This morning’s headline confirmed what many knew for months now.

Back in March of 2025, I wrote about the growing national debt, poor spending control and my optimism that DOGE might address some of these problems. You can read it here in Politics and the growing National debt.

DOGE

The Department of Government Efficiency.

It’s no surprise to most of us that the government is inefficient. The Department of Defense is one of the American taxpayer’s largest expenses. We’ll spend close to $1 trillion this year in defense. And while the amount is controversial, the world is a violent place and we need to protect ourselves.

But that said, it is well recognized that the Department of Defense can’t pass an audit. It has no idea what it owns or how it spends the $1 trillion that taxpayers provide each year.

Shame on the Department of Defense and on congress. Why do we keep allocating the money if we don’t know where it goes? I’ve written that this would be unacceptable in a public company, but think about it in the context of our families.

We give our child $100 and off they go. They return hours later.

“Where’s the money?”

“I don’t know. Can I have some more?”

“Sure, here’s another $100.”

That’s crazy-talk. But it works at the pentagon.

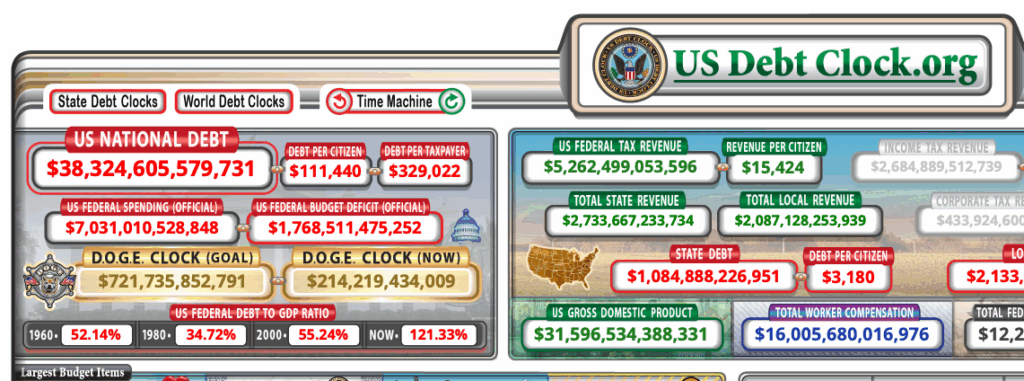

I had hoped that DOGE would be successful. It targeted $2 trillion in cuts. However, the debtclock tells us that we’ve revised the target way down and we’ve fallen quite short of even that.

Oh, and by the way, the total debt was $36,652.690,600,727 in March 2025 when I wrote the post. Check it out – there’s a picture.

Today it is $38,324,605,579,731. It is up almost $2 trillion in 8 months. That means we are accelerating our spending. We’re spending more, not less.

No wonder DOGE is folding.

Norway

A lovely country, though a might chilly.

It also caught my attention this morning. I read Analysis-Norway’s lesson for Europe on wealth taxes: let some millionaires go.

We often look towards European countries and their tax policies as a means to both address the growing national debt and to provide more services for our citizens.

The article is worth a read because it talks about the trade-offs.

Tax the Rich

This is a battle cry of many. Bezos, Musk, Gates and Taylor Swift have too much – though we love Taylor so we give her a pass.

Gates tends to get a pass too because of his philanthropical work though supporters had a rude awakening when he did a 180 on his climate advocacy. Interesting that this happened just as his AI data centers needed a massive power injection. Coal is cool. I guess Bill is a capitalist.

Anyway, let’s make them pay.

How we accomplish this seems to be universally mis-understood.

Musk and Bezos aren’t cheating the government. At least they haven’t told me about it and I’m pretty sure neither wants prison time.

In the US, we pay income tax. All of us. We earn money and we pay taxes on that money that we just earned. Higher earners pay more.

Businesses are also taxed. When Amazon or Walmart earns a profit in the US, they pay taxes on that money.

Business owners are not taxed on the growth of the businesses that they own. Musk owns quite a bit of Tesla, and x.ai, and SpaceX and a few of the companies. That’s because he started them and the companies grew in value. So the value of the companies that he owned grew.

Musk is also very clear that he wants to maintain control of all his companies. He does not tend to sell shares.

This is an imortant point. In the US, we tax realized gains but not unrealized gains.

Unrealized Gains

I bought my home over 25 years ago for $222,000.

Today it is worth about $600,000 according to Zillow.

I still live in it and don’t intend to sell anytime soon.

While I pay property taxes to the city each year, based on the value of my home, I do not pay any tax on the increase in value. Nowhere on our federal tax return does it ask us about increase in property value. That (600k – 222k = 378k) 378k of increased value is untaxed. It is an unrealized gain.

Same goes for ownership of a business. The shares of Amazon I bought can increase over 3,000%. That’s cool. I pay no tax on that unrealized gain.

Same goes for Musk. As his businesses grow, he pays no tax on their growth. Just like us.

Realized Gains

Realized gains come when we sell something and make a profit.

If I sell my home, that $378k becomes a realized gain. In most cases, if it is my primary home, I can avoid taxes, but not so for business ownership.

If I sell shares of Amazon, I immediately pay tax on the gain, because it goes from unrealized to realized at the point of sale.

If Elon sells shares of Tesla, he’ll pay tax, but as long as he holds it, he won’t.

Start-Ups

Most businesses begin as start-ups. Amazon did, so did Netflix, Apple and Walmart.

Some entrepreneur borrows money from everyone they know and starts a business in their garage. It grows and grows and requires capital (money) so it borrows more. The value of the business grows but often, it ain’t making a dime.

Amazon went years without making a profit. It kept putting all of its earnings into new ideas to give us more products and one day shipping. The value of the business grew, but the pre-IPO business owners weren’t making any money.

The business owners and the venture capitalists that provide funding aren’t paying taxes on the value of the business at this point.

In the US, we pay taxes on income and there is no income. Every nickel is going back into the business and we’re borrowing even more.

Imagine what would happen if we had to pay taxes on the value of the business. That’s money we couldn’t spend on growing the business. It would be impossible for start-ups.

That’s bad. That’s the risk of taxing based on value.

Margaret Thatcher

Before we get to Maggie, Let’s talk about socialism.

It is gaining popularity in the US. The new mayor of New York City, our largest city and the center of capitalism in the US is a self-declared socialist.

You can read more here, but that’s the gist of it.

Remember those guys who can’t get the pentagon to pass an audit? Socialists want to give more power to them. Let’s have them manage everything because they’re doing such a great job.

Taxing based on wealth is a key tenet of the Norway plan. Read the article.

Maggie

OK, let’s get back to her.

Socialism is about redistributing wealth. Tax the rich. Take it from Elon, Jeff and Bill and give it to the government to support the people.

Norway implemented an exit tax. They heavily tax people leaving the country, but the wealthy are still leaving.

It’s a difficult problem.

Wrap Up

DOGE is dead.

Another failed experiment in reigning in government spending.

In the past 20 years, the US government has successfully demonstrated that it is incapable of managing a budget. It doesn’t matter which party is in the white house or which party controls the house or senate. They’ve all failed.

Socialist policies are gaining popularity, but that’s been a colossal failure in many countries across the globe. Take a look at Pol Pot in Cambodia – how’d that go?

DOGE seemed to be our last hope. I was optimistic in March. The numbers show the failure.

What’s next?