Buying a car can be stressful. Let’s talk about some steps we can take to make this a more positive experience.

My sister in law is in the process of buying a car. I am one of the few who finds this process exciting. Most people that I know dread it. She’s no exception.

In full disclosure, I sold cars for a short while after I retired. Read on, maybe I’ll share some of the car guy secrets.

Why is it so Awful?

My friend Rich has recently bought 2 cars. Both experiences were less than ideal for him. We have coffee every Saturday and he describes the nightmare visits to car dealerships. Every dealer tried to get them to come in and sit down. It’s as if getting you inside and sitting, it will be harder for you to run away. Once inside, a salesman insulted him and his choice of vehicle.

Rich’s wife is concerned about safety and told a dealer she liked the car they had test driven but wanted one with a blind spot monitor. The dealer waved them in close like he was sharing a secret. He says “You go to Walmart, they sell a mirror you can stick on. It’s just as good”. Who treats people like this?

While I have had many good experiences with car dealerships and car salespeople, I still hear a surprising amount of stories like Rich’s

Am I Getting a Good Deal?

This is the biggee, right? As a car shopper, we are plunking down a huge amount of money for us. The average new car price is now close to $50,000. And used car prices aren’t that far behind. Other than a home purchase, this is by far the biggest spending decision most of us will make. We’ll likely be taking out a loan, so that means we will be paying for this for 3,5, or maybe even 7 years.

We research. We compare makes, models, prices at different dealerships, warranty coverage and options. We do this so that we can get the best deal. Then we head back to the dealership and we have to negotiate the price, possible dealer incentives, options, accessories, trade in value. Once we resolve that, off to the finance office. Again we’re negotiating. 3yr v. 5 yr v. 7 yr loans, all with different interest rates. Add ons. Extended warranty, wheel and tire coverage, more incentives for certain financing packages.

Am I Getting a Good Deal?

Same question. It wasn’t really 1 negotiation, it was about a dozen little decisions and negotiations to get to one final price. And regardless of how well I’ve negotiated, I always wonder if I could have done better. So the answer to whether your getting a good deal is “who knows?”

Level the Playing Field

The good news is there are some things you can do to make the process work in your favor. Because the process is not in your favor starting out. How often do you buy a car? The car salesperson goes through this negotiation several times a day. He/She has the home court advantage.

Dress for Success

This may sound silly, but I always feel a little bit better when I’m dressed up – more confident. You don’t need to go out and rent a tux or buy a new dress, but look professional. For me, I feel more confident, and it will almost assuredly improve the way you are perceived and treated.

Make a List

Early on in my management career, a woman on my team told me that it drove her crazy that every time she came to me with a problem, I’d tell her to go make a list. I stand by the list-making, but I’m happy to report my emotional intelligence improved over the years and this is no longer my go to move. Lists however have power.

Here’s how to start your list. Research is easy. All car manufacturers show their cars, options, prices (MSRP – Manufacturer Suggested Retail Price) on their websites. They often have a build-your-own feature where you can choose color, interior, packages and options and see the price for each.

For each vehicle you are interested in, make a list.

- Must have features – beyond 4 wheels an engine and doors, are there things that would sink the deal for you. List them and be ready to walk away if you can’t get them (like the blind spot monitor).

- Interesting features – things you don’t really need but you’d be willing to have if they came at a lower price point. We’ll talk more about these in a second.

- Features you don’t want – Whether they are wildly expensive and in your opinion, unnecessary, or you really don’t want them in your vehicle.

You should now have a solid list of the features and the MSRP for the vehicle you want.

Now you can start to think about what you’re willing to pay. You know the MSRP, what would be a good deal for you?

Calculating a Used Vehicle Deal

Calculating what a deal looks like on a used vehicle is a bit easier. A site like cars.com has fantastic search features. You can select the model years you’re interested in, mileage, color, features and price range. You can look locally or nation-wide. This will give you a good idea of what the vehicle you’re looking for is worth.

Cars.com also has some very helpful tools that you can see after clicking on most cars

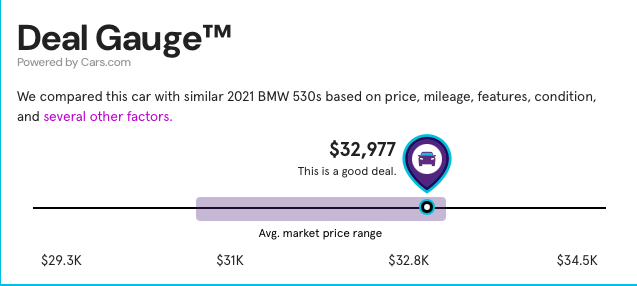

Deal Gauge

The deal gauge compares this vehicle’s price with similarly equipped vehicles. Under the several other factors link, it tells you all the items used in the comparison. One of the key items is supply and demand. This is hugely important. During the height of covid, a friend of mine who was still selling cars told me that he was constantly facing the ire of customers because many used vehicles were selling for more than they cost brand new. One woman found the original sticker price in the glove box and inquired why a 2 year old minivan cost $2,000 more today than it did new. Unfortunately supply and demand can do crazy things to consumer prices (try buying bacon today, you’ll see what I mean). The deal gauge factors this in for you. How cool.

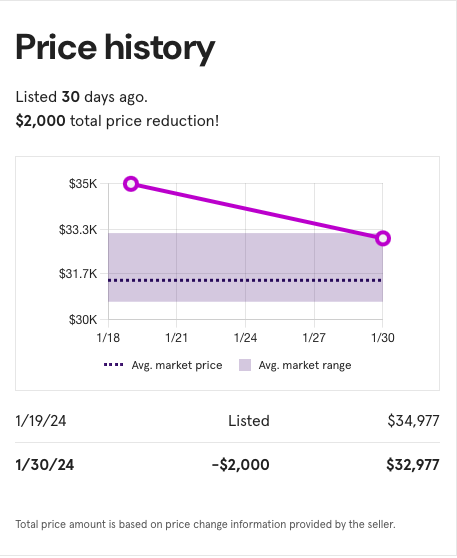

Price History

Even more cool than the deal gauge…Look at all the important information that can help us determine the price we would be willing to pay. This vehicle has been on the lot for 30 days. The dealer is probably itching to sell this. The dealer wants to clear this out to make way for new inventory. The price has dropped once, and that was a few weeks ago. The dealer may be open to a lower offer.

Calculating a New Vehicle Deal

I have not seen the deal gauge or the price history consistently on new vehicles on cars.com. I haven’t found a vehicle with the deal gauge, and the history seems to show on some but not all. There are other ways to find the info. A Carfax report should tell you, or you can ask the dealer. But, this can be a less precise process, because supply and demand can really move the price. My friend Tony bought a Hyundai Santa Cruz during covid. Even with lots of shopping and negotiation, he payed more than MSRP. This was a brand new model in high demand, and it was hard to find.

What are you Willing to Pay

With these inputs, decide what you are willing to pay. What does a deal look like to you. If the vehicle is new and in high demand (this especially happens when a vehicle comes out with a new design and new features), a deal may be MSRP or slightly higher. If it is used and there are lots of similar vehicles out there, and you’ve seen some that have been on the lot for a while, you may want a healthy discount. Think about what a good deal would be. What would make you happy? Come up with a number and write it down.

Interesting Features

I told you we’d get to this. It took a while, but it’s worth it. If you get to a point where you can’t get to a price that makes you happy, maybe you can ask the dealer to include an item or 2 from this list.

My wife nailed this a few years back. She was looking at several used convertibles. She ended up walking out with the vehicle she wanted in the color she wanted and she brow-beat the dealer into throwing in all-weather floor mats, a wind deflector (which is amazing – you can carry on a conversation in normal tones while driving on the highway with the top down…who comes up with this stuff?) and got them to agree to fix a small ding and repaint the door. Sometimes stuff that the dealer already has, or labor that doesn’t cost them out of pocket can be an easier negotiation. Have a list.

But Wait, There’s More

So, that get’s us through the shopping and negotiating a vehicle price, we think we’re done, and we get whisked off to the finance guy. Here we’ll get the hard sell on using their finance options, and all those other items to “protect our investment.”

Get Your Financing in Advance

Even more important than dressing professional…Show up with financing in-hand. If you’re paying cash, this is easy. If not, go to your local credit union or a bank with which you do business, and get a line of credit for the car purchase. Typically, they’ll be able to approve you up to a certain $ limit, provide you an interest rate and give you some documentation to prove it.

You’ve now taken control away from the dealer. If the dealer offers a better rate, or some other incentives that make it less expensive to finance there, by all means take them up on their offer. If not, or you’re not sure, stick with the offer you came in with. The dealer may offer financing incentives, but be sure you are comparing apples to apples. You will pay more total interest on a longer term loan than a shorter one.

Protect Your Investment

This one drives me up a wall. Very few cars are an investment. An investment is something you buy with the expectation it will grow in value over time. Very few cars do.

That said, it may be worthwhile to insure yourself against catastrophic loss. We all have different versions of catastrophic loss. If you’re paying a steep new auto loan and your budget is tight to begin with, your threshold for catastrophic loss could be quite low. An extended warranty could be a worthwhile purchase. Read the fine print. Make sure it covers the critical components. Know where you can get the repair work done (can you go to your usual repair shop?) and how you’ll get reimbursed. Or better yet, many will reimburse the repair shop directly. You can buy these plans on your own. Compare the best of these with the dealer’s plan. See some plan comparisons here.

You may also be offered a ceramic coating to protect the surface, wheel and tire protection which will cover those expensive items if you hit a curb or have a blow-out. These items may be attractive to you, maybe not. Decide in advance and stick to your guns. I can count the number of tires I’ve had to replace for a blowout on 1 hand and only use half the fingers. I’ve hit some curbs and scuffed some rims, but I feel it adds character. It’s a personal choice, decide before you go in.

Recap

Buying a vehicle can be stressful. While there are a lot of great car dealerships and car salespeople out there, I continue to hear friends and family talk about bad experiences. If you find a good dealership or salesperson, stick with them, but whether you like them or not, come prepared.

- Dress to feel confident and look professional

- Do your homework and bring your list – on paper

- Have a price in mind – what is a good deal for you

- Have financing before walking in to the dealership

- Have a position on additional features like ceramic coating, extended warranties or wheel insurance plans

This is always a heated topic. Please share your stories. We’ll accept helpful or funny, or both.

Informative article. It seems car salespeople work hard to keep their reputation. Everyone has a story, or two.

A third negotiation point is trade in value.

Your best advice is do your homework so you are informed. Know the average selling price, interest rates, and trade in value ahead of time.

I like to figure out a monthly payment range I can afford, with or without trade in. (KBB.com gives trade in versus private sale prices.)

Be ready to walk away.

In the end, know what’s going to make you comfortable and stick to it. And don’t let someone tell you they would’ve gotten a better deal.

Thanks for the response. I totally agree. Great point on the trade-in. Have all of your info and put it down on paper and carry it in with you. And you’re right…car dealers do this every day so we’re no match for them. We need to do our research and make our decisions before we go to the dealership to put us on a more level footing. Thanks!