This morning I got up, made coffee, my wife, dog and I went for a quick walk and I was looking for something fun to do while I finished my coffee. Like you, I thought to myself, wouldn’t it be fun to refresh my thesis on one of the companies in my portfolio.

If you’re laughing right now and thinking you’d rather watch paint dry, you may want to consider mutual funds. Mutual funds have a portfolio manager or they’re tied to an index, so someone does the analysis for you for a very reasonable fee. Read more about funds here.

However, if you think this could be interesting, but you’re not sure where to start, let’s talk.

Professional Research Analysts

Over the course of my career, I’ve had the pleasure of working with some professional research analysts. These folks typically cover an industry. A tech analyst would cover Apple, Microsoft, Nvidia, Intel, and lots of small tech companies as well. It’s important for them to cover the industry and not just individual companies, because they need a broad perspective in order to effectively compare companies.

Professional analysts spend their days reading research reports, visiting companies and talking with their senior management, comparing balance sheets… This is not my bag, so I’m glad we have them so I don’t need to do this.

Where to Start?

This is the part that throws a lot of people. I don’t have an MBA, I’m an english major who has never taken a finance course. How can I succeed against the Harvard MBAs who are professional research analysts?

We don’t have to. We’re not competing, in fact we’re leveraging what they’ve done (in school this was called cheating and you got in trouble. Now it’s leveraging and it’s cool, go figure).

Research Reports

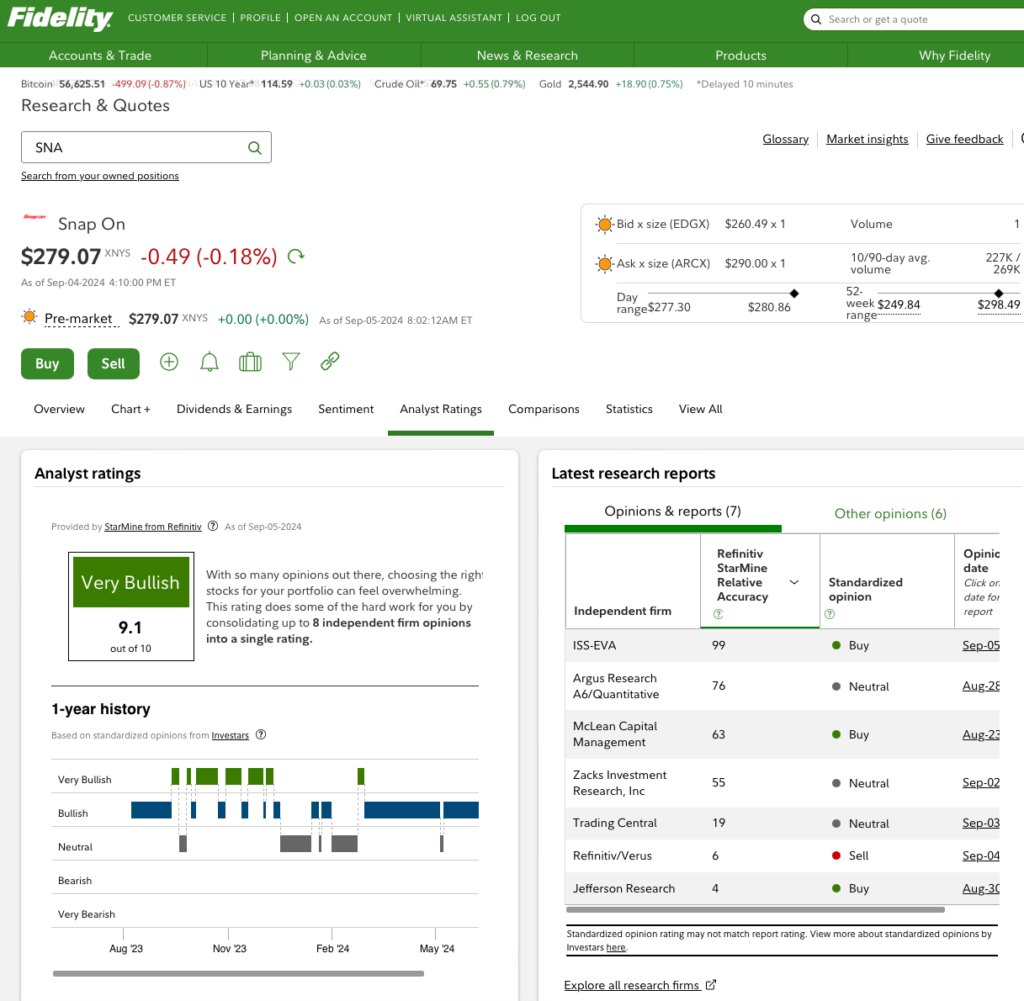

Your brokerage website likely includes research reports somewhere on the site. For me, I see something that looks like this.

This is where I start.

StarMine Rating

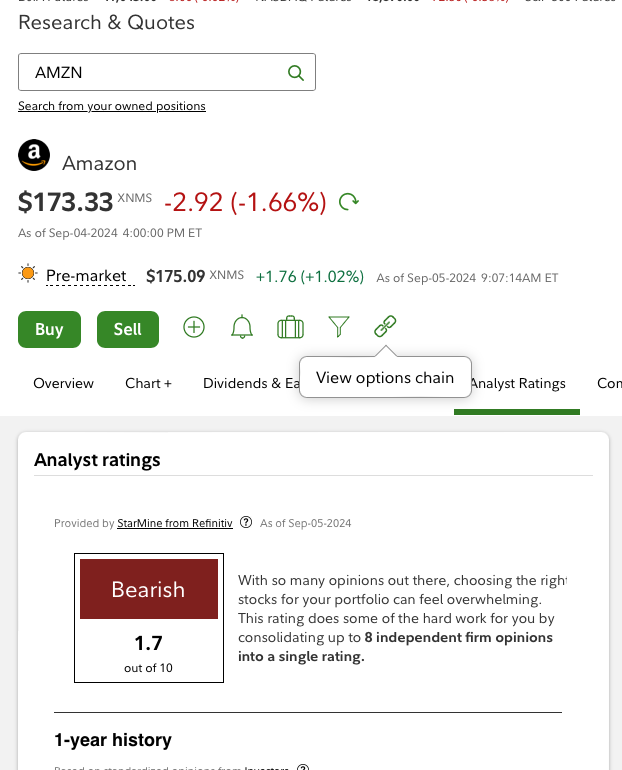

This is an aggregated rating across 8 independent firms. I don’t pay a whole lot of attention to this. In my opinion, research firms believe they need to be right soon in order to add value. They’re bullish on stocks they expect to pop in the short term because we all have short term memories. I as an investor however, have a long term horizon.

Case in Point: Amazon has a rating of 1.7, but it is the largest holding in my portfolio and I expect it to outperform in the long-run. Amazon always seems to rank very low here. Despite that, my initial Amazon purchase is up over 2,000%.

Research Reports

Here’s where those Harvard MBAs summarize what they’ve learned and share their opinions. Be sure to read a couple, not just one. Some of these are loaded with numbers and technical data that will make your head spin. Some have text with opinions along with comparisons to other companies in the same industry. I find these helpful.

But remember, these are opinions. If you scroll back up and look at the reports for Snap-On, you’ll see that McClean rates it a Buy, but Refinitiv rates it a Sell. Who’s right?

Read a few, think about the opinions, and make up your own mind as to whether it’s a buy, sell or hold.

I spent about 15 minutes looking through 3 different reports on Snap-On.

Notes

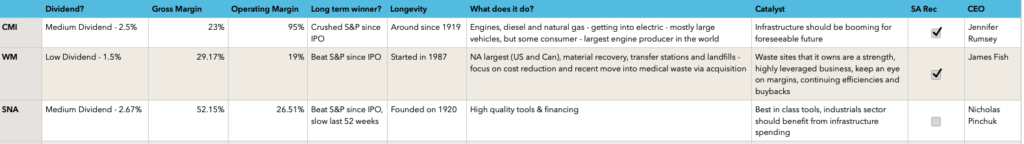

Ugh! Not notes. You don’t need to fill a notebook with what you’ve learned, but I keep a spreadsheet with a couple of key points on the companies I look at. Here’s an example.

Dividends

Dividends have an important place in my notes. Let’s look at an example of why.

I’ve held Waste Management (WM) since 2010. I bought more shares in 2019. Across 5 different purchases, I invested $36,000. My capital appreciation is $61,000. But my lifetime dividends are $23,000. Waste Management’s yield is fairly low, but over time, a solid company that regularly increases its dividend can surprise you (in a good way).

Longevity

I also like companies that have a long track record of success. Growth companies like Amazon, Apple, and Netflix are great, but I like to balance them with a healthy dose of companies like Snap-On that have been around over 100 years and have a proven track record of growing their business and rewarding shareholders. While we all know that past performance is not indicative of future gains, a 100 year track record is worth something.

Catalyst

After all of our reading (over the last 20 minutes) why do we think this company will outperform. Snap-On sells very expensive but top-quality tools. Peak at your mechanic’s shop and you’ll likely see lots of snap-on tools and storage bins. And with the cost of cars, trucks, tractors, steamrollers…going up, financing being expensive and infrastructure spending ramping up, there will likely be lots of fixing going on and lots of tools needed.

Wrap-Up

20 minutes spent, I browsed 3 reports, looked at some numbers and updated 9 columns in a spreadsheet.

My coffee cup is empty, but I have a much stronger conviction towards Snap-On and its future.

Conviction is important. Snap-On has not had the greatest year, it’s down 4.4%, while the S&P is up over 15%. It’s east to say “let’s dump this turkey and invest in a winner like Nvidia that is up 118% this year, or Netflix, which is up. 39% this year, or even Altria, that is up 35%.” Can you believe it? A cigarette maker in 2024 is up 35% while paying an almost 8% dividend!!! Holy cow!

But anyway, It’s easy to fall out of love with companies when we see red on our brokerage statement. 20 minutes spent revising our thesis will help us put some facts to the feelings and decide whether we buy more, sell and run away, or hold on and see what happens.