In many of my posts, I talk about the need to have an investment thesis for companies in which we choose to invest. This is a must, however, I’m not in love with the term thesis. The term thesis, to me, implies that there will be a lot of work and very little of it will be fun or particularly interesting.

Quick quiz: Building an investment thesis for a company can be:

- Fun

- Interesting

- Easy

- Quick

The answer is all of the above. Stay tuned to learn why.

Start With an Idea

This should be easy. In his fantastic book One Up On Wall Street, Peter Lynch describes his idea to look into investing in L’eggs because of the white eggs he saw all over the house. Read the book for the whole story. It is well worth it.

I’ll give you one of my examples. Back in the late 90’s, I bought a DVD player and it came with a coupon for a free month of a company called Netflix. DVDs by mail – who would do this when there is a DVD store on every corner? I gave it a shot and signed up and was absolutely amazed. I could build a queue online of everything I wanted to see. Discs arrived in 2 days and I could keep them as long as I wanted. No Late fees. I fell in love.

At some point I wondered whether Netflix was a public company and whether this DVD by mail thing was catching on. That’s how my idea of investing in Netflix began.

Ask Questions

Now that we have a company that we’re interested in, let’s find out a little about it. We’ll stick with Netflix, but we’ll pretend we thought of it today and look at current data.

Does Netflix Make Money?

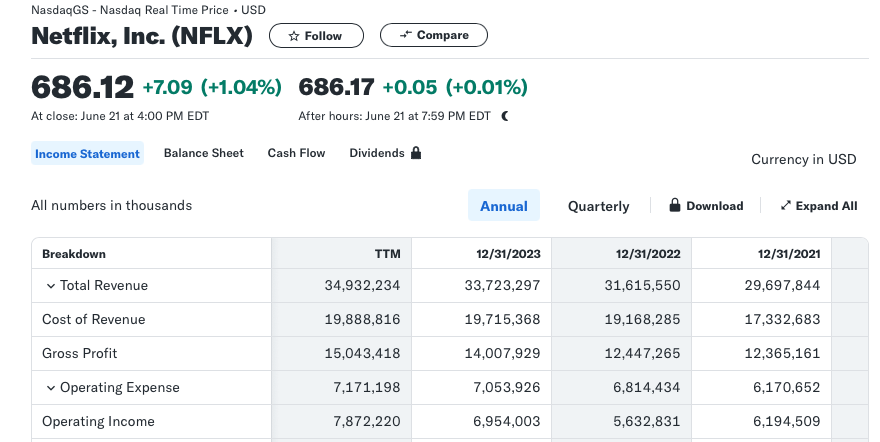

I like to start at Yahoo Finance. Check out the Financials tab for Netflix

Yup, there is revenue which means it is bringing in money and that revenue is increasing over the past few years. Netflix is profitable because it has a gross profit and that seems to increase nicely as well.

Does that make Netflix a good investment? Does it generate a lot of money? Does it perform better than peers? We need more info.

Price to Earnings Ratio (P/E)

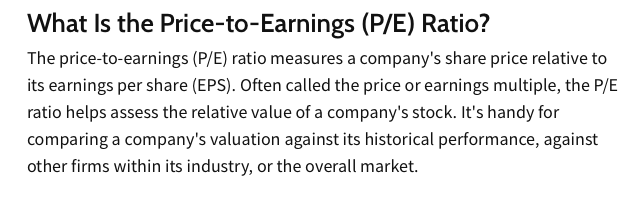

According to our friends at Investopedia:

Is Netflix a good value based on its historic P/E?

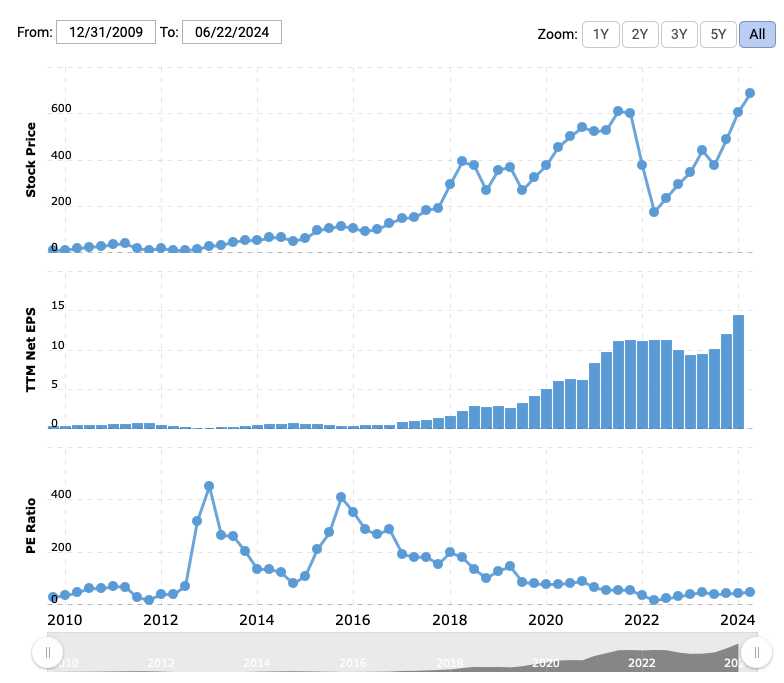

Let’s look at a historic P/E chart from Macrotrends:

The stock price (top chart) has shot up over the past 2 years. Cool if we had bought 2 years ago. Earnings have also improved (middle chart). Price to Earnings – that is what we’re paying for those earnings, has gone up, but is lower than historical averages. Netflix is a growth stock and trades on expectations more than financials, so take this with a small grain of salt. But this does tell us that Netflix is reasonably priced compared to historical averages.

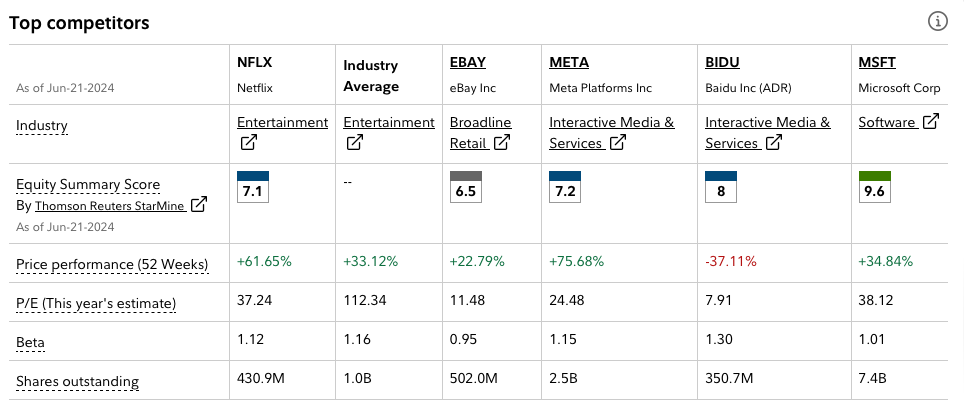

How does Netflix stack up against competitors?

For this, I go over to my brokerage site, look up Netflix and click the competitors tab. I get a nice little table that looks like this:

This gives me a nice snapshot. I can see that the P/E is inline with competitors. P/E needs to be looked at in relation to similar companies. There are a lot of slow growth companies with really low PE ratios. This does not mean they are a bargain.

I like the equity summary score.

What do analysts that follow the industry say?

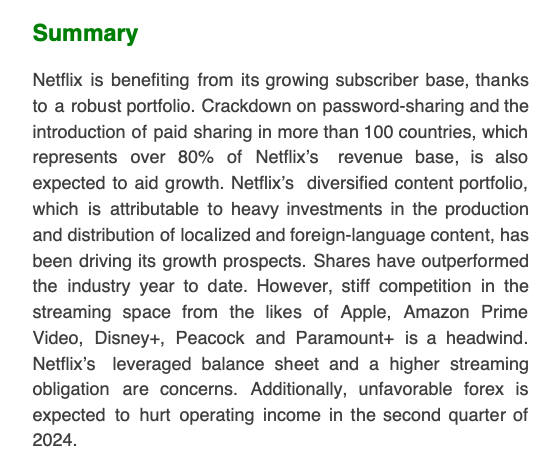

It’s important to get the perspective of someone who follows the entire industry. Netflix’ numbers may look good on their own, but since I don’t have the expertise to evaluate it against the industry as a whole, I like to read what the analysts have to say. One of my favorites is Zacks because they use words along with their numbers. Per Zacks research report:

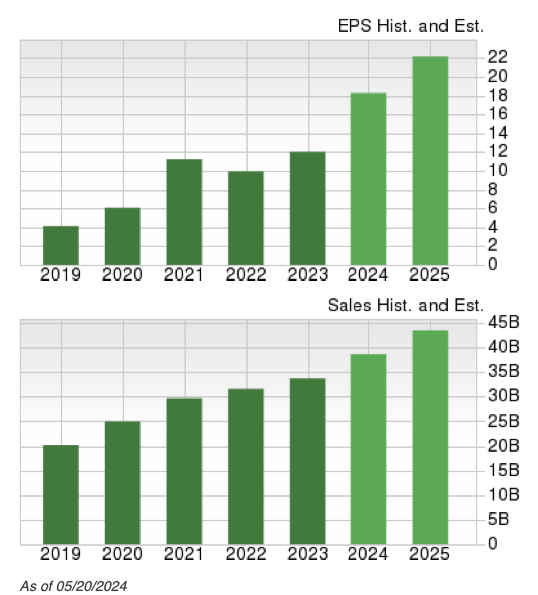

How about Earnings and Sales Growth?

Scroll down in the Zacks report and we see:

We like to see this trending up.

Zacks also includes reasons to buy and reasons to sell. They make it so easy. Read through and see how you feel about Netflix’ potential.

Final stop: The Motley Fool

I like the Motley Fool site. I am a stock advisor member so I get expanded content and recommendations, but on their free site there are plenty of great articles. Here’s some reading if you’re still interested in Netflix:

…and one more thing…or 2

Go to the company’s website. Check it out, you’ll learn a thing or 2 you hadn’t yet discovered.

Find out who the CEO is. You probably won’t bump into him anytime soon, but it’s nice to put a name to the person who is running the company.

Wrap-Up

Don’t let the idea of creating a thesis scare you. Unlike a thesis you may need to write at school, copy off of your neighbors. Not literally, but use generally available info from websites and from expert analysts to help make sense of the piles of data that is publicly available. No need to do all the calculations and comparisons yourself.

In 15 minutes you can easily complete the steps outlined above. This should give you a perspective on whether your big idea is a good investment candidate.

However, remember, all investments have risk. As you look through analyst reports, you’ll find one analyst rates a company as a buy, and one rates it a sell. Who’s right?

Timeframe is also a factor. I am often not right right-away. In other words, often when I choose to invest in a company, the stock price drops. Maybe this does not happen all the time, but it sure feels like it. My purchases of Shopify, Nvdia, and many, many others started with a dip. See more about my Shopify experience here.

This is why you need to go through the process of creating a thesis and deciding whether you have a strong conviction about the company in which you are investing. Read more about conviction here.

Any investment will likely test your patience at some point, but if you feel strongly about the success potential, it is much easier to stick with it.

That wasn’t so hard, was it?