Is a recession coming? Is the market overpriced? (and what does that even mean?). Are we due for a pull-back?

No one wants to make a rash financial move, so before we commit our hard-earned money to a stock or mutual fund purchase, we want to be sure we’re not buying at market highs.

Bank OZK

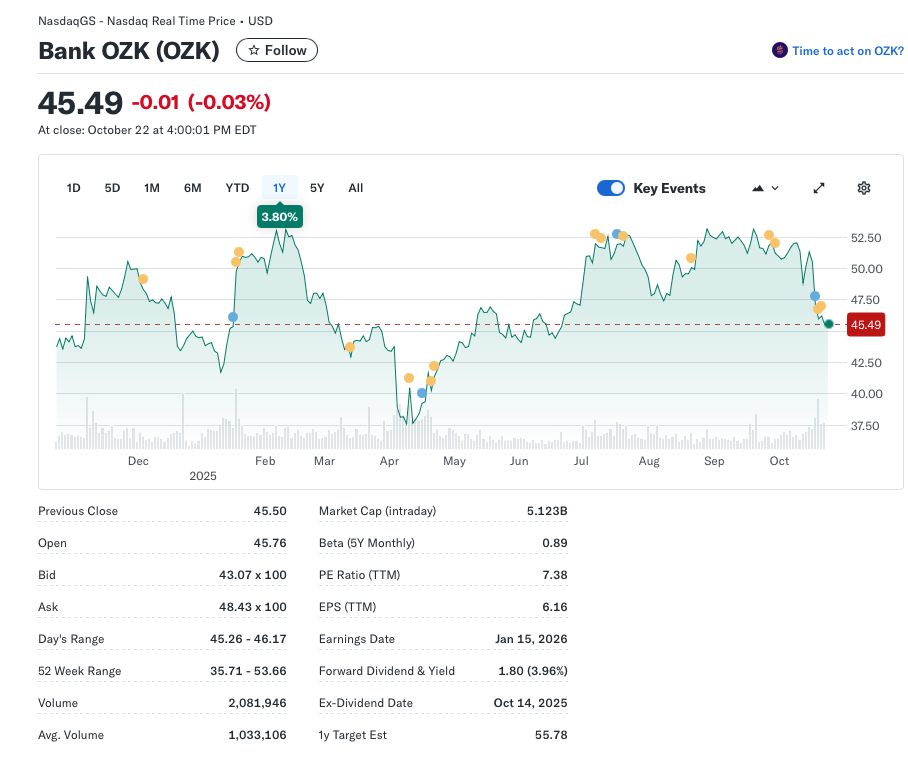

Bank OZK (Ticker: OZK) has been a favorite of mine lately. It’s a relatively small regional bank and I started buying shares in 2023. I’ve sold lots of covered call options as well. My original shares are up about 12%, which is cool, but when I add in $5,739 in dividend income (OZK pays 3.96%) and another $15,113 in covered call option income, I’ve done pretty well.

Note: I’ve used the dividend income to buy more shares of OZK – we’ll talk about that later. Though I’ve used the option income to pay for golf

This morning, I was taking another look at OZK, and I considered buying more shares. It is down a bit from recent highs.

Any type of a shift like this makes me take a closer look. How much do I own, what’s my return, should I buy more? I revisit and update my thesis.

And before I make any decisions, I take a look at recent news reports and some analyst reports.

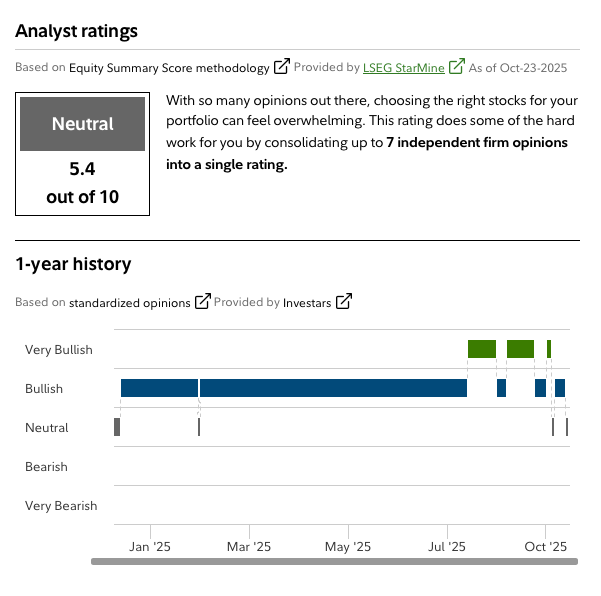

Analysts

And I chuckle a bit. Analysts are so predictable. About 2 weeks ago, 2 big banks, Jeffries and J.P. Morgan got fleeced by some bad deals in the auto parts sector. They immediately deflected responsibility by pointing out that the small banks were at risk due to possible bad loans. Small bank stocks tanked. And one smaller bank – Zions bank – actually did have some problems.

But to point to the whole regional bank sector and say they have risky loans seems inappropriate.

Anyway, the analysts reacted.

OZK had been a strong 8, now it’s a 5.4.

We can also see the trend, and just a month or 2 ago, we had some analysts who were very bullish. 2 weeks ago, they dropped their ratings. Analysts are great at predicting what just happened.

This is why I always look for an analyst report with text. Many focus on company fundamentals and trading technical statistics. It’s like reading tea leaves to tell what the next few weeks has in store.

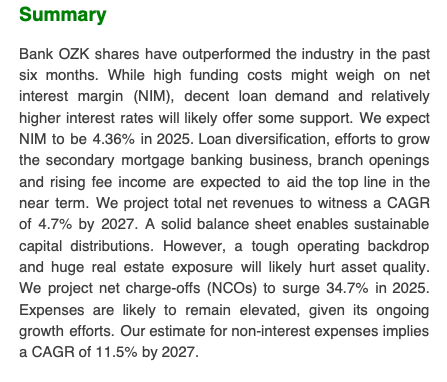

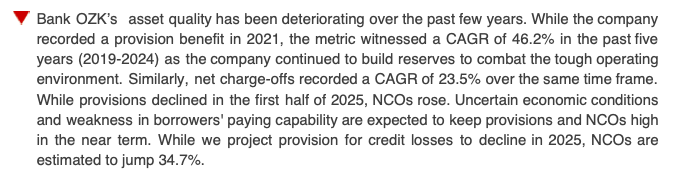

But while I write most of these off, the analysts that dig in and evaluate the companies in the sector, the risks and opportunities and write about what they’ve learned are incredibly valuable. Something like this from Zacks is helpful

or this

Zacks produces my go-to analyst reports

To Buy or Not to Buy

That is today’s question. There is no business fundamental change that seems to be causing the pull-back. The asset quality deteriorating story isn’t new. That’s one of the risks investors assume when investing in small banks.

So maybe pick up a few shares?

But back to the original questions. Is a recession coming? A pull-back? Is now the best time to buy?

Dividends to the Rescue

I mentioned that OZK pays a 3.96% dividend. That’s pretty good

But here’s the cool thing. The pay date was yesterday.

Dividend Reinvestment

In most of my accounts, I reinvest my dividends. Our broker will give us the option of taking dividends in cash, or reinvesting them to buy more shares. I like to reinvest. Here’s why.

The companies and the funds in which I invest tend to fluctuate in value day to day. Sometimes wildly. But, overall, like the S&P 500, they tend to increase in value over long periods of time.

The SPY 1 month chart is frothy.

The 5 year chart is a bit smoother

And go back even further.

While not all stocks go up, the S&P 500 has a proven track record of success over long periods of time, for the past 100 years or so.

Back to Dividend Reinvestment

Sorry for the diversion. I’m back.

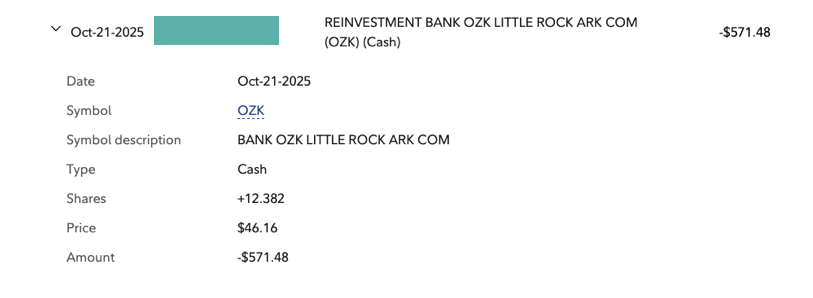

I reinvest my shares of OZK. I don’t need to buy today, even though I’m still excited about the company, because yesterday, when the dividend was paid, I bought 12.382 shares.

My cost was yesterday’s price of $46.16. This is lower than the cost on some of my purchases. Sweet! I’m dollar-cost averaging.

And if I look back at all my dividend reinvestments:

I’ve bought shares at prices ranging from $41 up to $51.

Every January, April, July, and October, I buy more shares because OZK pays a quarterly dividend which I choose to reinvest. Sometimes I buy high, sometimes I buy low.

Wrap Up

It’s important for us to keep investing. Putting money in a bank account getting 1% annual interest isn’t going to build wealth. But at the same time, it’s hard to make the decision to put our hard-earned cash into stocks or funds. What if a pull-back comes.

I put a large chunk of money into the market in early 2008. Guess how that went?

But a dividend reinvestment plan is a great way to make regular small purchases.

OZK pays roughly 4% per year in dividends, which is about 1% per quarter. That 1% – which in my case is $573, buys more shares. Every quarter. Regardless of price.

This is how a 401k plan works. The money comes out of our paycheck. It buys more shares. This happens every paycheck regardless of whether the market is up that day, or down.

It can be hard to find the extra cash to invest. But a nice dividend paying stock or fund with a dividend reinvestment plan ensures that we are making regular small investments.