Growth companies are not necessarily companies that grow quickly, or at all. Many burn out and fade away. Today, we’ll take a look at what a growth company is, whether we should invest, and some ideas on determining an appropriate buy price.

Growth Companies

You can read the details from investopedia here.

A growth company is typically a young company whose valuation relies on ultra-high growth. The business is often based on a great idea or product like Uber, Netflix, or Amazon.

In the early days, the company generally takes in a lot of cash, but invests that cash and more to grow the business. These companies usually take on a lot of debt, or sell pieces of the business to venture capitalists in order to fund their growth.

At some point, these companies go public. This means they sell shares to the public on a stock exchange. Investors who invest in growth companies typically have a strong belief that the company will succeed and are willing to forego earnings today for sales growth today and the promise of profits in the future.

Here’s one of the reasons that growth company’s stock prices are volatile. Investors expect to see year over year sales growth of 20% or more each quarter. When the company has a quarter where they don’t put up 20% growth, the stock price tanks.

Or when a company does put up 20% growth but forecasts slowing growth due to economic factors like inflation or tariffs, the stock may tank.

It doesn’t seem fair. Who can grow at this rate every single quarter? What if the right business call is to invest more in the business and grow by a smaller multiple for a quarter or 2? This is what Amazon decided to do in the early years and they were punished at almost every earnings release.

Investors have very high expectations. Since profits won’t materialize for many quarters to come, investors expect steady sales growth to assure them that the company is on the right track. Any signs that the company won’t deliver often send investors heading for the door.

Palantir

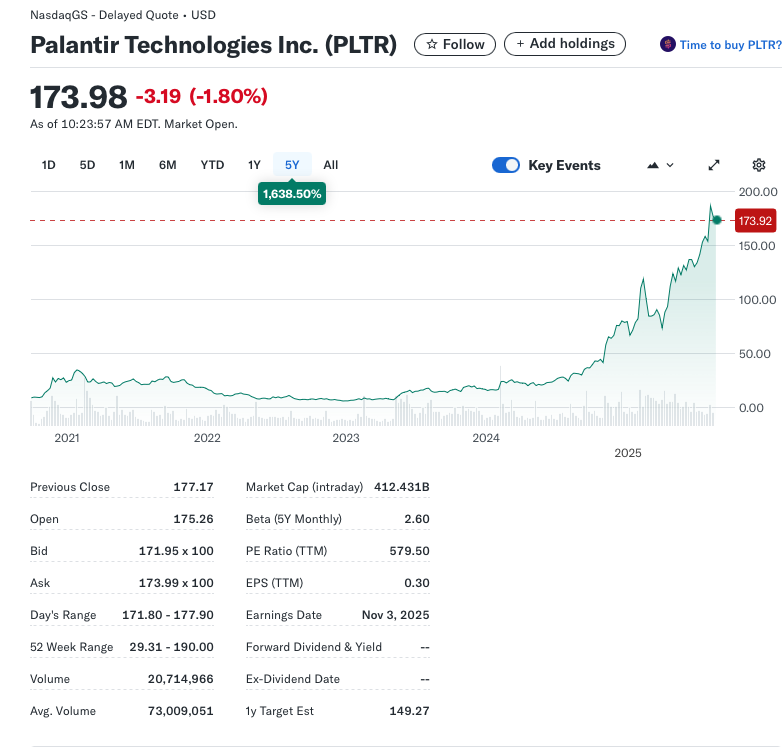

Plalantir is one of the hot stocks in the news these days. Here’s why.

It’s up 1,638% since 2021.

And, bonus, it’s profitable. It has $0.30 in earnings per share and trades at a p/e of 579. The Argus investor report for Palantir lists SAP as a competitor. SAP has a p/e of 42. SAP is a much larger and more mature company.

The reason we pay more than 10x for Palantir’s earnings is that we expect huge growth. If that growth doesn’t pan out. That stock price will plummet.

Buying Growth Companies

Now that we know what a growth company is, should we buy shares?

1,638% gain in a few years is pretty attractive so maybe.

My Experience

Over the weekend I wrote a post about Not buying UPS. In the post, I gave my reasons why I thought it wasn’t the right time for me to buy shares of UPS. I then talked about my 3 favorite companies – Amazon, Apple, and Netflix. Each of these 3 has had extraordinary gains.

I bought and sold shares of Amazon, Apple, and Netflix many times over the years. I still have some positions from 2008 and 2009 that are up quite a bit.

And while these positions have increased in value quite a bit, I’ve also bought shares of Lemonade, Under Armor, and many others that have not done so well.

I bought shares of Lemonade for as much as 141.49 per share. I sold at $18.21. That’s a cool loss of 87%. On one Under Armor position, I lost 78%.

Buying Growth Companies (part 2)

This gives us a bit more clarity on the “should I buy shares?” question.

If a loss of 80% on our investment terrifies us, then maybe not.

Growth Strategy

I can’t remember where exactly I read this, but I remember reading that venture capitalists tend to lose money on most deals. But every now and then, they get the big one that makes up for dozens of bad decisions and can build a fortune.

In venture capital, it is a bigger sin to lose out on a big winner than it is to back a loser.

I have a strategy for growth. It’s based on 2 facts.

- Many growth companies will not make money, and may go to zero

- Even the biggest winners will have significant pullbacks. Sometimes these will be 50%, 60% or 70% pullbacks and they may last years.

I know that I need to invest in many companies because some will win and many won’t. I typically have at least 25 growth companies in my portfolio.

I also know that I need to hold on for the long run, unless there is a major change to my thesis.

Examples

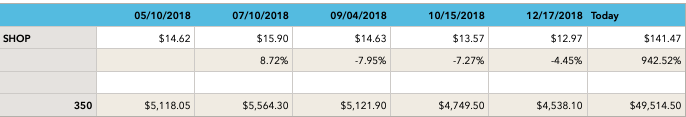

In the secret to building wealth, I talked about my experience with Shopify. I had heard about Shopify, I’d done my research and I bought a few shares. I took about $5,000 and bought 350 shares.

Under each date is the price of SHOP on that date.

After 2 months I was up 8.72% – brilliant. Then I’m down 7.95% so back where I started.

Then in one month, down 7.27%, then down an additional 4.45%

The last line shows the value of my Shopify shares. By mid-December, I’m down 11% and I’ve lost $579.

Growth stock my foot!

I held on and today my Shopify shares are worth almost $50,000.

Netflix

Netflix was even rockier.

In late 2004, Netflix dropped 75% and stayed down for a year.

Under Armor

I held on to Shopify and Netflix, but I dumped Under Armor.

There was some chaos at Under Armor. Some c-level execs left, the founder stepped aside and then came back. There were inventory mistakes that they were unable to correct and they ended up discounting a lot of inventory and diluting the brand.

My thesis was on shaky ground, so I held on a long time, perhaps too long, then I sold at a loss.

What Did I Learn?

Not every great idea translates to a great business. And it’s really hard to tell which will and which won’t.

So, I do my research, create a thesis, buy and hold and expect volatility.

I have a basket of 27 growth stocks. Some will be great, most won’t. And the great ones more than make up for the not so great.

When to Buy

Growth stocks never look cheap.

I bought shares recently of Bank OZK, which is a small low-growth, but high dividend yield regional bank. About as dull a business as you can get. OZK has a p/e of 8. Seems cheap compared to Palantir’s p/e of 579.

I also bought shares of Palantir recently.

I can’t tell you how many times I heard about Amazon being ridiculously over-priced. This was when it was trading in the single digits. It’s now at $230.59.

Price v. Expectation

My expectation for any growth stock that I buy is that it will double several times. Shopify doubled from $5,000 to $10,000, to $20,000, to $40,000 and past that to $49,000. And I expect to see it at $80,000 within the next few years.

Some will meet my expectations, most will not.

But the expectation is doubling multiple times.

Sometimes we agonize over price. I love this company and want to invest, but it’s p/e is over 1,000, or it’s not profitable so I’d like to see a 10% pullback before I buy.

We all do this. It’s easier to justify the purchase if we get it 10% off.

But, if our expectation is for a 1,000% gain over time, will the 10% pullback make a difference?

Buying on the Way Up

I have gotten myself comfortable buying on the way up. Especially for growth companies.

I keep an eye on those quarterly growth numbers. I may buy more shares if the company misses and the stock price pulls back. But if it misses several quarters or has trouble keeping executives, I get nervous.

Wrap Up

All of this is art more than science. There is no number, or formula that will confidently tell us that a growth company will succeed.

It’s important to have the right expectations. Some will succeed, many won’t. Buying a few, or many, gives me better odds.

I like the hunt. I like coming up with the idea, looking into the company, seeing what analysts think, and then making a small investment and watching.

But, investing in growth companies is quite a bit different than investing in large stable companies or investing in mutual funds. It takes commitment and patience.