Yesterday’s light read was Gen Z is deep in ‘financial nihilism’: Why young people are betting big on stocks and crypto.

Here’s a quick rundown:

I can’t help contrasting this with Sylvia Bloom. I’ve written about her and I always spend some time talking about her when I teach personal finance classes. You can read about her here and here.

Sylvia was born in 1919.

She was born to immigrant parents in Brooklyn, NY. When she was 10, the great depression hit. I’m guessing she had reason to be disillusioned as well.

Investing is Hard

I think we may be spending too much time telling folks investing is easy. All you need to do is set up a 401k contribution and let it grow. Piece of cake.

But in reality, it’s hard.

First we need to put aside money that we’d prefer to spend on other stuff.

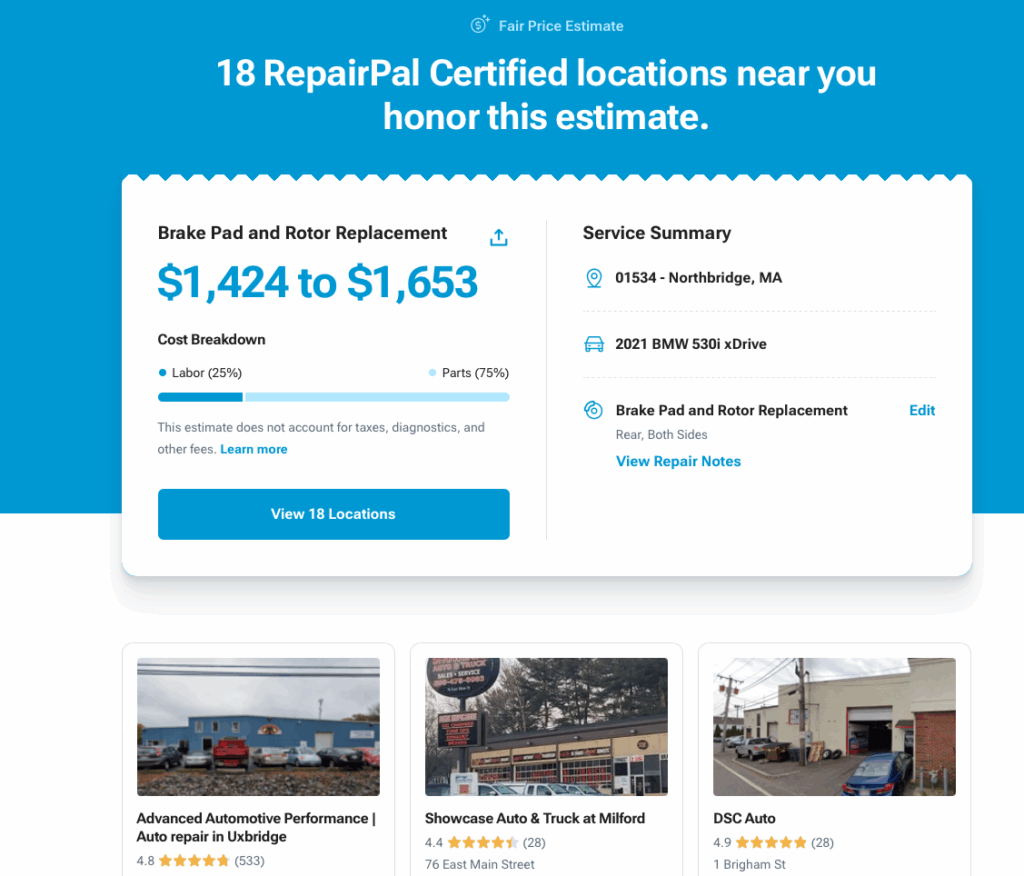

I just spent over $2,000 on new tires and brake pads and rotors for my car. I was prepared for the tires. They have been close to worn out for a while and I’ve been putting off replacing them. Winter is coming so I knew I’d have to shell out some cash for new tires. But the brake pads and rotors were a surprise, and not a pleasant one.

I choked a bit on the price and did some quick research at repairpal and realized that yup, $1,200 was more than reasonable.

So, quick plug for repairpal. It’s a great source to see what we should be paying for service, and the repair shops it recommends are researched by repairpal and customer comments are displayed on the site.

But anyway, I’m out over $2,000. How excited do you think I am about putting aside money for investing?

And today is brake pads, tomorrow it’s the mortgage, maybe a student loan payment, braces for the kids…

It’s hard to find money to invest.

Waiting

Sylvia made her first appearance on the blog in THE SECRET TO BUILDING WEALTH. Spoiler alert: In case you don’t click, the secret is time.

Sylvia built her fortune over 60+ years.

She went to work every day as a secretary. From what I’ve read about her, I expect she worked hard and didn’t spend a lot of time at the spa or on lavish vacations. She put herself through college while working and probably had to take some loans to do so.

And it’s easy looking backward to see that the S&P 500 averaged 10% return per year with dividends reinvested. Knowing that today, it’s easy to say that we should stay invested. But what if you didn’t know?

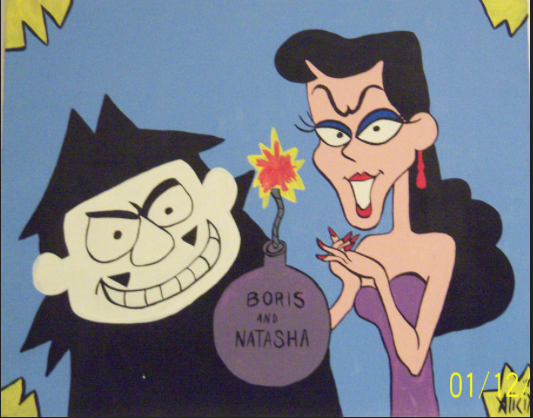

Sylvia was 10 when the great depression hit. She was 20 when World War II began. Korea, Vietnam, the cold war…there was a lot to be pessimistic about. When I was a kid, we’d have drills in school where we’d simulate a nuclear attack. For some reason we thought crawling under our desks would save us.

Russia was a real threat. Remember this?

Optimism

It’s easy to be optimistic when things are good.

A bit harder when a foreign nation has just bombed our country.

The Pearl Harbor bombing was a long time ago. 84 years is a long time. It’s easy to forget.

Sylvia was 22. Was she investing?

Patience

To say patience is a lost art is a huge understatement.

If I want to know about Pearl Harbor, I do a web search. I can read about it immediately. As a kid, I had to ask my mom for a ride to the library, hunt a bit, and search through a book and read. No CTRL-F.

And remember commercials? I’ve been hooked on Netflix for years. They recently added commercials to Amazon Prime Video. I can’t watch.

And remember buffering???

We’ve been conditioned not to wait. We can get everything now.

Wrap Up

I don’t believe that investing is dead.

I’m optimistic. I bought shares of 3 companies this week and invested $20,000. I expect that $20,000 to grow over time. In 20 years, I believe that the shares of those 3 companies will be worth significantly more than they are worth today.

In So How Do I Know the S&P 500 Will Go Up? I wrote about the reasons why I’m optimistic.

I read the news. Things are not ideal (ha ha). There are a lot of reasons to be pessimistic today.

This isn’t new. There are always reasons. Pick your decade. I believe there are more reasons to be optimistic than pessimistic.

But it’s hard to invest. We’ll need to make sacrifices to put money aside. This is hard if you’re optimistic. Even harder if you’re not.

We need to save money in order to invest. This is hard.

I like to find ways to save that don’t make me feel like I’m depriving myself. Shopping for cheaper home and car insurance or finding a discounted cell phone plan gives me the same benefit but with a lower cost. And I can use those savings to invest. Read more here and here.

And then we wait.

And wait.

I put a large chunk of money into an S&P 500 fund in early 2008. How do you think that worked out?

It took until 2012 – 4 years, to get back to even.

Imagine, putting hard-earned money aside, waiting 4 years to have exactly what I started with???

Well, here’s what has happened since I broke even.

Wrap Up (again)

Sorry, got carried away.

My point is that I don’t believe investing is dead.

I do believe that great American companies will grow. It may not be the ones we think, but that’s why I like the S&P 500. It’s a basket of the 500 largest publicly traded US companies.

Investing will always be hard. We need to save, which means putting aside money. And most of us need that money for other things so we need to get creative.

And we need to be patient and wait. We’re not good at this, and we’re getting worse. And we’re not good at being patient through setbacks.

Sylvia’s generation was much better at this.