We invest to grow our wealth, so it’s natural to want to keep score. How are we doing? If we’re not doing as well as we’d like, or as well as the other guy, maybe we need to make some changes.

This is how we’re programmed. We did this in school with our grades. We do this in sports. So naturally we do this with investments. It makes sense.

And I am a big fan of measurements. I’ve written posts here and here, about this. But I’m also a big fan of not reacting and about looking at some of the below-the-surface metrics. Let’s talk about what that means.

Paper Trades

I have a spreadsheet for everything. I’m a big fan of the paper trade. Whenever I get an idea like “I should sell XXX” or “YYY looks interesting, I should invest now,” or even “my mutual fund is underperforming the fund I just read about on CNBC. I should sell mine and buy the winner.” I create a table, write down the trade, the $ value, the price, and my rationale, then I watch.

Most of the time I just watch and learn and don’t actually make the trade. Sometimes I do. For me, this works for 2 reasons. First, I feel like I’ve taken action. I can stop obsessing and move on. Second, I gather an inventory of decisions and I can watch these over time and look for patterns.

I love paper trades.

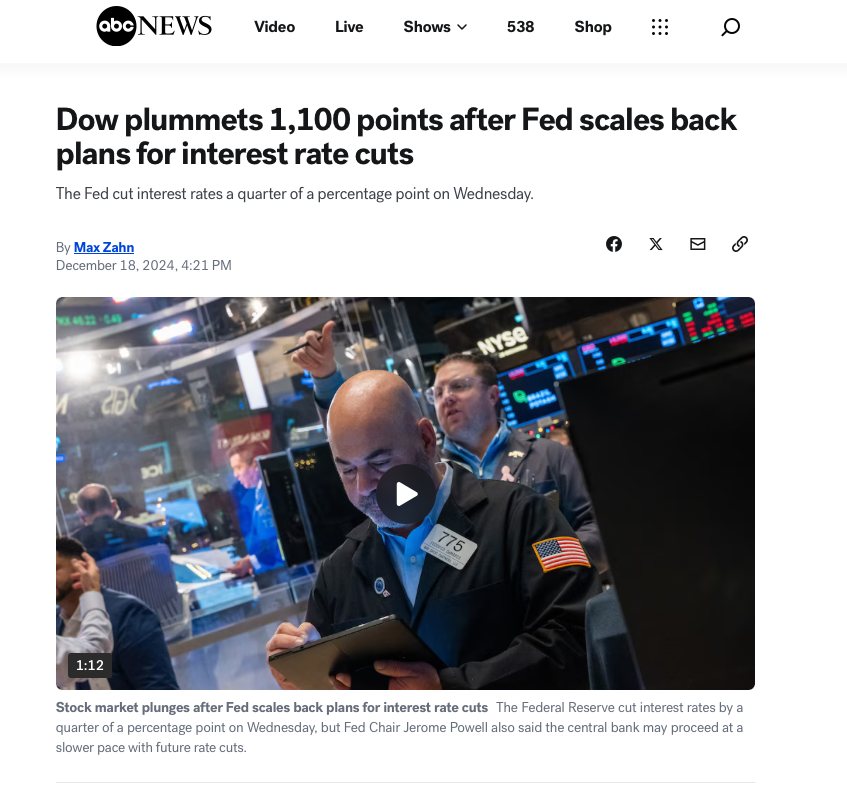

Measurement: Today’s Market

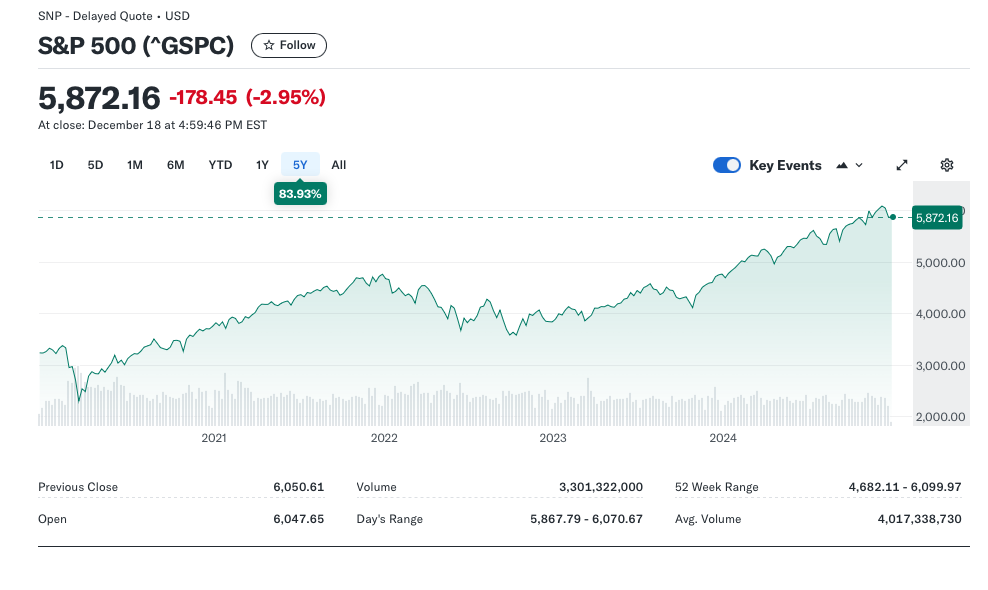

This is from ABC, but similar stories were everywhere. This is a measure. Stocks were down big. Some of the money we needed for retirement, college, vacation…is gone. It creates panic.

This is a measure. But it’s not the only one.

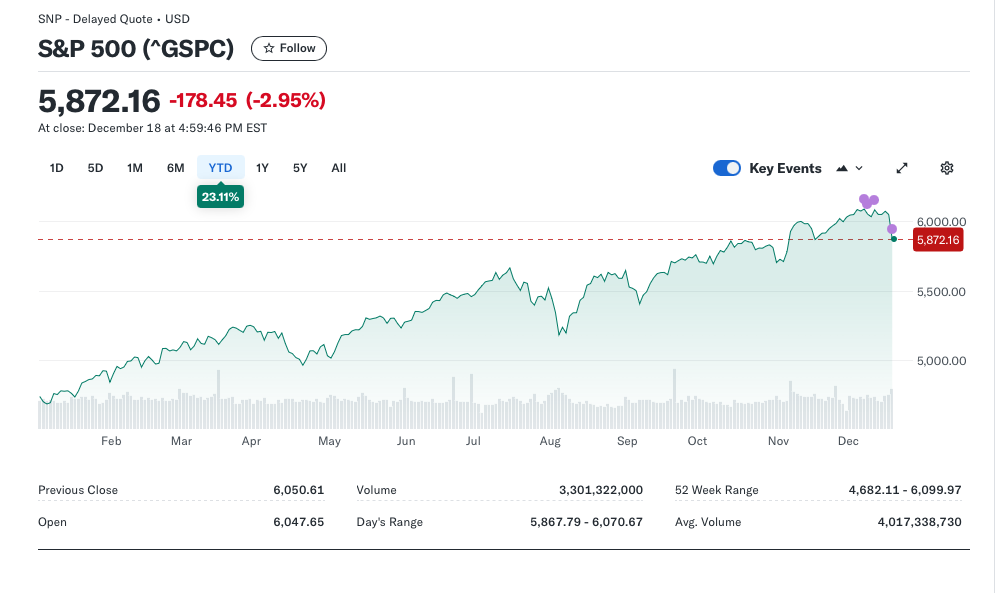

Here’s another:

We can see the alarming dip at the far right where we drop almost 3% in one day. But zooming out to YTD, the S&P 500 is up 23.11%. That’s another measure.

Zoom out to 5 years, and the S&P 500 is up over 80%

My point is that if we’re measuring based on yesterday, we’re in a panic, and rightly so. If we’re measuring since January 2024, it’s a different story.

Visibility

Unfortunately, the day’s nearly 3% drop gets more attention than the slow steady climb of the S&P 500. So the numbers we see day in and day out don’t tell the whole story and may cause us to react.

Here’s a suggestion. On the top, front and center of my spreadsheet, I have a table that shows me 2 very important metrics for me.

- Liquid net worth change year-to-date – I don’t include house and cars – these are tough to measure. It is only my account balances. This shows me how I’m doing after all expenses, new investments, savings, dividends, and market returns.

- Liquid net worth change since retirement – same accounts. In 2019, I made the decision to retire. How are my account balances doing since I retired? I’m spending my savings, but I’m also aggressively invested with part of my portfolio. The market has been pretty good. Is the plan working?

These 2 measures help keep me focused on my investing goals rather than the day to day gyrations of the market.

But, Isn’t That One Better?

But, there is still the urge to analyze the price performance of our investments and get rid of the low performers and buy the better performers. Makes sense right?

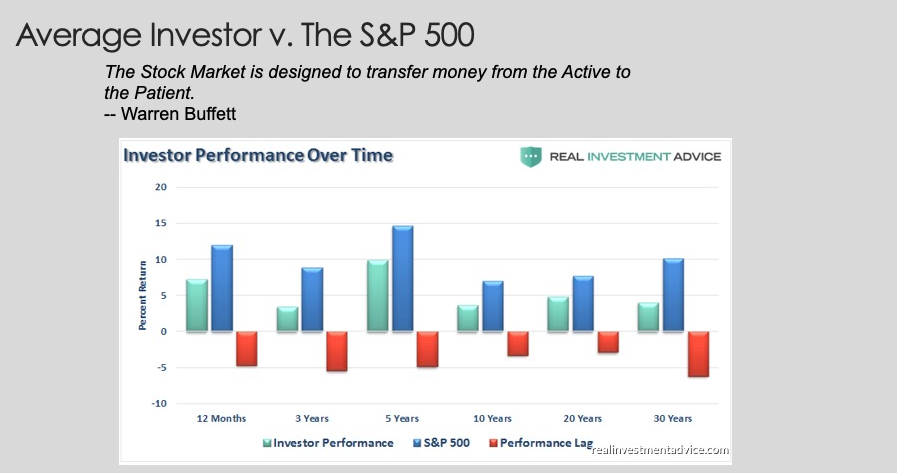

I use this slide in my personal finance class. The chart is from realinvestmentadvice.com. Because we all tend to chase the hot stock or hot fund, in the long-run, we under-perform the S&P 500 index.

This urge to move to “better” investments costs us. And I love the Buffet quote.

Compulsion to Act

As much as I have my YTD and since-retirement measures to keep me focused, I still keep score at the share purchase and share sale level to assess the quality of my buy and sell decisions.

As a side note, I did some analysis a while back that showed that if I never sold an investment, I’d be right about where I am today. While many of my investments were turkeys and dropped 50, 60 or even 90% in value, these would be more than offset by others like my sale of XPO Logistics in 2021 that is now up more than 230%.

Buy and hold, who would have thought?

And when you feel the compulsion to act, put it on a spreadsheet and watch it for a bit.

Texas Roadhouse

Who doesn’t love a good steak, and don’t even get me started with the rolls and cinnamon butter…

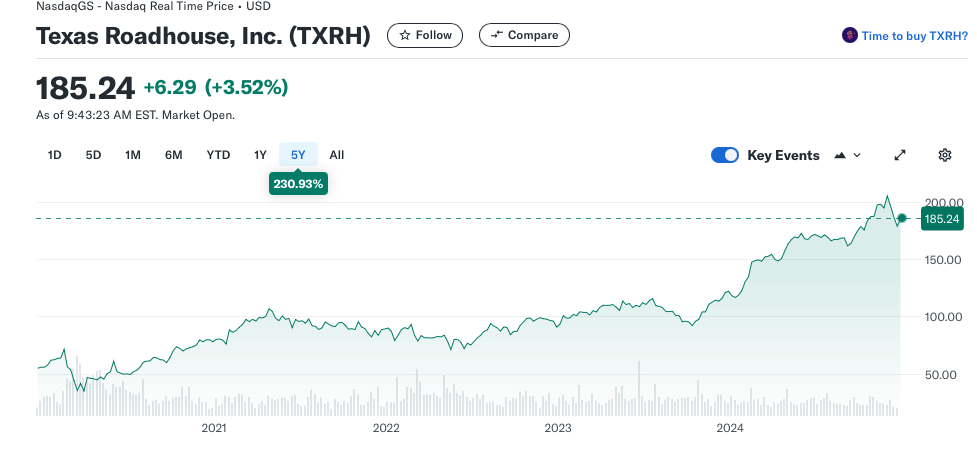

As much as I love the restaurant, I’ve had a rocky relationship with the stock since my purchase in 2017. I bought shares after hearing the founder and then CEO Kent Taylor on a podcast. I did some research, liked the story and bought shares.

The pandemic came in 2019, not good for restaurants. The company cut its dividend. Soon after, the CEO (Kent) tragically passed away. The stock price languished at around $100 per share for about 2 years.

My thesis had changed, Kent and the dividend were a big part of it. The stock was floundering. Maybe time to sell and move to a better investment? I have lots of other stocks that are doing well. Even the S&P 500 was doing better. Maybe move to a nice low-cost index fund.

I put it on a spread sheet and moved on. I still like the company (and the rolls) but the story has changed somewhat.

Surprise Surprise Surprise

I love Gomer, so I’m re-using (for those who saw this in a prior post)

Now, in 2024, TXRH is up 51.4% year-to-date. It’s a restaurant not a tech start-up. Holy Cow!

In January, I never would have guessed that TXRH would be one of my best performers this year. In fact, with inflation, I expected it would struggle.

And one company that I was particularly bullish on, IDEXX Labs (ticker: IDXX) which does lab testing for pets and livestock is down 25% this year. After writing about the amount we spend on pets, I was convinced IDXX would be a winner, and I bought more shares.

Conviction

One of my favorite words. We need to have conviction in a company, or mutual fund, before we invest our hard-earned dollars. And if we’re doing this right, we may be spotting an opportunity before others do. Typically for me, it takes weeks, months or years for an opportunity to pay off. Don’t be too quick to sell.

Wrap-Up

What we measure matters. For me, I like to think about my goals and make sure that the metrics I gather give me a true picture of how I’m performing against my goals.

If my goal were to not lose money on any day, I wouldn’t invest. That’s easy.

But with no pension, and no more income, I rely on the growth of my investments to fund my retirement spending. I need a sound asset allocation strategy to ensure I have my short-term spending needs covered along with my long-term growth needs.

I also need to ensure that my equity investments (as a group) are likely to grow over time. I need to recognize that all of them will have good years and bad years. They’ll have some really good and bad days. But I shouldn’t react. I didn’t sell Texas Roadhouse in 2021 and I won’t sell IDEXX Labs today. And I hope to be writing a post about the stellar performance of IDXX next year, or maybe the year after.

A Note on Long-Term Holding

I rarely hold an investment less than 3 years. Unless the thesis changes dramatically like Intel, I hold on and watch. Provided we do a reasonable amount of work on a thesis before buying, our portfolio as a whole will likely perform well over time. We need to make sure we give our investments the time they need.

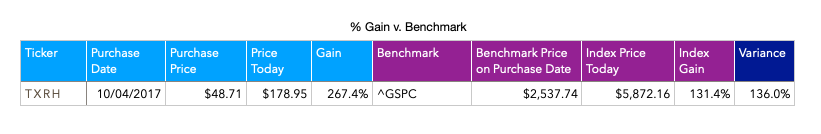

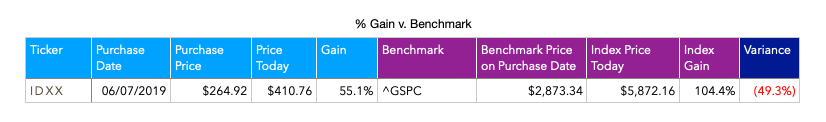

Here’s another measure that I capture. I like to track the gain of my investments v. a benchmark. In this case, TXRH and IDXX are both equities, so I compare my purchases against the S&P 500.

TXRH crushed the S&P 500, and while IDXX lagged, it has still made money. And who knows what will happen next year.