I write a lot about evaluating companies and tracking performance, as well as the wealth building track record of the S&P 500, but how does a beginning investor get started buying stock?

Before we jump in, a couple of thoughts.

Owning Shares of a Company

First, I don’t like to think about investing in equities as buying stock. This is personal opinion, but to me buying a stock seems to distance my thinking from what I’m actually doing. When I buy a share of a company’s stock, I am becoming an owner.

AT&T is a big company. There are over 7 billion shares of AT&T held by investors. If I own 1 share, I own a tiny tiny tiny piece, but I am a shareholder. I’ll be invited to the annual shareholder meeting. I can vote my shares at the company meeting, and I am entitled to $1.11 each year in dividends for my share. As an owner, I participate in profits.

A stock is a piece of paper. It represents an ownership share in a business that makes things, provides services, has debts, pays employees and may earn profits. There is a lot to it.

Read more about stock here.

Mutual Funds

While direct ownership by buying shares of our favorite companies can be enjoyable and profitable, we can participate with less effort and risk by buying shares of a mutual fund.

A mutual fund is a pool of investments. For example, rather than buying shares of 1 or 2 companies, we could buy an S&P 500 Index fund and instantly own shares of the 500 largest publicly traded US companies. Pretty cool.

While not all mutual funds will have positive returns, many will over long periods of time. The S&P 500 has averaged 10% per year with dividends reinvested over the last 100 years or so.

Read more about Mutual Funds and ETFs here.

Buying Shares

For me, I got interested in investing in shares of companies around 2000. Some of my buddies at work were making a killing buying shares of any company with dot.com in the name. The internet was hot. And I figured that since I worked in an investment firm, I should know a little about companies and trading.

I did some reading, subscribed to an investing newsletter and bought some shares.

2000 was a rough time to start. Soon the interned bubble burst. There was a lot less talk at the water cooler when everyone’s brokerage account balance was in the toilet.

Buy What You Know

Before I get there, I love watching Jim Cramer. he’s great entertainment “Buy, Buy, Buy” or “Sell, Sell, Sell”. Complete with sound effects. Nothing against Jim, but if I were to be parting with my hard-earned money to invest in a company, I wanted more help than that. I wanted more thorough analysis, and I wanted someone who would interpret the financial data and write about it in a way that I could make sense of it.

I subscribed to the Motley Fool Stock Advisor. I find their analysis valuable. I like that they give reasons to invest and watch areas for every company. And they update their perspective regularly so I’m not left out in the cold wondering if an earnings surprise is a blip or if it’s symptomatic of a bigger problem (like accounting irregularities – yuck).

I read some analysis and chose a few recommendations – Amazon, Apple, Netflix and Costco. I was a customer of these companies. These were companies I liked doing business with, and I liked what I read about their market opportunities. I supplemented my Stock Advisor reading with a few analyst reports on my brokerage website and I started a small position in each.

Because I know these companies and I was interested in them as a consumer of their products, it was more interesting for me to learn about their businesses.

I also bought shares of Evolving Systems, which I knew nothing about. It was a hot tip from a guy I met on a vacation trip. That tanked. I have many other investing failures that I can go through at another time.

Knowing a company is a good place to start, but then we need to decide whether we think the company will make a profit for us. Read more in How to Build an Investment Thesis for a Company.

Start Small

For every company in which we’re interested, we can often find one Harvard MBA investment analyst who thinks the company is a buy and another one who thinks it’s a sell. No one really knows.

So we have an idea – “boy, I love Netflix, maybe it would be a good investment.” I buy a few shares. Now I’m an owner. I have a very small position and I start to pay attention.

I buy more shares. Sometimes I do this on a pull-back, but sometimes I buy at a higher price.

That’s Crazy

I bought shares last month for $9 per share. Why would I pay $12 per share today. That’s crazy-talk!

Here’s why: Earnings may have grown. This is the biggest long-term driver of a company’s stock price. Companies that grow their earnings faster are more valuable. Would you like to earn more money or less? Right, same for companies. And if we own a company that grows its earnings faster than the competition, investors will be willing to pay more for those shares. And if the future (forward) earnings prospects are high, that drives the stock price up even further.

Earnings Growth

And earnings growth can also come from smart acquisitions, or from growing the business in new directions.

Home Depot recently bought a company called SRS to help it get a stronger foothold with professional builders. I like this acquisition. I think it gives it a competitive advantage over Lowes. I think that means more earnings in the future. But I don’t know for sure.

Amazon used to sell books. Now it sells everything, it delivers more stuff than Fedex and UPS combined, and its AWS data centers and tools are used by thousands of companies. It has grown these businesses and has made them into profitable enterprises and that means, you guessed it, more earnings.

Buy on the Way Up

When I buy a bargain stock, I am usually disappointed because it tends to get cheaper still. I bought Yellow trucking as a turn-around play. Yellow is in bankruptcy now. Companies can and do go to zero.

I have bought Amazon shares many times. I often bought after an earnings pullback where the stock price was down double-digits for the day. And while it was down, it was still significantly higher than my last purchase price.

Buying great companies on the way up as earnings grow can be profitable.

Diversify

The late great Charlie Munger referred to this as Deworseification.

Be careful. This can be a double-edged sword. We’ll talk about what this should be and what it shouldn’t be.

I own shares of over 60 companies. I’m diversified in that no one company can sink me. Amazon is my largest holding by far, but if it went to zero, I wouldn’t be wiped out. I have 59 other companies – along with quite a few mutual funds.

We never know which companies will win. We can thoroughly research and find companies loved by the analysts and still lose money. There are no guarantees.

But holding many companies helps lessen the risk.

Of the 60+ companies I own, most are tech and almost all are US based.

I worked in tech and I’m interested in tech companies so it’s an area I know a lot about and it’s an area I’m happy to read about.

I live in the US. I do business with a lot of these companies. I know about the economy here. I know very little about Zimbabwe. Why would I invest there?

Diversification outside of areas we know can be risky. However, not putting all of our eggs in one basket is prudent.

Keep Score

I wrote a couple of posts this week about this. In IF YOUR EQUITY INVESTMENTS HAVEN’T GAINED 24% IN 2024, YOU NEED TO MAKE SOME CHANGES. I got a little worked up.

What got me going was hearing from a friend how his financial advisor had not grown his investments very much. I was shocked because we’ve just come off of 2 years of more than 20% gains in the S&P 500.

A nice low-cost S&P 500 fund is a great choice for most people. I have a good chunk of money here.

We won’t be positive every year, but history shows us that the S&P has returned on average 10% each year with dividends reinvested. If our individual companies (or actively managed funds) aren’t keeping pace with the S&P 500, we should be considering some changes.

But Wait

But first, choosing a company in which to invest should be a significant event. While it’s not a marriage, we should go in planning for at least 3 years of wedlock with our betrothed. So do your research!

I’ve found that it likely takes 2-3 years for my investment thesis to play out. I bought Shopify – a platform similar to Amazon – back in 2018. I really liked the company and its potential.

Shopify underperformed for a year or so, before it took off. I bought shares at $14, and then I bought more at $62. Shopify is now at $122. Had I ended our relationship when it dropped below $10, I would have missed out on huge gains.

How to Keep Score

Most spreadsheet programs have a stock function. We can use it to return the price for a particular symbol on a particular date. This makes keeping score easy.

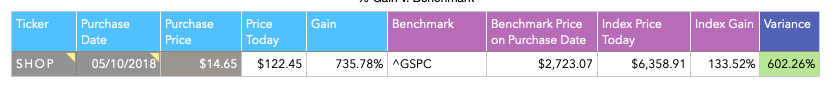

I enter the Symbol SHOP for Shopify. I enter the purchase date of 5/10/18, and the spreadsheet looks up the price on that day. It looks up the price today, Then it calculates the gain. The S&P 500 (Ticker: ^GSPC) is my comparison.

The S&P gained 133% since May 2018, while Shopify gained 735%. Yay!

Shopify was behind for many months. This was a bummer, but I believed in my thesis and I was committed.

Wrap Up

In order to grow our wealth, we need equity investments. For most, a diversified mutual fund or a nice low-cost S&P 500 fund is a great choice. But for those who want to invest in individual businesses, with a little work, some reading, and patience, this can be rewarding.

I’ve got plenty of posts on finding companies, creating a thesis, and investing, but I wanted to step back today and look at the basics. How do we decide to start and how would we make that first investment and then how do we evaluate whether we’ve made a good decision.