Before we dive in, let’s talk about what an ETF is and why we might want one in the first place.

An ETF, like a mutual fund, is a basket of securities. S&P 500 ETFs like the State Street SPDR S&P 500 ETF (SPY) is a popular ETF choice. We’ll talk about why later, but SPY holds 500 or so different securities. It holds every S&P 500 company.

The S&P 500 is a basket of the 500 largest publicly traded US companies and consists of names like Coca Cola, Walmart, Apple, Nvidia, and lots of others. Read more here and here.

I can take $100, buy a partial share of SPY, and instantly own a diverse group of 500 stocks that represent different sectors of the US economy. I did this back in February. Read here.

Depending on the ETF, it may hold a basket of stocks, a basket of bonds, or some of both.

Mutual Funds

I tend to like ETFs over mutual funds for 2 reasons.

- ETFs tend to be more tax efficient because they typically do less buying and selling

- ETFs trade on an exchange (they are after all Exchange Traded Funds) so I can sell/buy one during market open hours.

But other than that, Mutual Funds and ETFs are very similar. And sometimes it is easier to find a mutual fund that meets our needs.

Which Ones Are Best For Beginners?

Go to 50 websites and you’ll get 50 different answers.

You’ve come here. so I’ll give you mine.

Passive v. Active

Active management relies on a portfolio manager or a portfolio management team to make investment decisions for the fund or ETF. There are also research analysts who advise the portfolio managers. All of this is expensive, so the management fees, also known as the expense ratio, of active funds and ETFs are typically higher than passive.

With passive management, the fund or ETF is linked to an index and holds what the associated index holds. The fund company needs to subscribe to the index to get regular updates, but there is no portfolio manager and there are no research analysts.

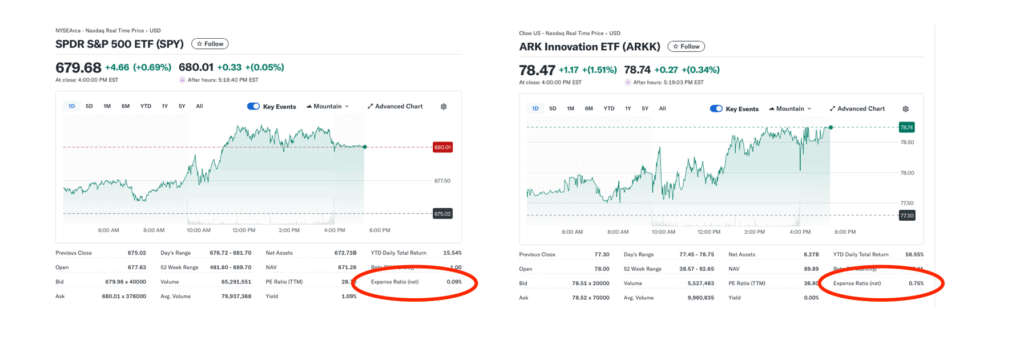

Let’s compare the expense ratio of the passive SPY to the ARK Innovation ETF.

Buying the S&P 500 ETF, with an expense ratio of 0.09%, I’ll pay $9 per year for every $10,000 I invest. For the ARK fund, I pay $75 per $10,000.

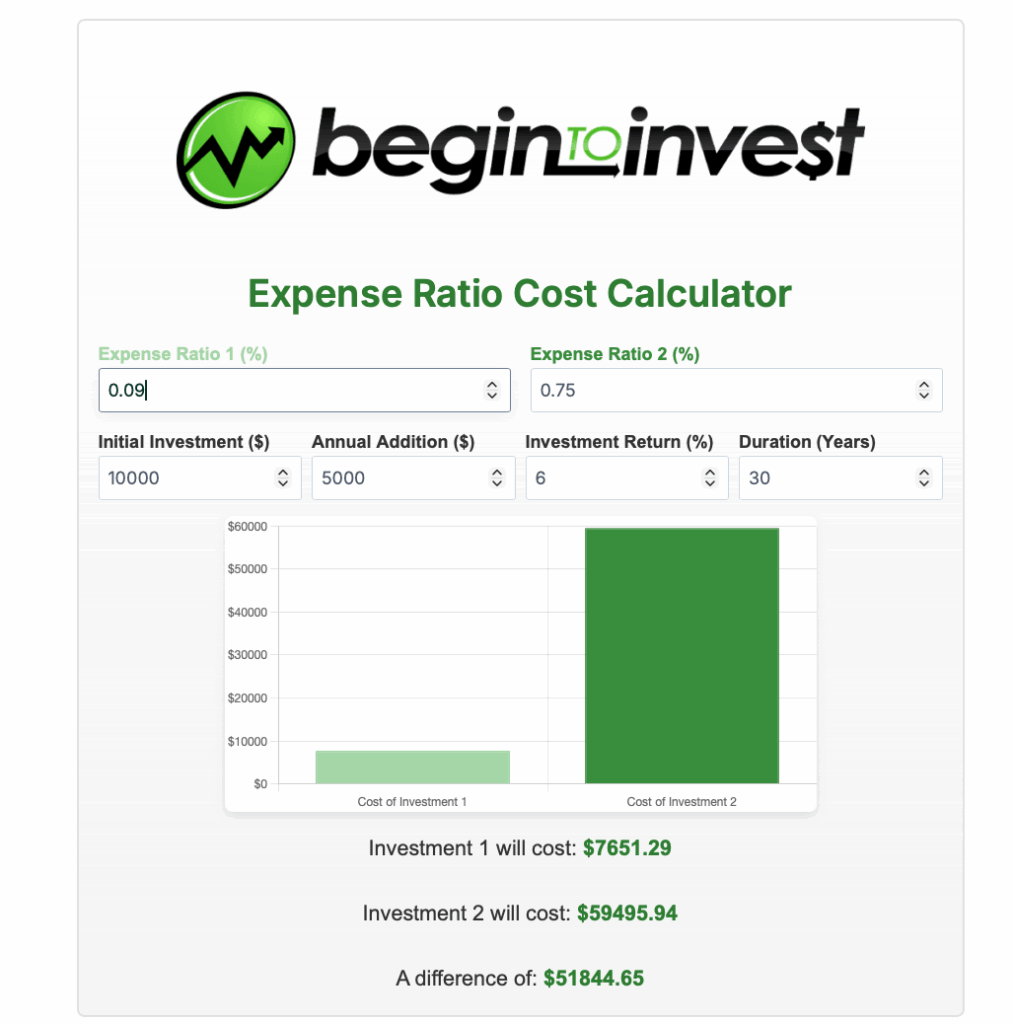

While this doesn’t sound like a huge difference, our assets grow over time, so we pay more $ as they grow. And the amount we pay in fees is lost growth. Check out a comparison from begintoinvest.com.

Read the post on compounding for a more detailed explanation.

And as a final note, we all remember Peter Lynch. Back in the 70’s and 80’s, he outperformed the S&P 500 for 13 years in his tenure managing the Fidelity Magellan fund. The reason we still talk about this 50 years later is that no one else has done it.

So if most portfolio managers under-perform their index, why not buy the index and save the fees?

As a beginning investor, stick with passive.

Geography

Quick, what’s the capital of Pakistan???

No, we’re not doing that today. But geography is a factor in choosing investments.

Many advisors tell us that we need to invest in European companies, Far East companies, emerging markets… It’s important to have our money scattered throughout the globe so that we are positioned to capitalize on growth in any geography.

I believe that’s hoo-hah.

I’ve seen Caterpillar construction equipment in India. I’ve gotten a Starbucks coffee in China. I went to a McDonalds in Hong Kong. Many large companies in the S&P 500 are global companies that get a large chunk of revenues from outside the US.

I’ve held emerging market ETFs and country-specific ETFs. They’ve all underperformed the S&P 500 over long periods of time.

Size

Large Cap, Small Cap, Mid Cap.

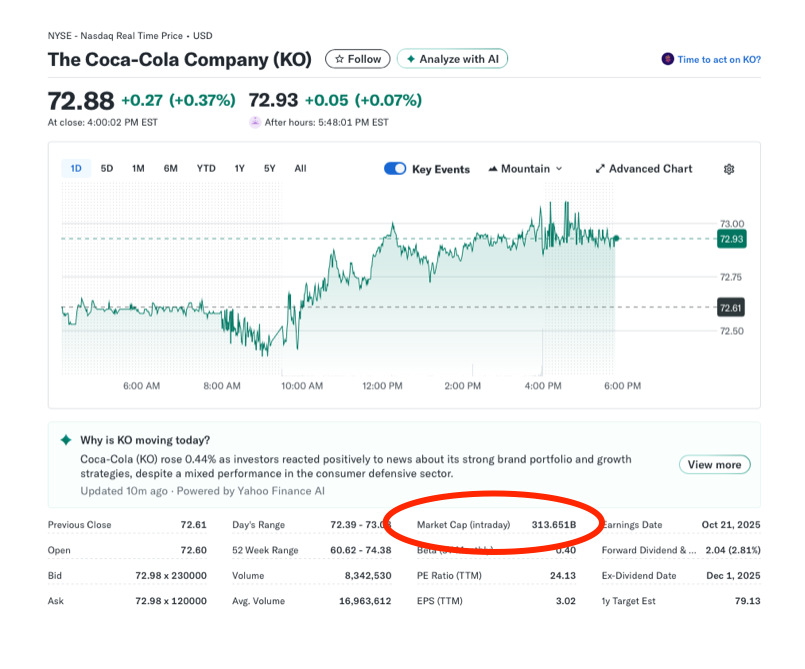

Cap refers to market capitalization, or more simply, what the company is worth.

It’s easy to calculate.

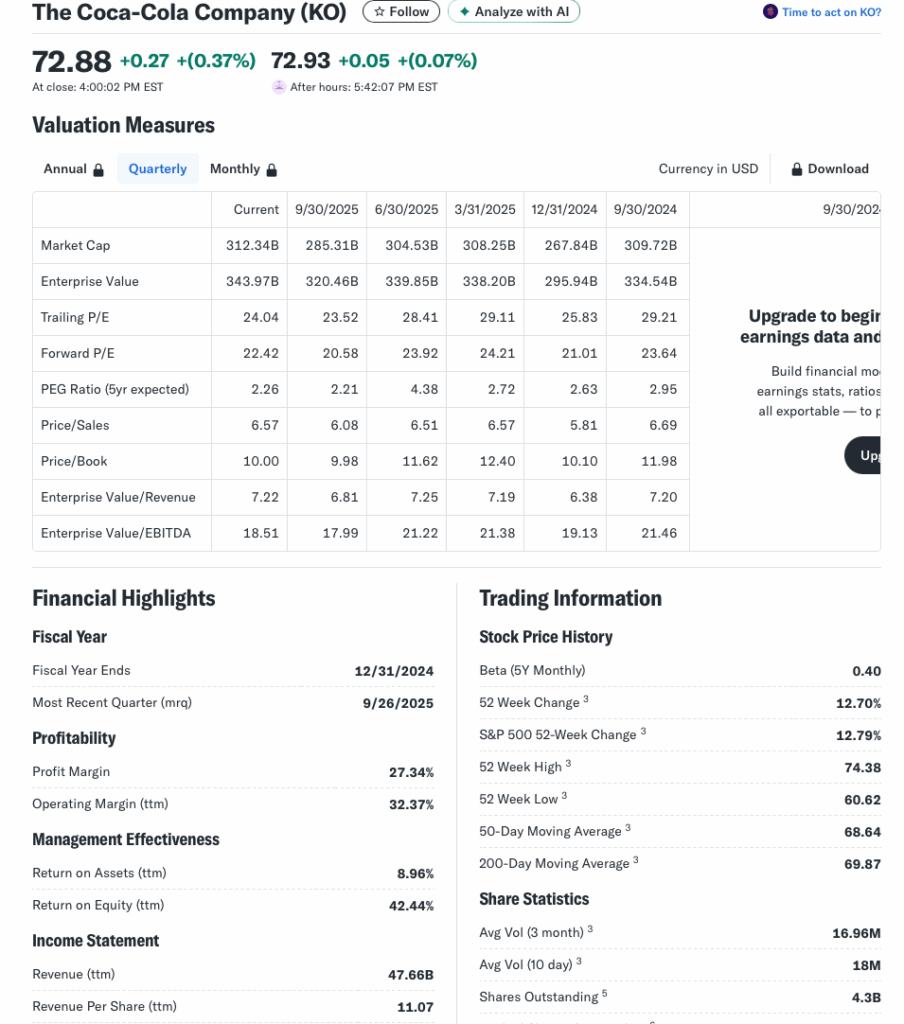

Coca Cola (KO) has 4.3 billion shares outstanding. You can see it on the bottom right of the yahoo finance statistics page.

The closing price of Coca Cola is $72.88. That means every share outstanding is worth $72.88 right now. $72.88 per share x 4.3 billion shares = a little over $300 billion, which is what we see here.

I asked Grok, here’s what he had to say.

Again, our advisor friends will often tell us we need some of each. Small caps and micro caps have the biggest opportunity to explode.

But here’s the deal…our economy goes through cycles. We had the financial crisis of 2008, the interest rate spike in the 2020s. We don’t know when the cycles will start and end, but we have down cycles every few years. Always.

Large cap companies are big stable companies like Coca Cola, that have been around through market ups and downs. They tend to have lots of cash on hand, so much so that they pay dividends to shareholders because they can’t think of enough businessy things to do with all their money.

So while I recognize the potential of smalls and micros, I tend to stick with large and mega.

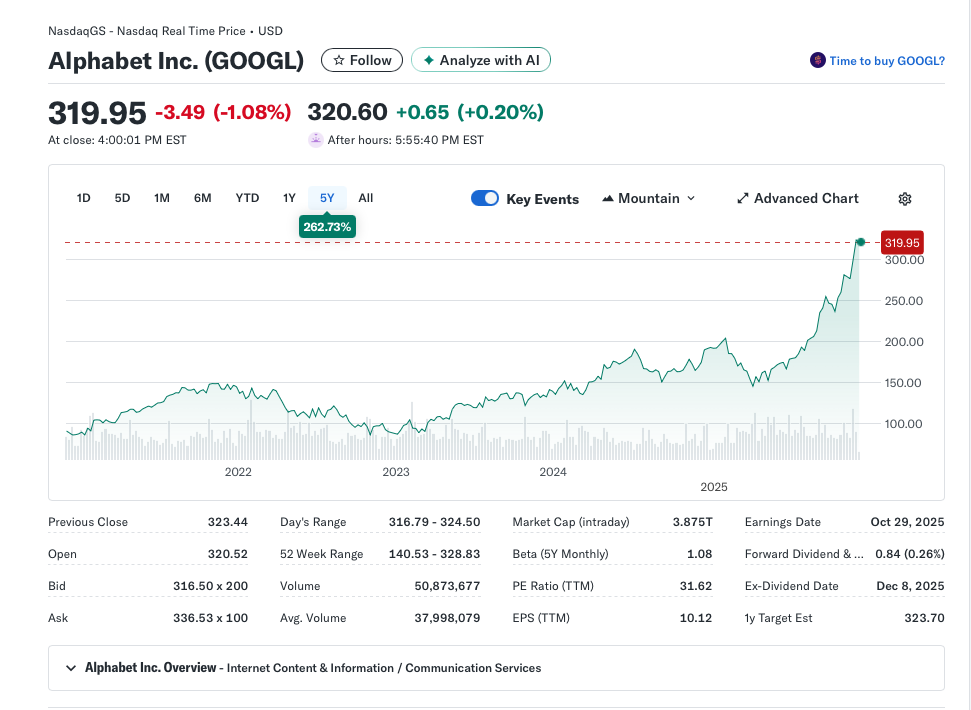

Google parent Alphabet is a mega cap stock. It’s huge. But it seems to have done pretty well over the past 5 years.

And Alphabet is one of the top holdings in a nice low-cost S&P 500 fund.

Asset Class

Equity, Fixed Income and Cash.

We like them all and they all have a place in our portfolio.

Equity means ownership and typically we’re talking about ownership of a company. An equity ETF or fund holds a basket of company stocks. Equities are a more volatile asset class, but they tend to outperform over long periods of time.

Fixed income provides income which is, well, fixed. Fixed income primarily refers to bond funds and ETFs. Bonds are a loan. If I buy a $1,000 Walmart bond, I’ve given Walmart $1,000 to build stores or buy trucks. Walmart agrees to pay me x% per year until maturity, at which time, I get my $1,000 back.

The x% is the fixed rate. If x = 3%, I’ll get $30 every year.

A fixed income ETF or fund will buy a basket of bonds and pay ETF/Fund shareholders regular dividend payments which is comprised of the bond interest.

Fixed income provides us with income and tends to be less volatile than equities.

Cash, or cash equivalents are very secure short term investments. Some of these may be covered by FDIC, which insures holders up to $250,000 against losses. Some of these are not covered, but are considered very low risk. Low risk provides lower return.

Cash is not going to decrease in value, but may lose out to inflation.

As an investor, we need to have some of each asset class.

How Do We Decide?

Deciding how much of each is a process called asset allocation. Read more here.

Here’s the Reader’s Digest version.

Money for our emergency fund and for our monthly budget and spending needs to be in cash.

Money that we’ll need in the next 5 years should be in a mix of cash and fixed income.

Money that is for a longer term goal like college for a young child, or retirement should be largely in equities.

Asset allocation needs to be evaluated every year. An S&P 500 equity fund may be a great place for my grandson’s 529 investments today when he’s 4 and has 14 years until college. 11 years from now, I’ll start migrating the assets from equity to cash and fixed income so that the money I need for tuition in 2036 is available (even if we have a stock market crash in 2035).

ETFs

With that out of the way, I have 2 suggestions for equity ETFs. I’ve owned both for over 10 years.

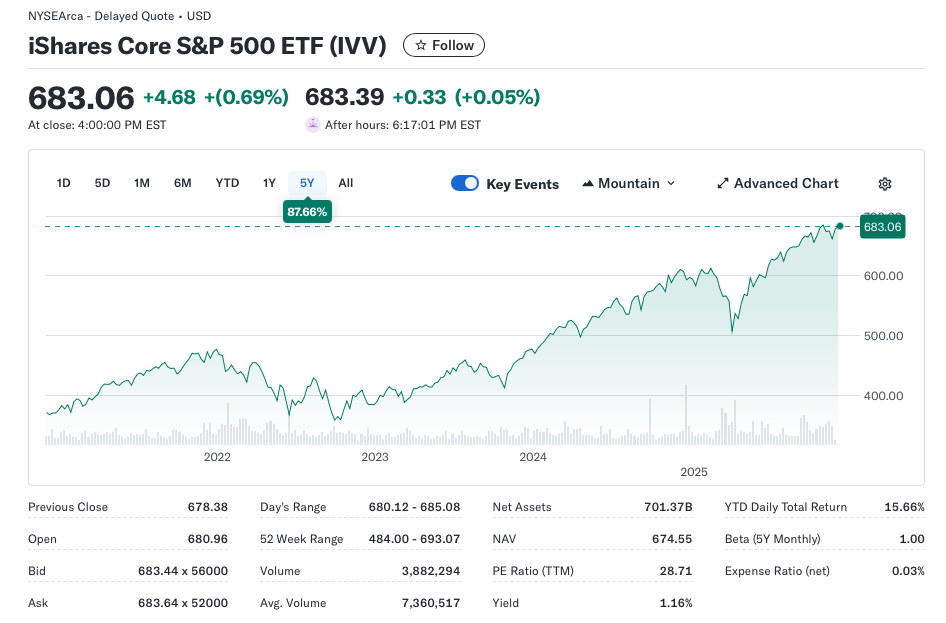

iShares Core S&P 500 ETF (IVV)

The expense ratio is 0.03%. It’s 1/3 the cost of SPY.

Other than expense, every S&P 500 fund and ETF holds almost exactly the same companies in exactly the same ratio.

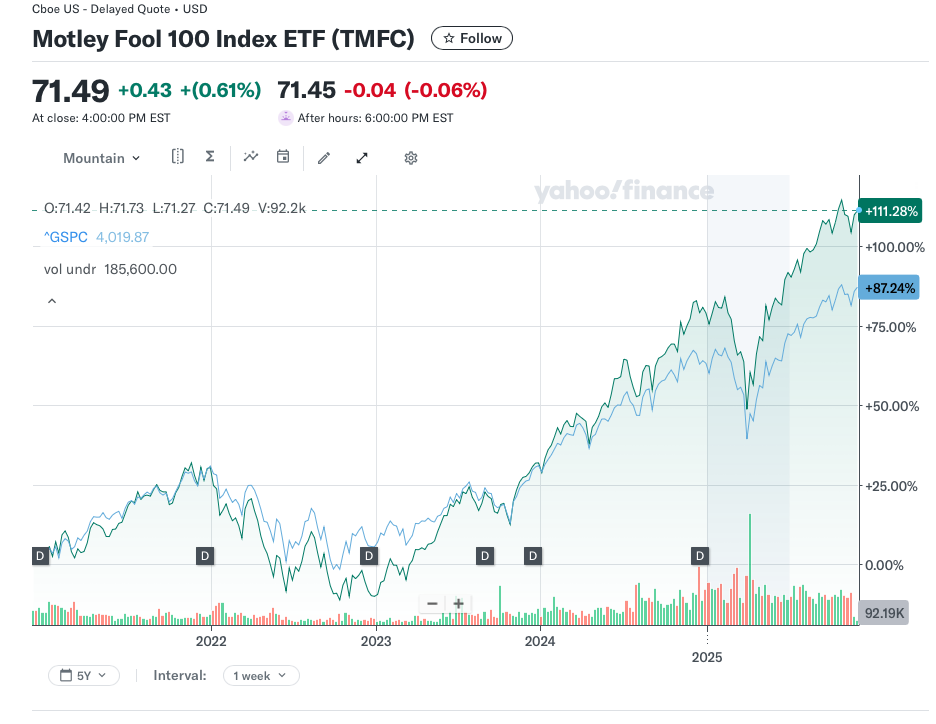

My other favorite is Motley Fool 100 Index ETF (TMFC)

While this has an expense ratio of 0.50%, its performance has been better than the S&P 500 over the past 5 years. It holds a basket of securities from the Motley Fool investor universe. I subscribe the Motley Fool stock advisor and I listen to their podcast. I like their buy and hold philosophy. This ETF holds many of the S&P 500 companies, but the ratios are different and it holds some smaller companies as well.

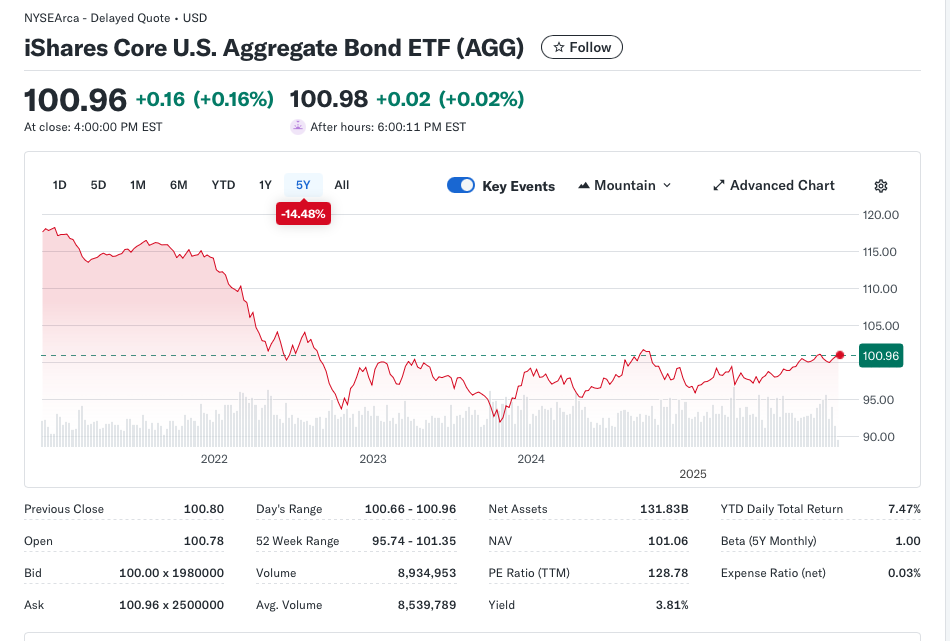

For bonds, I like the iShares Core U.S. Aggregate Bond ETF (AGG)

Rising interest rates have not been good for bonds. But even as the price of the fund drops, we’re still getting a bond interest payment in the form of a dividend each month. Bonds can be tricky. Read more here and here.

And I also like the T. Rowe Price Ultra Short-Term Bond (TRBUX). It holds very short term bonds which are less sensitive to changes in interest rates. We’re in an unusual period right now where this is yielding more than the AGG ETF, but weird things sometimes happen.

Cash

Cash does not belong in an ETF or fund.

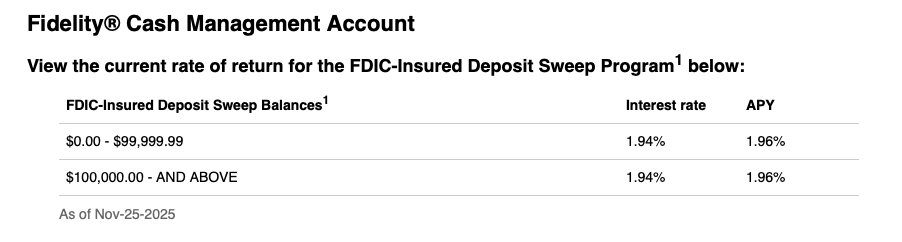

I keep my emergency fund and my spending money in my Fidelity Cash account. It is FDIC insured and yields 1.94%. I have an ATM card that I can use at any ATM on the planet and Fidelity reimburses me for fees. I also have checks and can use online bill pay. Do not put your cash in a bank that pays you no interest.

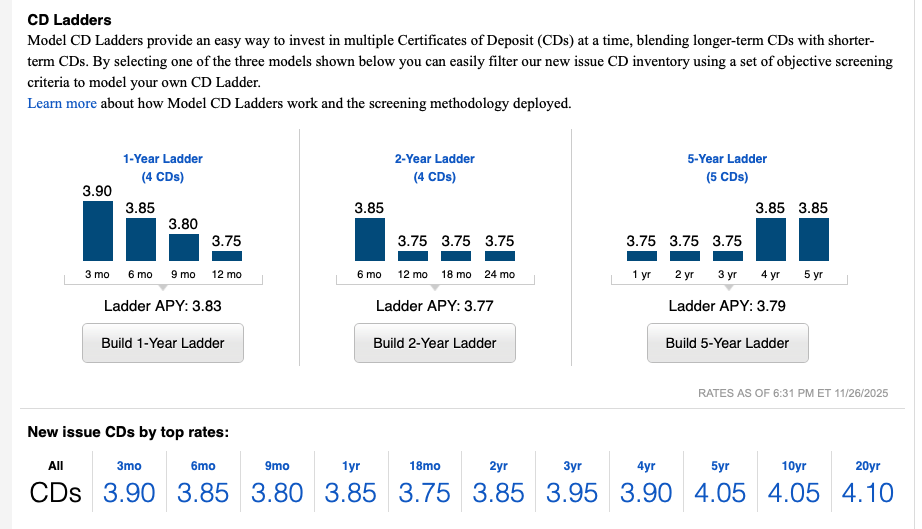

Cash that I need for upcoming expense in the next few years, since I’m retired and have no income, is in a CD ladder. I buy a 1 year, 3 year, 5 year and 10 year CD. I stagger these so something is maturing each year so that I have cash coming in, but I can take advantage of the higher rates of longer-term CDs.

Here’s an example of available rates and possible ladders.

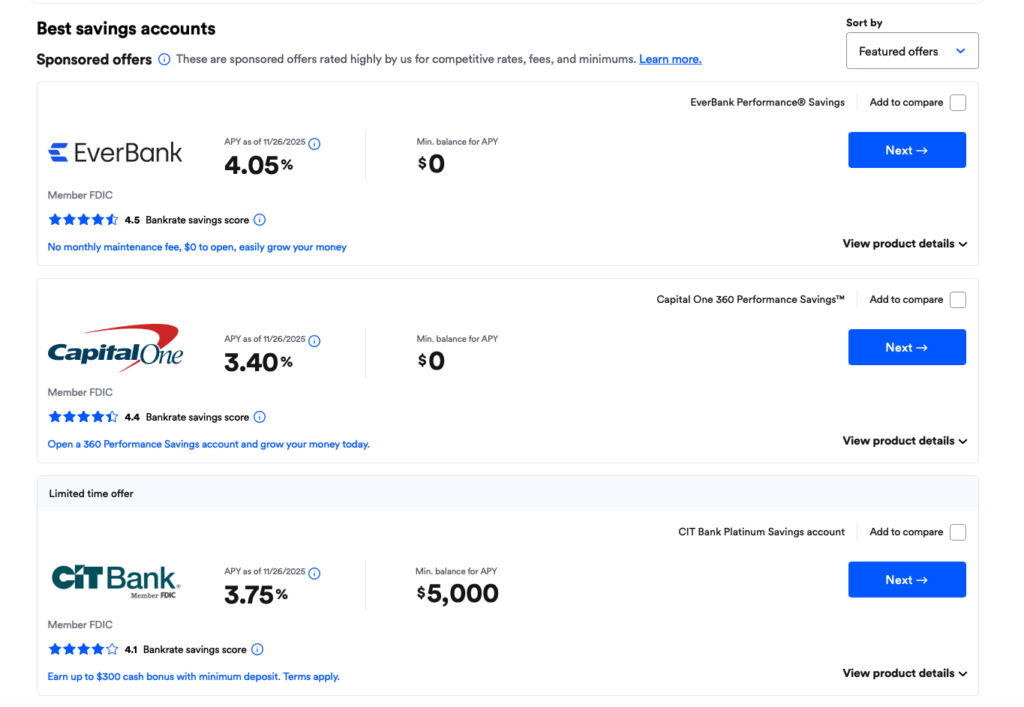

I also like high yield savings accounts. I check rates regularly on bankrate.com.

Broker

You’ll need a brokerage account to buy funds and ETFs. You can also buy brokerage CDs. All the cool kids are using Robinhood, but I suggest you stick with Fidelity, or Vanguard. You can set up an account, or many accounts, for free and they have tools, educational resources, and even advice if you need it.

Risks

Every fund and ETF, and any investment – even real estate, has risks. Prices can drop.

But should we worry about our broker or our fund/ETF manager?

The short answer is No.

If our broker were to go out of business, there are procedures for transferring our assets to another broker.

And if the fund company were to go under, there are similar safeguards. Here’s an example.

That said, I regularly print off my statements. Since everything is trapped in the internet, I like to have some recent proof of what I own.

Wrap Up

We all need to invest, whether we’re 20 or 70. Read more here and here.

Mutual funds and ETFs are a great way to do that.

I own shares of every mutual fund and ETF we’ve talked about here. I’ve held them for 20 years or more and I have no plans to sell. I don’t trade, I invest.

But, that said, these are a great starting point. As we learn more it’s easy and free to sell some shares of these to invest in a fund or ETF that we feel will be a better fit for us.

If you’re curious to learn more, I have lots of posts to help.