This is exactly what I asked myself this morning.

While perusing my IRA account, I came across a lot of red next to my Caterpillar covered call. Take a look. Red is usually bad.

There’s a lot here, so let’s break it down.

At some point in the past (we’ll get to that in a sec) I sold a contract to buy 100 shares of Caterpillar stock for $400 per share. I received $11.24 per share, I sold 1 contract (that’s the -1 in the quantity) so I netted a cool $1,124.00.

But, if my loss is limited on a covered call, how can the gain/loss show -$14,780.68?

Yikes!!

Breath

Deep breath, hold it….

This has to do with how the record-keeping system handles covered call values v. the value of the underlying shares.

Let’s dig in.

Let’s start with the underlying security – Caterpillar.

I’ve got a solid $49,013 gain on my shares. Yay!

But not really.

The record-keeper knows I have 207.367 shares. The value of each of those shares is $557.32 x 207.367 = 115,569.77 – that’s the current value of my position.

I can see that I paid $66,556.14 so yes, I’ve gained $49,013. That’s basic math.

Not Really

But the value of my Caterpillar holdings aren’t really $115,569. Here’s why.

I’ve sold a contract to sell 100 of my shares to an option contract holder for $400 on or before 11/21/25. Those shares are not worth $557.32 per share to me. They are only worth $400 per share because that’s how much I’ve committed to selling them for.

And it would be really confusing to look at my position and see a position value that did not = current price x shares owned, so my recordkeeper shows that as lost value in the option contract. I didn’t actually lose that money, but it is the difference between the market value of the covered shares and the contract value.

Here’s what I really own.

My Caterpillar position is 107.367 shares x the current price of $557.32 + 100 shares x the contract price of 400 = $99,837.77, which just happens to be $14,780.68 lower than what the position record shows.

This is important because I really don’t own $115,569 worth of Caterpillar. I own $99,837.

Imagine if the record-keeper didn’t show this and I sold my Caterpillar shares for $557.32 each. On November 21, I would need to buy them back at market price and sell them for $400 each, or $40,000 for the 100 shares. My loss could be unlimited, just like with a naked call.

Am I an Idiot?

That’s the next logical question here. What kind of an idiot would promise to sell shares at $400 each???

All I can say is that it looked like a good idea at the time.

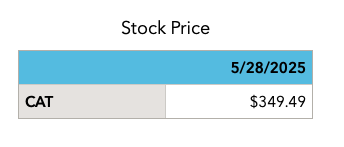

May 28, 2025

It was a Wednesday. Nice late spring weather. I had a guy over to remove some trees. In the morning I sold some covered call options. I sold one for Caterpillar.

Here’s what the Caterpillar stock price looked like on that late spring day.

Who’s the Idiot now?

Back then, I got $1,124 for a contract to sell 100 shares of Caterpillar anytime between today and roughly 6 months later (11/21/25) for $400 per share.

At that time, if Caterpillar’s share price is above $400, I’ll sell the shares and net a cool $50 per share, or $5,000.

This transaction nets me $1,124 + $5,000 = $6,124. That’s a $6,124 / $34,900 = 1.75% gain for 6 months, annualized at about 3.5% – not bad.

But wait, There’s more

I need to look into this a bit more. Typically, I sell shorter durations (I shoot for about 1 month) and I choose a strike just above the current price to maximize option income. With this, I’m selling at $50 above the current price and 6 months out. Seems off.

There is more to this story.

I bought the original Caterpillar shares way back on December 2, 2024. I paid $402.39 per share. I immediately sold a January 10, 2025 (1 month) covered call with a strike price of $405. I picked up a cool $1,154. For 1 month.

Caterpillar’s price plummeted. By end of December 2024, only a few weeks later, Caterpillar was trading at $347, a 13% drop, but the option contract that I sold was down over 90%. Remember, options are derivatives – they derive their price from something else – in this case the underlying security. A derivative’s price movement is exponentially larger than the price movement of the asset from which they derive their value.

I bought back the option at $0.20. So, I sold for $1,154, bought for $20, and I now have a $1,134 profit, along with some Caterpillar shares that have dropped 13% in value.

But since I only sell covered calls on companies that I’d be happy to own for the long term, I’m OK with this.

And then…

A few days later, I realize that I can sell a May 2025 (six months away) covered call with a strike price of $410, and a premium of $9.55 per share. I’ll put a quick $934 in my pocket and if the shares hit the strike in May, I’ll make another roughly $7 per share or $700.

And Caterpillar pays a dividend, so every quarter, I get a nice little dividend payment to ease the pain.

May comes and Caterpillar is still in the 350 range. I keep my shares, the premium and a couple of dividend payments.

One More Time

On May 28, I still have the shares.

The price has been stuck in the 350 range for a while.

I sell a December call, and since this is my 3rd sale, I’m willing to take a bit of a haircut on the cap gain. I set a $400 strike, which means I’ll lose $239 in cap gain, but I pull in another $1,124 in premium.

Wrap Up

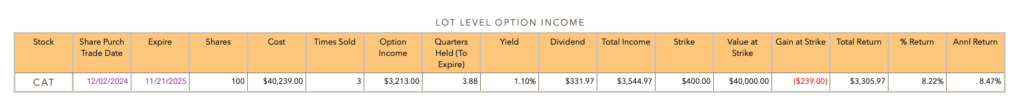

A lot went on here, so let’s look at the Lot Level Option Income spreadsheet.

I bought 100 shares that cost me just over $40,000. I sold options 3 separate times. I’ve taken in over $3,000 just in option premium. I’ve held almost a full year, so I’ll get 3 quarterly dividend payments so that’s another $300 or so. I lose $239 on the sale, but I’ve made a nice profit of $3,305 for an annualized return of 8.47% on the $40,000.

But, while 8.47% and $3,305 is nothing to sneeze at, I lost the opportunity for huge gains. Caterpillar’s stock price is $557.32. I could be sitting on a gain of 554.32 – 402.39 = 151.93 x 100 shares = $15,193.00. That beats $3,305, right?

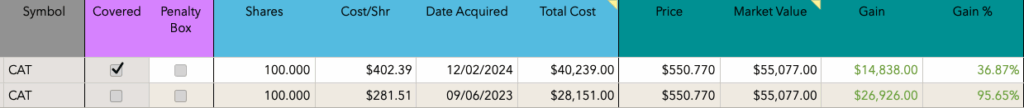

That’s why I have 207.367 shares of Caterpillar.

I sold covered call options on 100 shares, but kept 100 for myself. The .367 is dividend reinvestment, but here’s the breakdown of the 200 shares.

I actually bought the original 100 back in 2023, so my gain is even greater.

Bonus

If you are a regular reader, you may remember a similar story about Caterpillar covered call options way back in 2024. You can read it here.

Same thing happened, the price fluctuated, I sold some covered call options, and then at one point the stock popped and some lucky option contract buyer got a huge win.

In both cases I had a small win from my option premium, but I also participated in the huge win because I held on to 100 of my shares and refused to sell option contracts on them.

While sticking to our strategy of always selling at a strike higher than a purchase price can protect us from losses, selling covered call option contracts limits our gains. And this is a problem.

We need to make sure we have a significant portion of our wealth invested for the long term. The equity investments will fluctuate and give us some heartburn along the way, but if we’ve done our homework and chosen well, this has proven to be a great way to build wealth.

Another Bonus: Keep Score

It is very important to keep notes or a spreadsheet on hand that provides all of this information about prior option sales, and especially, what I paid for the original shares.

I need to know what I paid for the original shares to be sure I don’t set a strike price below my original cost.

And being able to see the prior option income on the 3 sales, I was able to make the decision that I’d be willing to take a small hair-cut on the cap gains in order to get a better option premium on what looks to be the final sale.

Icing On The Cake

…because who likes plain cake?

Today is November 20 one day after the original post. I wake to see this in my transaction history.

Nice timing.

Holding through volatility can be difficult. It’s tough to see our favorite company’s stock price decline, and sometimes stay down for months.

A nice dividend payment can help keep us committed.