I just finished writing about dividend aristocrat Fastenal here. The post was about how important it is to have companies in our portfolio that pay a regular, and increasing, dividend. Read it. It’s quick and informative.

Just after I wrote about Fastenal, I read Bank OZK Announces Increase to Quarterly Common Stock Dividend and Announces Preferred Stock Dividend.

The headline is:

Bank OZK

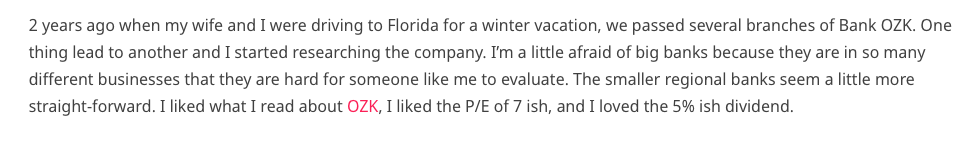

In my Happy Friday post a while back, I talked about how I came across Bank OZK and why it was a good income investment.

Here’s a bit of the post.

Bank OZK caught my eye because we had been watching the Netflix series Ozark. Yup. That’s really how I became interested. A TV show. Then some research started and it looked like a good idea.

My first OZK purchase was in Jan 2023 (after we arrived in Florida). 2 1/2 years later, I currently hold 1,060.936 shares long which I intend to hold forever. I have another 200 shares that I’ve sold covered calls on.

In the 2 1/2 years that I’ve held, in addition to the capital gain, I’ve sold covered call options on my shares 43 times for a net profit of $17,568.00. I’ve also received $5,075.57 in dividend income.

My capital gain on the shares I hold long isn’t anything to write home about. It’s $4,828.68. But my goal for an income stock is to provide income through dividends and (sometimes) covered call option sales. It’s nice to have some capital gain, but that’s not part of the thesis.

Bank OZK pays a 3.65% dividend.

Quarterly Increases

60 quarters of consecutive increases. That’s 15 years. Not quite enough to be a dividend aristocrat, but not too shabby.

Quarterly increases show that the company is committed to the dividend and that the company is generating enough of a profit to cover the payout while funding operations.

Dividend.com

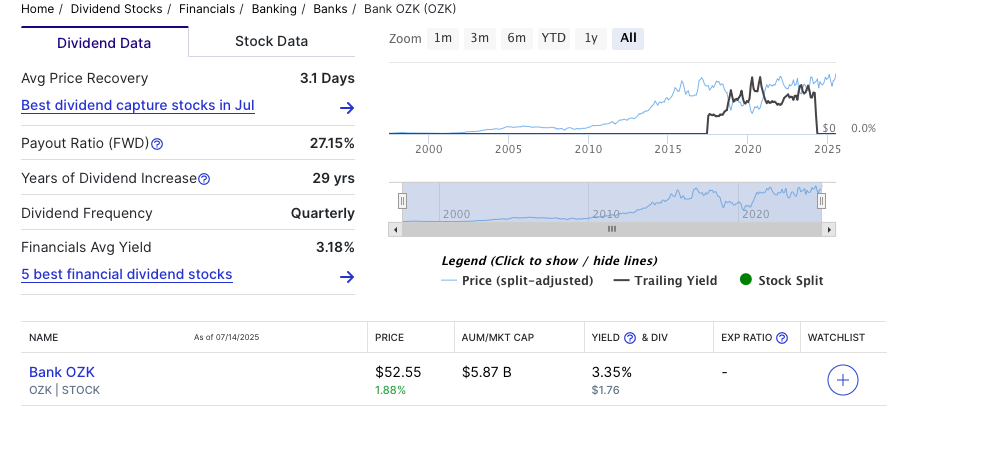

If we’re looking for dividend info, why not try dividend.com?

So, first thing…I was wrong. Just because there were 60 quarters of consecutive increases didn’t mean that there weren’t regular annual increases prior to this. It turns out that there have been 29 years of annual increases.

Dividend aristocrat-like raises, but as a small cap it is not one of the largest 500 publicly traded US companies, so not part of the S&P 500, so not a dividend aristocrat. Dividend aristocrats must be S&P 500 companies.

Further down on the page, the folks at dividend.com rate the quality of the dividend.

Pretty good marks.

Keeping Score

As investors we want to win and we can’t tell if we’re winning if we don’t keep score. The main way I keep score of equities is to compare each purchase’s return to the return of the S&P 500 for the same period.

My thinking is that if my purchase is trailing the S&P 500, I would have been better off just putting the money in a nice low-cost S&P 500 fund and saving myself the research and ongoing reading and analysis.

Here’s the comparison for my oldest purchase of OZK.

My shares are up 29.73%, but the S&P 500 is up 59.72%. According to this view, I’m losing.

But that may be the end of the story for our growth stocks (that typically don’t pay a dividend) but for income stocks, we need a more complex measurement.

We need to factor in the dividend and (possible) covered call option income.

For OZK, my total return including dividends and option premium is $27,472.25 on a cost of $45,646.36. That’s a 60% return.

Better than the S&P 500’s 59%.

Back to My Thesis

That’s nice to see – beating the S&P 500, but that’s not part of my thesis. I don’t expect my income investments to be big winners. I expect them to make a small capital gain as a group, and provide a regular stream of income.

The stocks I’ve talked about in this and the prior post are Fastenal, T. Rowe Price and Bank OZK.

Bank OZK is the winner. It has outperformed the S&P 500 with dividend and option income included. Fastenal is not far behind. But T. Rowe Price is down by 50% and is trailing the S&P 500 by 88%.

I’m still optimistic about T. Rowe Price and continue to hold and enjoy the 5% dividend along with some covered call sales.

However, the basket of income stocks, which includes 26 stocks (as well as some mutual funds and ETFs) provides me with a nice income stream and has in total, gained a few dollars.

Wrap Up

As we enter retirement and our paycheck goes away, it’s helpful to be able to create a new income stream. Income stocks and mutual funds can fill that gap.

Fastenal, T. Rowe Price and Bank OZK are 3 of my favorites.