Interesting headline from a guy who recently posted IF YOUR EQUITY INVESTMENTS HAVEN’T GAINED 24% IN 2024, YOU NEED TO MAKE SOME CHANGES.

The post in question was the result of a discussion with a friend who was lamenting lackluster performance in his retirement account. The S&P 500 has been up more than 20% in both 2023 and 2024, and it’s up over 10% already this year, so I was concerned.

I did some digging and found that his portfolio has been severely lagging the market for many years, and his financial advisor is to blame.

This is unfortunate. This is his retirement nest egg and it needed to be invested prudently to allow him some comfort and security in retirement.

Thus the post.

We need to hold both ourselves and our advisors to a high standard. We need to measure our progress to goal and make changes if we are lagging a simple index like the S&P 500. If our equity choices are lagging the S&P 500, why are we not simply invested in an S&P 500 fund?

Two Sides

But like everything, there are 2 sides to every story.

Over coffee on Saturday, Rich talked about an upcoming visit to his financial advisor. Friday was a bad day in the market. This makes Rich anxious and he’s happy that a professional is making decisions for him to prevent him from making poor choices that he may regret.

And I have recognized in a few post that while most of us are capable of managing our finances, for those who don’t have the temperament, an advisor may be a good alternative.

That’s Not Helpful

OK, let me dig in a bit.

Both can be true – that we need to maximize gains and that it’s OK to lag the S&P 500’s performance.

Rich made the comment that he just needs x% return each year to cover expenses.

Rich and his wife are still working, and both are about a year away from retirement.

At this point, they are past wealth generation mode and are looking at harvesting the earnings from their portfolio. Their youngest child is finishing up college, and they are past a lot of the big expenses that many of us have.

Big gains are not a priority. They’re looking for a dependable income stream to fund modest retirement expenses.

Others at the same spot in their careers may be looking out and thinking that they’d like a winter home in Florida, or a boat, or would like to do more traveling. For these folks, these are goals that need to be funded. And in many cases, funding them will require gains more like what we’ve seen from the S&P 500, so they may need to take on additional risk and accept some volatility to achieve these goals.

Goals

It’s important to understand our financial goals and to build an investment strategy to meet those goals. Modest goals will allow us to adopt a less-risky strategy that will have both lower volatility and lower returns.

Aggressive goals, whether we’re 20 and planning to fund 30 years of retirement, or 64 and looking to buy that retirement home on the beach, will require a more risky investment strategy. We’ll need to be heavily invested in equities and we’ll also need to accept that growth could be slow. It may take many years to achieve those goals.

The important thing is to understand our goals. Develop an asset allocation strategy to meet our goals and makes sure our expectations align with our allocation’s historic performance.

Performance

The S&P 500 has averaged 10% gains per year with dividends reinvested over the last 100 years or so. That’s a solid track record. But the S&P 500 has been volatile, seeing years with 30% loss, or 2 or 3 consecutive years of losses, as well as some jaw-dropping single day drops.

But buying the S&P 500 and holding for 5 or more years has almost always been a winning strategy. And when we extend it to 10 years, or 20, or 30, or even 40, our chances of matching that return increases dramatically.

The S&P 500

So here’s something interesting.

It’s important to note that just because the S&P 500 has acheived dramatic gains, especially recently. That does not mean that all equities and equity funds have had similar gains.

The magic of the S&P 500 is that it is made up of the 500 largest publicly traded US companies. That’s a diverse group across many industries and market sectors.

The S&P 500 rebalances itself. If a company’s growth is slowing, and it becomes the 501st largest publicly traded US company, it will be removed from the index and replaced by the new number 500.

And here’s another tidbit. The S&P 500 is market capitalization weighted. This means that the larger market cap companies have a higher influence on the S&P 500’s performance. A company that has a billion dollar market cap has twice the influence on the S&P 500 price as a company that has a 500 million dollar market cap.

This is cool because those growing companies keep having a larger influence on the index. This is not without risk. If those huge companies fail, this will have a huge impact on the index. Something to be aware of and possibly hedge against.

Technology

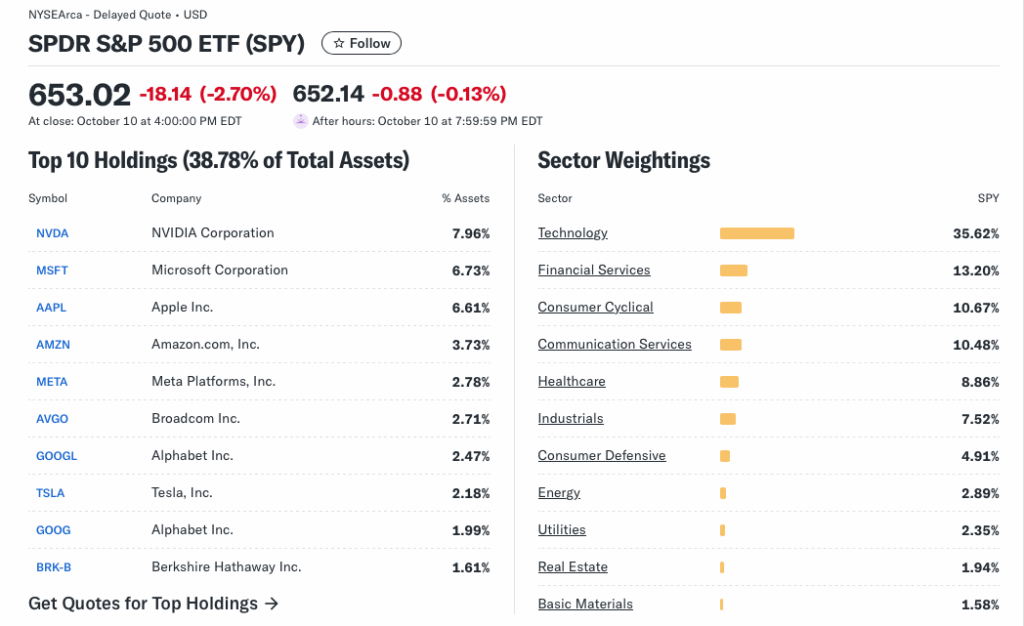

Another interesting point. Look at the top 10 companies in the S&P 500 today.

The top 10 are all tech companies – almost. Berkshire Hathaway isn’t. And Amazon is categorized as a consumer cyclical company, even though it gets a huge chunk of earnings from its Amazon Web Services unit. And Amazon’s logistics and warehouse automation seem to make it more of a tech company…but anyway…

Look to the right. The S&P 500 is 35% tech. That’s a pretty big weighting.

Tech Performance

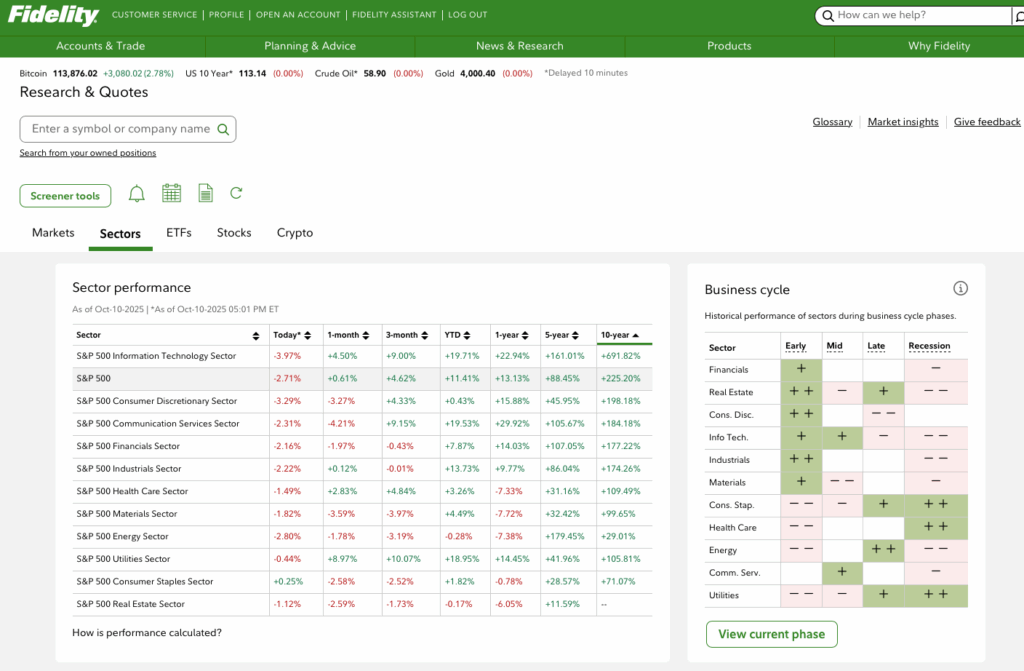

Turns out that has worked in the S&P 500’s favor. Tech has done well. Over the past 10 years Tech has almost tripled the return of the S&P 500. And it shows up pretty well in almost all periods.

This view is important because it helps demonstrate the impact that the exponential growth in tech has had. Tech is a big part of the S&P 500 so if we invested in an S&P 500 fund, tech drove us to record gains. If we invested in a materials fund, or even a telecommunications fund, we’d have had some good returns in some periods, but nothing compared to tech and the overall S&P 500.

Wrap Up

So, 2 points today.

Beating the market is great, but what we really need to do is define our financial goals, assess our risk tolerance, and develop an asset allocation strategy that will give us the best chance of meeting our financial goals without stressing us out.

Also, I was surprised at how much the technology sector has influenced the S&P 500. We hear a lot about Apple, Microsoft and Meta and Broadcom, but I didn’t realize they had so hugely outperformed the rest of the market.

All stocks, and all equities are not equal. Often we hear that the market is up x%. That does not mean all stocks and sectors are up. In the recent past, tech has been driving much of the rally.

This is why an S&P 500 fund is such a great choice. It is well diversified across the US economy, and the largest and most successful companies will have the most influence on the index.

Good luck.