Is leasing a car worthwhile or should I buy? Let’s take a look at the numbers and some other considerations. Buckle up!

First, thanks to Mike T, one of our readers who suggested this post. I have always been firmly anti-lease. I have 2 main reasons:

- Everyone I know who leases gets a new car every 3 years. While that’s cool, especially for a car-guy like myself, nothing is cooler than driving a vehicle that is paid off. No monthly payment. How cool is that?

- Everyone I know who leases seems to have a story of how that got hosed at trade-in because they exceeded their miles or there was a ding in the paint that most humans could not see.

I had no facts to back it up, but this was my feeling. And now…the facts.

Scenarios

I used my current vehicle, a 2021 BMW 528i xdrive as a starting point. I’ll talk through the steps which can be easily repeated for any vehicle.

I wanted to look at 3 scenarios:

- I lease a vehicle today and then roll into a new lease after 3 years and 36,000 miles. This repeats forever.

- I buy and hold (I like this strategy with investments as well) for 10 years or 120000 miles and then trade-in for another new purchase.

- I buy and hold for 3 years and 36,000 miles. I’m essentially mimicking the lease but with an upfront buy.

Scenario 1 – Lease

I walk into my BMW dealer. Of course I’ve done my homework as outlined here. I don’t have a trade in, but I know the Kelley Blue Book value of the car I’m leasing from kbb.com. I’ve also looked at prices at other dealerships so I’m ready for battle.

I find a beautiful 2024 BMW 530i xdrive.

After a test drive, I decide this is the one, so off to the finance office.

Financing

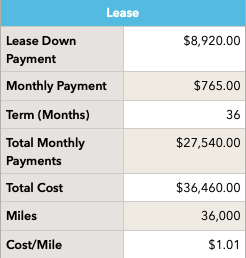

Here’s the deets (as the cool kids say – I saw it in a movie once): I’m planning to drive 12,000 miles per year (the national average) and I’m signing up for a 36 month lease. I put $8,920 down and I’ll make payments of $765 per month for 36 months. In order to compare the 3 scenarios, I’ll calculate a cost per mile for each.

Pretty simple math. I make 36 payments of $765, add this to my downpayment and I’m out-of-pocket $36,460 on this sweet ride. I have excluded sales tax from this discussion so we’re comparing apples to apples.

I drive my limit of 36,000 miles, and don’t go over, and no dings. My cost per mile is $1.01 and I start all over with a new lease and a new payment, which likely will be higher, given inflation and all…

Scenario 2 – Buy and Hold to 10 years and 120,000 Miles

Same car. On the BMW website, I can click to switch between buy and lease so it’s easy to compare. As usual, I’ve done the homework from the car buying post. In this scenario, I’ve also gone to my local bank and secured financing before I showed up to the dealership. However, the dealer is offering incentives that make their total out-of-pocket amount lower (don’t just look at monthly payment) so we’re going with the numbers on the website.

Financing

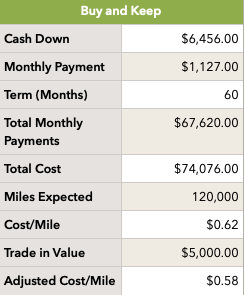

I’m a typical buyer so I’m putting some cash down and then I’ll finance the rest over 60 months (5 years, yikes). Here’s what it looks like:

You’ll see similar math, but I’ve included a cost per mile and an adjusted cost per mile. The adjusted number includes a trade-in at the end of 10 years and 120,000 miles. To get this number, I went to kbb.com and got the price of a 2014 BMW 535 xi with standard options and average condition and 120,000 miles.

Cost per mile, even without the trade-in is significantly lower. Not a huge surprise because under the lease scenario, I’m paying for that nice new car every 3 years. Under this scenario, I’m driving this bad boy for 10 years.

New Car Smell

I love the new car smell. It’s also great to get a new set of wheels, but it looks like I’m paying twice as much for the privilege.

There are also implications with keeping a car for 10 years and 120,000. In the old days (when I was a kid) this was quite a stretch. These days, there is no reason almost any vehicle can’t go 120,000. Just change the oil.

Also, buy a car you’ll be happy with for 10 years. If this scenario is your strategy, buy a car that will fit your lifestyle and that you’ll be happy with so that your not looking to trade in after 2 years – spoiler alert, you’ll lose money.

I Love an Old Car

All 3 of my most recent vehicles (and we’re going back to the 20th century here) lasted well over 100,000 miles and I owned each for an average of 8 years. Buy good vehicles and take care of them. They’ll treat you well. This strategy can work.

Scenario 3 – Buy, Hold for 3 and Trade

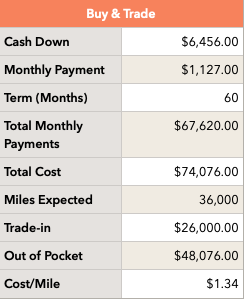

I don’t like the sound of this already. We’ve all been conditioned to know that the price drops steeply as soon as we drive off the lot. This is true throughout the first couple of years of ownership. But, let’s run the numbers and see what happens.

This is identical to scenario 1, except that I’ve added a trade-in amount, subtracted that to get a revised out-of-pocket amount and divided this amount by the 36,000 miles driven.

The trade in amount is from Kelley Blue Book. It’s for a 2021 (3 year old) BMW 530i xdrive with standard features and 36,000 miles.

Analysis

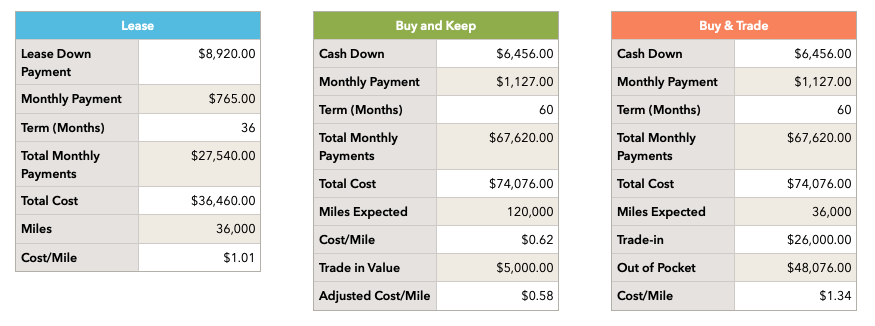

Let’s compare.

Just like in investing, buy and hold works.

But, as always, cost is important to understand, but it is never the only factor.

My monthly payment is $362 more to buy than it is to lease. That’s a big chunk of change.

Here’s a Crazy Idea

Here’s an interesting alternative. Let’s say we leased for 10 years and we took the $362 savings (over purchase option’s monthly payment) and invested it in a nice low-cost S&P 500 fund.

That’s Interesting

To clarify, in this alternative, I sign a new lease agreement every 3 years for the next 10 years. I make my monthly payments, but I also invest $362 each month in a low-cost S&P 500 fund. This assumes I could afford $1,127 (the monthly cost to buy and finance) out-of-pocket which may be a stretch, but bear with me. At the end of 10 years, assuming an 8% average annual return, I could have $67,000. Sweet!

Compare that to the per mile savings of the buy and hold option:

- Over 10 years, I will drive 12,000 per year x 10 = 120,000 miles

- Under the buy option, I am saving 43 cents per mile ($1.01 for the lease option – 0.58 for the buy option (including the trade-in at the end))

- 43 cents x 120,000 = $51,600

- The money in the S&P fund could be more than my savings on buy and hold.

Say that again…

That was a bit of a diversion…let’s slow down. The buy option is the most cost effective option at 58 cents a mile (with trade-in at end) v. $1.01 per mile with the lease. Over 120,000 miles, which is what we will drive in 10 years, that’s a $51,600 savings over leasing.

In 10 years we need to lease 3.3 times since we lease for 3 years and we need a car for 10. So that’s over $100,000 out-of-pocket compared to the one time out-of-pocket for the buy and hold.

Investing the $362 difference and leasing could be a way to get that new car every 3 years and save money over buy and hold. Could is important. The S&P 500 with dividends reinvested has returned around 10% per year on average over the last 100 years. That’s a pretty good track record but no guarantees.

Wrap-Up

It’s important to understand cost, especially with a big purchase like a new vehicle. Looking at the numbers here, we will pay less by buying and holding for 10 years, but we could get the same vehicle for a much lower monthly payment by leasing.

Hopefully you are all now saying AH HA! This is how they getcha.

I was a car salesman for a while. I still have friends who sell cars (though I lock up my cash when they visit – just kidding Randy). Most of them are trying to earn a living while trying to help us. “Hey Brian, I know you want that 530 and you can’t afford the $1,127 per month to buy. How about if we lease the car and your monthly payment will be $765.”

Win-win for everyone. He got a sale and I was able to get the car I wanted for $362 less every month!

It takes some work to sit down and figure out that if I have to enter a new lease agreement every 3 years, and that over the next 10 years I will be paying thousands more.

When we’re sitting in the dealership and all of these alternatives are coming at us, it’s hard to consider all the factors. This is why the deal is often good for today-only.

Take a pause. Have the salesman or the finance guy write it down and go home and do your math.

Let me know what you think.