I wrote recently about a decision not to buy a stock. Read here.

This is something I don’t write about enough. It’s fun to talk about our winners. “I bought shares of (name your favorite) and it doubled in 2 months!! That’s what we like, and that’s what people want to hear about.

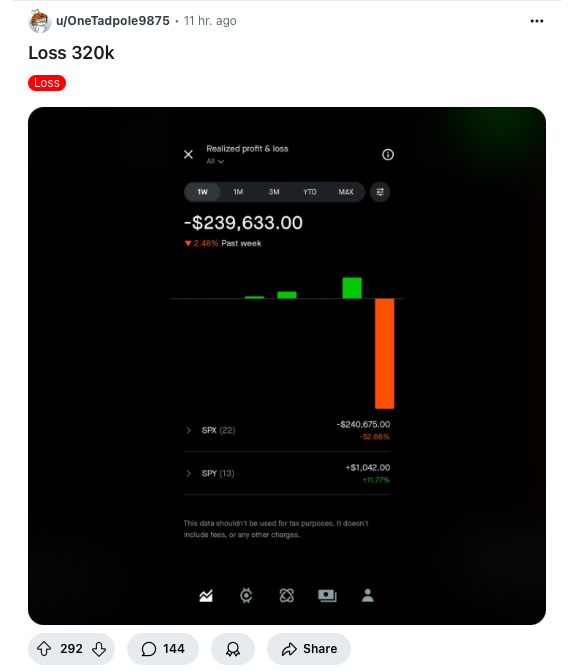

Or, some of us tune in to wallstreetbets to see who lost big. That’s fun too. It seems some take great pride in their own disaster and enjoy sharing with others.

Big gains or big losses. Both are exciting.

Dull

Unfortunately, there are a lot of dull moments in the quest to make money.

This is true if we work in an office, if we’re flipping burgers at McDonald’s, or if we’re an investor.

Most people don’t want to tune in for that. I can feel your eyelids drooping already.

But stay tuned. This is important and we’ll make it fun. Here’s a funny dog pic to start us off.

Background

I consider myself a successful investor. I retired at 56 and unless I have a spreadsheet error, my wife and I should make it to our mid 90’s.

I’ve never had a hot tip that worked. In fact, I’ve had several that left me poorer, though a bit wiser. I consider this paying for my investing education.

My secrets are all over this blog. So it’s not really a secret. Here are the key points.

- Prioritize saving. If it doesn’t hurt a little, you’re not doing it right.

- Invest. You don’t need to be clever. A nice low-cost S&P 500 fund has proven to build wealth over long periods of time.

- Be patient

Sure there’s other stuff and the over 200 posts are littered with stories and learnings from my many years in finance.

Thanks to those who have read and commented. I’m glad folks are reading.

Successful investing does not mean right every time. Far from it. I am right sometimes. I am wrong sometimes. I get better over time.

Choosing Companies

To me, this is the fun part.

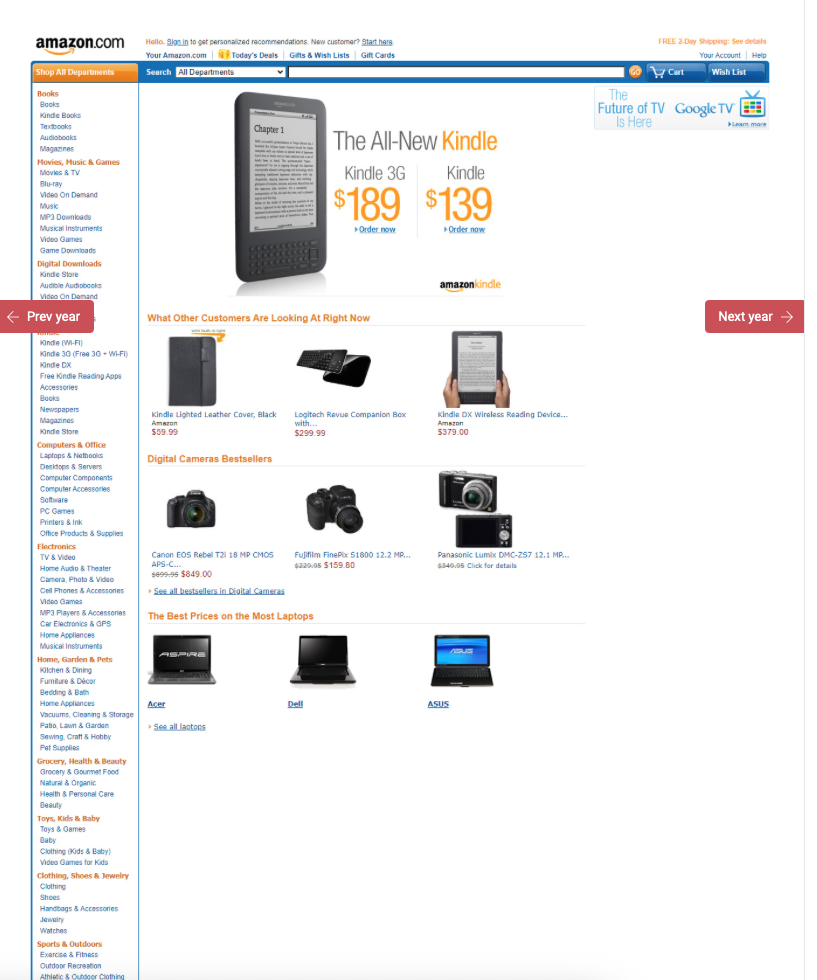

I write often about Amazon, Apple and Netflix. In the early 2000’s, these 3 companies stood out to me.

Amazon was selling stuff online – mostly books at this point. Here’s what the website looked like.

I love electronics and I hate to go to stores. That’s what attracted me in the first place.

And the over the years, they started selling more stuff, adding Amazon Web Services, buying airplanes and trucks to build out their own delivery network….it goes on and on.

I put a few dollars – literally, a few – sometimes less than $100 – into Amazon stock purchases over years. Often when earnings were announced and there was a 20% pullback, I bought a few more.

I’m not Warren Buffet. I’m investing hundreds of dollars not billions.

Apple

I bought my first Apple computer in 2008, and I wanted (but couldn’t afford) an iPod when they first came out. I had a cheap knockoff (remember the part about saving needs to hurt. Here’s an example. We don’t necessarily have to deprive ourselves, but we can’t always have everything we want, gasp!)

I had a lot of crappy phones too until I could afford an iPhone. And for many of those early phones, I wouldn’t spring for a data plan. I got data over wifi when available, other than that, if I wanted entertainment, I had to call someone.

And all that money I didn’t spend on iPods, iPhones, data plans and other stuff went to purchase shares of Apple.

Netflix

My daughter was young, I was divorced, and I was working crazy hours, and traveling for work. My new DVD player came with a coupon for something called Netflix. I went online, created a wishlist and DVDs started showing up in the mail.

My daughter always had something to watch (I also skimped on the cable channels to save a few bucks), no more late fees, keep it as long as you like and when they go back, a new one shows up 2 days later.

Winners?

They’ve all done quite well over the last 25 years. So has a nice low-cost S&P 500 fund.

Netflix totally killed it with a 114,998% gain, but nothing wrong with the $12,624% gain of Amazon.

But there are some jaw-dropping pullbacks for all of them. Look at Netflix during the whole quickster debacle of 2008.

I had many shares that were in the red.

But we’re getting off track. The point is that this is the fun part for me. I love finding cool companies, doing some homework and investing.

Not Investing

But for every Amazon, Apple and Netflix, there are dozens of companies I took a look at and said “not for me.” Sometimes I was right to skip them, other times I missed out.

For me, I need to be committed to the company’s story. I need to believe that they have something that sets them apart.

For an older company like Cummins (CMI) that’s been around a long time, this is pretty straightforward. There is a ton of data on the company, its earnings, its performance in tough times, and its ability to grow earnings. In the early days of Netflix, there was no track record. My commitment came from my belief that they would excel.

I look at lots of companies that don’t pass this test for me.

UPS

United Parcel Service – Men in short pants delivering packages. What’s not to love?

I invested in UPS in 2022. I sold covered call options on all of my shares and I enjoyed the dividend. If I recall correctly it was around 3%.

I ended up getting out of the investment entirely in 2023 during some rough times for UPS. I lost faith in the company and I was seeing companies like Amazon opting to build out their own delivery network.

I sold at $154 per share. I had a capital loss that was offset by the dividends and option income. I ended up ahead by $34.01. Yawn.

UPS Again

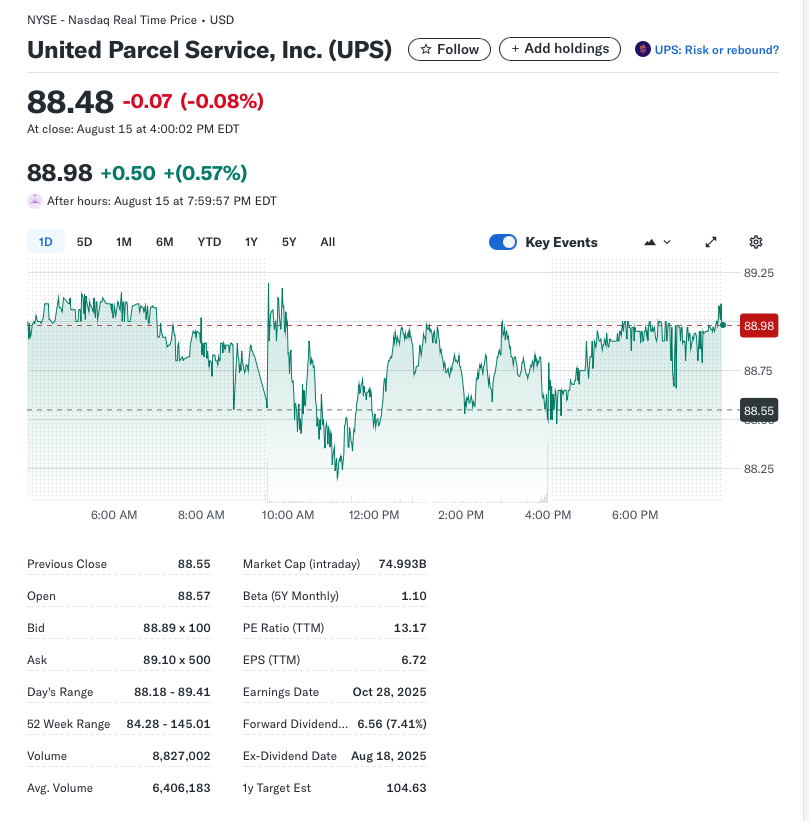

Today, while reminiscing, I decided to take another look. I was aware that the stock price was in decline.

Holy Cow!! It’s down to $88.48 and the dividend is 7.41%.

I liked the company in the $160 per share range. Today it’s half off and look at the dividend!!

Dividend

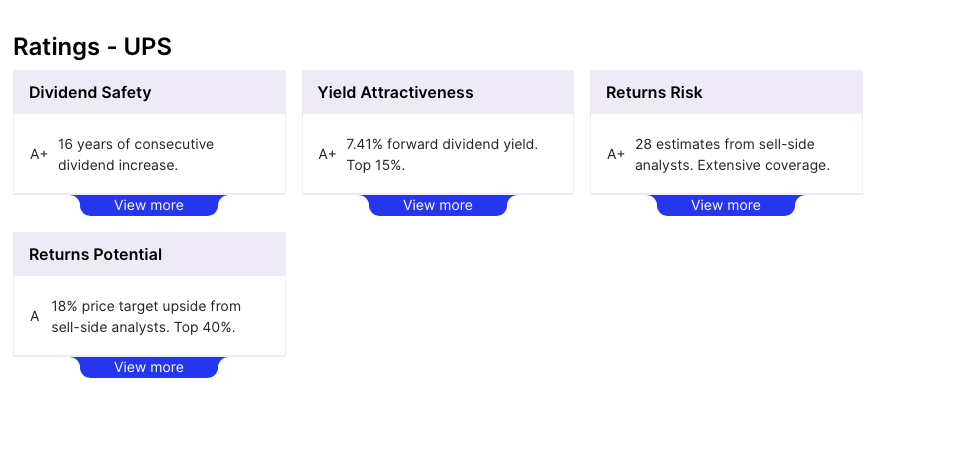

Dividend.com has nice things to say.

At this point, my finger is itching to hit the buy button. A solid company with a 7% dividend and it’s on sale!

Independent Investor Reports

Before I do something crazy, I stop by to read some investor reports on my brokerage site. Here’s what one had to say.

I’m getting even more excited as I read the first 3 sentences…and then…

The Business

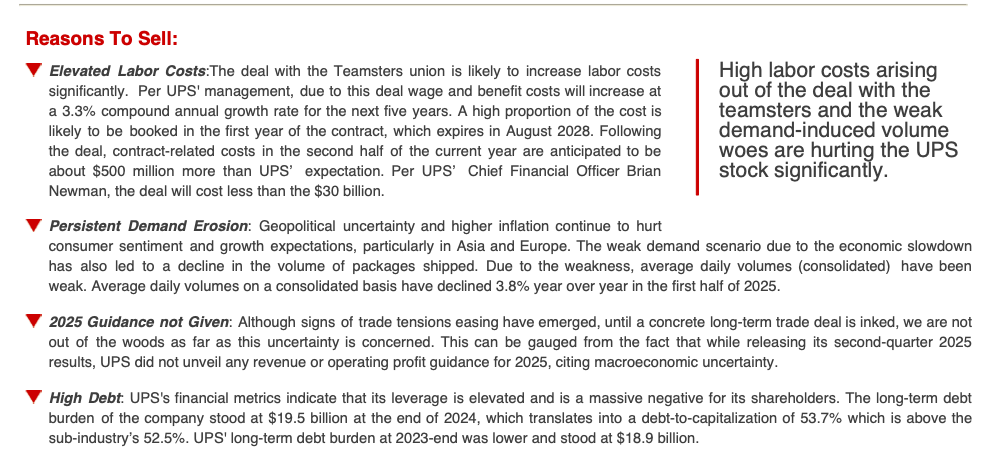

Geopolitical uncertainty. Yup!

That’s a problem. Include tariffs with that and UPS has some headwinds.

And I wasn’t too excited about management in 2022. Do I think this is the management team to navigate these headwinds? I don’t feel great, and I sold for this reason in 2022. If I buy shares of UPS at the low low price of $88 and they make their way down to $44, I’ll be quite unhappy with myself.

And while dividend.com is optimistic, what if UPS has to cut its dividend to help keep the business afloat? Would I like the stock at $44 with a 1.5% dividend? After buying at $88 my capital loss would be 50%, and my dividend would be 0.75% (based on 1.5% of the current price of $44, not my purchase price of $88).

Read On

In fairness, there are reasons to buy highlighted in the report as well, but the reasons to sell are compelling.

My Goal

This is where I reflect on my goal as an investor. It is very simple: TO MAKE MONEY!

UPS could double from here. It could raise the dividend. Who knows? But is this the best place to put my money? Does UPS have a better chance than Amazon, Apple or Netflix?

Would I be better served buying shares of those companies instead? Or a nice low-cost S&P 500 fund.

Wrap Up

I don’t need to invest in every company that wins big. I only need a few to build wealth.

I’ll invest in companies that I believe in. I’ll be right sometimes and I’ll be wrong sometimes.

But I have to be committed. This is what helps me stay the course when the company pulls back – which they all do at some point.

I can tell you, I don’t have that level of commitment with UPS right now.

I do have that level of commitment with Amazon, Apple, Netflix and with the S&P 500.

I’ll pass on UPS. I’ll keep my eyes on it, but now is not the time for me to buy shares.