In Tax Strategies For Seniors (and everyone else) – Chapter 1, we introduced the US Government graduated tax system and talked about some tax savings strategies.

While the US (and state and local governments) need to collect taxes to provide services, none of us enjoy writing that tax check. We need to pay our fair share, but no need to over-pay. Right?

Understanding tax brackets and how graduated taxes work is key to managing our tax burden. Go back to the chapter one post to review if needed.

Standard Deduction

A few years ago, we all got a nice gift from our government. The standard deduction was increased – a lot.

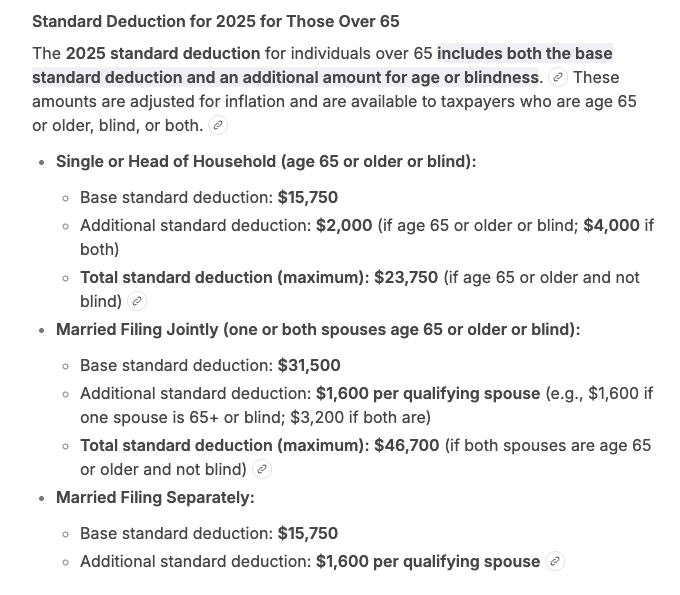

In the past, we had to pull receipts and itemize deductions, but now it is fairly uncommon for us regular Joes to itemize. The standard deduction for 2025 tax year is $31,500 for those who are married, filing jointly. We’d need a lot of deductions to make itemizing worth our while. More on this in a sec.

And even better….if we’re over 65, we get a bonus. There’s an addition to the standard deduction just for being old. How cool is that?

We talked about the senior deduction in chapter 1. That’s an additional $6,000 per person. It phases out at higher incomes, and it expires in 2028, but check out chapter 1 for more details.

Medical Expenses

As we get older, we have lots of medical expenses. Everything hurts.

We spend more time at the doctor’s office, we have prescriptions and pills, and we may be paying for additional medical services.

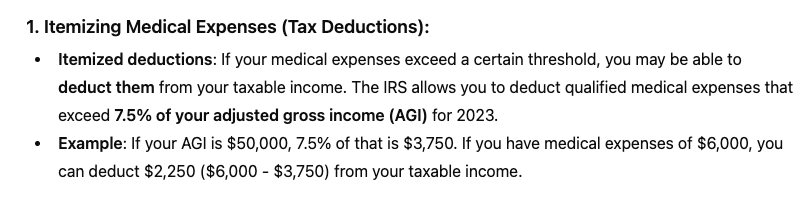

The good news is that medical expenses can be deductible and this may be a situation that makes it worth our while to itemize.

Here are the specifics:

To Itemize or Not to Itemize

That’s the question.

Medical expenses plus all of our other deductions need to exceed the standard deduction in order to make itemizing worthwhile.

So, I was excited to learn this year that my mom is chronically ill. So, that came out wrong. Let’s clarify.

My mom has been living with Alzheimers for several years. Last year, in-home care plus our visits just weren’t enough. She needed more care. She moved into a memory care unit and has been quite happy with the extra socialization and with the facility overall. This has been a huge relief.

But, it’s quite expensive. My mom is a saver so she’s got it covered, but still…

Because my mom needs assistance with at least 2 activities of daily living, she is considered chronically ill, so her memory care facility expenses are deductible.

Her expenses significantly exceed the standard deduction.

Turbotax

Back in the late 80’s, I paid an accountant to do my taxes. I thought it would save time. Ha Ha.

The accountant transposed 2 numbers in my SSN and I spent the next year trying to prove to the IRS that I was me and I had in-fact paid taxes for prior years.

Never again.

I’ve been using turbotax since.

But Wait, There’s More

It slices, dices, even makes coleslaw.

Well not really, but there are 2 big reasons to use turbotax.

Uncover Deductions

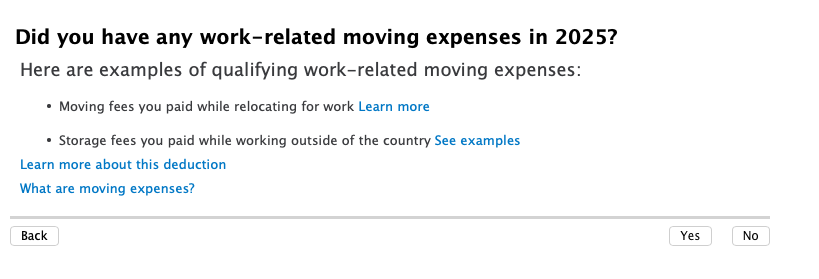

Turbotax has a nice question and answer feature that guides us through all of the potential tax deductions and credits.

No I didn’t, but thanks for asking. Turbotax knows all the rules (its so smart) and asks me questions to see if I qualify.

What If

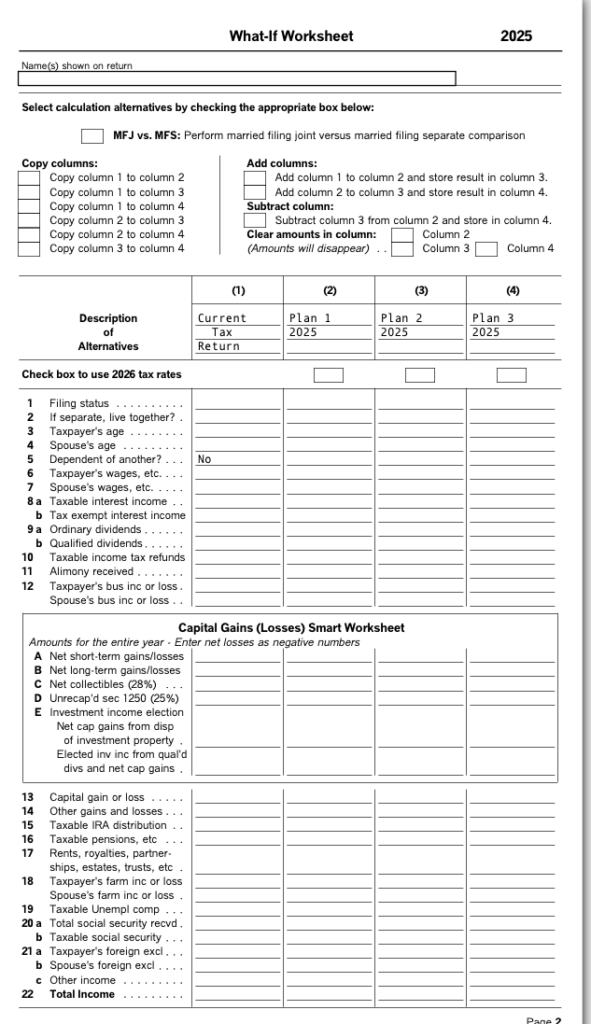

Here’s the home run, and it is only available in the version that we download to our PC or Mac. Go to Forms==>Open Form, then search for what if and you will see the what if worksheet.

After I’ve done my taxes, column 1 is populated with my filing status, age, wages, dividends, interest, retirement distributions…

I can then click to copy these values to columns 2, 3 and 4 and then modify the values to see the impact of various changes.

So today, on Feb 10, 2026, that ship has mostly sailed. Tax year 2025 is done and I have to live with most of those decisions.

But, once I’ve done my 1st draft of 2025 taxes, I can start doing what-if scenarios for 2026. What if I do a Roth conversion? How will that change my tax paid? Will it put me in a higher bracket?

What if I sell some of that Amazon stock I bought in 2010? What tax will I pay on the cap gains?

Turbotax Recap

Turbotax premier, which is the version that handles more complex scenarios like cap gains and losses, costs less than $100 for the desktop version and allows me to model out what decisions I may want to make in 2026 to minimize my year end taxes.

Yes, tax law may change and my 2025 version won’t exactly match 2026, but it beats the heck out of my spreadsheet.

And going through every step of the Q&A ensures we haven’t missed anything.

I did a lot of research for this post, but I’m sure there are lots of deductions that I’m not aware of. Turbotax knows.

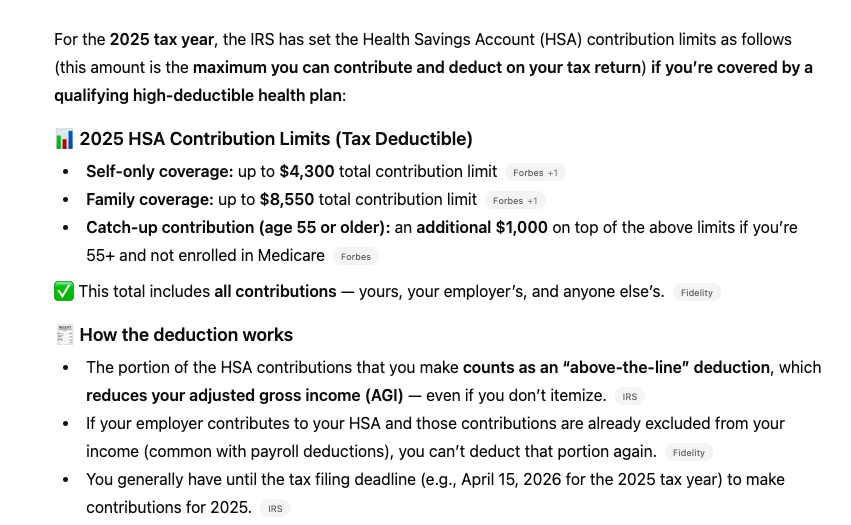

HSA

An HSA is a Health Savings Account. In order to qualify to make contributions to an HSA, we need to be an active member of a High Deductible Health Plan (HDHP).

I am and I get a deduction of $9,550. This reduces my adjusted gross income even though I am taking the standard deduction.

an HSA also grows tax free and there are no taxes on withdrawal as long as we use the money for qualified medical expenses.

My wife and I are fairly healthy and we have no prescription medications so an HSA with an HDHP makes sense for us.

For those who have more regular doctor visits and higher expense, a high deductible health plan may not make sense. This will disqualify you from contributing to an HSA. More here. And here. And here.

Roth Conversion

I’ve talked a lot about Roth. I’m a big fan.

With traditional retirement accounts, we get a tax benefit today and pay ordinary income tax rates on everything we take out. If I’ve got $500,000 in a traditional 401k, I’ll pay taxes on all $500,000. That could be $50,000 to $100,000 in taxes depending on our situation and the huge unknown of future tax rates.

And then there’s required minimum distributions. Whether we like it or not, we’ll be forced to take money out starting at age 73. That could alter our tax situation and force us to pay IRMAA (we’ll talk about her later).

Roth has no tax benefit going in, but we’ll never pay taxes on what we put in or on any earnings growth. Have $500,000 in a Roth? That money is all yours. Zero taxes. If tax rates go up to 50% to cover our national debt crisis, you won’t bat an eye.

Conversions

So, I’m doing conversions every year.

The big challenge with conversions is that we’re taking a distribution from our IRA or 401k and we’re moving that money into a Roth. This means we pay taxes on every penny.

We need to make sure we’ll have money on hand in April to pay the taxes.

We’ll also want to make sure that the Roth conversion doesn’t force us into a higher tax bracket.

This is why I love the what if worksheet in turbotax. Run some scenarios and see what happens.

IRMAA

IRMAA is the Income-Related Monthly Adjustment Amount and it could apply to our medicare payment.

I’m retired and 62 years old. It’s great to be retired, but I need to pay the full amount of my family medical plan. Even with the lower cost high deductible plan, I’m paying about $20,000 per year. Ouch!!

I’m looking forward to age 65 when I begin medicare. I’ll save a fortune.

But I’ll need to keep an eye on Roth conversions.

IRMAA adjustments are charged to high earners on their Part B and Part D medicare based on filing status and adjusted gross income.

If I’m not careful, I could put myself into a higher IRAA bracket with my Roth conversion and end up paying hundreds more every month for medicare.

Note that IRMAA has a 2-year look-back. This means that my premiums at age 65 will be based on my adjusted gross income from my taxes at age 63.

Get Help

Seriously. Get Help.

Not that kind. Tax Help.

Taxes are complicated. It may make sense to hire a professional.

But you may do just as well with Grok, ChatGPT or any other AI assistant.

Don’t be afraid to ask.

I told Grok my age, how much I had in my Traditional IRA, my annual income, a few other bits of info and I asked him to give me a Roth conversion strategy to minimize taxes and IRMAA impact. I got a nice spreadsheet comparing my tax liability with and without conversions.

Just now I asked ChatGPT “I’m 62, how can I save on taxes”

and 7 other suggestions.

AI isn’t magic. But it is really good at reading lots of articles on the internet really quickly and summarizing what it finds. It can also make some decisions about what makes sense and what doesn’t. It will fact check itself to some degree.

But it is not infallible. It can only summarize for us what it can find. If there is poor advice out there, it may find its way into the response.

Try it and see.

Social Security

Another lever we can pull to manage our tax situation.

I decided to take social security at age 62. I wrote about why in Social Security at 62.

But there are tax implications. Social security increases my income, which increases my tax and could move me into a higher tax bracket if I’m not careful.

Waiting til 70 probably provides a better tax benefit for those doing Roth conversions, and may make sense for those who want a larger monthly payment and are wiling to wait, but I’d like my money now, please.

Wrap Up

So, 2 posts with a handful of tips to save money on taxes.

I hope this helps and I’ll continue posting.

But don’t be shy about asking your favorite AI assistant to help with your personal situation. You should get some ideas that you’ve not thought of.

And if you feel you need it, sometimes a professional can offer advice and peace of mind that’s worth the fee.