I was at a retirement party yesterday and there was a lot of talk about social security – it’s fun to hang with old folks like me.

The general sentiment was a feeling that social security is my money. My employer and I both paid in through payroll taxes throughout my career so it’s mine.

Even AARP is worked up about this.

I wrote about this here, but I wanted to dig deeper on a few topics.

Why The Excitement?

Social security’s own trustees (we’ll talk more about them later) have stated that the social security trust fund will run out of money in 2035.

There have been rumors in the media that the government may cut benefits. But then again, it’s the media…

Both of these items have generated concern.

Is it Mine?

Yes and No.

Let’s start with Yes.

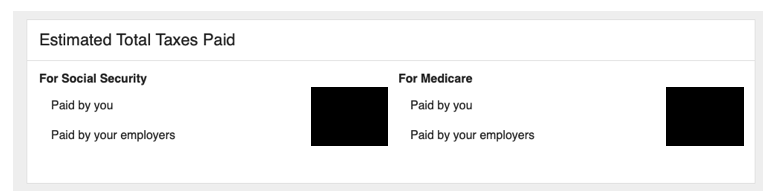

We can see what we’ve paid in payroll tax and what our employer paid.

If you’ve been reading, you already have an ssa.gov account. If not, create one now. It’s simple.

After login, at the bottom of the first page, you’ll see

Click on Review your full earnings record now. There’s some cool info. See your salary, as reported by the IRS, for every year you’ve worked.

In 1979, when I was 16, I earned

Scroll to the bottom and you’ll see

I’d like to think that that money belongs to me. After all ssa.gov knows that my employer and I have paid in and how much we’ve paid.

Please just send me a check.

And the No Part

While ssa.gov shows me the contributions, social security is not set up like a defined contribution plan (like a 401k). By that I mean, we don’t get an account statement, we don’t see our earnings grow, we don’t choose investments.

That money is meant to pay my benefits, but it is not really and truly mine.

How Social Security Works

Well, not how everything works, but we’ll focus on 2 key components. The Trust Fund and the Trustees.

The first thing to note is that when social security takes in money from you and I and our employers, it uses that money to pay benefits. So in 1979 when I was clearing tables at York Steakhouse and some small percentage of the $1,257 that I earned went to social security taxes, that amount was immediately paid out to some dude or dudette who was collecting.

And things were good for social security in 1979. Social security was taking in more in payroll taxes than they paid out in benefits.

What Happens to the Excess?

Since social security takes in more than they pay out, there is an excess. This goes into the social security trust fund (actually it is called the Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund).

What’s a Trust Fund?

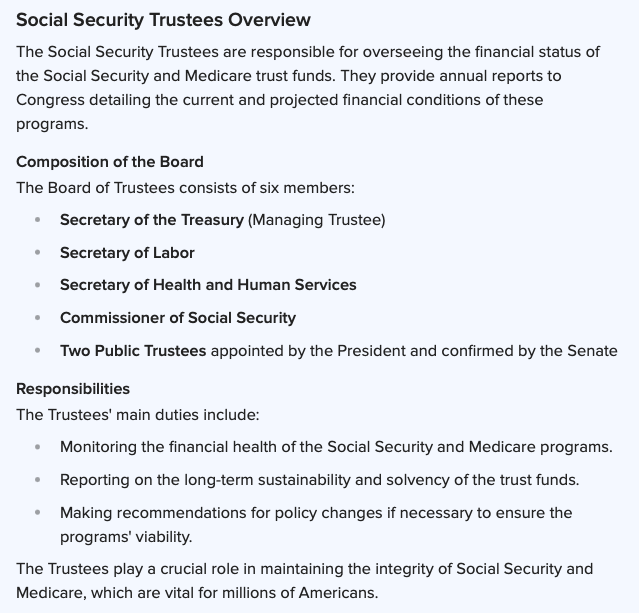

Basically it’s a pool of money, or securities, but the important point is that is is managed by trustees who are people who have a fiduciary duty to act in the interests of those that the trust serves. That’s us.

The trustees have to manage the trust for us, and not the government or the President or congress.

Wikipedia sums this up nicely.

This is good for us. Some important people manage these assets on our behalf, and report to congress.

Investments

And the trustees aren’t allowed to go out and buy Bitcoin or shares of Gamestop with the fund’s money. They are only allowed to invest in non-marketable treasury securities. Here’s more from the same wikipedia article.

This concerns me a bit. I love treasuries and have a few in my portfolio. They are generally considered very safe and conservative investments.

But treasuries are bonds, and as we know from the post on bonds , a bond is essentially a loan.

For example, I buy a treasury bond for $1,000 that has a 5% coupon and a maturity date of 8/11/26 .

I’ve given the government a $1,000 loan. They’ve agreed to pay back the full $1,000 on 8/11/26 – 1 year from today. And over the next 12 month’s, they’ll pay me $50 (5% of $1,000) in interest.

Wait a Minute

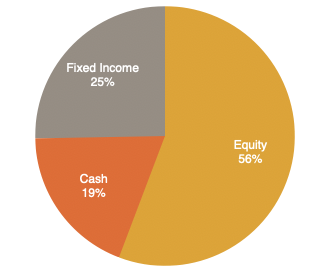

I have a nice diversified portfolio that looks like this.

I have stocks, equity mutual funds, bond funds, treasuries, CDs and money market funds. And yes I have 19% in cash. I have CDs paying over 5% interest, and my brokerage cash funds all pay more than 4%. This may change if interest rates drop, but for now, that’s a pretty good return for no risk and FDIC insurance.

But back to the point. The trust fund has all of its eggs in one basket. I won’t go through my spiel about the National debt, but this worries me a bit.

And my second concern is the government appointed trustees who are overseeing the bonds, which are essentially loans to themselves.

I’m sure this is less risky than I’m making it sound, but I’m not sure this is how I’d set things up. Then again, no one asked me.

2008 (or 2010)

It’s a little unclear, but either 2008 or 2010 was the first year that social security started to pay out more than it took in.

For those who have studied finance, you’ll recognize a problem here.

If we pay out more than we bring in, won’t we run out of money at some point?

Trust Fund

We still have the trust fund. As of 2021, the trust fund had over $2.8 trillion per the wikipedia article. That ain’t chump change.

The concerning thing was that recently, the social security trustees told congress in their annual report that the trust fund may run out of money in 2035. Apparently these things are complicated and you never really know for sure.

And while this doesn’t mean we can’t pay any more benefits, it likely means a reduced payment.

How Would That Work?

So you remember above when I was bussing tables and paying into the fund. My payments were going to someone else. Social security kept track, but they took in money, mine included, paid it out in benefits and put the excess into the trust fund.

In 2035, when the trust fund may be depleted, Some dude or dudette who’s serving coffee at Starbucks will be paying part of my social security check. The benefits for those collecting will be paid by those who are working and contributing.

How Does That Play Out?

Don’t ask.

Our population is aging. Good for pickleball, but bad for social security and for a lot of other aspects of our economy.

We’re living longer, so we’re collecting longer. But we’re not working and we’re paying (probably) lower taxes, and no social security taxes (probably, again).

We’re having fewer babies (not us, we should be playing pickleball, but young families…).

So this problem gets worse and not better.

Sound familiar? This is how defined benefit pension plans went down.

When people lived to 65 and the retirement age was 65, pensions were a cool benefit to offer. Many didn’t live long enough to collect. But then when we started to live into our 80’s and 90’s, it was no longer financially viable. That’s how the 401k was born.

Wrap Up

I’ve been doing a lot of reading on social security. The sound bites we get in the media don’t really add up and generally are there to influence our voting. That’s just my opinion, but it’s true.

As the Eagles sang in Victim of Love, “I could be wrong, but I’m not.”

In general, many of us are ill-prepared for retirement. We haven’t saved enough, and we just don’t have a good financial plan. This is not entirely our faults. Show me a high school or college class that teaches anything I post about here, including the car care products.

My generation is the first to have to largely support ourselves in retirement. My parents both had pensions. Most of my friends don’t have a pension. We’re on our own.

Social security won’t pay all of our bills, but it is a big piece of our retirement financial plan and it’s important for us to understand how it works and what the risks are.

“That’s just my opinion, but it’s true.”

Sounds funny, but I believe you – can’t trust the media anymore.

You should compile all these blogs into a high school course.