Here’s my favorite chart. We’ll talk about why in a minute.

Here are the actual return values going back to 2008 so you don’t have to squint.

Bubble?

The S&P 500 was up 26% in 2023, 25% in 2024, and 17% as of December 15, 2025.

As we know, the S&P 500 has averaged 10% per year with dividends reinvested over the last 100 years or so. So if we’ve got 3 years in a row with (much) greater than 10% returns, aren’t we heading for trouble?

And the good folks at CNBC have been very liberal in tossing around the term bubble especially as it relates to AI stocks. Our friend Nvidia, the poster child for the AI boom is up 27.4% this year, but is up roughly 1,000% since mid-2022.

Sounds like a bubble.

Averages

And we all know how averages work. If we’ve been above the average for 3 years, it stands to reason that we’ve got a below average year or 2 somewhere on the horizon.

What we don’t always consider is that it can take some time to revert to the mean. Which is just a fancy way of saying having a bad year or 2 to bring us back inline with the historical average.

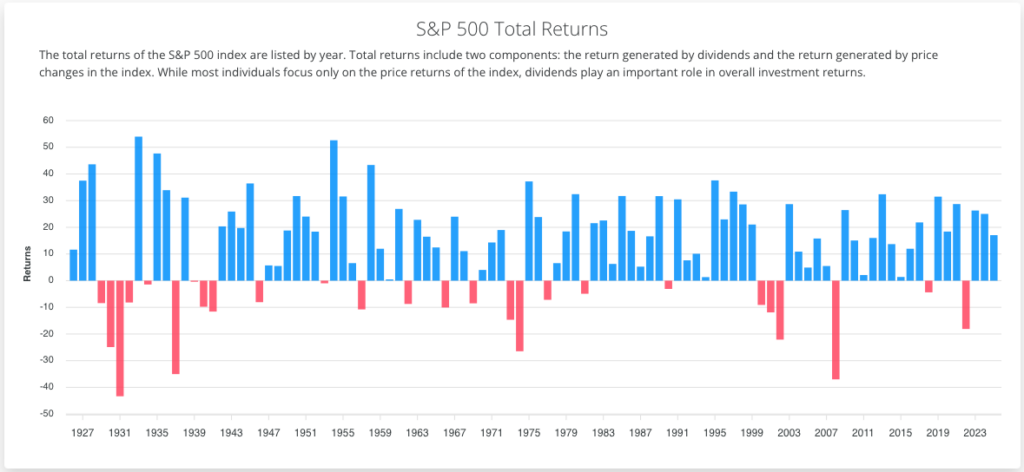

And if you look back at my favorite chart, there are at least 2 occurrences where after 3 good years we had a bad year. But there are also some streaks of 6, 8 and even 9 good years strung together before a pull-back.

We Really Don’t Know

The reason that I love the S&P 500 performance by year chart is that it demonstrates that we really have no way of knowing what’s going to happen.

I remember after the 2008 crash, we had a big run-up in 2009. By late 2010, as we were having a 2nd good year, talk of bubbles started to emerge.

And despite the bubble talk continuing, we had a pretty solid run all the way up to today. Yes, we pulled back in 2018 and 2022, but total return since 2009 has been huge.

We will absolutely have a pullback. I can’t tell you whether it will be in 2026, 2027, 2028, or beyond.

What Do We Know?

This is more helpful.

We do know that the S&P 500 has averaged 10% return per year with dividends reinvested over the last 100 years or so.

We know that the S&P 500 has gained over 50% in a year two times. And we know that it has had more positive years than negative.

We know that if we invest for 1 year, it is almost a coin-toss as to whether we’ll be up or down. But the longer we stay invested, the closer we’ll come to attaining that average 10% return per year.

What Do We Do?

And here it is. The big question.

History shows that the best thing to do is nothing. Don’t panic sell. Continue contributing to our 401k, and continue reinvesting dividends.

Go back to any period of time, including 2007, right before the big crash, and that strategy proved successful years later.

But we’re human, we’re emotional, and that’s our money!!!

Panic Selling

It seems to make sense.

I woke up this morning thinking about Cummins (ticker: CMI) and Caterpillar (ticker: CAT). These aren’t AI companies, they’re old American steady, slow-growth companies. Caterpillar makes big trucks and Cummins makes big engines for big trucks.

But they are both up over 40% this year. That’s unheard of.

Maybe I sell some shares. Maybe I sell all my shares. Certainly feels like a big-truck-bubble.

Breath

Luckily I have a thesis for both companies. My thesis hasn’t changed and I remain optimistic about both.

And despite the run-up, neither is a huge part of my portfolio. Why is this important? Sometimes due to huge gains, a company can start to dwarf our other holdings. I start to get concerned when any one company becomes more than 5% of my portfolio.

Recently I sold some Apple, Amazon and Netflix shares for exactly this reason. Their share price changes were having too large an effect on my portfolio day to day for me to be comfortable.

They remain 3 of my favorite companies. They each have a large position in my portfolio, but I sold some shares and locked-in some capital gains in order to bring them more inline with the rest of my holdings. Hopefully I’ll get to do this again in 5 or 10 years.

So, in my opinion, selling to re-align my portfolio makes sense, which is why I sold some shares of Apple, Amazon and Netflix.

Selling just because a stock has rocketed up (but is not over-sized in my portfolio) doesn’t make sense. My thesis hasn’t changed. I’m probably not buying more shares at this price, but there is no reason to sell. That’s why I am continuing to hold all shares of Cummins and Caterpillar.

Asset Allocation

I’m a lot more interested in my portfolio allocation than I am in a particular stock or fund’s short-term price movement.

Cash

I’m retired, so I keep the money I need for all of my expenses over the next few months in a nice money market fund. I like the FIDELITY MA MUNI MONEY MKT PREMIUM (Ticker: FMSXX).

This is an investment product and is not FDIC insured, however, money market funds have only “broken the buck” 2 times ever. Money market funds have a share price of $1, always. Gains are paid as dividends. Breaking the buck, i.e. going below the $1 price is really bad. No major fund company’s money market funds have broken the buck.

FMSXX pays about 1.78% APR (currently – this fluctuates) which is not quite what a high-yield savings account pays, but the dividend it pays is exempt from federal and Massachusetts state tax. It’s a Muni fund.

I regularly move money from investments to cash to ensure I have a few month’s worth of expenses in FMSXX.

I also have some money in an emergency fund (FDIC insured and I can write checks and use an ATM).

Everything Else

Everything else is positioned to generate income through bond fund and dividend-paying stock dividends, or is allocated to growth stocks to generate earnings that I’ll need when I’m in my 80s and 90s.

And because interest rates are so high right now, I have a lot of 3,5, and 10 year CDs that are paying above 4.5%.

So, I’m at around 20% cash, 25% fixed income, and 55% equity.

I feel like this gives me a solid foundation in case the market has a few down years in a row. My cash coupled with the dividend and interest income can carry me so that I’m not forced to sell equities in a down market.

The equities will have some bad years. I don’t know when, but I’m sure there will be some rough ones. I’ll let them run for now and as I get closer to my 80s, I’ll start selling them opportunistically and generating cash.

Having a solid asset allocation strategy means that I don’t have to worry about what the market will do in the short-term.

Wrap Up

Fun fact: I started my first real job after college graduation in 1985. The S&P 500 is up over 4,000% since 1985. That was 40 years ago. That’s the magic 10% per year.

The other important fact is that we never know for sure whether the S&P 500 will be up or down in the short term. Many analysts will have opinions. Very few will be right. Almost none will be right twice.

So even if you guess right and sell to avoid a huge drop, when do you get back in?

I’ve found that spending some time on an asset allocation strategy prevents me from making rash decisions.