OK, not exactly, but it is coming up on February 26.

To refresh our memories, back 1 year or so ago, I wrote a post about my optimism about the S&P 500. As I thought about this, I decided that I needed to back up my statement by putting some of my own money to work.

This lead to the 2/26/2025 post called Put Your Money Where Your Mouth Is. I won’t relive the moment, but I talked about the American economy, innovation and some of the catalysts that make me optimistic. I ended with a shiny new purchase of $100 worth of the State Street SPDR S&P 500 ETF Trust (SPY).

A Wild Ride

For those who have been following along, the past year has been a wild ride. Tariffs were on, then off, then on, and now no one’s really sure.

The US bombed Iran. Wars continued to rage in Hamas and Ukraine.

Oh yeah, and then the whole Argentina thing. What happened with that?

AI became the greatest thing since sliced bread. Then it wasn’t. In recent weeks tech companies have lost billions in value as investors start to question the massive investments required.

The S&P 500

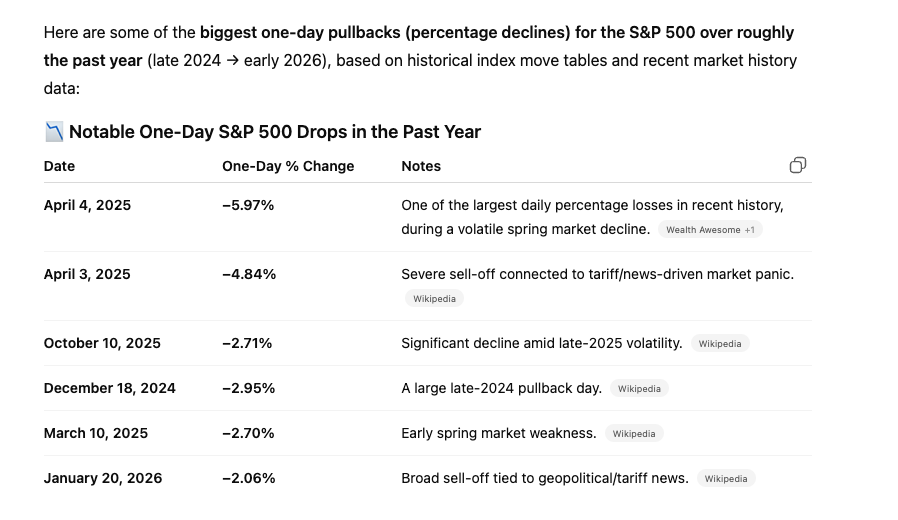

My friend ChatGPT provided some insight on some of the bigger pullbacks in the past year.

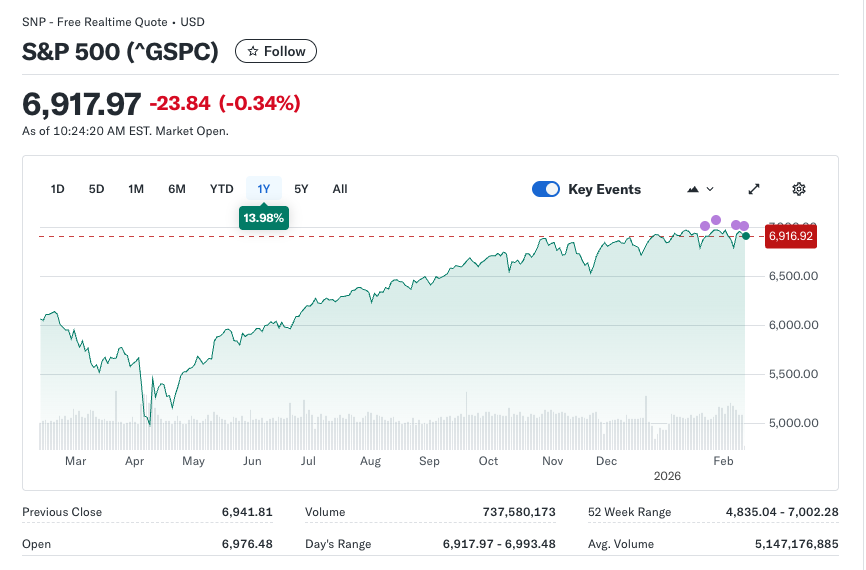

There were certainly some rough times, but overall, the S&P 500 has been positive for the past year. It’s up almost 14%.

My Commentary

I wrote a few subsequent posts about my $100 investment in SPY

You can read them here.

2 weeks in, I was in big trouble. I was down 5.8%.

Certainly not life changing with a $100 investment, but imagine if we’d decided to put $50,000 to work in the S&P 500 by buying a nice low-cost S&P 500 fund. We would have lost almost $3,000 in 2 weeks.

Some of us would run for the hills, sell what’s left and move it to a nice high-yield savings account.

Lessons

1st lesson is that selling can be costly.

Sticking with our $50,000 investment, yes, we would have been down big after 2 weeks. But hanging in there would have put us ahead by $7,000 or so after 1 year.

I learned this lesson the hard way in 2008. I had lost my job, the market was losing money daily and I sold everything.

I felt better right off the bat as the market continued to drop. But we then hit one of the greatest bull markets in history. Had I hung in there, I would have continued to worry for a few months, but I would have been better off today.

Hanging in there through the pullbacks is important, but it is equally important to have a solid asset allocation strategy so that we’re not risking our rent check or our grocery money.

Who Would Have Know?

When we look at the chaos in our lives and in the world every day, it’s hard to predict what will happen next. CNBC tries (God bless them) and they’re pretty good at explaining what happened yesterday, but they’re yet to nail predicting what’s to come. Perhaps AI can help.

This makes it seem awfully difficult. If the experts don’t know, what chance do we have?

Here’s a secret. The advantage we have is time. I wrote about this in one of my first posts, The Secret to Building Wealth.

We know the market is volatile. And when we forget, days like April 4, 2025 reminds us when the market drops almost 6%.

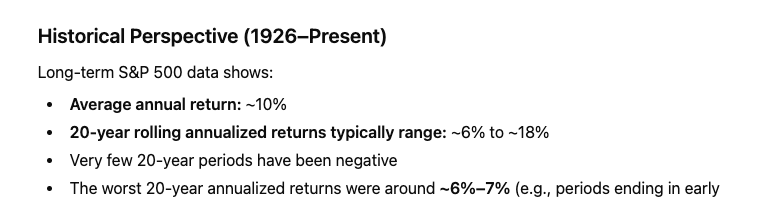

But we also know that the S&P 500 has returned about 10% per year with dividends reinvested over the last 100 years or so.

I say this a lot, so what do I really mean.

Buy a nice low cost S&P fund from your broker. I prefer IVV to SPY because the fees are lower.

Set the fund to reinvest dividends. This means that every time the fund distributes dividends, instead of that money going into our account as cash, it is used to buy more shares. This guarantees that we are regularly putting more money to work in our investment.

And then wait.

The chances of us making money in the short term are 50-50, but as time passes, our odds get better. Based on historical info, a 20 year investment in the S&P 500 would have returned between 6% and 18% per year depending on the period. This must be true. ChatGPT told me.

And Another Thing

Looking at what’s happened historically is helpful as things tend to repeat over many year periods, but it’s not a guarantee.

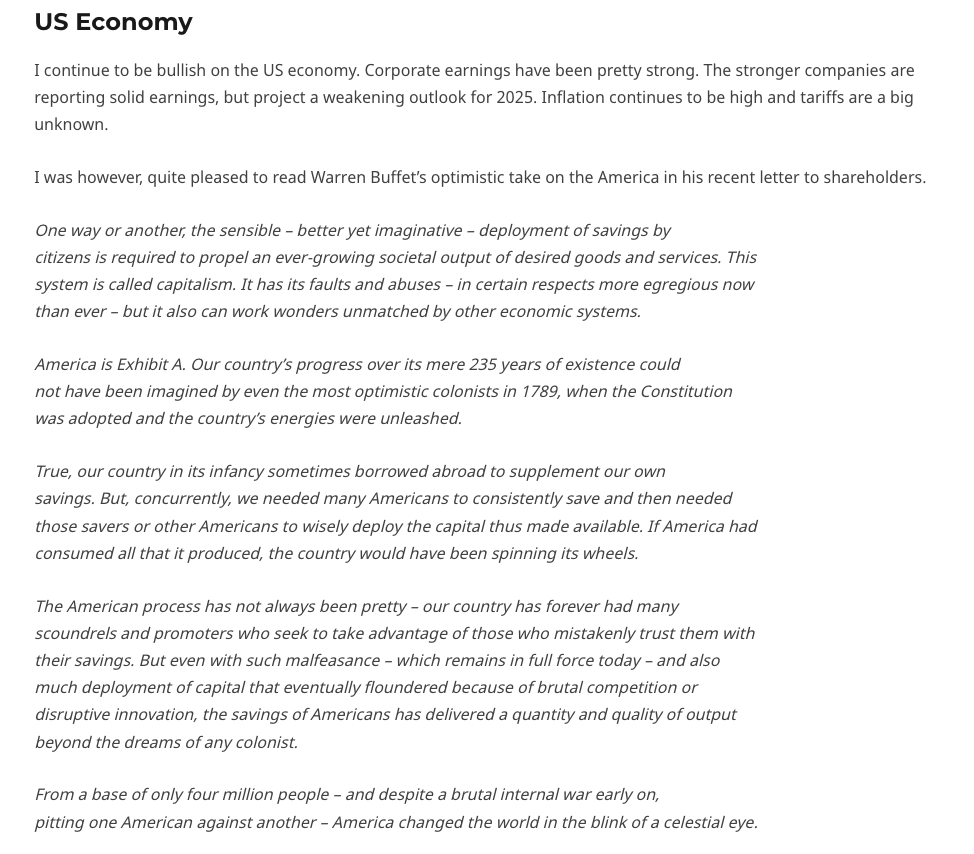

That’s why I like to see what successful people have to say. I know a lot about the economy and the stock market as it’s a bit of a hobby for me. Warren Buffet knows a bit more. So I like to read his stuff to see what he thinks. In my put your money post, I included an excerpt from the Berkshire Hathaway annual report.

While we never know what will happen in the future, we can become better investors by listening to smart guys like Warren Buffet.

And the guy trying to sell you a mutual fund may or may not be a smart guy. I like to look for a proven long term track record.

SPY

So here’s the evidence.

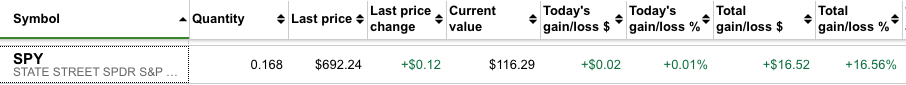

I bought a fraction of a share last year. It cost me a little less than $100. I’m up 16.56%.

I wish I had invested more.

Wrap Up

I’m glad I did the put your money post and the follow-ups.

It’s a good demonstration of what can happen even in an especially chaotic time.

Who knows what will happen next year or the year after, or 20 years down the road. We’ll keep checking in. That will be fun.