I was a little surprised last week when yet another executive order made the scene. This one targeted the assets available for investment in worker’s 401k plans.

I’d like to say that I can see the benefit of this, but I just can’t. Before we get into the analysis, let’s take a look at the executive order and what happens next.

Executive Order

The executive order directs the Department of Labor (DOL) and the Securities and Exchange Commission (SEC) to look into existing regulation and provide updated guidance in 180 days. Read the details here.

It goes on to talk about giving plan fiduciaries clearer legal protections.

401k Plans

Before we go on, let’s talk a little about 401k plans.

Fun fact: 401k is the section of the US tax code that defines these plans.

The plans came about in the early 1980’s as companies were finding that their employees were living too long and it was no longer viable to offer defined benefit pension plans.

401ks were a nice alternative. Both employers and employees get some tax benefits but the burden of saving and making investment decisions falls to the employee.

In order to be a qualified 401k, which means the employer and participants are entitled to tax advantages, the plan must have a fiduciary. This is what the IRS says about that.

Fiduciary

This is good news for employees. Most of us don’t know a whole lot about investing or investments so it’s nice that we have a qualified professional whose job it is to make sure we don’t run with scissors.

As a plan fiduciary, I’ll choose a group of suitable investments for the plan. Participants will have a range of reasonably priced equity, fixed income and stable value (yuck) investments from which to choose. The fiduciary may also add features to the plan like auto enrollment, defaulting to target date funds and annual contribution increases.

The fiduciary’s role is to make the plan advantageous to the participants. We like the fiduciary.

And as long as the fiduciary acts in our interests, they are protected. We can’t sue them, if for example, our stable value fund gains almost nothing in value over 20 years.

I’ve written about stable value funds before. I believe they have no place in a retirement plan, unless we’re already retired. The goal of a stable value fund is to preserve capital. When we are saving for retirement, our goal needs to be to maximize investment return over many years.

401k Plan Investments

As a participant, our company, the 401k provider, and the fiduciary will choose a slate of investments from which we can choose.

The new executive order asks that the DOL and SEC look into expanding that slate of investments to include things like crypto, real estate and private equity.

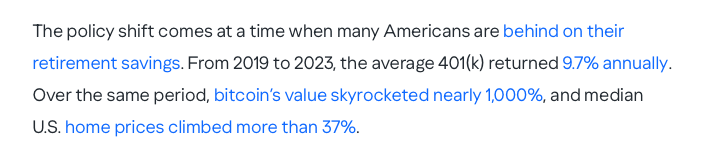

Here’s the rationale:

Let’s Analyze This

That’s the background (facts), now let’s look at what this means. This is opinion, but like I said yesterday, I may be wrong, but I’m not. Thanks to the Eagles for this line (from Victim of Love).

9.7% ???

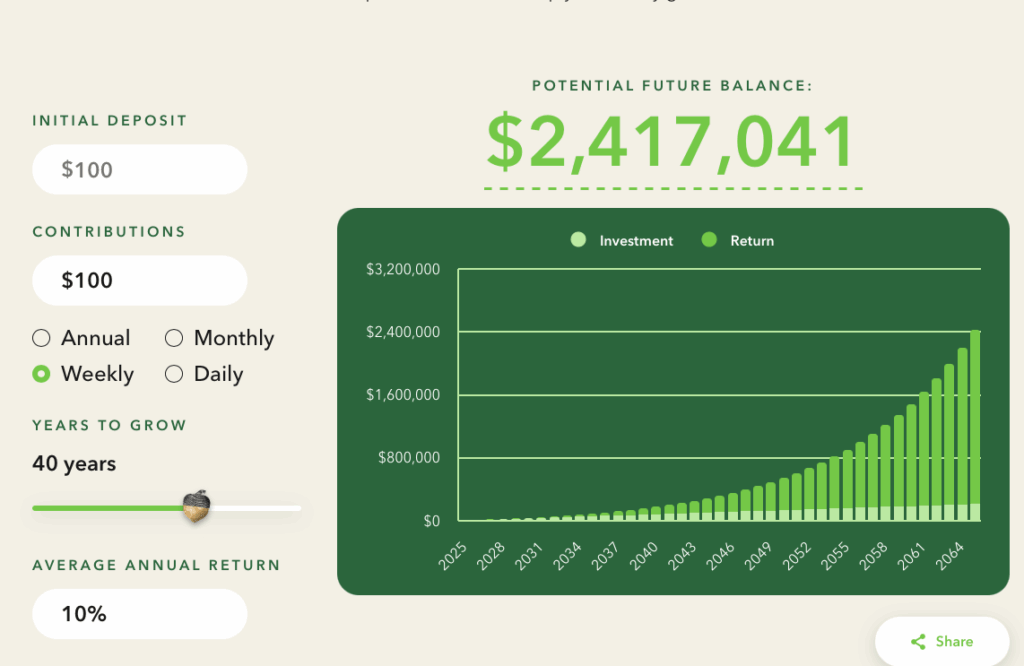

The article implies that 9.7% is something to sneeze at. If I put $100 per week in my 401k for 40 years, at 9.7%, I’ll have roughly

Context

A couple of facts.

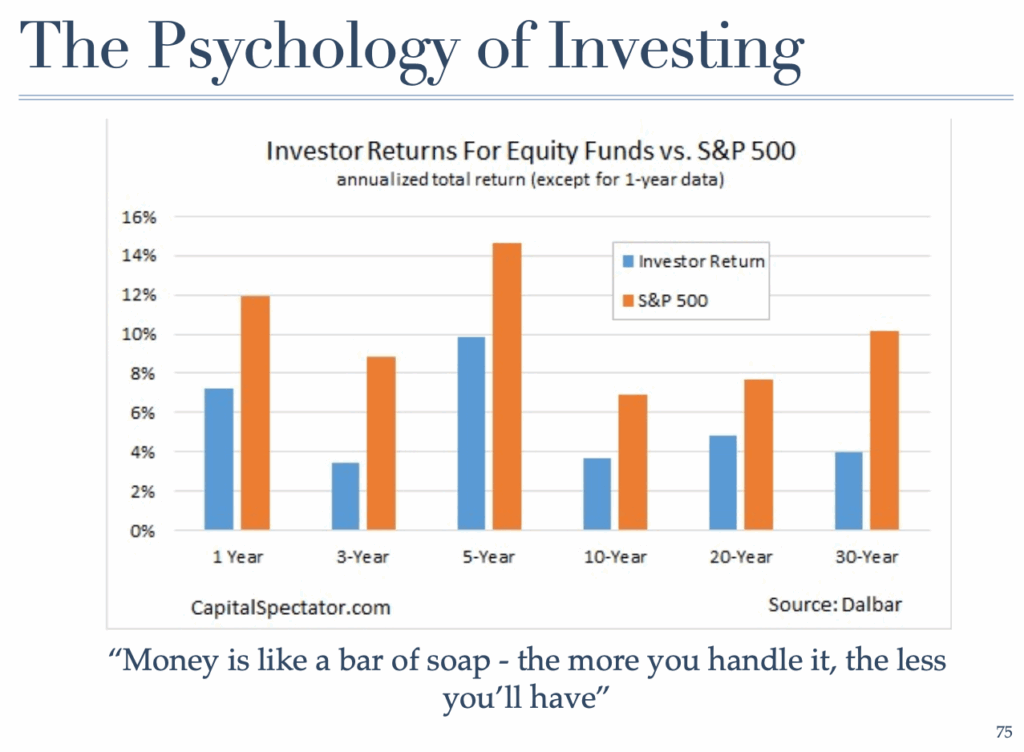

The average investor significantly under-performs the S&P 500. This is because we’re either too conservative, or we are continually chasing last year’s best performer which locks us into a buy high/sell low routine.

The point of this fact is that we would all be much better off if we parked our money in a nice low-cost S&P 500 fund and walked away.

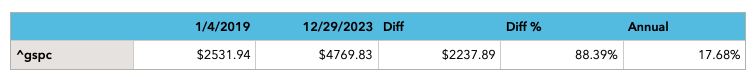

And yes, 9.7% is a solid return, but the S&P 500 returned over 88% during that 5 year period, which is over 17% per year.

Here are 3 important facts:

- The average investor under-performs the S&P 500.

- The S&P 500 has averaged 10% per year with dividends reinvested over the last 100 years or so.

- 10% per year return is more than enough to retire wealthy if we commit to start saving and investing early in our careers and we’re patient.

Alternative Investments

The folks who invest in alternative investments like crypto, real estate and private equity tend to be experienced investors. And even they have mixed results.

And the inexperienced who invest in these tend to have disastrous results. For every bitcoin millionaire, there are dozens who have lost their life savings.

Investing in alternatives requires a level of patience, knowledge and expertise that many less-experienced investors don’t have.

Some who are making money in bitcoin are doing so by trading it. They hop in and out. Are we going to be doing this in our 401k plan?

Instead of working during the day, employees will be watching the bitcoin ticker and trading their 401k assets.

Redemption Fees

For investors like you and me, redemption fees are largely a thing of the past. These fees were charged to investment holders to discourage them from moving their money out of the investment.

Most mutual funds invest in liquid assets like stocks and bonds. If fund shareholders redeem shares, the fund manager can easily liquidate holdings to pay us our money.

Not so with private equity and other alternative assets.

Real Estate

Let’s use real estate as an example. Let’s say our 401k plan has a real estate investment that we’ve chosen.

Now as a note, this is far different than a real estate fund which is designed to hold a basket of real estate stocks and also carries a cash position.

This real estate portfolio is actually made up of office buildings, data centers, shopping malls and other hard assets.

If many 401k investors want to sell – and this is exactly what happens on market pull-backs, the real estate portfolio managers will need to sell properties to raise cash.

This is disastrous.

The portfolio needs to list property and try to sell. And it’s selling in a down market so it will likely lose money.

And how long do you think this will take? Will we get our money overnight like we would with a mutual fund? Not likely.

I’m not making this up. It happened to investors in a Blackstone real estate portfolio. Read here.

Many alternative investments use redemption fees (we pay to get our money back) or won’t commit to a timeframe for returning our investments because they have our money invested in real assets that must be sold v. securities which trade on exchanges.

Wrap Up

As someone who writes and teaches to try to advance personal finance understanding and who advocates conservative and patient investing to build wealth (remember Sylvia), I’m not excited about this executive order.

Turning 401ks into a casino where untrained investors can harm themselves and their financial futures seems risky to me.

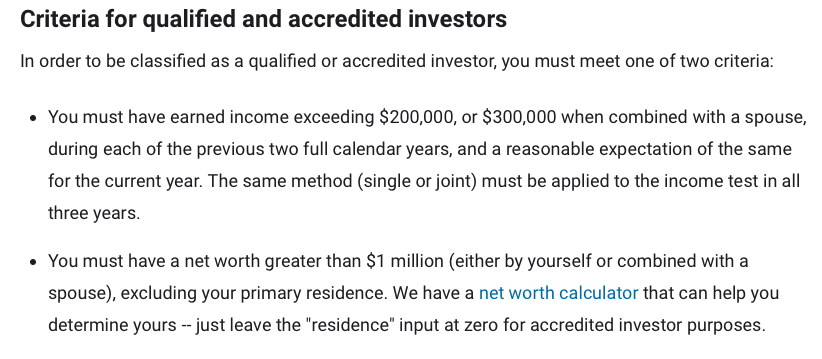

We’ve already seen this when Blackstone took in unaccredited investors into one of its private equity funds. More about accredited investors from the motley fool here.

Here are the highlights:

The good news is the executive order asks for the DOL and SEC to look into this. Hopefully this is as far as it goes. But even then, if it does come to fruition, we don’t need to invest in these options.

The sad part is that many will. And they’ll trade in and out. and be worse off than if they were put into a nice low-cost S&P 500 fund.

The sad part for us is that this will cause more under-funded retirees who will need to be supported by our tax dollars.

No one asked me but there you go.

I Told You So

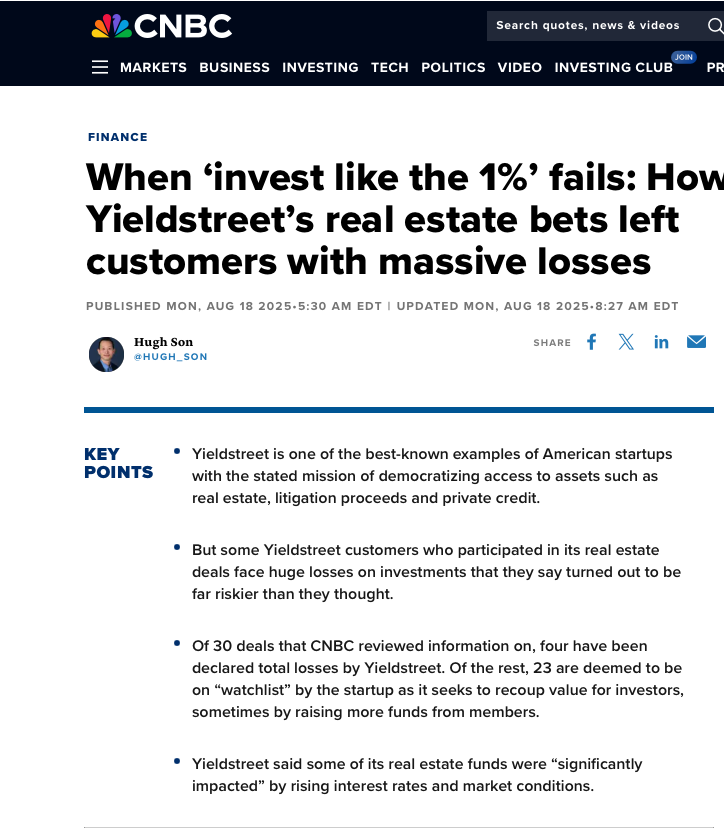

Updating last week’s post with a headline from CNBC today:

Like Blackstone, it looks like Yieldstreet decided to make some cash by selling complex investments to the average Joe investor.

There are 2 big differences between most of us (aka the average Joe investor) and the “accredited investors” who invest in these complex securities.

- Knowledge. Most of them went to business school or have staffs of Harvard MBAs who understand these products. They’ve also got years of experience so they understand how they behave which helps them not react.

- Money. People and institutions that invest in these products have lots of it. Their own and most often they are investing on behalf of others.

These investments aren’t designed for the average Joe. That’s why we have mutual funds.

I may be wrong, but I’m not.

Is there valid concern that bitcoin BS will need a bail out like the banks?

My opinion, I’d say no right now because bitcoin and other cryptos are unregulated and while there is a lot of money in crypto, a crypto failure would cause a lot of pain, but would not be a huge risk to our financial system. However, if it continues to grow in popularity and we start performing everyday transactions like loans, mortgages, payroll, bank deposits, etc. via crypto it could become too big to fail – in other words, the government would need to prop it up to prevent a greater catastrophe.