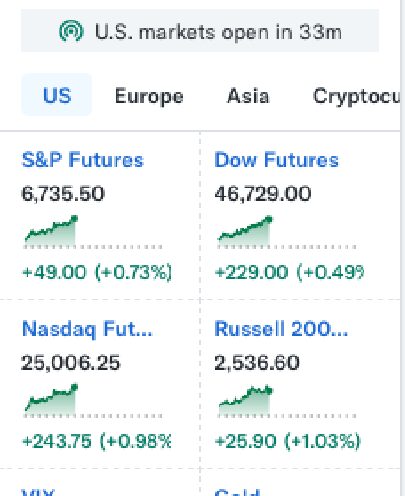

It’s a bit of a pickle. Today’s news on CNBC:

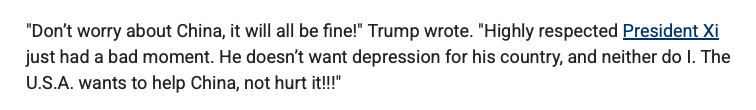

This on top of Friday’s late afternoon crash after a Trump China tariff threat. That crash was followed by a pop on Monday when Trump said, and I quote:

It will all be fine. And the market leaps to new highs.

Overvalued

Never mind the last few days, the last few weeks have been filled with stories saying the market is overvalued.

We’ve been warned.

But we’re up a couple of percentage points since then.

What gives?

A Lot

First let’s start with the market’s history of behaving irrationally. While we’ve seen the S&P 500, a proxy for the US stock market, gain 10% per year with dividends reinvested over the last 100 years or so, it’s not been a smooth ride.

We’ve had bumps of 20, 30 and 40%. We’ve had consecutive years of losses.

The financial news media is great at explaining why a drop or pop happened after the fact. Where are these experts before the event occurs?

This is a bit unfair. No one knows what drives the small swings in the market. We have some indicators, but they are not always accurate.

Here’s a prediction for the next 20 years. Listen carefully.

The S&P 500 will be volatile in the short term, lurching one way or another on any given trading day, week, month or even year. But money invested in a low-cost S&P 500 fund today will be worth more 20 years from now.

Check back in 20 years to see if this is accurate. I’ll do a post.

Interest Rates

OK, let me do a little better than telling you a lot is going on and giving my reckless prediction.

Remember interest rates?

I was caught off-guard a few years back when interest rates skyrocketed. I had never invested through a high interest rate economy. I learned some cool lessons, but it wasn’t cheap.

One of the lessons that I learned is that when treasuries, which are a very low-risk asset, are paying 5% annual interest, few investors are willing to pay a premium for a stock that has a steady track record and pays a 4% dividend.

The stock may be a better investment in the future, but many investors will trade that potential (and the risk associated) for 5% in hand today.

I learned this the hard way when many of the great American companies that I held plummeted in value. Investors were dumping shares to buy treasuries. This drove the price down further and further as there were more sellers than buyers. I figured out what was going on too late.

Well folks, the opposite is happening today. Treasuries are offering much lower rates than a few years ago. Now I can get a higher annual return from some of these great American companies than I can in treasuries.

And it’s not just dividend-payers that are winning. Cash and some fixed income assets are becoming less attractive. Interest rates are dropping and are expected to continue to drop. This is causing rates in high interest savings accounts, CD’s, treasuries and other safe havens to drop. And those of us investors who were quite pleased with a 5% 1 year CD, are looking for a similar yield and not finding it. This is forcing us back to stocks.

This isn’t a flood. It’s a little more subtle, but there is money that needs some place to go and the stock market is a likely spot given the declining rates in cash and fixed income.

AI

And because it’s 2025, we can’t write anything without mentioning AI.

But because of that allure. AI is generating a ton of investment.

And it ain’t just the tech companies.

Con Edison and NRG Energy are crushing the S&P 500 this year. AI will need lots of energy so investors are looking at indirect ways to profit off the AI boom.

AI is causing lots of building – data centers, power plants, infrastructure. Companies like Emcor and Caterpillar are beating the S&P 500 this year. Guess why?

Wrap Up

The answer is no one knows why the market continues to go up. Will it rise next week? Next month? No one knows.

Will it be up in 5 years, probably, 10 years, most likely, 20 years, most definitely. Why? Because history shows that to be the case and the American economy still has a lot of the same catalysts today as it had in the past. Read more here.

I do think that money is moving from lower income-producing classes like cash and fixed income into equity and this is helping to drive prices up. I also think AI is a factor. And I am sure that I have no idea how long these factors will continue to have an influence on stock prices.

And I also know that I don’t care. I hold shares of Caterpillar today. I will continue to hold them 20 years from now as long as there isn’t a major change in my thesis. Caterpillar is experiencing a boom because of AI. I’m confident people will find other stuff to build when and if the AI boom dies off. And I expect they’ll buy Caterpillar’s products to help them build it.

Betting on short-term moves in the market is risky. Investing money in the S&P 500 and letting it grow over long periods has been a proven winner.