Thanks to Tony for suggesting this topic.

It’s February and it’s cold so there’s not much else to do but sit at home, watch the snow and worry about how much of our retirement savings – or earnings – Uncle Sam is going to take from us.

Taxes

I’ve written about our growing national debt and how I’m less than thrilled about how our elected officials choose to spend our tax dollars, plus about another $2 trillion per year that the federal government borrows to feed its habit. Read more here, here, and here.

As unhappy as I am, I do recognize that we need to pay for roads, bridges, emergency services, and lots of other things, so taxes become a necessary evil.

But that said, there are things we can do to minimize our tax liability and if we understand how taxes work, we may be able to reduce our payments.

Pay As You Go

In the US, we have a pay-as-you-go tax system. This was news to me when I retired.

When I was working, taxes were deducted from every paycheck. I never had to think about it.

When I stopped receiving a paycheck, I had no tax withholding, and while I had no real income from an employer, I had income from investments. If we don’t pay taxes on our income throughout the year, we’ll pay penalties at the end of the year when we file our tax returns.

That’s what pay-as-you-go means. We need to make payments to the government (both state and federal) on a quarterly basis else we’ll be penalized.

Be sure to pay quarterly estimated taxes!

Graduated Tax System

I live in Massachusetts. We pay a straight 5% rate on taxable income. That’s boring, so let’s talk about federal taxes.

The US Government has a graduated tax system. This works better with an example, but you can find the tax rates here.

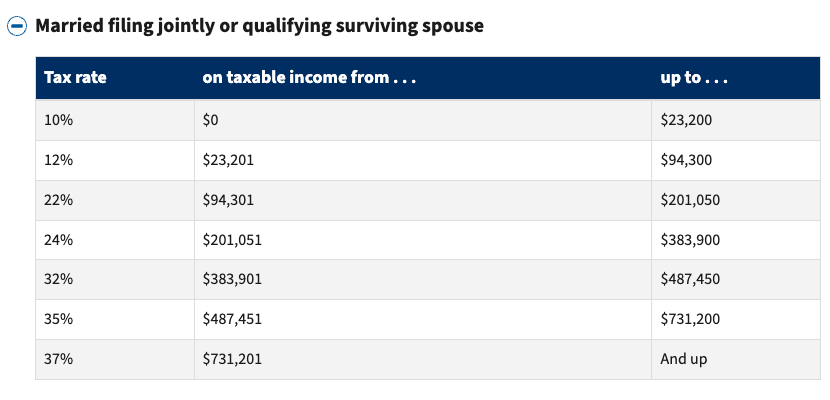

Here are the 2025 Married Filing Jointly tax rates.

Graduated Tax Example

Let’s say I’m married, filing jointly with my spouse, and we’re both retired. Our 2025 income is $100,000 made up of dividends and interest from investments in taxable accounts, and income from 401k withdrawals.

Let’s talk about this for a sec.

Taxable accounts are accounts like an account at our local bank, a high-yield savings account, or a brokerage account at Fidelity, Vanguard or Robin hood. We put money into these accounts after taxes have been withheld. Taxes have already been withheld on the principal, but we need to pay taxes on any interest or dividends, or even capital gains. Our financial institution is nice enough to send us a 1099 form with all this info calculated for us.

Tax-advantaged accounts like a 401k, have a tax advantage (gasp!). For traditional 401k accounts, money goes in tax-deferred. We don’t pay taxes today on the money we put in. We don’t pay taxes on dividends, interest or capital gains. But, when we take money out of a traditional 401k, all of it, whether it is principal, interest, dividends or gains, is taxed as ordinary income.

Roth contributions to a 401k work a little differently. There is no tax advantage today, but we pay no taxes on withdrawals in retirement, regardless of whether we’re taking principal, dividends, interest or cap gains. We’ll talk more about Roth later.

Example???

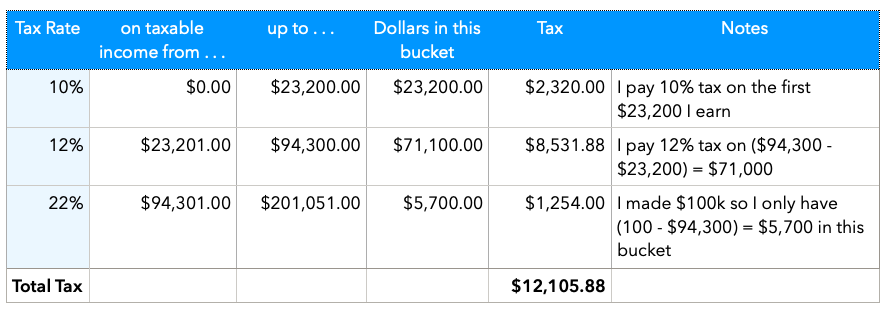

Right, back to the example…Married, filing jointly, $100,000 income. My dividends and interest from taxable accounts is well, taxable, and my traditional 401k withdrawals are taxable as well. We’ll talk about social security taxes in a bit…assume no social security for now.

So let’s take the table above and see how our $100,000 gets taxed.

They key point here is that just because my income was $100,000, doesn’t mean I’m taxed at the 22% rate. I’m actually paying about 12% ($12,105 in taxes divided by $100,000 in income).

That’s because I pay a lower rate (10%) on my first $23,200 regardless of how much my total income is.

It’s actually a bit more complicated and we’ll look into things like long-term v. short-term capital gains rates a little later.

Strategies to Minimize Taxes

One clear strategy here is to manage our 401k withdrawals to try and keep ourselves in the lower tax brackets. If we can keep our total income under $94,300, our maximum tax bracket is 12%. There is a pretty big difference between paying 12% tax and 22% tax.

Let’s say I needed an additional $10,000 from my 401k at the end of the year and that would take me into the 22% bracket. I’d pay (22% x $10,000) = $2,200 in taxes. But if I could defer that withdrawal into the next year, I could potentially pay 12% x $10,000 = $1,200. That’s a thousand dollars in tax savings!!!

Capital Gains

Long-term v. short-term. This matters. A lot.

Long-term typically refers to an asset held for more than 1 year. Pretty straightforward.

Short-term capital gains are taxed as ordinary income.

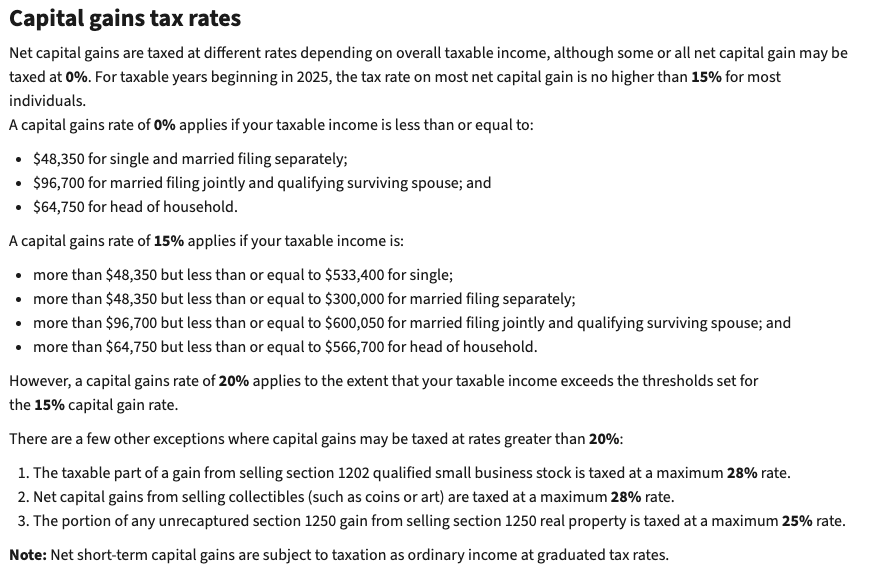

Long-term capital gains are taxed at a lower rate based on our income. Per the IRS:

Capital Gain Strategies

So, while it makes no difference if you trade in and out of stocks in your 401k (it actually does because you’ll probably lose to a nice low-cost S%P 500 fund, but for tax purposes, it doesn’t) because short-term v. long-term gains rules don’t apply (it’s all taxed as ordinary income), we should try and avoid short-term gains in our taxable accounts.

Check it out…if we’re married, filing jointly, and our income is less than $96,700, we pay NO taxes on our long-term capital gains. Sweet!

Tax Loss Harvesting

I am not a fan of tax loss harvesting.

This is a process where we sell a losing investment in order to offset gains, thus reducing our taxable capital gains.

Almost every investment I’ve made has lost money at some point. And most of them have gone on to be big winners. Some needed more time than others.

So yes, I do sell investments when my thesis changes, but in my experience, the process of hunting for losing investments at the end of the year and selling them to save a bit of tax on capital gains is a strategy to ensure we lose money.

Social Security Tax

I turned 62 this year so I began taking my social security. This is awesome. I get a monthly payment to help pay for golf and vacations, and maybe some grocery shopping.

But, I’ll need to pay taxes on this new income stream. Bummer.

There’s been some misinformation about eliminating social security taxes. Social security payments are taxable. There is however, a senior tax credit which helps offset the social security tax payments which we’ll talk about in a sec.

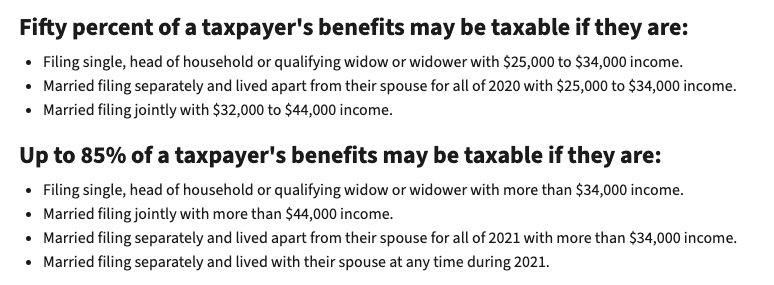

The good news is that not all of my social security income is taxed. Depending on my income level, either 50% of my social security income is taxed or 85% of my social security income is taxed. Read more here from the IRS.

Here’s the scoop for those who don’t like to click.

So, going back to my married, filing jointly, earning $100,000…

If $20,000 of that $100,000 is from social security, 85% of my social security payment will be taxed as ordinary income.

85% x $20,000 = $17,000 will be taxed. The remaining $3,000 will be tax-free.

If I could keep my income below $40,000, only 50% of my $20,000 would be taxable.

Senior Tax Deduction

Anyone, like myself, who is old, but has not yet reached 65, feel free to skip ahead.

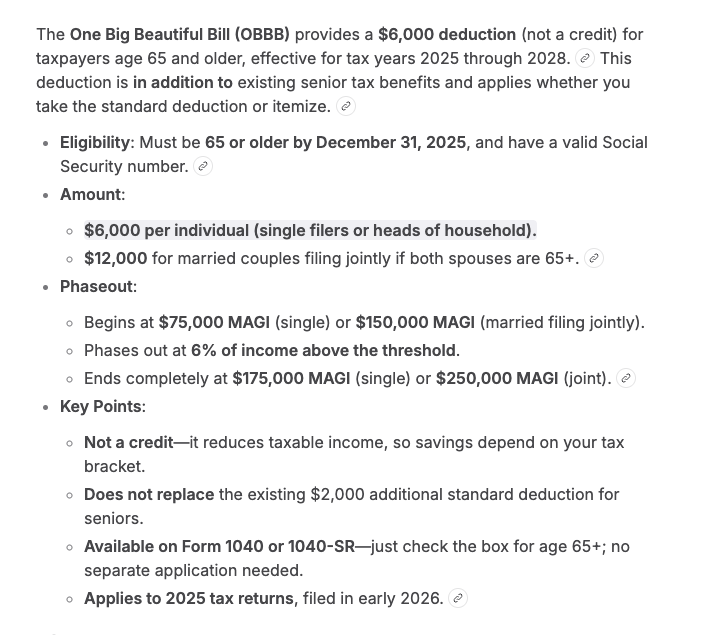

For those 65 and older by December 31, 2025, you are eligible for the new $6,000 senior deduction that was part of the One Big Beautiful Bill that was passed in 2025.

Here’s how it works.

In our example, if I’m married, filing jointly with $100,000 in income, and my wife and I are both over 65 on December 31, 2025, I will have an additional $12,000 deduction, on top of my standard deduction.

To take advantage, my income must be below $175,000, and below $150,000 to get the full deduction.

This benefit is currently scheduled to expire in 2028.

Wrap Up

That’s a lot of tax talk for Day 1.

Stay tuned for more tips on how to keep your hands on as much of your money as possible during tax season. Not sure what we’ll cover next, but it will be fun!

The key point for today is to make sure we understand the dollar thresholds for our tax brackets and for the deductions that we hope to take.

Sometimes small tweaks to our income planning can save us some money in taxes.

Another tip. Taxes are incredibly complex. I believe they’re overly complicated, but it keeps the good folks at H&R Block and Turbotax in business, so good for them.

I’ve got spreadsheets to help me estimate my taxes and they end up being mostly accurate, but it’s not until I put the real data into the current version of Turbotax that I get a true picture of my taxes.

There are things like wash sale rules that could prevent us from recording a capital loss on an investment if we buy or sell a substantially identical investment within 30 days before or after.

Swear to God. That’s an actual thing.

And what really is substantially identical??

See you soon.