I’ve written about covered call options quite a bit. Here’s a list of posts, including a step by step guide.

Covered Call Options

It sounds a little tricky and risky, but if done intelligently, we can manage that risk. Let’s first talk about what they are.

A covered call option is a contract. It’s an agreement between 2 investors. One is agreeing to sell 100 shares of a specific stock at a specific price on or before a specified date. The other has the option, but not the obligation, to purchase those shares at the specified price, on or before the specified date.

Oh yeah, that helps…Let’s try an example.

OKTA March Call

Yesterday I sold -OKTA260320C100. Let’s break this down

- – all option symbols begin with a dash

- OKTA is the underlying security on which the option contract is written

- 260320 looks like a date. It is. It is the expiration date of the option contract

- C denotes a call option. It could also be a P for a Put option but that’s a story for another day

- 100 is the strike price

What Did I Sell?

I sold a contract that allows another investor to buy 100 shares of OKTA on or before 3/20/2026 for $100 per share.

I got a premium of $3.35 per share. Contracts cover a round lot of 100 shares so I got $335.00 in option premium.

I bought my shares of OKTA for $99.90 each in July of 2025. OKTA is currently trading around $86 per share.

Why Did I Sell?

This is an important point for me. Options are a great way to earn a small premium, but they cap our upside potential. By agreeing to sell at a slightly higher price in exchange for current income (the option premium), we can miss out on huge gains.

This is why I will not sell covered calls on most of my equity portfolio. Its job is to grow.

I take a small portion of my equity allocation and sell covered calls against those shares.

In this specific example, I have shares of OKTA in my brokerage account that I bought in 2018 that are up 162%. These are off-limits.

I regularly buy shares of OKTA in my IRA specifically for covered calls. I have one group of 100 shares of OKTA that I bought in May 2024 that I’ve sold covered call options on 11 times. Each time, they’ve expired and I’ve sold another covered call option.

In every case, I will only sell a covered call option if I will have a positive capital gain. Selling at a loss to get the premium is a guaranteed path to the poorhouse.

So, the answer is, I sell to get the small amount of income. In this case the $335.00. Do this a few times a month and it’s a nice little income stream.

Complicated?

Yes.

First off, we need to research the underlying company – in this case OKTA. If the stock price drops, and they all do eventually, we could be stuck holding it waiting for recovery.

We also need to evaluate the premium we’ll receive v. the time we’ll need to hold the shares. I like to target 1 month to minimize risk, but with my OKTA shares, the price has pulled back so I’m looking out 4 months to get a reasonable premium. The 3.34% that my option sale represents doesn’t look so great if we divide by 4 (months). That’s less than 1% per month.

So there is a lot to think about and there is some risk to manage.

So many of you may think “I’d love to make some option premium, but it seems too difficult and risky.”

Covered Call Option ETFs

I had this same thought about a year ago. Covered call options are a great way for an experienced investor to improve returns, so why aren’t there ETFs that do this?

There are.

I found a few and in December of 2024, I bought shares of 2.

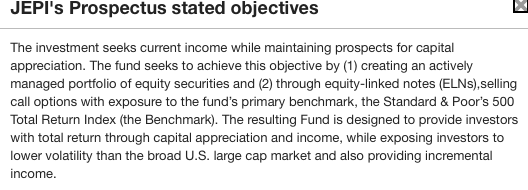

The first is JPMorgan Equity Premium Income ETF (JEPI)

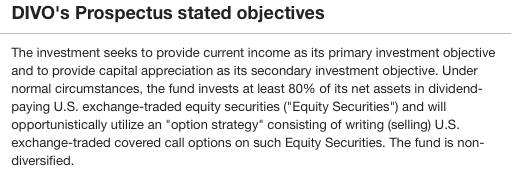

The 2nd is Amplify CWP Enhanced Dividend Income ETF (DIVO)

I was excited and I bought shares of each.

I was also curious to see how they perform because the yield of a typical ETF is based mainly on the dividends received from the companies that they hold. They’re pretty dependable.

With DIVO and JEPI, the dividend will be influenced by their ability to continue to sell covered call options. They’ll experience a lot of the same challenges that we’d have.

The Results are in

DIVO

I bought 300 shares on 12/26/24 (Merry Christmas!) at $41.09 per share for a total cost of $12,326.46

I received monthly dividend payments of about $56, though my most recent was $67. So that’s about $680 in dividends, which I reinvested.

The stock price of DIVO today is $45.50. So my initial purchase is up about 10.73%

Total return with dividends reinvested is (14,322.36 – value today minus cost of 12,326) = $1,996.36 gain, which is a 16.2% return.

JEPI

I bought 250 shares on 12/26/24 (Merry Christmas! again) at $58.64 per share for a total cost of $14,660.00

I received monthly dividend payments which vary quite a bit. One month was $80.47, while another was $144.20. I reinvested a total of $1,233.06 in dividends.

The stock price of JEPI today is $57.47. So my initial purchase is down about 1.99%

Total return with dividends invested is (15,601.81 – value today minus cost of 14,660) = $941 gain, which is a 6.4% return.

Wrap Up

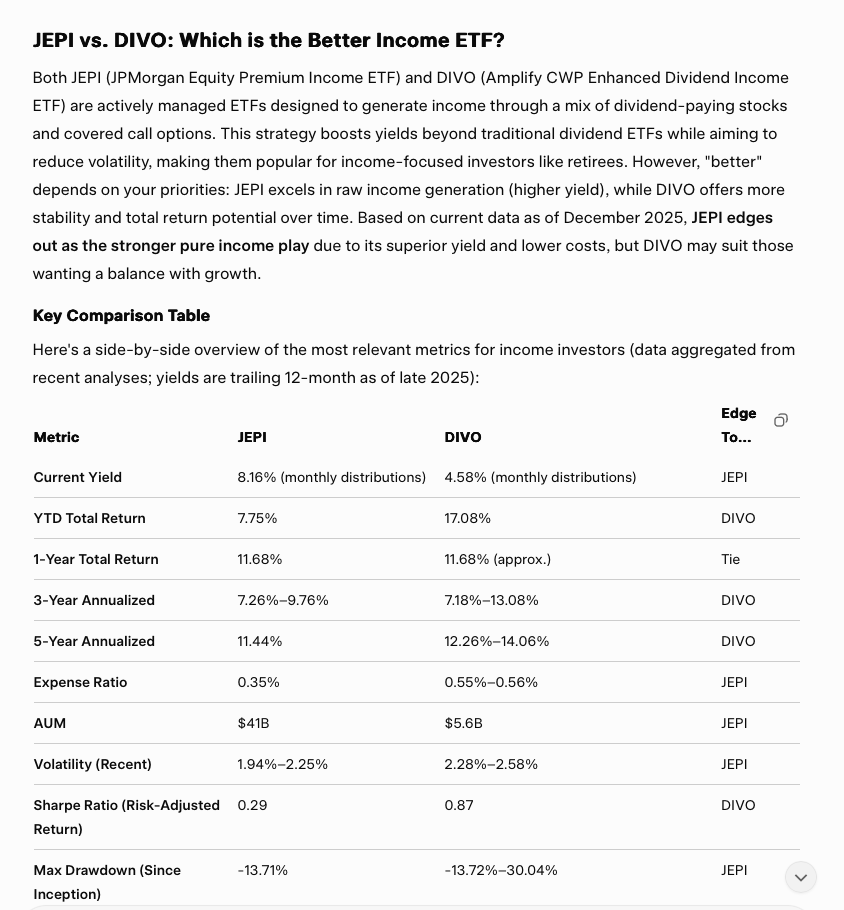

JEPI advertises both a distribution yield and an SEC yield that are higher than DIVO. And that’s exactly what I’ve seen over the past year.

DIVO had a solid capital gain in addition to a solid and steady dividend. JEPI lost a few bucks, but paid out a large but fluctuating dividend.

I asked Grok what he thought and he said:

Given that, why not buy both?

The bottom line is that covered call options are a great way to generate some portfolio income but they’ll require some work and we’ll take on some additional risk.

Funds like DIVO and JEPI make those decisions for us. They don’t do it for free. Their expense ratios are over 10x a nice low-cost S&P 500 fund like IVV.

But if you’re looking to dip your toe into the income generation of Covered Call options without the hassle, these both seem to be solid options.