I’ll ruin the surprise and tell you right now that they’re not.

As much as we’ve seen Nvidia’s price sky-rocket in the past few years, I can’t tell you if it will be worth more next week than today.

Some folks were pretty happy with airline stocks. And then 9/11 happened.

We really don’t know. But that shouldn’t keep us from investing and today we’ll talk about why.

Build-a-Bear

I was shocked to read recently about Build-a-Bear Workshop’s stock performance. I remember these in the mall from when my daughter was young. She often asked to go. We didn’t and by the looks of the store, most others decided not to visit as well.

Honestly, I was shocked to hear that the store was still in business.

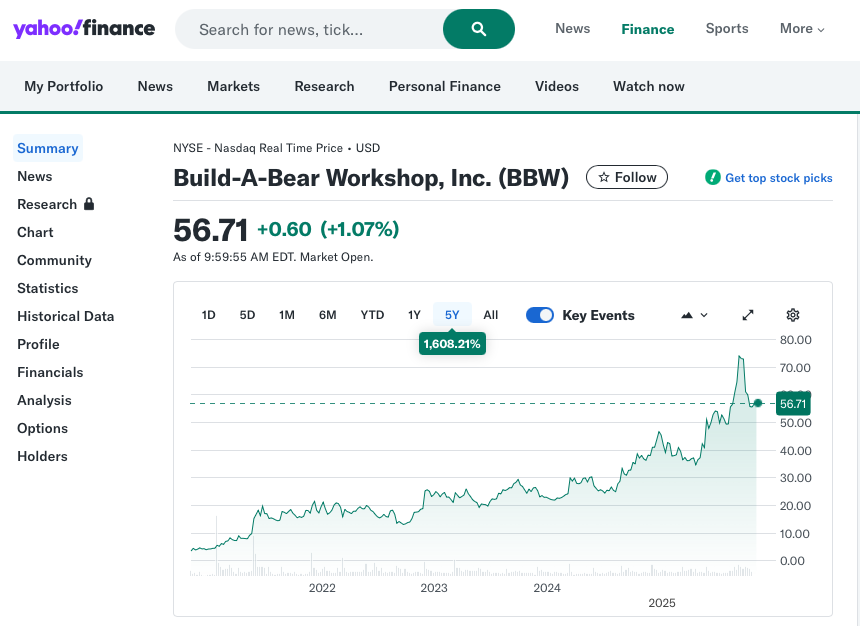

I was even more surprised to learn that the shares of Build-a-Bear are up 1,608% in the last 5 years.

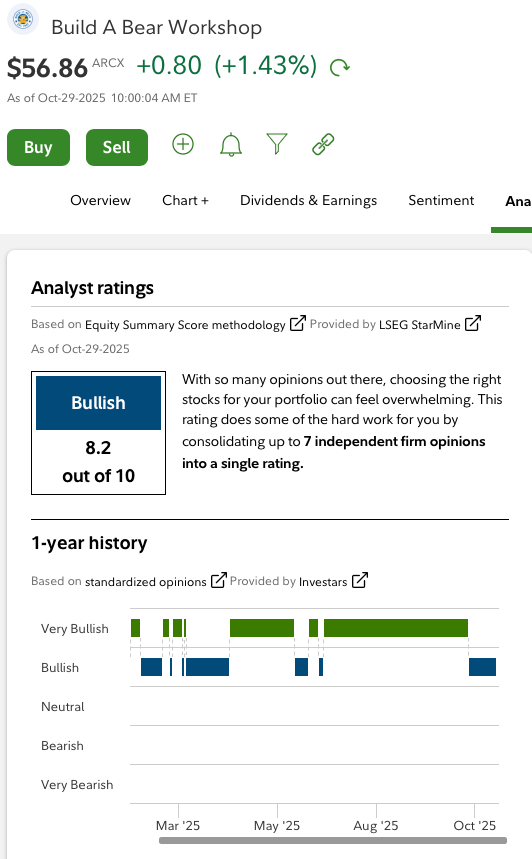

And this isn’t a meme stock thing. The analysts love it.

That one certainly wasn’t on my watchlist.

A Crazy Year

Build-a-Bear aside, 2025 has been a crazy year.

The S&P 500 is up almost 18% YTD even though tariffs are still discussed in many earnings calls, inflation is still keeping prices high, we have armed conflicts in Ukraine, Gaza, and other spots…it’s certainly been a crazy year, but that hasn’t stopped the S&P 500.

I wrote a little bit about why the market may be going up. You can read it here.

And if you guessed the market gains of 2025 are about AI and tech stocks like Nvidia, Broadcom, and others, you would be mostly correct. Nvidia is in the news daily and is up 56% YTD.

Some Outliers

But there are some outliers, and Build-a-Bear ain’t the only one.

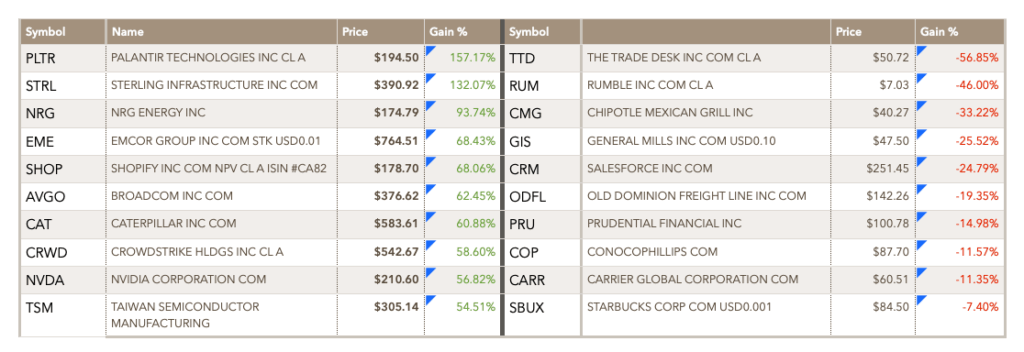

Here is a spreadsheet I keep of my top gainers and losers of the year. Companies on the left are the top % gainers this year, the right are top % losers.

I’ve written about many of these companies in my posts. Starbucks is a favorite, but it has struggled recently. To see it on the right side is no surprise.

Caterpillar makes big machinery. It’s a large US company that has been around since 1925 and is considered a bell-weather for the construction and infrastructure sectors.

Caterpillar is up 11.69% Today. While we may see a move of that size from a big tech company, it’s just not seen in a large infrastructure company. And Caterpillar is up 60% YTD.

Caterpillar is up more than Nvidia this year.

So is Build-a-Bear.

Others

Sterling Infrastructure, NRG Energy, Emcor (builders) are all up as much or more than the AI companies.

What does this mean?

Perspective

I’ve been thinking a lot about this since the Build-a-Bear article.

First, it’s important not to react.

Will Build-a-Bear continue to sky-rocket or will it come crashing down?

Do I need to buy more shares of Caterpillar? Or sell my shares and take the profit?

If these thoughts are running through your head then congratulations, you’re human.

We need to take a breath and analyze a bit before we react.

Long-Term

I’m a long term investor.

I bought my first shares of Starbucks in 2012. Those shares are up 280% but they lag the S&P 500 by 120%.

However, Starbucks pays a 2.9% dividend. I’ve received over $30,000 in value from dividend payments over 13 years.

(note that I said in value. I reinvest my dividends in more shares. The $30,000 represents the current value of these shares. In most cases, I’ve bought shares below today’s price so there is a market gain on top of the dividend itself.)

Starbucks has had a rough couple of years, but it’s treated me well and I’m optimistic about the new CEO so I’m holding tight.

And while I love the Caterpillar return lately, it has been a slow steady grower and dividend payer over than last 100 years. I expect at some point it will probably pull back and then return to a more normal performance level for a large-cap infrastructure company. I’m happy holding the shares I have.

And Build-a-Bear is a mystery to me.

Wrap Up

We don’t have to invest in every winner. One or 2 big winners can make a big difference.

And chasing winners is a recipe for disaster.

I like to look for sustainable trends. Years ago, I saw something in Apple, Amazon and Netflix that I expected would last. And when I invested, each of these companies had a track record of success even though they were not profitable.

And there are no guarantees. Under Armor had a track record of success, but never quite figured out how to succeed. That was a costly lesson learned for me.

If we choose to invest in individual companies, we’ll be likely to choose more losers than winners. But our gains will likely far outweigh our losses. A company can double its price many times over, but can only go to zero once.

And even the best companies will face tough markets or tough business cycles. And we’ll never know how long these conditions will last.

This is not the first time Starbucks has had headwinds and has under-performed. I’ve gone through this several times, but each time, they’ve come through a stronger and more profitable company.

Unfortunately, there are no roadsigns that tell us what will happen tomorrow, next week, next month or next year.

If we choose to invest in individual companies, we do our research, we create a thesis, we buy shares and we’re patient.

I like to buy at least 25 individual companies so that I don’t have all my eggs in one basket.

I also like to buy a healthy dose of S&P 500 funds because while I may make some bad picks, I expect the 500 largest publicly traded US companies will do pretty well.

Some crazy stuff, but I remain confident in the long-term prospects for the companies in which I own shares, the S&P 500 and the US economy as a whole.