I’m pretty excited about Roth conversions. I’ll tell you why in a sec, first some background…

Our retirement accounts, our IRA and 401k, 403b and SEP are tax advantaged accounts. The government provides tax incentives to encourage savings.

A traditional retirement account is a tax deferred account. This means that we pay no tax when we contribute, the account grows tax deferred, and we pay ordinary income taxes on withdrawals in retirement.

The idea behind this is that we’ll be able to contribute more because the money coming out of our paycheck isn’t taxed. And we’ll also get a tax advantage because our tax rate will likely be lower in retirement when we’re no longer receiving a paycheck.

Roth

A while back, the Roth IRA and 401k showed up. While it seems like a nice advantage for savers (and it is), I have to believe that the government hopped on board because the Roth lets them get their greedy little hands on our tax dollars sooner.

For the Roth, there is no immediate tax benefit. Unlike the traditional account, the money is taxed before it goes into your account. The government gets its cut right away.

But, the account grows tax free and the money we take out in retirement is tax free. We don’t pay ordinary income tax rates on withdrawal. We pay bupkis.

How Do I Get One?

Many companies now offer Roth contributions to 401k plans. You may be able to switch.

We can also open up our own Roth IRA and make contributions. There are tax considerations and income limits so do some reading first.

Roth Conversions

But, for those who have saved for years in a traditional IRA or 401k, we can make Roth conversions.

What’s this you ask?

Well, we take assets and move them directly from a traditional retirement account to a Roth account.

Once we move the money, it grows tax free and there are no taxes in retirement when we withdraw.

Conversion Taxes

However, we will pay taxes on every nickel we convert.

The Roth Conversion allows us to move into a Roth, but we need to pay taxes in the year in which we make the conversion. If I decide to convert $100,000 from a traditional IRA to a Roth IRA today, I need to put aside money to pay the taxes when I file next April.

This is a big deal.

Let’s say we’re in a 22% tax bracket. We’ll pay 22% of that $100,000 in additional taxes. Quick math tells me that’s $22,000 I need to come up with next April, in addition to anything else I may owe.

And I wouldn’t recommend waiting until April. We’re required to pay taxes on earnings as we earn. If we don’t pay at least 90% of our tax burden in withholding and in estimated taxes, we’ll pay penalties.

I have a big spreadsheet that helps me estimate the required estimated tax payments. But I’m still surprised sometimes.

Taxes are tricky.

Assets

Here’s the trick.

If you were reading carefully, you may have noticed that I said converting assets at one point.

The first year I didn’t really think about this and I sold some securities in my traditional IRA and converted the money into a Roth.

Then I bought some new securities with the Roth cash.

This year in April as Liberation Day hit and the market tanked, I had an ah ha moment. What if I convert shares from my traditional to my Roth?

I’ll convert shares of companies that I love that I expect will appreciate in value. I’ll convert them at a relatively low market value in April. I’ll pay taxes based on the conversion value. My account will show the actual value when the market recovers from the tariff craziness and I’ll have saved on taxes.

I’m essentially converting more potential future value for less taxes.

How Did It Work?

Let’s take a look.

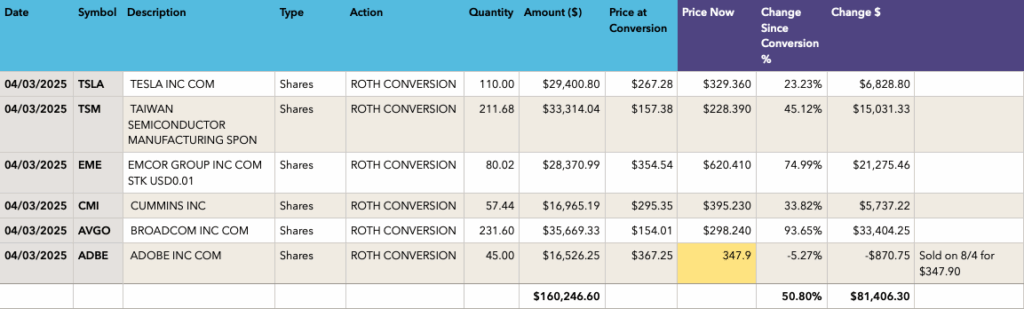

I converted shares of 6 companies that had pulled back significantly YTD. My conversion was on 4/3/2025.

I converted $160,000 worth of shares. This is the market value on 4/3. My broker will send me a 1099-R for that amount and that’s what I’ll pay taxes on.

Since 4/9, as we all know, investors decided they didn’t really understand this tariff thing anyway and “how bad can it really be?” and started buying stock hand over fist.

The market has rallied over 27% since Liberation day. Yay!

The value of the shares that I converted have increased by $81,406. At a tax rate of 22%, that’s over $17,000 in taxes I won’t have to pay.

Wrap Up

The whole Roth v, traditional is a tricky one. Which is better?

It depends.

If taxes are higher today, traditional is nice because I avoid taxes today and pay them in the future when I expect to be in a lower tax bracket. The unknown here is the tax rate in the future.

Roth, on the other hand, is a great way to save some tax-free money. I pay taxes today. Assuming that I’m working today, my tax rate may be higher than when I retire…but no more taxes…ever (on this money).

In the Roth, the growth isn’t taxed. With a traditional, I will pay ordinary income tax at withdrawal on every dollar, including the gain. Not so with a Roth. And since I’m planning on holding the Roth investment for many years, and the S&P 500 has gained on average 10% per year with dividends reinvested, I expect the gains to be huge.

So, in my opinion, avoiding tax on the gains moves the needle enough in the Roth’s favor to make it a good bet even with the tax rate unknowns.

And this year’s ah ha moment about converting shares instead of dollars makes the Roth even more appealing.