It’s Thanksgiving week. Christmas and New Years are right around the corner. In a little over a month it will be 2026. Can you believe it? Where did 2025 go?

In between all the shopping and celebrating, now is a good time to think about our finances. Yay!

It’s Really Not That Hard

Most people avoid the year-end check-up because they’re not sure what to do. Today, we’ll take the mystery out of it. And I promise it will be quick and painless.

Goals

It’s important to be clear on our financial goals. This is job 1.

Here’s an example of why this is important.

Yesterday, I fed some info into grok.com about my holdings and asked how my performance was. I killed it this year. Not so much over the past 3 years.

I started thinking about why I had underperformed and started coming up with a list of stocks to sell. If I’m not confident a company will beat the S&P 500, then I should just own an S&P 500 fund, right?

I got pretty spun up reviewing my performance and my thesis and coming up with a sell list.

Luckily yesterday was Sunday and I couldn’t trade. I woke today with a clearer head.

Income

I forgot about this.

I’m retired. I have no income. Duh!

That’s OK, because I’ve been saving for 40+ years to build the nest egg that will act as my income stream. And I’ve done a pretty good job buying a basket of income stocks and bond funds to create my income stream.

Income Stock

Per Investopedia, an income stock is:

Over the past 5 years or so, I have bought shares of 21 companies that pay a solid dividend. The dividend yield of the group ranges from 1.11% to 5.58%.

My APR for the basket is 3.97%. I calculate this by taking the current yield for each security x the market value to get the annual income. Then I take the sum of the annual income / the total cost for the 21 securities to get the 3.97% APR for the basket.

A 10 year treasury pays about 4.03%, so this isn’t bad.

In this group, I hold General Mills, which pays about a 5% dividend, but is down 25% this year. And I hold NRG energy, which pays a 1.11% dividend, but is up 85% YTD.

2 years ago, I never would have thought NRG would be performing better than most growth stocks. And I would have expected General Mills to be a solid market beater, especially with its entry into the pet food business.

Boy was I wrong.

But I knew I’d be wrong. That’s why I bought shares of 21 companies. I’d have done better if I put all the money in NRG, but I’d be in the poor house if I put it all in General Mills.

The point is that this basket is trailing way behind the S&P 500. I’m up 10% and the S&P 500 is up over 70%,

But my goal is not to beat the S&P 500 with this basket. It’s to generate income. And it’s done that quite well.

Recap

The point of the rather long and winding story is that we need to understand our goals.

When I forgot my goal was income and started to compare to the S&P 500, I almost made a rash decision that would have prevented me from achieving my primary goal of generating income.

Now, that said, I also have a nice little basket of growth stocks that includes Google (up 68% YTD) and Broadcom (up 63% YTD) but that’s a story for later.

Goals (Again)

Now that we know why goals are important, I’ll review mine.

- Create an income stream that will cover my expenses. I love the S&P 500 and expect that over a 10 or 20 year period, it will be up an average of 10% per year. But I also know it is sometimes down for years in a row and there have been 2 or 3 periods in the last 100 years where the market has been basically flat for 10 or so years. Since I don’t have a paycheck, I want to be prepared for the flat market scenario no matter how unlikely it is.

- Invest for growth. I’ll hold onto a basket of growth stocks and some S&P 500 funds. I also need to find some new winners so I’ll buy small positions in some small companies. I’m in good shape financially today, but I need to generate growth for 20 years down the road.

- Cash Cushion. My income stream covers my expenses today, but companies can cut their dividend and bond fund yields and Treasury and CD yields are likely to drop if interest rates keep coming down. So while I’m covering expenses now, this could change quickly. Cash is always nice to have. I’ll keep a bunch on hand and will use CD ladders, Money Market funds and low-risk short term government income funds to provide interest to offset the effects of inflation.

- Minimize taxes. For me, RMDs – required minimum distributions – start in 2036, when I’m 73. I want to convert money from my traditional IRA to my Roth each year to minimize the taxes I’ll be paying in 2036 and beyond.

Those are my goals. I’m not saving for a boat or a new retirement home, or anything else big so it’s really just positioning my assets to meet these 4 goals.

Now that I know my goals, I’ll assess how my portfolio is performing against each.

Income Stream

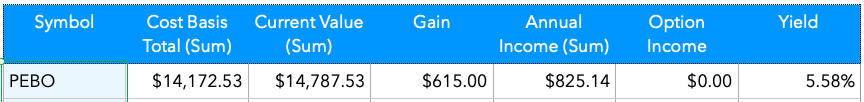

I needed a new spreadsheet to track this goal. Here’s a sample:

People’s Bancorp (Ticker: PEBO) is a nice little regional bank with a low p/e and high dividend yield. It’s not gaining much, but it will pay me $825 per year in dividends for my $14,172 investment.

This spreadsheet has 21 other names on it and I’m making sure the group as a whole has a positive gain and I’m keeping an eye on the 3.97% calculated aggregate annual return to make sure this doesn’t drop too far.

I have a similar sheet for my Cash and CDs, and another for my bond funds. If yields drop or I’m taking an aggregate loss, I can recognize this right away.

Growth

Apple, Amazon, and Netflix, and a handful of other favorites have fueled the lion’s share of my growth for the past 20 years. I’m optimistic about them for the future, but I don’t expect another 3,000% gain for any of them.

So I need some replacements.

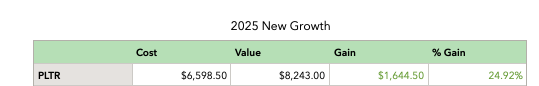

I keep my eyes peeled and when I see a compelling small company, I invest a few thousand dollars. I keep a spreadsheet.

Palantir is the top performer on this list. I have one company down 20%, and another down 16%. I’ll be wrong more than I’m right, but if only 1 or 2 that I’m right about gain 3,000%, I’ll be in good shape when I’m 82.

Cash

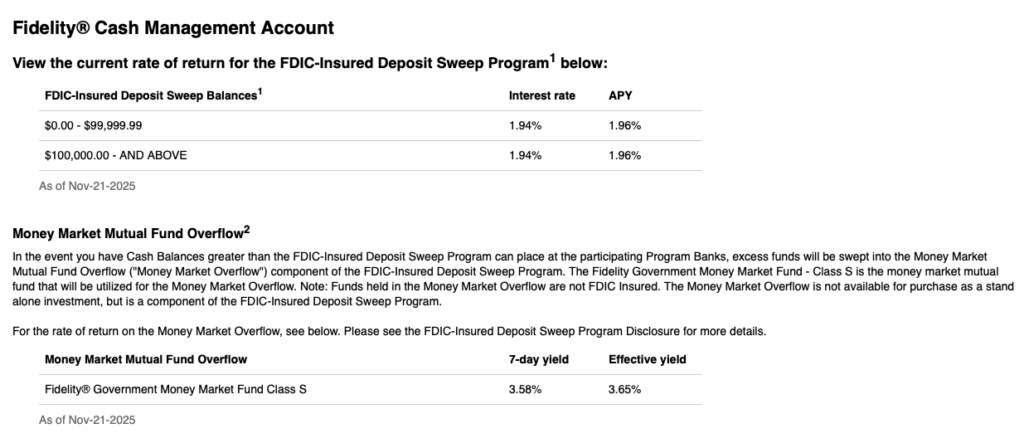

My emergency fund and my cash for paying bills is in a low interest checking account. Bank of America’s low interest checking account is 0% interest and sometimes charges a fee.

My cash is in my Fidelity Cash account. I get close to 2% interest. I also get an ATM card and Fidelity reimburses me for all ATM fees. I can write a check or go to any ATM on the planet. Don’t accept 0% interest.

Outside of my emergency fund, I have a CD ladder set up. It is a group of CDs that expire in 1, 3, 5 and 10 years. I’ve set them up at various times in the past so I have a constant cash flow as one expires, and it allows me to have some of my cash in higher-paying longer term CDs.

Taxes

I am in year 2 of Roth conversions. I love having some Roth money because the taxes are paid. It grows tax free and I can withdraw it tax free. And no RMDs.

Paying the taxes stinks. I have to put aside a good chunk of money each year to pay taxes on the amounts I convert.

This year I explained my situation to Grok and he created an optimized plan for Roth conversions. He did a nice job of explaining his rationale and he fielded all my subsequent questions. He’s very patient.

Wrap Up

My portfolio will not beat the S&P 500. It won’t even come close.

But that’s OK. That’s not my goal. It was 15 years ago. It’s not now.

- I have an emergency fund that is always there and will not lose to inflation.

- I can generate income to cover my spending.

- I have some money in growth stocks and S&P 500 funds to (hopefully) provide gains 20 years down the road.

- And I have a plan to convert assets to Roth to minimize taxes.

And let’s not kid ourselves. Things change. Remember 2008?

At year-end, we articulate our goals and then we allocate our assets as best we can to try and meet those goals.

My plan may hold true through 2026 and I’ll revise it again.

Or it may go belly up on New Year’s day. And I’ll come up with a new plan.

See, that wasn’t so hard.