I wrote a post a few month’s back making the case for taking social security at age 62. Read here.

The post details all the choices and projections, but here’s the quick summary.

I am convinced that if I take my benefits at 62, invest each payment in a nice low-cost S&P 500 fund, I will have more than enough of a nest egg built up at 70 to make up for the difference in payment amounts.

The S&P 500

The S&P 500 has returned 10% per year with dividends reinvested for the last 100 years or so. While it’s had wild fluctuations in the short term, its track record at 5 years, 10 years and especially 20 years is pretty consistent. Those who are wiling to be patient have been rewarded. I see nothing that tells me that trend will end anytime soon. Here’s why.

Given that, I’m fairly confident that I can take social security as early as possible (age 62), invest every check in a nice S&P 500 fund (like SPY) as soon as it arrives, and I’ll build a nest egg that will more than cover the difference between the dollar amount I receive at 62 and the dollar amount I would receive at 70, had I waited.

Example

I started getting social security payments in June of this year…yay!!!

I’m getting $2,720 per month.

Social Security is pretty open about the fact that we’ll get 77% more per month if we wait til age 70. It comes out to about an 8% increase for every year we delay.

If I wait, I’ll get $4,790 per month. That’s over $2,000 per month more.

So my nest egg needs to fund $2,000 per month x 12 months = $24,000 per year until my plan-to age of 94. Plan-to is a polite way of saying “when I die”. So 94-70 = 24 years x $24,000 = $576,000. I need the nest egg to grow to $576,000. Wow.

A Picture is Worth…

And who doesn’t love a spreadsheet more than a picture??

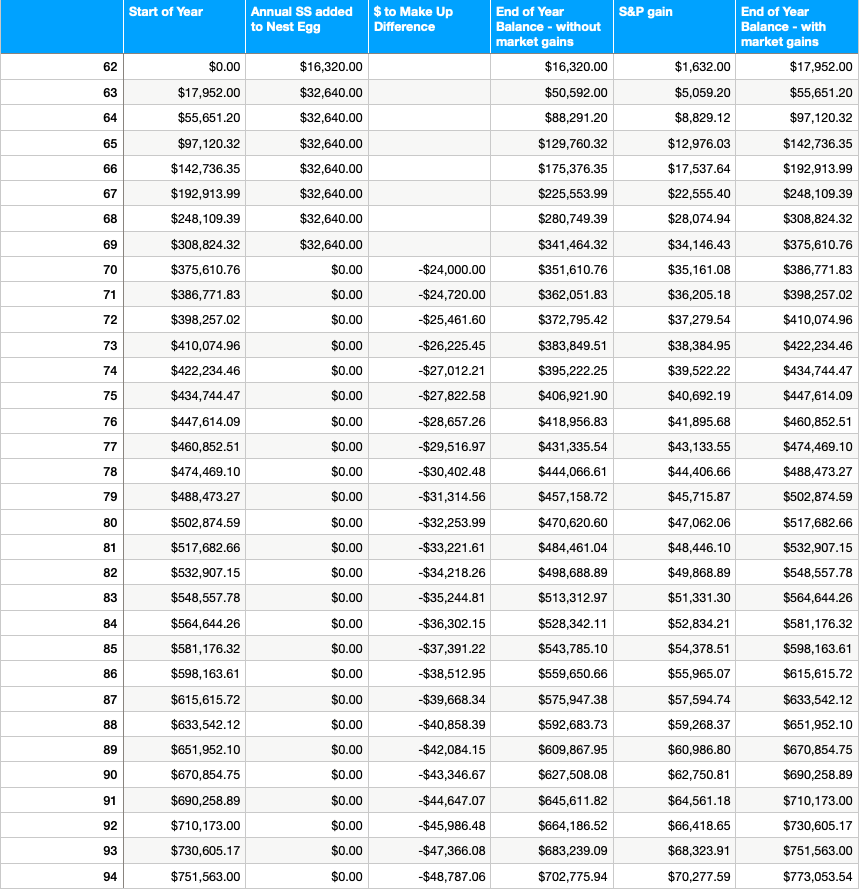

For simplicity, I assume the S&P 500 (and thus my nest egg) grows 10% per year.

At age 62, I start with 0 and I’ll get 6 months of Social Security payments, so $16,320.

I’ll get 10% return on that $16,320, which is $1,632.

Next year, my starting balance is the $16,320 + the $1,632 in returns. But I’ll get the full year $32,640 social security and make 10% return on the new balance.

My nest egg grows until age 70 where I start taking my social security payments in cash AND I pull $24,000 from my nest egg to cover the difference between the higher payment I’d get at age 70 had I waited, and my current age 62 payment.

*** Huge footnote. My nest egg continues to grow from the S&P 500’s annual return. I am, however, no longer contributing cash as I’m using the cash to pay expenses and I’m also withdrawing from the nest egg to make up for the difference in social security payments.

To be a good sport, I increased the $24,000 by 3% each year to account for inflation.

Here’s what happens.

When I end the year at age 69, my nest egg has grown to over $375,000.

At 70, I start spending my monthly social security check so I’m no longer adding to the nest egg. AND, I start taking $24,000 per year to make up for the lower payment amount.

Even with adjusting up for inflation, the market return is more than the amount required to make up for the difference in payments.

How Am I Really Doing?

Thanks for asking. Let’s take a look.

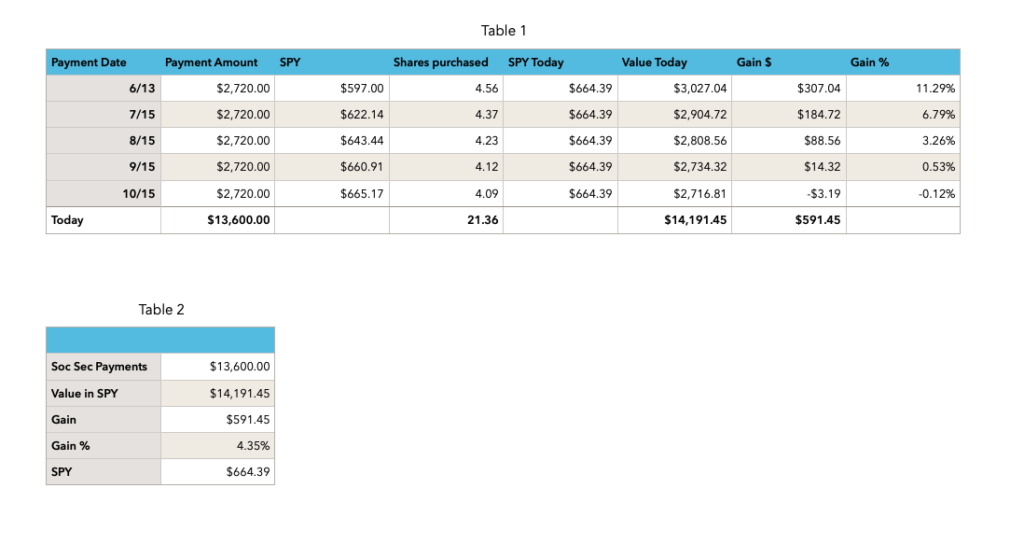

Each month, I take my $2,720 and buy shares of SPY. My 6/13 payment is up a whopping 11.29%, while my most recent 10/15 payment is down slightly.

But on the whole, I’m up 4.35%.

Fun Fact: I have that $14,191.45 in my brokerage account. I can take it out and spend it if needed. If I had waited, I’d have the promise of a payment of $4,790 per month in 8 years (from our government – the same one that is nearly $38 trillion in debt). Which would you rather have?

Wrap Up

My earlier post back-tested this strategy on prior returns.

Today, I tried a different approach; assuming a 10% return and using actual dollars in and dollars out at age 70.

There are unknowns either way. We don’t know that the SPY will increase 10% per year. We don’t know if social security will change its payouts. For that matter, we don’t know if we’ll be hit by a golf ball and have an unfortunate change in our plan-to date.

Very little is certain in finance and in life. But based on the numbers here and in the prior post, I’m pretty confident that $2,720 per month today is better than $4,790 per month at age 70.

AND, by taking the payments at 62, I have the money in case of emergency. If I wait until 70, I don’t have that money if I need it.