What the heck is a board of directors anyway?

In today’s post, we’ll talk about 2 recent events that demonstrate the difference between an effective board of directors and a not so effective board. Before we do, let’s talk about what a board of directors does.

Public Companies

All public companies have a board of directors. From now on, we’ll call them a board, for simplicity and ease of typing.

Private companies and nonprofits may have a board as well. They may be referred to as a board of trustees, but they’re similar.

Elected by Shareholders

You know those proxy statements that you get via email that you immediately discard? You shouldn’t. First of all, it generally comes with an annual report which tells you about the company and the industry in which it operates. This is good stuff. Read more here.

But the 2nd important piece of the proxy is that you, yes you, get to vote on company business. Other shareholders may submit proposals which you can vote on. And, you get to vote for the board of directors! You can read more about company ownership and voting in the post on stocks.

What do they do?

The board looks after shareholder’s interests. The CEO of the company reports to the board. The CEO runs the company and is responsible for the overall strategy and management, but the CEO must meet regularly with the board to discuss progress.

The board is typically made up of very experienced and senior people who provide valuable oversight and expertise. If you started a new tech company, how cool would it be to have Satya Nadella from Microsoft or Tim Cook from Apple on your board? I bet they’ve been through a lot and would probably have a lot of good advice.

Here’s a good article from investopedia that talks about the role of the board.

The hiring and dismissal of senior executives and upper management

This is #2 on the investopedia list, but it is #1 in my heart. Here’s the full list of board responsibilities.

Back to our topic of the day

Remember…the 2 recent events…

Here’s a headline today from CNBC, Intel considers an outside CEO, taps headhunters, sources say. Not the most eye catching headline, but here are the key points.

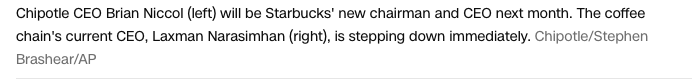

Compare this to a similar headline from August. We’ll look to CNN for this one. Starbucks’ CEO is out. Chipotle’s Brian Niccol is taking over.

What’s Different?

On the surface, these headlines look similar. Another CEO is out. Yawn!

If you don’t own shares of either company, you may have not really thought about either. But there is a difference, and it matters. It matters for Intel and Starbucks and their shareholders, but it matters for every share owner of a public company.

Starbucks

I am a shareholder and a coffee lover so I watch Starbucks closely. And it was no secret that the company had been struggling, but that’s a story for another day.

But the investing world was stunned on August 13, 2024, when the announcement that the high-profile CEO of Chipotle would be taking over at Starbucks to replace a CEO who had been in place about a year.

The investing world was also pleased, as Starbucks’ share price jumped about 20% on the news.

Take a look at the stock price chart for Starbucks. Stock price declining over the last year and the big pop on Aug 13.

Intel

I have not been kind to Intel. I lost money on Intel, but I learned quite a bit. I look at Intel as an investing lesson. It cost me to learn the lesson, but that’s OK. Read more here and here.

Intel is the gift that keeps on giving. Here’s another lesson of poor management.

Intel’s poor performance has not been a surprise to anyone. The stock price has plummeted. It’s down more than 50% in the last year.

Recently, Intel slashed its dividend. Always a troubling sign. It was the recipient of billions of dollars of government funding yet was still struggling. One analyst wondered whether the CHIPS act funding from the Biden administration was an incentive or a bailout. Ouch!

So, yesterday, Dec 2, 2024, no one was surprised when it was announced that the CEO hard retired, effective the day before.

Let’s look at the market reaction.

On the morning of the 2nd, as the news is coming out and the market opens, there is a pop. The market is excited about the prospect of new management.

Around 12:30, people must have had time to think about this over lunch and ask themselves, “hey, if the old guy was out as-of yesterday, who’s driving the bus?”

What’s the Difference?

In case you hadn’t picked up on it, both companies were dealing with a stock price decline coupled with business challenges.

The difference is in how the 2 different boards handled the situation. Starbucks announced the departure of the current CEO along with the name of the new CEO. And because the new CEO was a very high-profile CEO, with a record of success at Chipotle, he was likely not posting his resume on monster. The Starbucks board likely worked for months to recruit him.

This is very good work and exactly what we want our board to be doing. When the company is struggling, they should be working on contingencies. They should be talking to people who could come in and help.

I think the Starbucks CEO swap is one of the most under-appreciated events in 2024 investing news. This was nice work, well executed and well communicated.

Intel…sorry. Getting rid of the existing CEO is probably the right move but arguably too late.

Let’s look at the key points again.

This is horrifying. They’re considering tapping an outside CEO. They’ve hired an executive search firm. And the Hail Mary…maybe we can get back that guy who left. Bravo. Maybe you should have thought about that 12 months ago.

This is what a board does

They don’t just go to quarterly meetings and pick up a nice annual paycheck. They should be actively managing the risks of the company and acting on behalf of the shareholders. Their job is to protect our interest and ensure the company is successful.

As I wrote this, I thought about reading the book Bad Blood. You may have also seen the TV mini series version, The Dropout. Both tell the story about Elizabeth Holmes and Theranos. Amazing story. Definitely worth a read or watch.

But the part about the company’s board was fascinating. Theranos had some big names on the board. Theranos also had some very high profile investors advising them. What’s fascinating is that most of these folks had zero experience in the medical field. How do you oversee something you don’t understand?

In Tharanos’ defense, the board was stacked with politicians and this is important for a medical company. It needed a bit more medical oversight. Read more here.

Wrap-Up

A lot of stuff here, but I hope it leaves you with a better understanding of the important role that a board plays in a public company. As shareholders, the board is acting on our behalf. That’s important.

And as shareholders, we get to choose the board members. This is important. Please vote. Read the proxy statement, skim the annual report, and vote.