As an investor, there is nothing more exciting than when I buy shares of a company and I’m immediately rewarded with a huge gain.

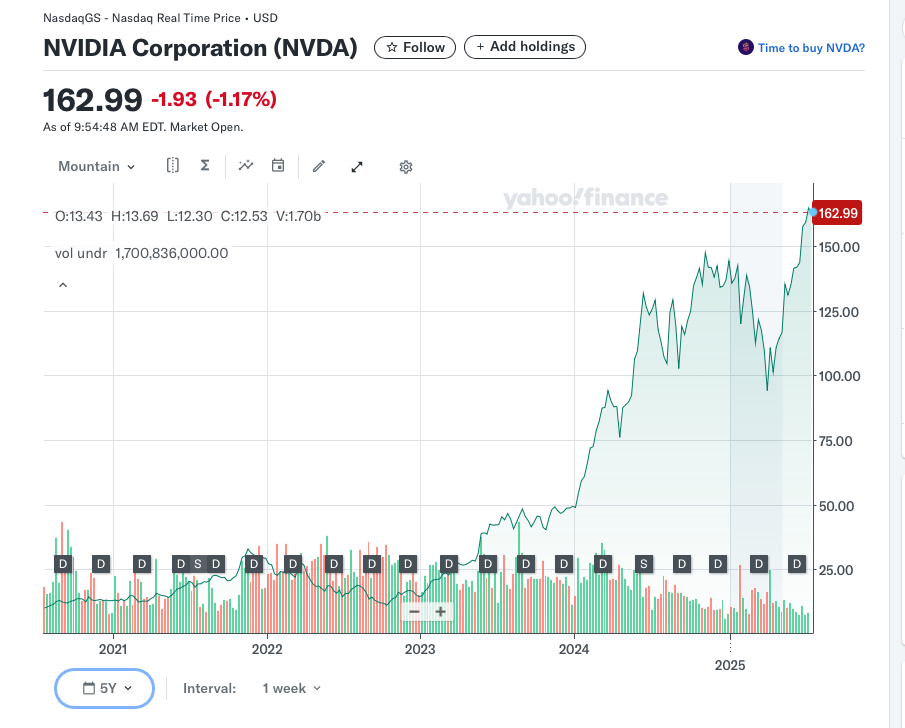

Take Nvidia (ticker: NVDA) for example. Look at this 5 year chart.

Since late 2023, it’s been on fire.

I’m excited because I own shares.

I’m up big on this investment, but in all honesty, it has not been one long party. I bought shares in 2022 when I was starting to get interested in computer chip stocks. Not being an expert, I bought a basket of chip stocks and Nvidia was one of the companies.

As you can see from the chart, Nvidia had a rough start for me. Toward the end of 2022, I was down 35% on my investment and I sold half to take some losses to offset capital gains. As a side note, almost every time I have sold a company’s stock to harvest tax losses, it has bit me in the ass. Lesson learned: If I believe in a company’s long-term prospects, don’t sell at a loss.

Nvidia

The point of all of this is that I’m not perfect. No one is. I did well on Nvidia, but I had to ride out a 35% drop before enjoying the huge run up. I wish I had held onto those shares in 2022, because they’d be up 1,049% since I sold.

But, I held onto half, and those are up about 1,000% (remember, I had to stand by while they dropped 35% before they started their run up. The 1,049% was the gain since I sold the other shares.)

But, the point here was that it is thrilling to invest some money in shares of a company and watch it double many times over in the course of 3 years.

That’s what we all want, that’s what we see in movies and that’s what’s all over social media.

Boring

I’m 65 and I’m investing some of my assets for income that I’ll need when I’m 90. I hope I make it that far, but that’s another story.

That’s why I invest in some higher risk growth companies like Nvidia.

But I’ve moved pretty heavily from growth stocks to more boring value stocks. Today’s example (again) is Fastenal, (ticker: FAST).

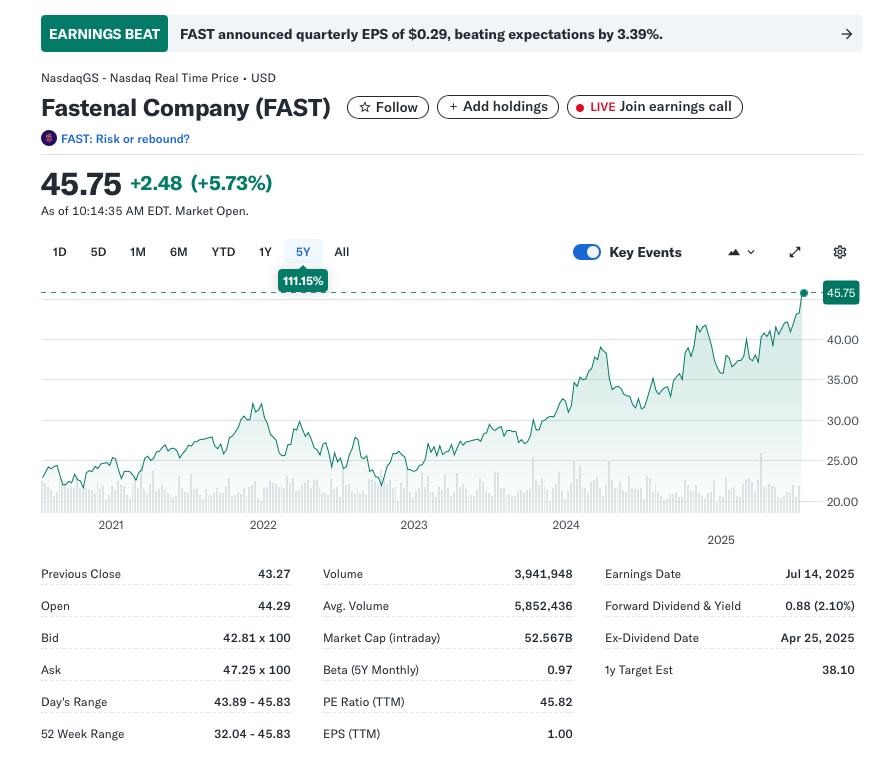

Take a look.

Fastenal beat earnings expectations today and the stock is up 5.73%.

That’s awesome, however, my main reason for owning Fastenal is the dividend of $0.88 per share or 2.10%.

For every share I own, I receive $0.88 per year, paid out in 4 quarterly installments.

Income Stocks

I own quite a few income stocks. For me, I expect little or no capital gain. What I expect is a consistent dividend payment.

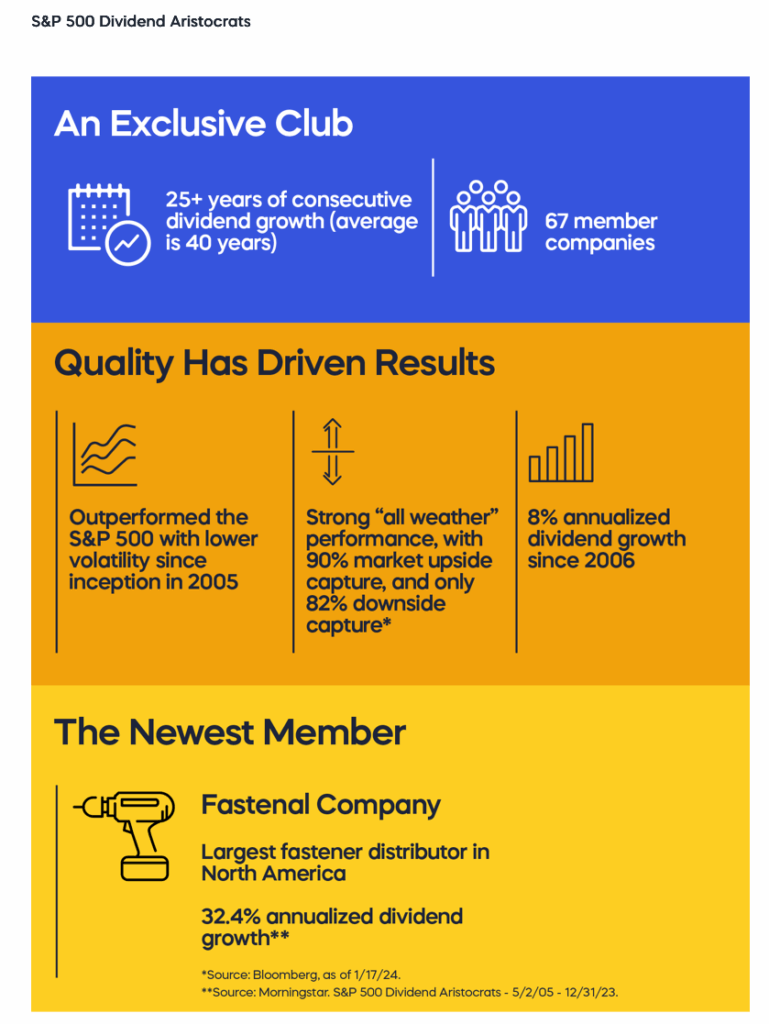

Fastenal is a dividend aristocrat. Read here from proshares.

Simply put, dividend aristocrats are S&P 500 stocks that have raised dividends for at least 25 consecutive years. There are also dividend kings who are S&P 500 companies that have increased their dividends for 50 years.

Dividend aristocrats and dividend kings are good choices for income stocks. That’s because in order to be able to increase their dividend each year, they need to be increasing company earnings to support the additional payout. For a company to do this for 25 or 50 years, or more means they’re doing something right.

But, as with any equity investment, there are no guarantees of capital gain or of continued payouts.

Fastenal became a dividend aristocrat in 2024.

Fastenal

I’ve written about Fastenal before.

- Here’s a post about some things that impressed me in their annual report

- I mentioned Fastenal in a list of boring stocks that are nice to hold when the market melts down

- And here in a post on finding great companies

- And here in a post on companies evolving

Over the past 2 years, I’ve written a lot about Fastenal. It’s a boring company today and was it boring 2 years ago. It sells fasteners, it’s not an AI leader and it’s not mining bitcoin.

In the post on evolving companies, I highlighted how Fastenal is putting its own vending machines inside of customer’s stores, factories and warehouses. Fasteners may be boring but the innovation at Fastenal is not.

Dividend

So let’s talk more about the dividend and why it is important.

I mentioned above that Fastenal pays a $0.88 per share dividend which nets a 2.10% yield.

Most people focus on the 2.10%, but let’s talk about the $0.88.

If I buy 100 shares today at $45.75, I’ll spend $4,575. Based on current dividend payout (what was actually paid last quarter), I’ll expect that in the next 12 months, I’ll receive $88.00 in dividend (paid in 4 equal quarterly payments). My dividend of $88 divided by my cost of $4,575.00 = 1.9%.

Why 1.9% yield calculated v. 2.1% on yahoo? Could be that they are basing off of a lower price – before the recent pop, or they are projecting out an increase in the dividend based on historical averages.

I manually calculate this and almost every time it is accurate. I bet Yahoo catches up in a day or 2.

But, let’s look at the shareholder experience related to the dividend and yield.

I bought my most recent shares of FAST on 11/18/2024 for $41.31 per share. The upcoming dividend is $0.88 per share and yields (either 2.1% or 1.9% depending on calculation) based on today’s price.

But my yield on my purchase is 0.88 / 41.31 = 2.13%.

My Yield

When we hold a stock for a long time and our shares increase in value, the yield increases. While yield is posted based on current price, our yield is based on the price we paid for the shares.

I invested $41.31 for each share. My yield is higher than the posted yield. And as the share price increases over time, my cost remains fixed so the yield goes up.

Here’s a more exciting example. Apple pays a small 0.51% dividend. That’s $1.04 per share. The current share price is $208.49.

I bought shares in 2008 for $4.49. I’ll get the $1.04 dividend for each of these shares. 1.04/4.49 = 23.16%. I’m getting a 23% dividend based on my cost.

Wrap Up

I started buying shares of Fastenal in 2023. I was looking for solid dividend-paying companies. As I’ve read annual reports and researched Fastenal, I’ve increased my conviction, as you can tell from my many posts that mention Fastenal.

Fastenal is not likely to double in a year. It’s probably going to be up in strong market cycles and down in weak cycles. I’ve been lucky to hit it on a strong cycle and that helps offset other dividend stocks I hold like T. Rowe Price, which pays a 5% dividend but has struggled. Some of my shares are down 50%. (…and since my cost was higher than the current cost, my yield is actually lower than 5%- yuck!)

But as a group, my income stocks have a small capital gain and pay me every quarter to hold them. This income helps my wife and I with the bills, trips, golf and other stuff we do.

While we all want to win the jackpot. We’d love to invest in Bitcoin and see it double in a week. We watch the superstars on Youtube who made a fortune and are driving Ferraris. That could be us.

But don’t miss out on the power of boring steady US based companies that pay a regular dividend and increase the payout regularly. They’re nice too.