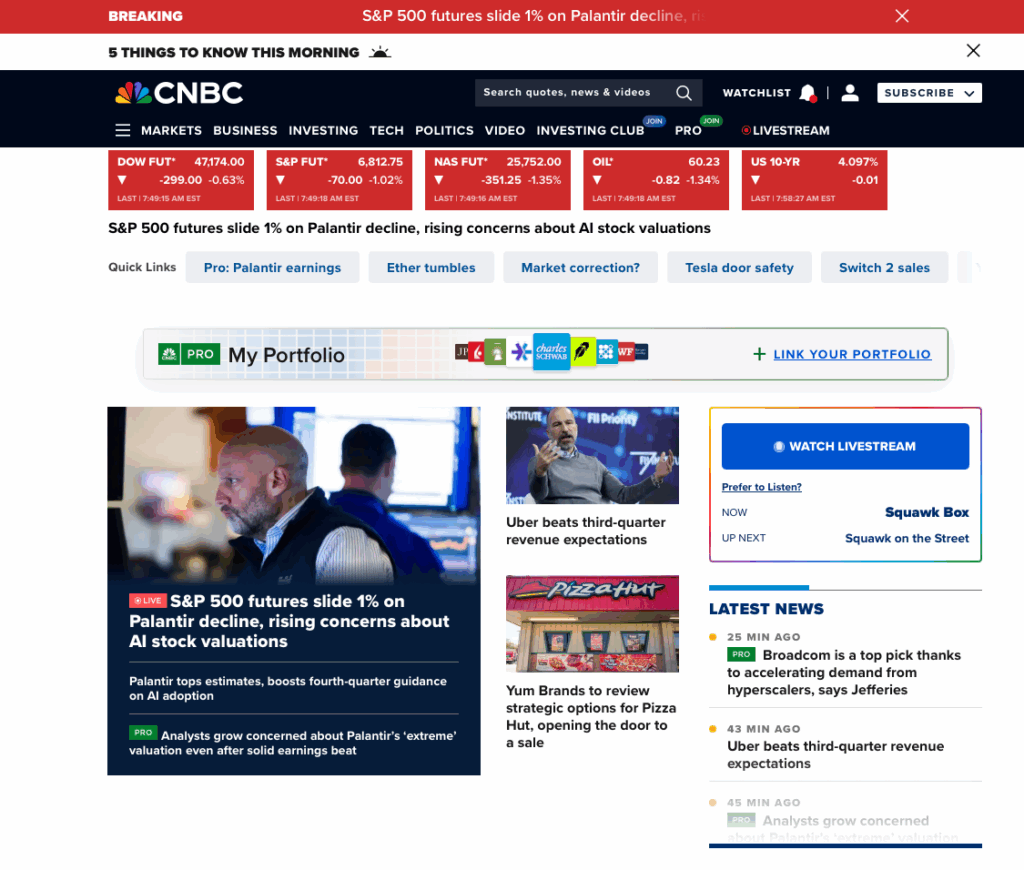

Today’s stock news on CNBC is quite a mixed bag.

First thing we notice is how concerned our professional trader is. Look at the tension. He looks worried. We should be too.

The S&P 500 futures are down (so are the Dow and the NASDAQ). He’s right to be worried.

And he’s worried about tech darling Palantir which has been on a tear lately.

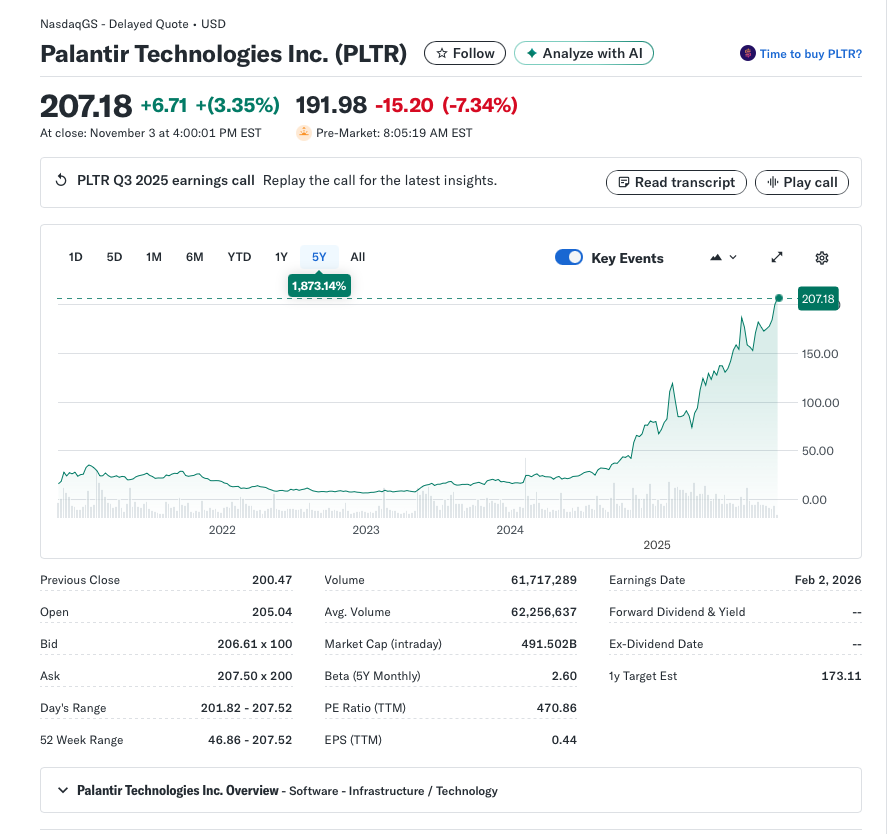

Palantir

Palantir has had a good run. It’s up 173.94% year-to-date. The S&P 500 is up 16.65%, so Palantir is crushing it.

Look at the chart.

And check out the p/e of 470. That’s expensive.

Price to Earnings Ratio

Price to earnings ratio, or p/e, is a way to measure how much we’re paying for a dollar of earnings. Ideally, we want to pay the lowest amount possible for the most earnings. p/e simply divides the price per share of a company’s stock by the earnings per share. A lower number signifies that we’re paying less for earnings.

p/e is one of many metrics we can look at, and it is a very popular one for measuring whether a company is cheap or expensive. But p/e misses an important factor. It does not consider future earnings potential.

A nice small bank like Bank OZK has a p/e of 7.62. Alphabet (Google parent company) has a p/e of 28.01.

If all we care about is p/e, then we’ll buy shares of Bank OZK and call it a day.

But I’m saving for my future retirement years. I’m not just looking for steady earnings, I want earnings growth. A company like Palantir is attractive because it is a well-respected company today and it has recently gotten some large government contracts, but its technology has huge potential, especially with the current AI boom.

Is it worth 470 times earnings? Who knows?

Worried

But that’s why our trader is worried.

But he’s a trader (actually, he’s probably an actor or a model, but you get the idea..) and traders are looking to move huge volumes of stock throughout the day to make a small profit on each trade that in aggregate adds up to a lot of money.

Most of us are not traders. I’m investing for 20 years down the road. Palantir’s p/e is daunting. Can it grow earnings fast enough and long enough to justify that price?

I don’t know, but I bought a few shares. I bought some shares of some lower p/e companies, and some shares of an S&P 500 ETF as well to help offset my risk.

The trader is worried. I’m not. I didn’t put all my eggs in the Palantir basket, and I have the advantage of being able to wait and watch over the next 20 years. The trader needs to trade today.

Mixed Messages

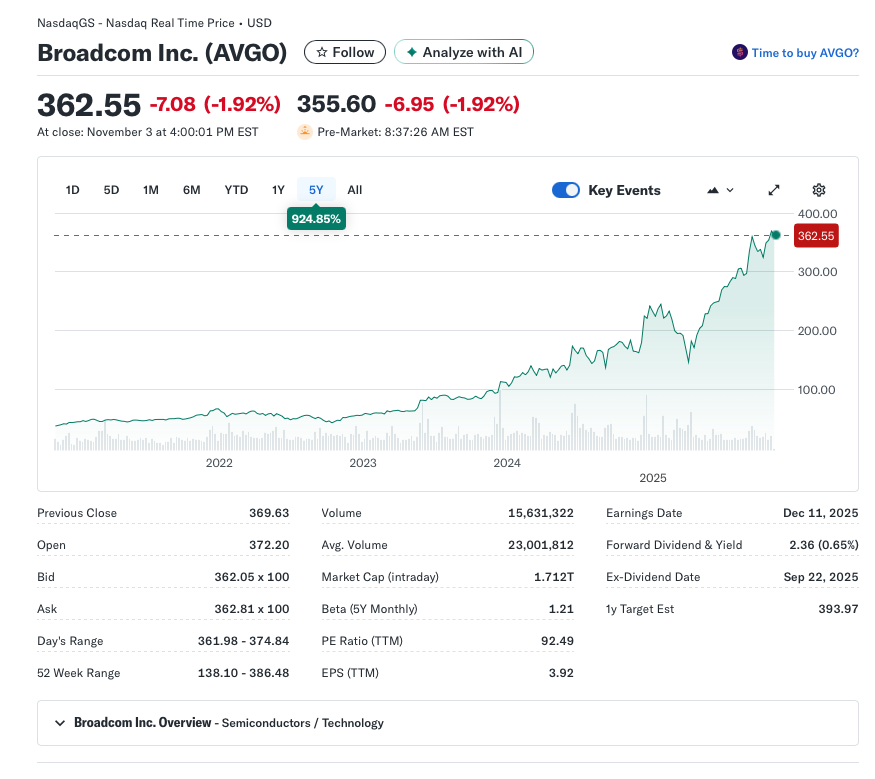

While our eyes focus on the panic’d trader and his Palantir dilemma, we may not notice the Broadcom item. Pro readers (those who pay) can read about how Broadcom is a top pick thanks to accelerating hyperscaler demand.

Broadcom is no Palantir, but it’s had a huge run-up as well.

I bought Broadcom shares in 2022 that are up over 500%. Yay!

p/e of 92.49 is not Palantir level, but it is way higher than Alphabet’s 28.

On the left side of the CNBC page we’re worried about a tech stock due to AI stock valuations. On the right side, Broadcom is a top pick (despite being a tech stock with a high valuation and AI focus).

Wrap Up

I like CNBC.

I go to the site every day and I like to read what they have to say about companies and the market.

But they are a news agency that survives on advertising dollars so they need lots of compelling stories throughout the day to keep us coming back.

And unfortunately, there just aren’t that many compelling stories on most days.

And this is totally OK, except for the fact that it can make long term investors edgy. We start questioning our choices. Should we sell? Should we buy? Well we better do something, look how worried that trader is.

I’m a big fan of doing nothing. In investing, once we’ve done the hard work of selecting a mutual fund or a company to invest in, sitting back and letting it go is often a great strategy. The market will be volatile. Growth stocks like Palantir will be very volatile.

I have a basket of stocks and funds. No one position can wipe me out. I have a little bit of Palantir because I love the potential. I think it could double many times over in the next 20 years, but it could also go to zero. I thought the same about Amazon when I first invested in the early 2000’s and look how that worked out.