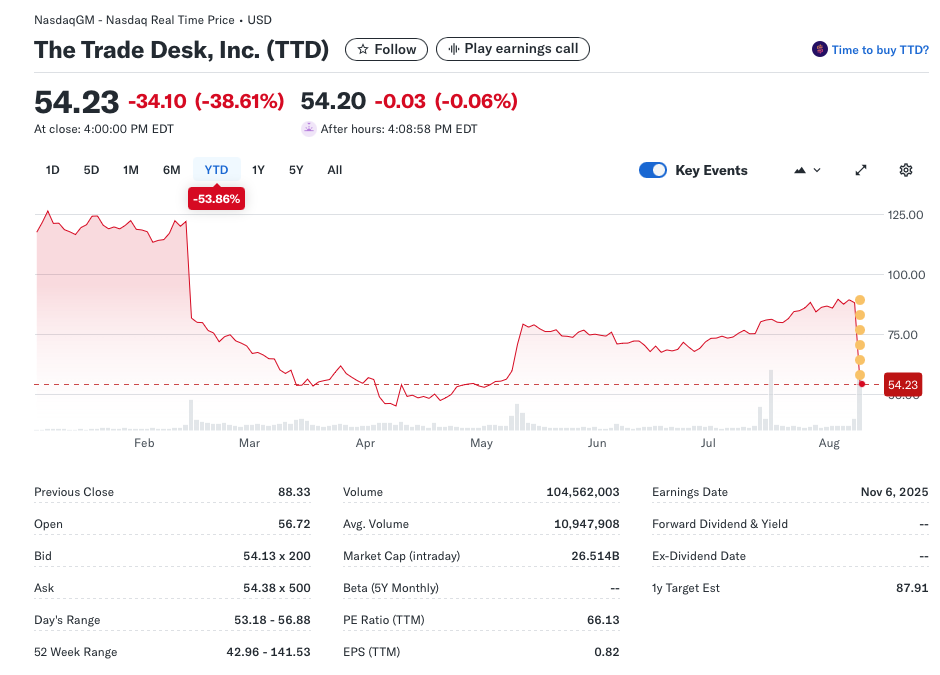

Today was a rough day for one of my favorite stocks – The Trade Desk (Ticker: TTD)

Down almost 40% today.

The yellow bubbles mark the 5 analysts that downgraded the stock. I bought 200 more shares. I’m adding this to the 200 I bought on 3/28/25.

The March shares dropped initially – I hate this. We think we’re buying at the bottom and over the next month, the company proves it can go even lower. Awesome!

The 3/28 shares were starting to look pretty good until today’s jaw-dropping plummet.

I love the company and put another $10,000 in.

With those analyst downgrades, some not-so-great earnings news, and a CFO departure, it could well drop another 10 or even 20% in the coming weeks.

To me, this is still a great company with a huge market opportunity. Let’s see where it’s at in a year.