I read recently that many younger folks view sports betting and crypto currency as ways to build wealth. They are disillusioned with the stock market.

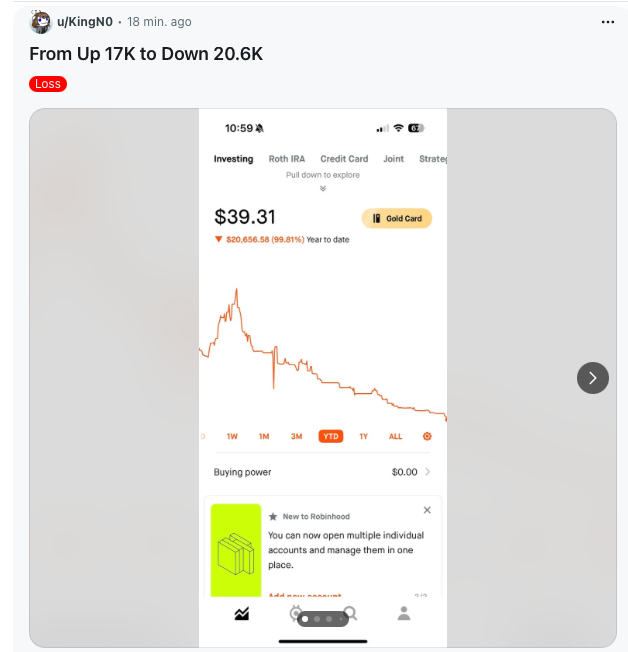

And this morning I check in on the wallstreetbets reddit site and see.

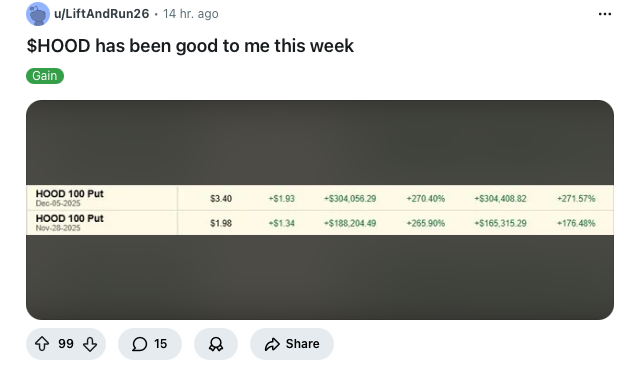

or even better

Imagine being up nearly a half million dollars in a short amount of time. How cool is that?

I hope LiftAndRun26 cashes out and puts his winnings in a nice low-cost S&P 500 fund.

Rush

He won’t

Wallstreetbets is all about the rush. Big risks, big winning, big losing. That’s excitement.

Boring

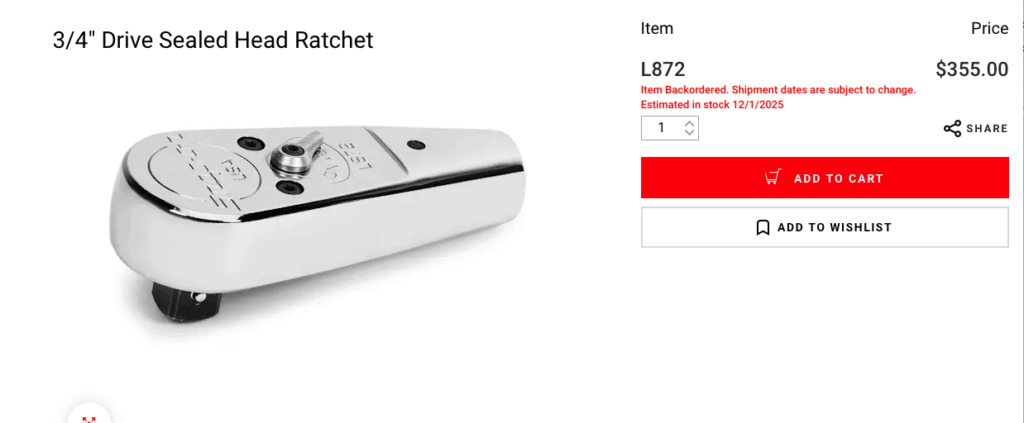

In my boring little world, I’m excited about Snap-On (Ticker: SNA). Snap-On sells premier tools, equipment, storage chests and cabinets to professional mechanics. Their stuff is pricey.

I’ll shop amazon.

But Snap-On trucks are all over the roads and the company has been around since 1920, so it must be doing something right. I wrote about Snap-On here.

Snap-On

I bought my first shares in 2022. They’re up 45.06% v. 71.77% for the S&P 500. Not bad, but nothing to brag about.

But Snap-On pays a nice 2.96% dividend. I re-invest each quarterly dividend payment to buy more shares. The value of these re-invested dividends today is $4,433.

I’ve also sold 15 covered call options on Snap-On shares, which has netted me another $13,145.

So while the shares are trailing the S&P 500, if I add in the dividend re-investment, I’m a little ahead of the S&P 500.

Options

Today, I have a covered call option that will expire, as the strike price is below the current price of SNA.

Back on October 16, I sold a covered call option with a strike price for $350 and I got an $810 premium payment. SNA is at $331.45 right now, so this contract expires worthless and I keep my shares and the $810 premium.

I’ve done this before on these same shares. I’ve sold covered call option contracts that have expired worthless 4 times and I’ve received $3,557 in premium. And I still have the shares.

Boring!

$3,557 in option premium. Big deal.

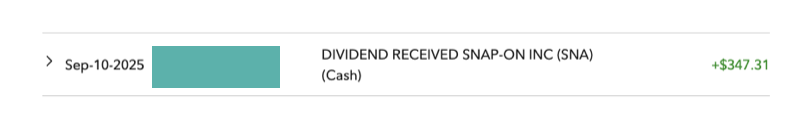

Or my quarterly dividend payment:

Or even the cap gain

This is peanuts compared to the half mill that LiftAndRun26 made just this week.

And by the way (the cool kids would say BTW) that little D after the symbol means I have another dividend payment coming soon. Yay!

Boring is Beautiful

But this is real money. I can take it out of my account and buy a nice dinner or play a round of golf.

But even better, let it grow. Maybe I’ll leave it there, enjoy the dividends, sell a few covered call options and see where we are in 20 years.

S&P 500

I like finding great companies that I think will beat the market. I buy a few shares and watch and learn.

But it’s just as easy to build wealth with a nice low-cost S&P 500 fund or ETF. Sounds boring right?

iShares Core S&P 500 ETF (IVV) is up over 11% year to date. It was up more than 20% per year in both 2023 and 2024.

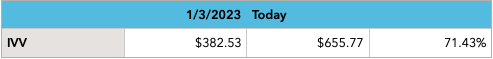

Take a look

It’s up 71.43% in less than 3 years.

That’s better than normal, but The S&P 500 has averaged a 10% return per year with dividends reinvested over the past 100 years.

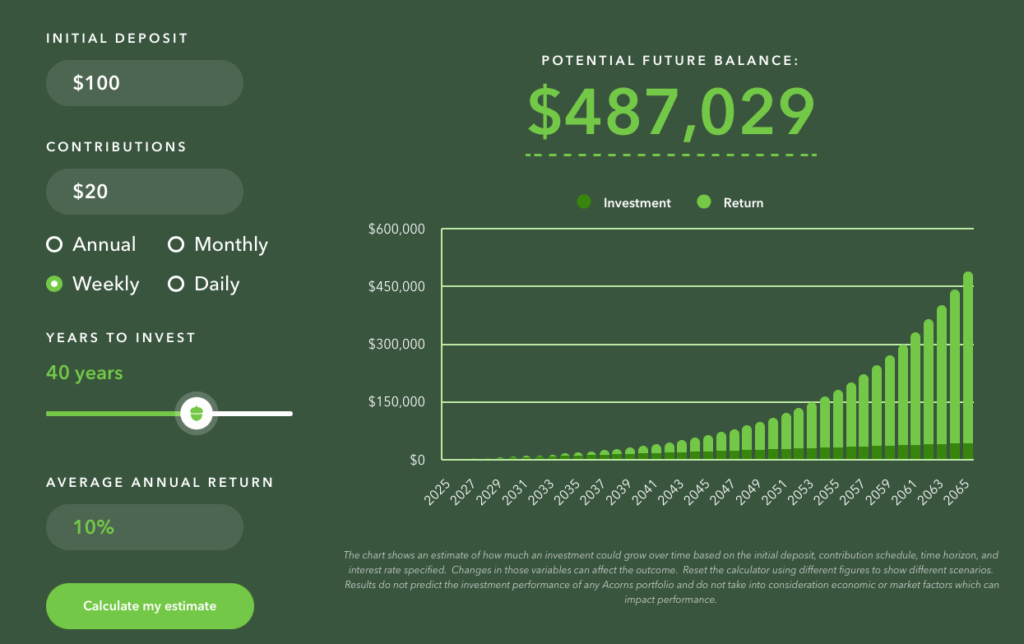

Put in $100, add $20 every week and in 40 years, you’ll be up there with LiftAndRun26

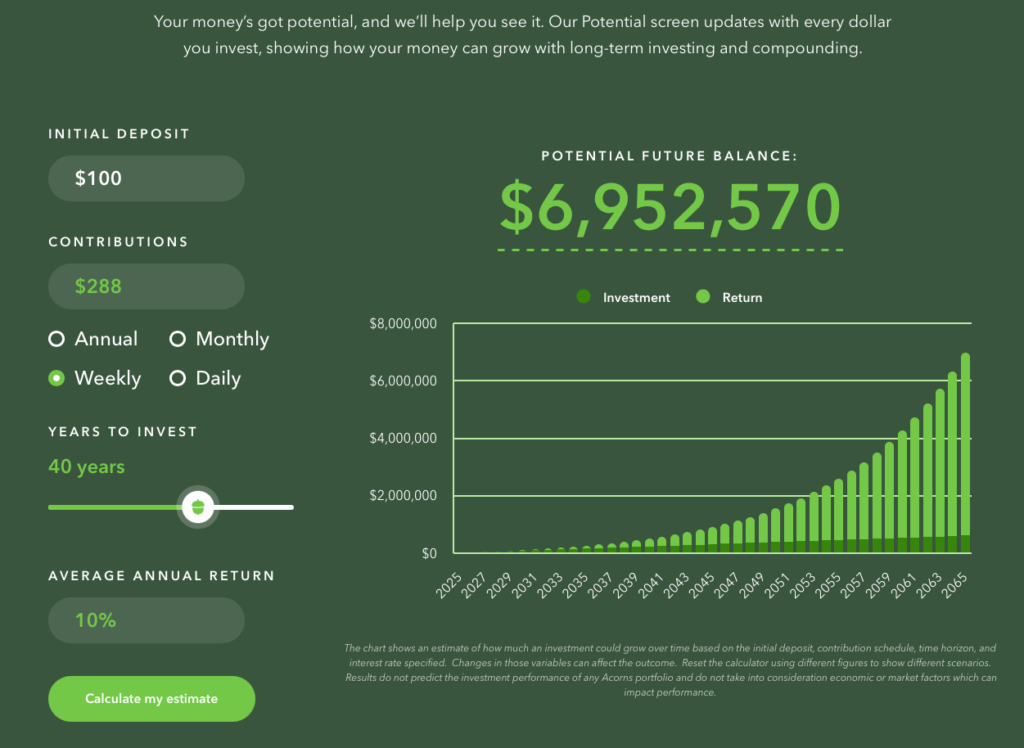

If our annual salary is $100 and we commit to saving and investing 15%, look what happens.

Wrap Up

There’s nothing better than a windfall. Invest a few bucks and make a million. That’s the appeal of the lottery and sports betting and some of the crazy stuff going on wallstreetbets.

But most often, wealth is built slowly over time. It probably feels boring along the way, but it wouldn’t be boring to retire with $6,952,570, would it?

That’s the magic of compounding and the impact of time.