I had a few things running through my head this morning so I thought I’d do a quick post to let them out.

This is why I started the blog in the first place. I would sit around describing in my head how mutual funds worked or how to benefit from your company’s 401k. While I was working, I taught classes and this stuff was able to get out. Now I find it stuck in my head with no way to get out. Writing it down helps me move on.

So for those reading I hope you find it entertaining and helpful, if no one is reading, that’s OK too.

TD Bank

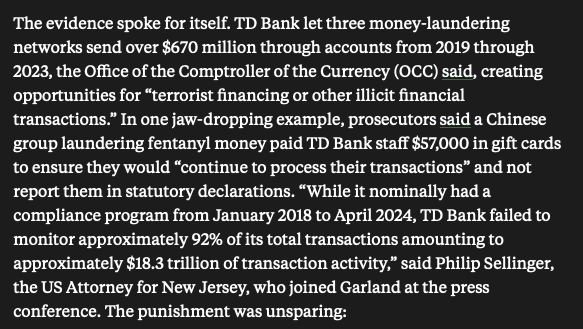

With the most consequential presidential election of our lifetime (again) and serious life-threatening matters like devastating hurricanes, who really cares about what’s going on at a boring Canadian bank, right? Read this from the Daily Upside:

TD Bank pays $3 billion in penalties and the CEO apologized, but this is truly terrifying. How can this happen?

TD Bank is not a small company. They are the 10th largest bank in the US, and if you’ve been to a Bruins or Celtics game, you’ve been to the TD Bank Garden in Boston.

The Stock Market

I wrote a couple of post this year about hanging tough when the market pulls back. Read here and here.

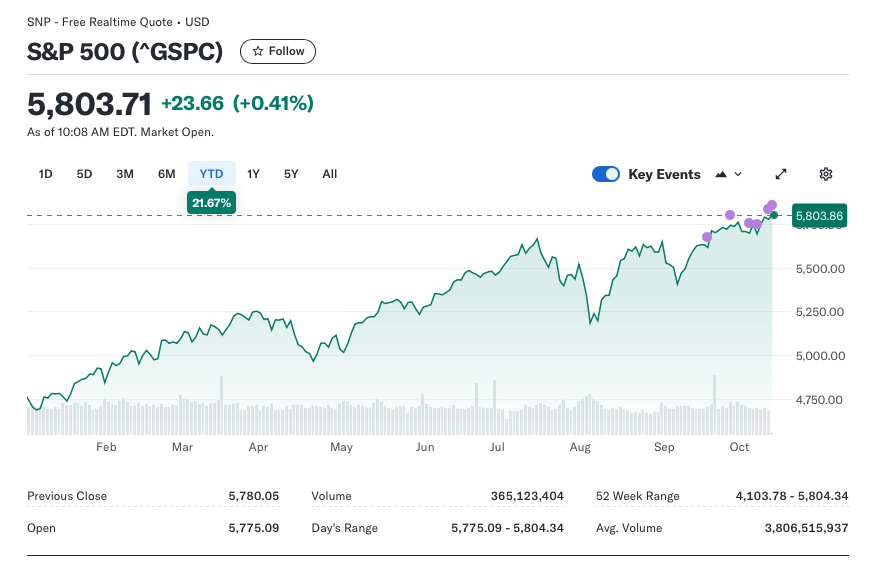

Despite a little turbulence, the S&P is up over 20% year to date.

This is great news for buy and hold investors. If we can ride out the bumps and focus on our long-term investing goals, the S&P 500 has proven itself to be a massive wealth-building machine.

I got up this morning and started thinking about buying more Tesla on the post robo-taxi drop. Tesla is down 8% this morning. Or maybe I’ll buy Fastenal. It’s a company I love and it popped today. Maybe time to buy more.

Just Stop

Take a breath. I just went through a process of re-allocating my mutual fund investments. Read more here. As part of this process, I moved some assets from equity to fixed income. I was happy (earlier this week) with my portfolio allocation. Why would I buy more equities today?

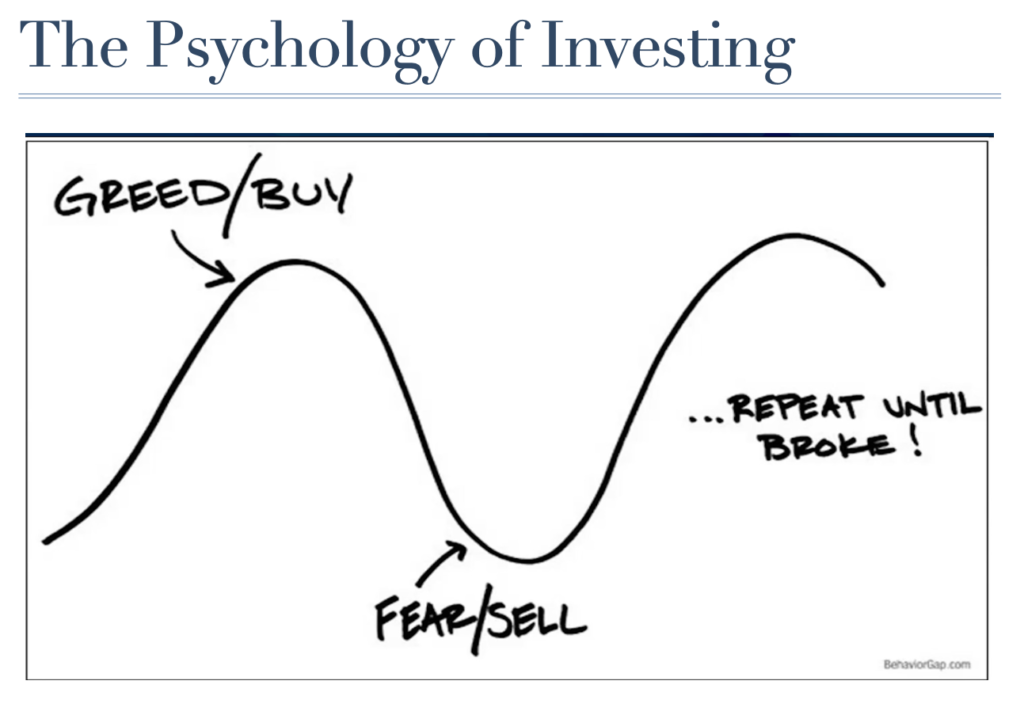

Emotion – that’s why. That’s drives many of our decisions. Don’t forget this chart.

Fraud

Last week I started a volunteer position at AARP, helping out on their fraud hotline. Folks can call in and get support and advice on how to address fraud. This week I sat in on some listening sessions with real callers. A couple of things I wanted to pass on to our readers.

Fraud is big business

Read the full article from the Federal Trade Commission here.

I’ve written extensively about data brokers and various scams here, here and here.

Scam International

Scam International is not a real company, but it could be. We’re typically not being scammed by some gamer living in his parent’s basement or some out of work tech dude. The people scamming us likely work for a large organization with a professional building in an up-and-coming office park. They have an HR and training staff. And they have the best technology money can buy. These people are criminals and they are good at what they do.

Emotions

We are all pretty good at making decisions. I got a little optimistic this morning and wanted to buy shares of several of my favorite companies, but I talked myself down. Emotion makes us react. My friend Brett was going through a stressful time and he bought an ab-lounger on TV at 3am. He kicked himself the next morining. We don’t make the best decisions when emotions are involved.

Scammers know this. This is why they call saying your brother has been in an accident, or your grandson is in jail and needs bail. We make bad decisions when there is a crisis and a deadline.

Example

I was on the phone with a guy this week who was desperate to pay down some of his credit cards and improve his credit score. He was contacted by a company offering a loan. He accepted and for some reason the process involved paying with gift cards and allowing them access to his smartphone. The loan amount was removed from his account and the gift cards were gone.

On the few calls I’ve attended, the folks who have been scammed have been intelligent. They are well-spoken. They are mad at themselves for falling for obvious (in hind-sight) scams. Emotions make us do crazy things.

A Few Suggestions

It’s heart-breaking to hear how these folks’ lives have been turned upside down. Be careful. here are some precautions.

- Don’t answer the phone – If you don’t know the caller, let it go to voicemail. If it’s legit, you can call back.

- f you call back, check the number first. If the FBI is calling, do 2 web searches for the FBI’s number. Call the main switchboard and ask for the agent who called you. Note, I did this and I got the agent, but he had no idea who I was. Clearly the person who called me and left a different call back number was scamming me.

- Be suspicious. Info about us is everywhere. I still am amazed that my wife and I can be talking about a vacation spot and the next day, a youtube recommendation shows up for that very location. The FBI scammer that called me called regarding my mom’s medicare fraud claim. This was legit. I had called medicare. The info was legit. He was not.

- Don’t answer suspicious emails. I was one of many on a paypal scam email last week. 2 on the email did a reply all saying this was a scam. Nice work. Phishing is about finding out which emails are active. Not replying works 100% of the time.

- Don’t click links – ever. Go directly to the site through your web browser. Whether it is an amazon link or funny cat video, even if it seems to be coming from a friend, don’t click.

- Verify – a lot. Anytime an opportunity comes to you, be suspicious. Check the better business bureau. If it’s an investment opportunity, check with FINRA. Be aware that info can be implanted on your computer. So verify a minimum of twice.

Extra Credit

- Use a password manager and use strong passwords for everything

- Freeze your credit report – read more here

- Get a copy of your credit report. You can now request them weekly. Request it for free here: https://www.annualcreditreport.com. Do not pay for a copy.

- Consider a VPN. This protects your identity online. I’ll write more soon.

Take steps now. Unwinding identity theft is a nightmare.

Wrap-Up

Well, that’s the happy news for Friday. The good news is that the market is up this year so we should all be richer as long as we’ve managed our emotions.

And please take fraud seriously. It is a big deal and we can all be victims. Take precautions.

And have some fun.

I’m visiting my daughter and grand-daughter today and trying out a new meatball sandwich. Tomorrow, my wife and I are playing golf with friends and Sunday is beerfest.

And my pal Randy, who lives in South Florida, is safe after all the crazy weather they’ve had.

While there is a lot to be anxious and fearful about, there is so much more to enjoy and to be thankful for. Limit your online time and get out and have some fun.