I don’t like Bitcoin and I’ve often recommended that readers stay away and go with a nice low-cost S&P 500 fund instead. And if you really feel the need to own some, keep the position to a very small percentage of your investable assets.

But I also realize that I’m wrong sometimes and Bitcoin is certainly a thing, so maybe I shouldn’t be so quick to write it off.

So, in February of 2025, I bought a few shares of Grayscale Bitcoin Mini Trust ETF (Ticker: BTC). This is an ETF that holds 1 asset – bitcoin. While I’m not actually buying bitcoin, I’m buying an ETF that buys it. Here’s exactly what the prospectus says.

I’m still a little afraid of losing my bitcoin key and thus losing all my bitcoin or of being hacked. Best let the professionals custody my bitcoin for me.

How’s it Performed?

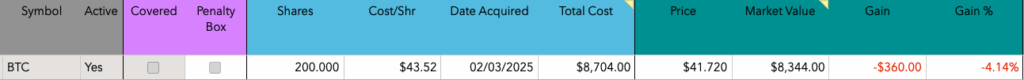

My investment of about $8,000 has lost about $360.

And YTD, it’s flat

This ETF has only been around a bit more than a year, but if we look at bitcoin itself, it has had quite a run. Over 5 years, bitcoin is up 418%, while the S&P 500 is up 85%.

However, those who bought in Q3 2022, and hoped to make a killing for a boat purchase in mid 2023 were out of luck.

Hindsight is great.

Today, we look at the huge gain and we’re excited. But we gloss over the trouble along the way. After holding for a year in late 2023, and being down 80%, would I have had the stomach to hold on? Today, we can see the huge run-up that follows. At that point, though, I don’t know what’s coming next.

What’s Next?

And that’s what worries me about bitcoin. What’s next. (and also losing my key or having someone hack my wallet).

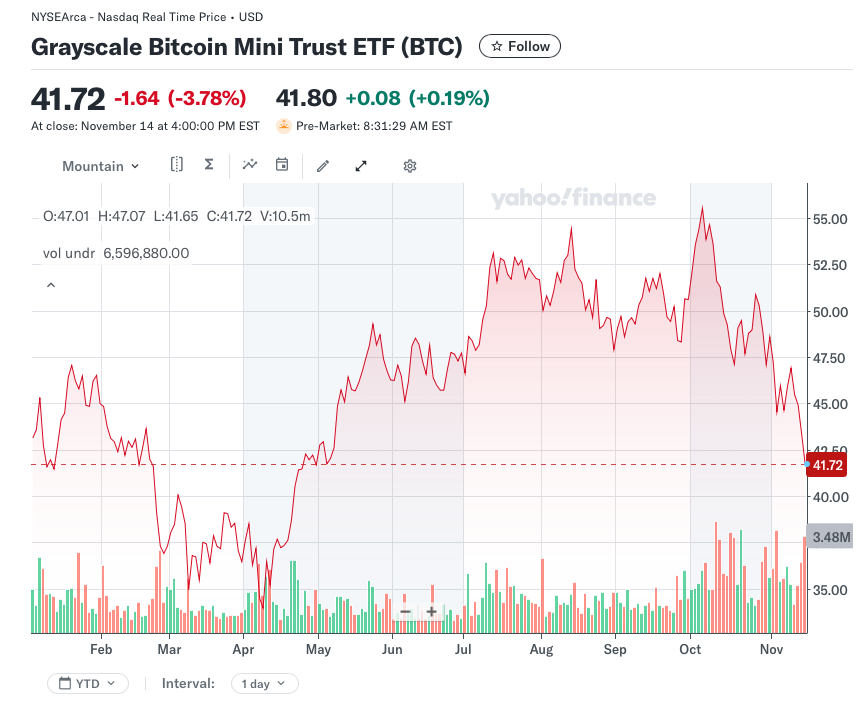

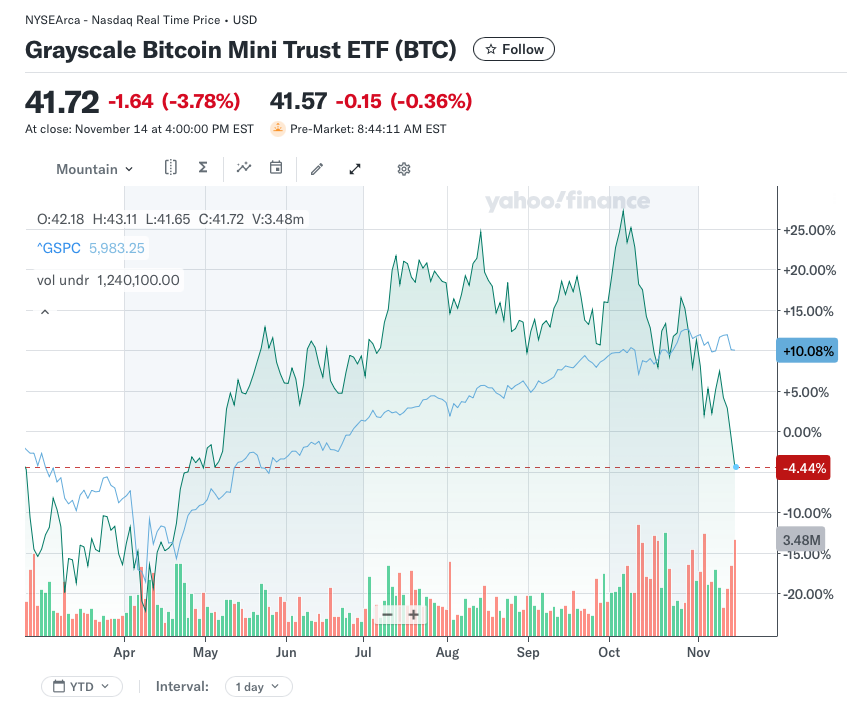

Today, I’m 9 month’s in and I’m down 4%. If we compare BTC v. S&P 500

I was doing well up until a few weeks back when it plummeted. Look at the last month.

What is Bitcoin?

Here’s what Grok says

Why is Bitcoin Volatile?

Only 21 million bitcoin will ever exist. That’s it.

There are almost 20 million bitcoin in circulation today. A million or so more will be mined, but then that’s it.

It’s like when people went nuts over the bored ape NFTs a few years back. They weren’t great art, and you couldn’t even hang one in your living room. People paid millions for a non-fungible token, which is basically something that lives in the internet (whatever that really means).

But they were scarce. So people speculated (that’s a nice word for gambling).

Bitcoin is scarce. People who invest in bitcoin are hoping that because there is a limited supply, the value will increase.

Will it?

And that’s the million dollar question for any investment. Will its value increase?

O’Reilly Automotive

Let’s do a comparison.

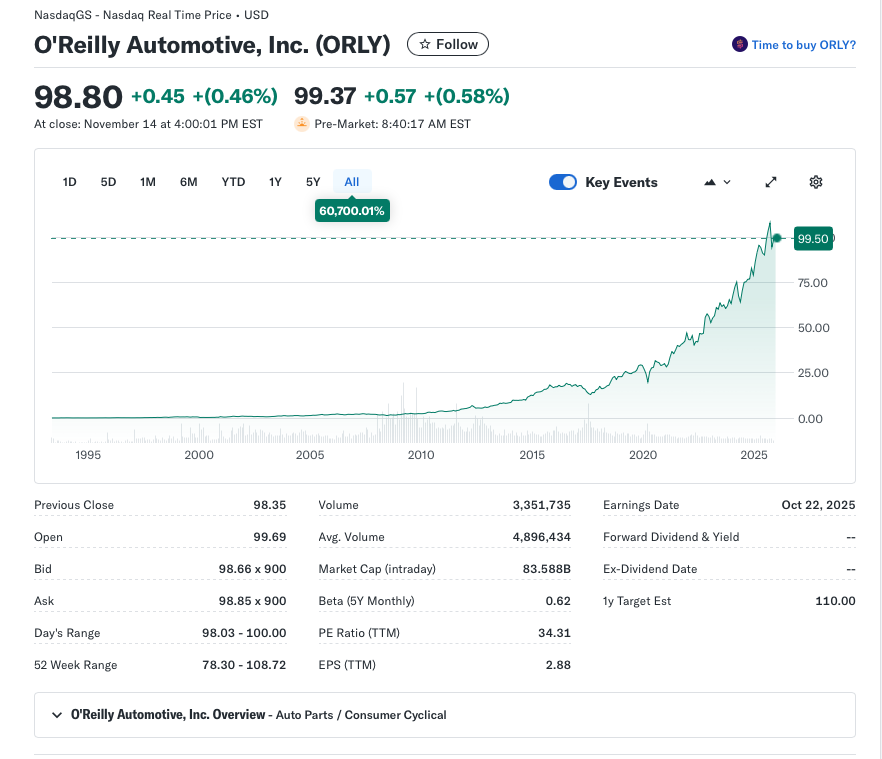

I love O’Reilly Automotive, Inc. (Ticker: ORLY).

Here’s why.

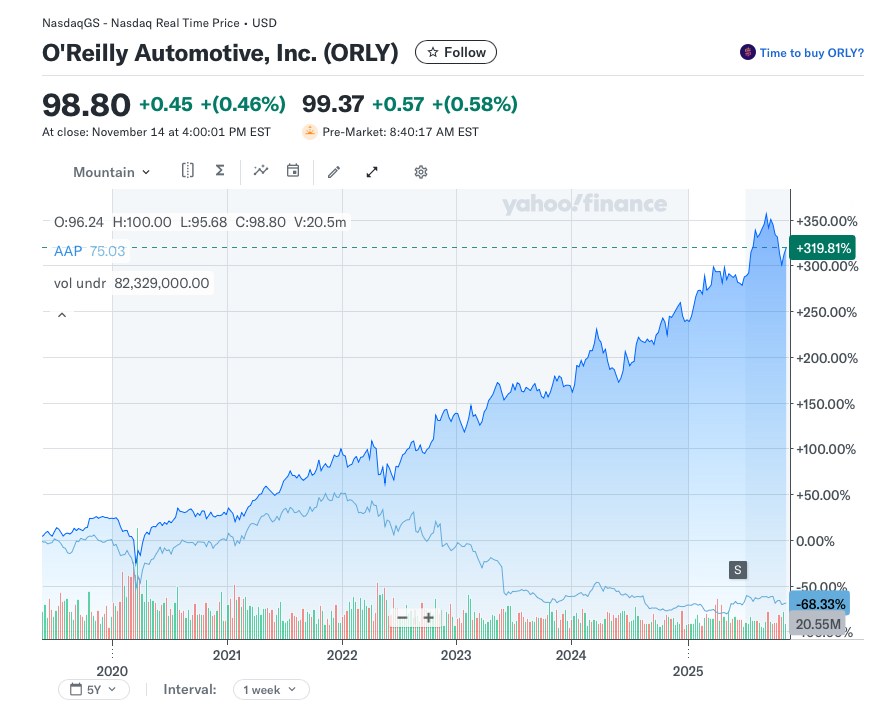

O’Reilly is an auto parts store. Seriously. And it is up 60,700%. It isn’t in the cloud and it didn’t invent AI. It sells mufflers and windshield washer fluid.

It also aggressively buys back its own stock. And it has made some wise acquisitions.

I wrote yesterday how vehicle prices are out of control. New vehicle average prices are around $50,000, and used vehicles aren’t far behind. And the 7 year vehicle loan is becoming standard. Yuck!

Given the cost, many vehicles are on the road longer. That’s good for an auto parts store.

And I wrote about car insurance rates going up. I’m still mad about this.

A big driver of vehicle insurance increases is that our legal system (don’t get me started) forces repair shops to replace v. fix. Their liability is huge if they take on the responsibility of repairing v. replacing.

So they’re buying new parts rather than fixing old ones. Who do you think that’s good for?

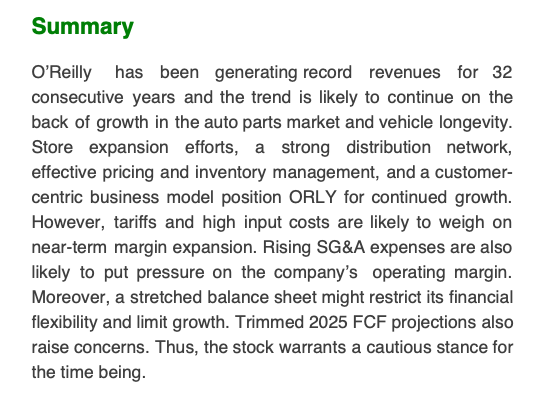

O’Reilly is also a well-run business. Advanced Auto Parts has the same tail winds. Look how it has done.

Enough love for O’Reilly.

Investing

Let’s start with my investing goals. This is a chance for you to think about yours.

I’m in it to make money. Period. That’s it.

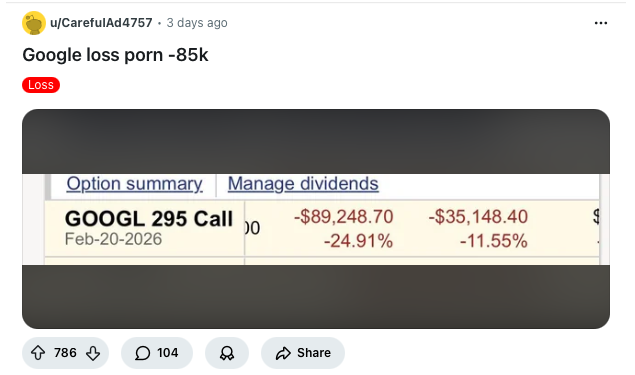

This isn’t true for everyone. Go visit the wallstreetbets site on reddit. Many are more excited about their losses than wins.

Everyone’s in it for a different reason. What’s yours?

ORLY v. BTC

Given that my goal is to make money, I’m not all that interested in the cool factor, the trends, or what will get me the most likes on reddit.

I like an investment like O’Reilly.

I can read about O’Reilly and see what’s going on. Here’s what one analyst has to say.

I can read about O’Reilly’s expansion strategy.

I understand this.

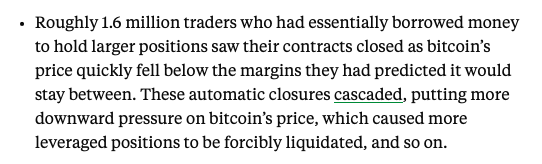

I read about Bitcoin today and here’s what I saw at the daily upside.

apparently

One of These Things Is Not Like The Other

For me, it’s pretty easy to understand a business like O’Reilly. I can visit their stores. I use their products, I can understand what the analysts are saying about the company…

1.6 million traderes (not investors, traders) borrowed money to speculate (gamble) on bitcoin futures. While I understand how this works, I’m not sure I understand how to make money with Bitcoin. Clearly 1.6 million traders don’t understand as well.

Wrap Up

All the kids are doing it, so I took a small position in Bitcoin.

When I did, my broker made me agree to their high risk trading policy. That tells you something right there.

I’m in for the long haul, but I’m only in for $8,704. That’s the most I can lose if BTC goes to zero.

I’m a little more optimistic about O’Reilly. I’ve invested $50k in small chunks over the last few years and I’ve gained about $35k so far.

I won’t become a wallstreetbets hero with my O’Reilly story, but I’ll enjoy the market-beating gains and I expect that in 30 years when I sell the shares it will have appreciated a bit more.