Disney is one of the top brands in the world. That’s a bold statement, but think about it. Who doesn’t know Disney? Ask any kid (or superbowl winner) where they would like to go and they’re likely to tell you Disney.

My golf buddy Rich just came back from a family trip to Disney. He’s got a daughter in college and a son in high school. They’ve been many times and they keep going back.

My BBQ buddy Tucker told me how fantastic his Disney cruise was. “They think of everything!”

And I can’t imagine how I would have kept my daughter entertained if it weren’t for our well-worn 101 Dalmatians and Beauty and the Beast DVDs (OK…our first copy was on VHS, but we upgraded).

Today Disney’s streaming service Disney+ is a must have for parents. Disney has made lucrative acquisitions like Pixar, Marvel and Lucas Films (Star Wars) which have supplemented its already burgeoning slate of Disney content.

And how about ESPN? That’s a Disney property as well.

Brand

Brand is important. Companies spend a fortune in marketing to build brand recognition. Think of the brands you trust.

- Starbucks – hate their food but I always get a nice strong flavorful coffee.

- BMW – My wife and I both love BMWs. Her X5 was incredibly comfortable in our drive to Florida a few years back. My buddy Chris texted me out of the blue last week and said “I just drove an X5 and I need one.”

Brand matters. Disney is a safe bet when it comes to planning a vacation or finding something to watch.

It’s easy to make the case that Disney is a great brand and a great company.

Investment

So, if It’s a great company, doesn’t it stand to reason that it’s a great investment?

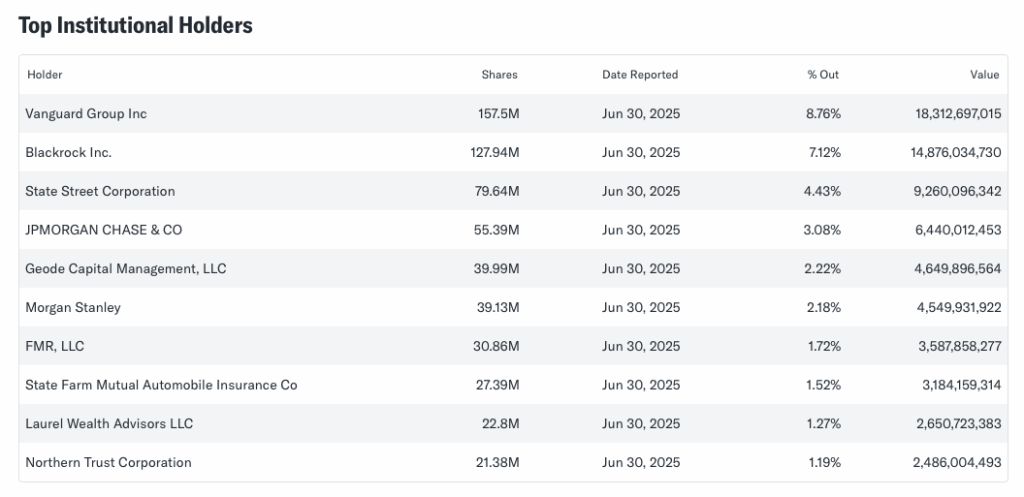

Institutional investors must think so. Check out the top holders at Yahoo finance.

Analyst Opinions

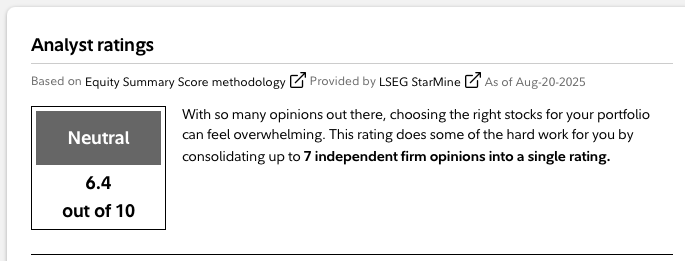

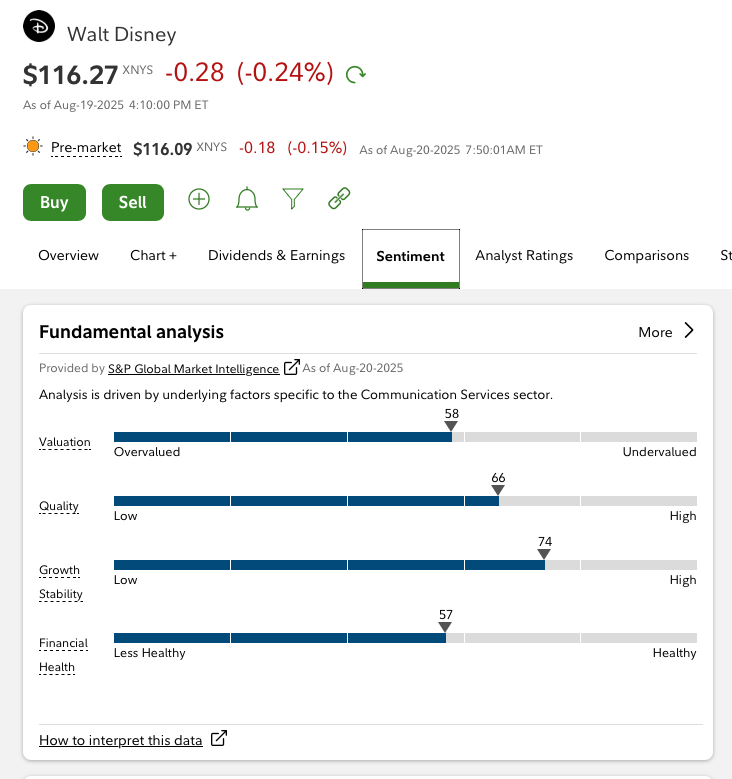

Here are a couple of indicators.

Analyst Ratings from LSEG

And fundamentals v. competitors

Looks pretty solid.

Past Performance

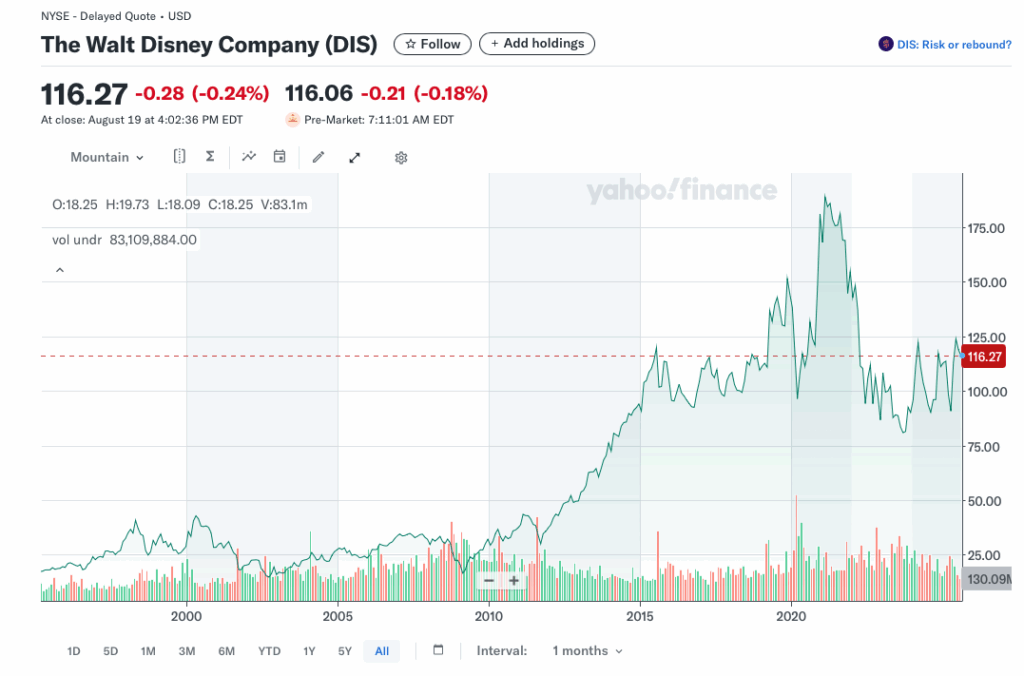

…is no guarantee… yeah, I know, but let’s take a look anyway.

Timing is Everything

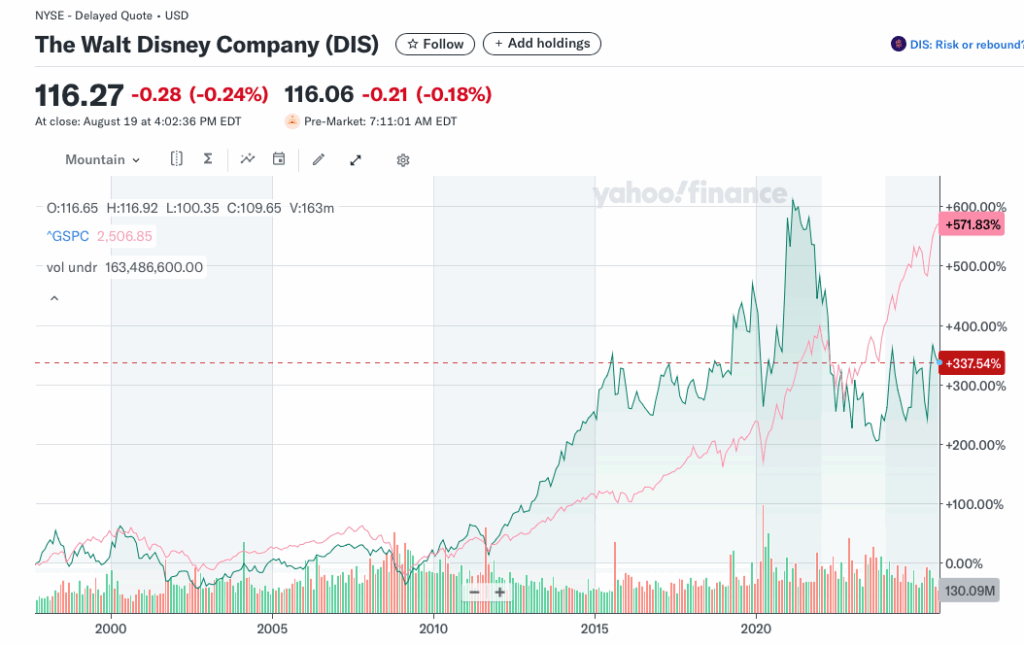

If we bought shares in 2009, we’re pretty happy. We’re a little bummed about the pullback from close to $200 per share in 2021, but we’re still in good shape.

If we bought in 2014. we’ve had 11 years of not much going on. We collected a small dividend, but even that’s been iffy. The dividend was suspended in 2020, but is back now, though at a lower level. Read here.

Performance v. S&P 500

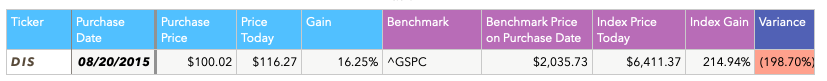

The chart below compares the price appreciation of Disney v. the S&P 500. In the first example, I’m buying shares of each on 8/20/15 – 10 years ago. Disney’s price gained 16.25%, while the S&P 500 is up 214%. Disney trailed the S&P 500 by almost 200%.

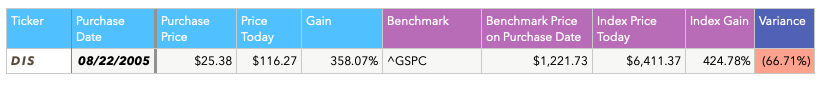

Even going back 20 years, it had some decent gains, but still trailed the S&P 500.

Take a look at the chart comparing the 2.

What Happened?

This is the question that started my day today. I’m not sure exactly what triggered it, but I started to think about my journey with Disney. I bought shares in 2010.

I had been an investor in Marvel (the comics company) in the 2000’s, and Disney purchased them in 2009. At that time, I took a nice profit on my Marvel shares, but it got me thinking about Disney. I bought some shares in June 2010, bought some more in August, then some more in 2011.

A big part of my thesis was the Disney brand. The parks, cruises, ESPN, Marvel…

I sold some shares in 2018 as I started to transition into Retirement-mode. I didn’t retire until the end of 2019, but I started preparing my portfolio in advance.

And then I sold the remainder of my shares in March of 2022.

We’ll talk about why I sold in a sec, but why was I thinking about Disney today?

It’s a fantastic brand. Not often do folks return from a Disney vacation disappointed. More often than not, they’re already planning their next visit.

As an investor, this seems like a company I’d want to own. What’s going on?

Turmoil

Now let’s talk about why I sold. See, I told you it would only be a sec.

Bob Iger has been the long-time CEO of Disney. He’s announced his retirement a few times and never followed through. In 2022, he finally retired and turned the reigns over to his hand-picked successor Bob Chapek.

Nothing unexpected. This happens all the time. And having the old CEO choose the new CEO is often a good sign.

Over the coming months, 3 things happened that soured me as an investor. Each individually might not have swayed me to sell, but all 3 together…Sheesh!

Fighting with Florida

Disney began a very public fight with (FLA) Governor Ron DeSantis.

Disney has had a sweet deal with Florida. Disney brings in tourists and creates lots of jobs, and Florida lets Disney govern itself.

The whole thing is pretty fascinating. One of my favorite authors Carl Hiassen wrote about it.

I won’t get into the details, but it was a very public fight with lots of threats from both sides. I was horrified as an investor. Didn’t seem like this was handled well by either side.

Fighting in the Board Room

Different than the hit song Smokin’ in the Boys Room by Brownsville Station. Also enjoy the Motley Crue cover.

Bob Iger remained on the board and was publicly at odds with some of Chapek’s decisions.

I imagine it’s hard being the CEO of a $200 billion company with over 200,000 employees. I bet it’s an impossible job when the chairman of the board – your boss – is publicly nitpicking your every decision.

OK. This one alone may have caused me to sell. But there’s more…

Disney Gets Into Politics

This is closely related to the DeSantis fighting, but the 2 things that concerned me were.

- The inmates seemed to be running the asylum. Disney management seemed to be taking queues from its employees and was buckling to their demands to take a (very public) stance on various hot-button political issues.

- Taking a public stance on issues that are not directly related to the company’s core business, especially political ones, immediately alienates somewhere around 50% of your customers. To me, this seems like setting your brand on fire.

I recognize that all companies are political. They make donations and they influence decision-makers. Walt Disney didn’t get that original deal with Florida by being a nice guy. Politics play a role.

I get it, but I felt Disney handled this poorly.

As an investor, we get to vote with our feet. I walked.

Regrets

Iger came back as CEO in 2022, and Chapek was gone. Boy, couldn’t see that coming…

And in 2024, Disney settled its differences with Florida.

I continue to follow Disney and wonder whether it’s time to get back in.

Wrap Up

I have not bought back in to Disney, and I probably won’t ever, or at least until some things in the business settle down a bit more.

Disney remains a fabulous brand – just ask Rich and Tucker, but I do think the brand has been tarnished. The company’s missteps in 2020 through 2022, which I do not believe were all Chapek’s fault, will take a while to recover from. And I’m not sure who is making some of their content choices but these seem to be dividing fans whereas in the old days, Disney seemed to bring people together.

It’s a different world today but Disney doesn’t seem to have as much potential as I saw in the company in 2010. I think it has some difficult waters to navigate.

On the other side of the coin, I like Netflix in media and entertainment, T-Mobile in telecommunications, and other companies that I think have a better chance than Disney in related industries.

Many mornings start this way for me. I say to myself “hey, what about…” Sometimes it’s about a BBQ joint or a friend I haven’t seen in a while, but often it’s a company in which I’m interested and it starts a process.

Have a nice rainy Wednesday.