So, I read this today in a very informative post on clark.com.

The post is called

Clark and I are on the same page. I had a similar thought in Why is The Market Going Up? Clark did a nice job of explaining what overvalued means and giving some commentary that is a bit more professional and coherent than mine. Compare them and let me know which you prefer.

Earnings

Where Clark really nailed it though is on his explanation of earnings and what it means to pay for earnings, and how valuation impacts our overall success.

Buying a Business

Often times we read and talk about trading stocks or buying stocks and I think these phrases distance us from what we’re truly doing.

When we invest in stocks, we are using our capital (cash) to buy a small piece of a business.

I remember when I was a bit younger, being intrigued to learn that I could buy shares of the Boston Celtics basketball team.

I didn’t buy shares, but thought it was really cool.

Why Do We Invest?

To me, this is a simple question. The one and only reason for me to invest is to make money. By definition, when we invest, we are buying something today that we expect will be worth more at some point in the future.

Whether I’m buying shares of Amazon, a classic car or a rental property, I expect to hold onto it for a period of time and then sell it for more than I paid. This profit – or capital gain – is the primary reason for my investment.

In the case of the classic car, I get to drive it and take it to car shows and look cool so that’s an added benefit. For the rental property, I will hopefully make some income in the short term if I can charge more in rent than I pay in expenses.

But the big enchilada is the expectation that I’ll sell my invetment for a tidy profit in the future.

Are There Other Reasons?

I brought up the Boston Celtics, because I think this is a great example of how we might think differently about investing.

Overall, as an investor, I want to maximize profit. I want to make the most money I can.

But, I grew up watching the Celtics. Maybe I’d want to own a piece of a team that I love.

And maybe I want a classic car as an investment.

And while there is probably more potential for growth in owning shares of GM than in owning a GM classic car, I might be willing to forego the additional upside for the joy of having a 1970 Chevelle SS.

Overvalued, Remember?

Clark did a nice job of laying this out.

The farm seems overvalued at $3 million.

But after we shell out the $3 million, those earnings go right into our pocket.

Clark states 2 important facts.

- When buying something overvalued, it takes longer to recoup our cost

- We may lose money if buyers “wise up” but we really have no way of knowing whether the farm will be worth more or less in the future.

Housing

In 2018 or so, my daughter and her husband bought their first home. The housing market was brutal. Houses were going for well over asking price and didn’t tend to stay on the market more than 24 hours.

I was a little concerned about them buying in an overvalued housing market but I’ve learned the wisdom of keeping my mouth shut. I don’t always pull it off, but I try.

They bought a nice home on a quiet street and that home is worth significantly more today.

Who’s to say what overvalued really means?

Price to Earnings

We’re evaluating whether a company is over valued based on what we pay for earnings. This is the price to earnings ratio, a.k.a the earnings multiple.

But here’s another consideration. Earnings aren’t stagnant.

Perhaps our dairy farm’s maximum output is 100,000 gallons of milk. Its earnings may be stagnant.

But a company like Apple can sell more iPhones, iPads, and other iStuff.

Apple can sell Apple TV subscriptions to more people, and more Apple Music subscriptions.

Apple’s earnings are fluid.

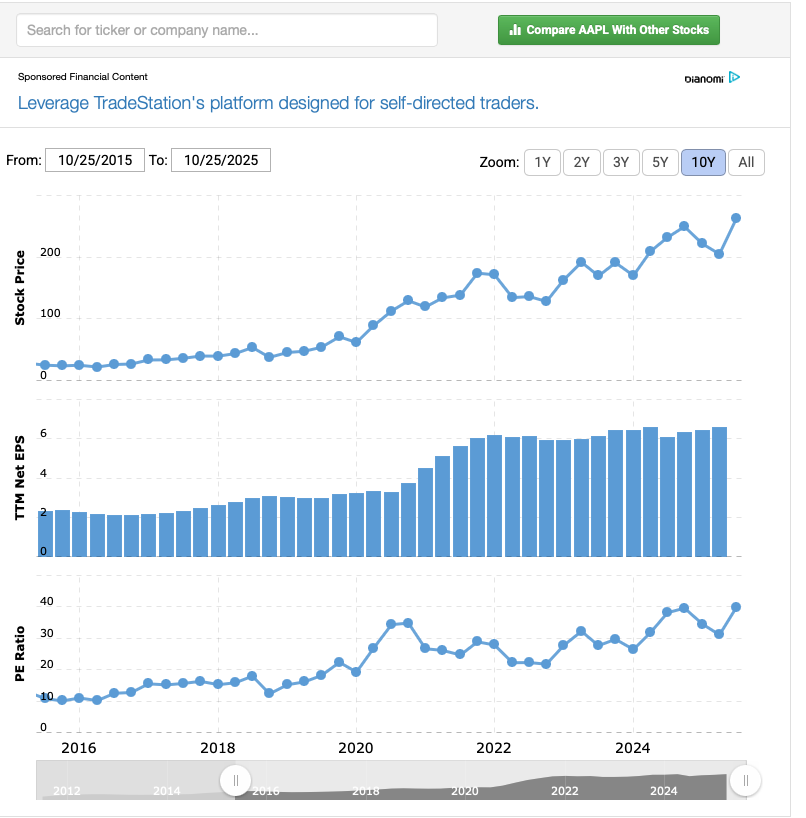

The chart below shows Apple’s 10 year price history, earnings per share history, and the p/e ratio.

Apple’s p/e is today is nearly 40. Well above its 5 year average of 29.

Apple’s price per share is $262.62. Its earnings per share is $6.60 so its p/e is 262.62 / 6.6 = 39.79.

But let’s say Apple’s earnings double over the next few years to $13.20. Our shares that we purchased at $262.62 are now earning us $13.20, not the original $6.60. and $262.62 / 13.2 = 19.89.

Regardless of what the shares cost at this point, the earnings on the shares we bought for $262.62 are $13.20. That means our earnings multiple is lower.

Wrap Up

We can’t predict whether something we buy today as an investment will be worth more in the future. That’s one of the risks we take in investing.

And for any business, whether it’s a dairy farm or Apple, we don’t know what the earnings will be in the future. Financial analysts have very complex models which will project earnings based on historic patterns, but we really don’t know.

I expected my daughter and son in law might end up living in a home that was worth less than they paid. I was wrong.

This is the beauty of a defined contribution plan or a dividend reinvesting plan. Both are ways to ensure we make regular investments over time. Sometimes we’ll buy when the market is overvalued, sometimes when it’s undervalued. But we keep buying and let the magic of compounding do its thing.