Bet you thought this was about me retiring and forcing my spouse to bring home the bacon. Nice idea, but no. This is even better.

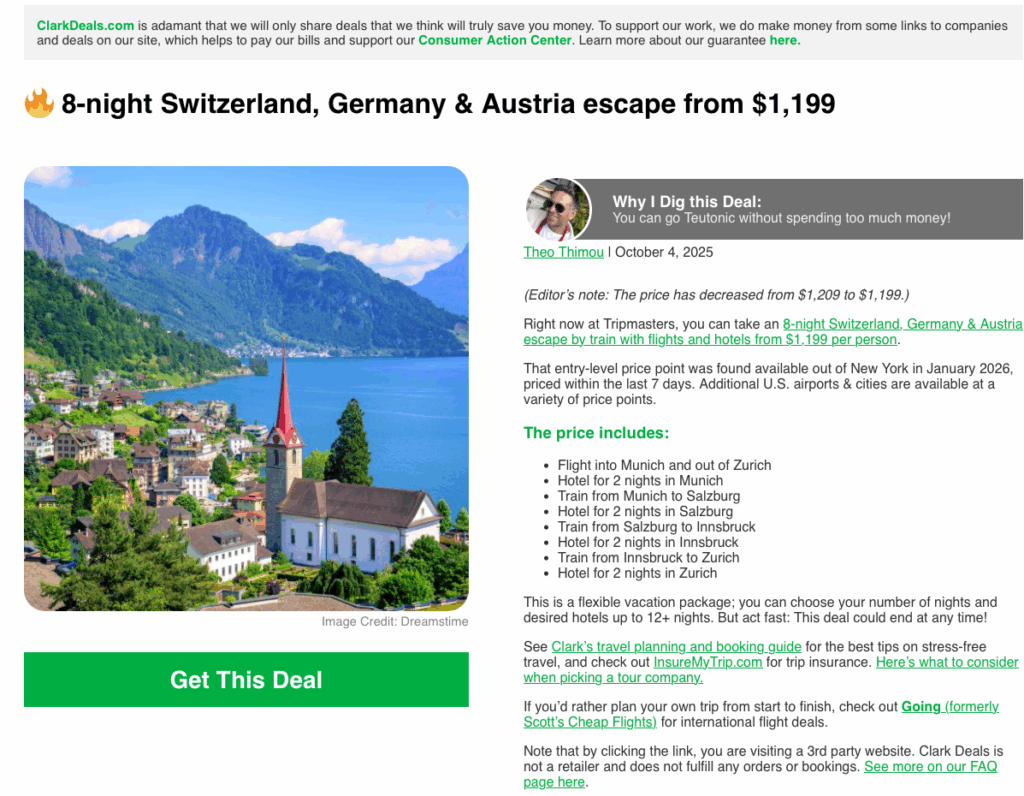

This morning I was reading clark.com. Clark is one of my favorite cheapskates. I subscribe to his daily email which has saving ideas and deals. Here’s one:

But anyway, back to the US…

Clark

Today Clark wrote:

If you’ve read my posts on compounding and time is the secret… you’ve heard a version of most of these. But the one that caught my attention is one that I’ve talked about, but I really like the way Clark expressed it.

Put Your Money To Work

I won’t rehash the topic (I thought the original hash was quite good – what’s a rehash anyway?? ) Read If you don’t find a way to make money while you sleep, you will work until you die.

The title is a quote from Warren Buffet who, it turns out, is a pretty sharp guy.

But think about this. Many of us work paycheck to paycheck. And if we don’t prioritize saving, that paycheck pays for food, clothing, rent, braces for the kids, maybe an annual vacation, a pizza…

You know how it works.

I love the Dave Ramsey quote that “a budget is telling your money where to go rather than wondering where it went.”

We need to find a way to put some money aside and we need to make that money work for us.

Saving

I’m a big cheapskate and also a big saver. I like to find ways to save where I don’t deprive myself.

I want to get the same stuff for a lower price.

But, while that’s true today (where my money is doing the work and I’m retired), for most of my working career, I had to make conscious (and sometimes painful) decisions to prioritize saving over spending.

I wrote in one post about wanting a 10-speed bike as a kid. All the other kids had one, but in a home with 1 working parent with a teacher’s salary, this wasn’t likely. I got a paper route and put aside money every week until I had enough. Boy, was I proud when I walked into the bike shop and bought my first 10-speed bike!

You can read some of my posts on saving here and here, or here.

Investing

And some of that money we save needs to be invested.

Yes, there is risk with investing. And yes, there is a difference between investing and gambling.

Buying shares of Gamestop, Hertz, or the meme stock of the day because the other kids are doing it and a YouTube star tells you that you can be rich is not investing.

Buying shares of a nice low-cost S&P 500 fund and being patient is.

When we invest, we are taking a risk for a potential future reward. We are buying something of value, with the expectation that it will be worth more in the future. The odds are that if we are patient and we hold it for a long time, an S&P 500 fund will be worth more many years from now.

If we want big gains by the end of the year, we may be out of luck.

The S&P 500 has grown by about 10% per year with dividends reinvested over the last 100 years or so. That’s a pretty good track record. It may be up or down 30% or more, and has been down or flat for years on end, but the longer we hold, the better chance we have of achieving that 10% annual return.

…Money Working???

Back to the point.

I am no longer the breadwinner. My money now makes a lot more every year than I did in my best year.

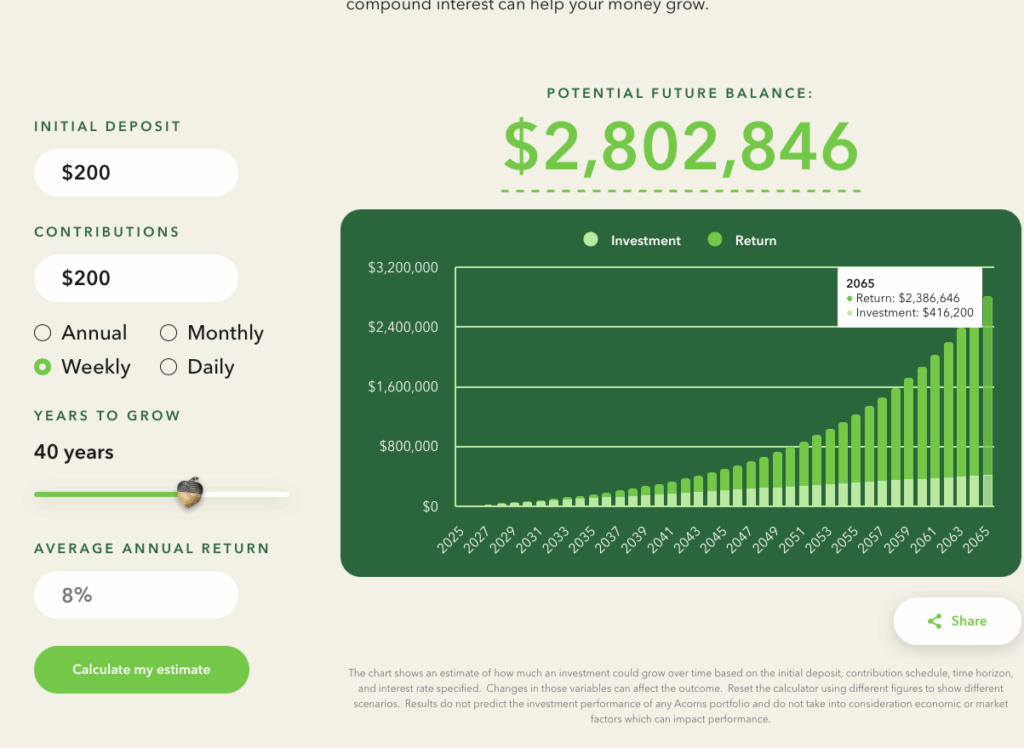

Let’s take a look at a projection at acorns.com

I’m 20 years old (yeah, right. You’re not fooling anyone. But let’s pretend).

I make $75,000 per year. I put $200 from each weekly paycheck into my 401k. (I’m saving 13.8% of my salary)

I’m investing in an S&P 500 fund, but I’ll reduce my expectations to an average 8% annual return instead of 10%.

In 40 years, it’s 2065, I’m 60 years old, and I’ve got $2,802,846 saved.

And here are some fun facts.

- My money has been working for me

- It made $2,386,646 over the 40 year period!!!

- I only put in $416,200 of my own money

- The increase in return between 2064 and 2065 is over $200,000. My money made more than I did this year!

- And with compounding, my money will get a raise and make even more next year.

Wrap Up

In this scenario, my money is earning over $200,000 per year while I sleep, or play golf, or just sit on the deck and smoke a cigar and sip bourbon…

And this is not an unrealistic scenario.

In 2025, when I’m 20 years old and I’m making $75,000, It’s going to be a stretch to put aside $200 per week. But that’s still only 13.8% of my salary. Many advisors recommend saving 15% or more.

But, as my salary grows, that $200 is going to be a smaller percentage of my income. In all likelihood, I’ll increase my contributions.

And as for the 8% annual return, history shows us this is more likely 10%. Especially over a period of 40 years.

So yes, this is totally realistic. And I’d argue that we could do better.

But the bottom line is that our money is making a solid income for us. It is now the breadwinner, and it’s beating me, even if I’m working.

So, I’m now at 60 years old, why not take a break, let my money keep working and I’ll have some fun.

Thanks to Clark for his perspective and thanks to Dave Ramsey for the budget quote.

And I recommend playing around with the projection tool at acorns. Try different saving and growth scenarios. With a 40 year time horizon, the results are amazing, but someone who is in their 50’s and starts saving for 20 years can have some pretty outstanding results by the time they’re 70.