If you read only 1 article on this site, please choose this one. Compounding is the magic that will enable you to grow your wealth over time. Understanding how compounding works will help you to envision how your wealth can grow over time. Knowing this will help you stick with a regular saving and investing approach which will build wealth.

Interest on Interest

Simply put, compounding is interest on interest. Let’s take a simple example to demonstrate the concept.

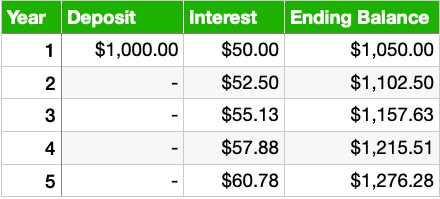

You’ve got $1,000 burning a hole in your pocket. You make the smart move and rather than buying a boatload of scratch tickets, you run to the nearest bank and open up a 5 year Certificate of Deposit (CD) that pays 5% annual percentage rate (APR), compounded annually.

As we know from previous posts, a CD is a fixed income product. That means it has a fixed interest rate – for our CD, that’s 5%, and it has a fixed duration – again, for us, it’s 5 years. So let’s look at what happens after we plunk down our $1,000.

During that first year, nothing happens….but wait. At the end of our 1st year, the bank calculates 5% interest on our $1,000 investment ($50) and credits that to our account. We now have $1,050. Continue to be patient. At the end of year 2, the bank calculates 5% interest on $1,050, and credits you $52.50. Your balance is now $1,102.50. Let’s look at a table to see how this grows over 5 years.

You started with 1,000 investment, and you ended with $1.276.28. That’s an increase of $276.28, or 27.62%. Compare that to a simple interest (non-compounded) 5% x 5 years = 25% return.

Al & Peg – the story of 2 savers

Now that we understand how compounding works, let’s look at how compounding can supercharge your retirement savings.

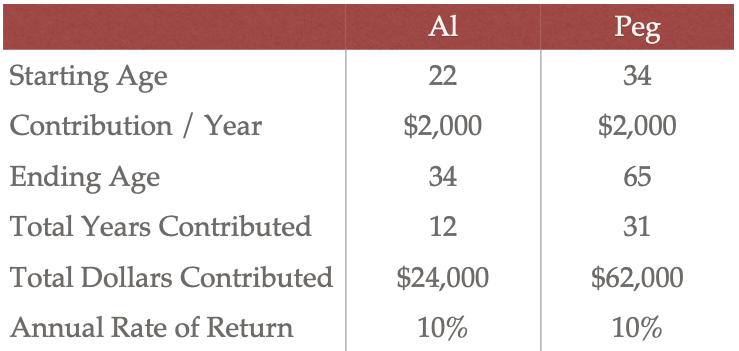

Let’s look at 2 savers – Al & Peg.

- Al begins contributing $2,000 per year to his savings at age 22

- Al invests his savings in an S&P 500 index fund that earns a 10% rate of return per year

- Al stops contributing at age 34 when his daughter Kelly is born

- Al’s savings continue to grow even though he no longer contributes

- Peg parties like it’s 1999 and doesn’t begin saving until age 34

- In order to catch up with Al, Peg contributes $2,000 per year until she retires at age 65

- Peg earns the same 10% rate of return per year

Here’s a table to compare their savings habits:

* The S&P 500 has returned roughly 10% per year with dividends invested over the last roughly 100 years

The big question. Who has more at age 65?

Peg puts away more money – $62,000 v. Al’s $24,000. With 31 years of compounded growth, Peg ends up with the healthy $442,503.09.

Al, however, wins. Even though he invested less of his own money, by starting early and letting that compounding grow and grow, Al ends with $993,306.59.

How is this possible? While Al stops adding to his principal, he continues to get 10% return added to his balance each year. This 10% return is $200 in his first year. Not bad. But in his final year, at age 65, his return is $90,000 for just one year.

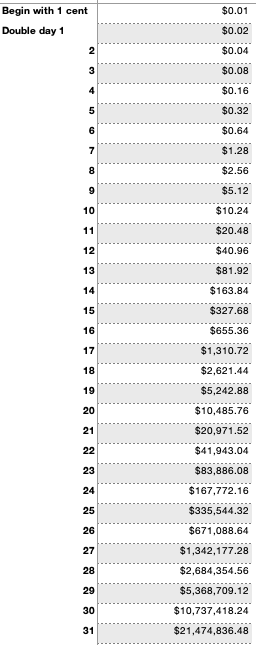

Penny Doubling

There is a similar demonstration of the power of compounding. A person is asked: “Would you rather have $1 million, or would you rather start with a penny, and have the value double in value every day for a full month?” See below for a demonstration

You’ll notice that early on, the results aren’t all that impressive, but as you start getting into large numbers, the effects of compounding are huge.

The key take-away here is that time is critical. Al started early, and even though he stopped adding new money, over the 40+ years between age 21 and 65, the growth was enormous.

How does compounding apply to me and my investments?

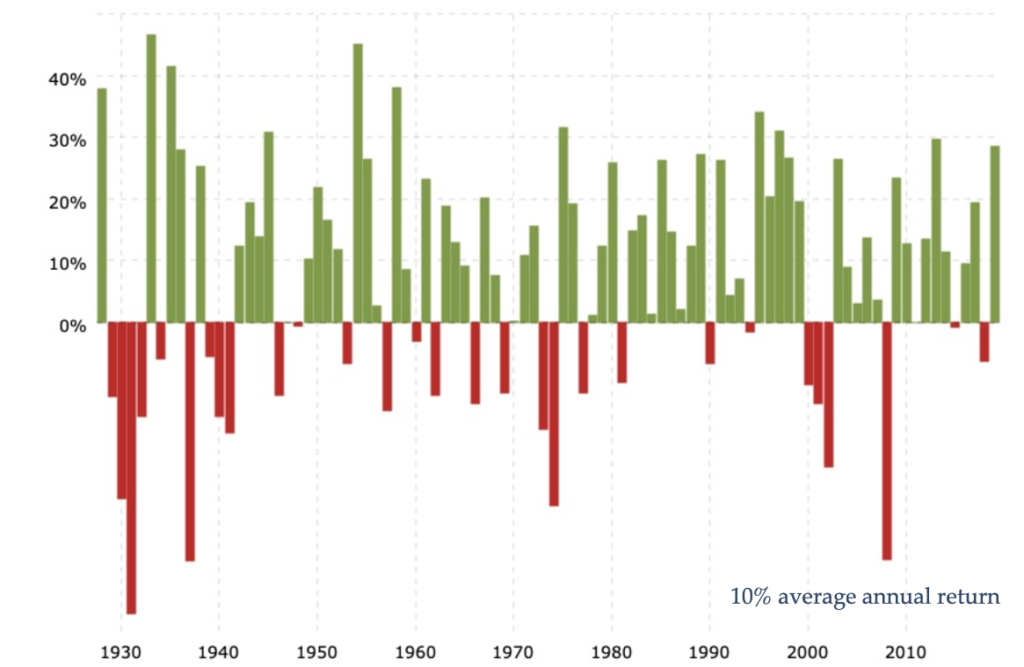

The big question you’re all asking is “how do I know the S&P 500 market will grow at 10% a year going forward?”

You don’t.

First, while 10% has been the average over the last 100 years, it varies greatly year by year. See the chart of S&P 500 yearly returns below thanks to the good people at NYU

Second, we don’t know – it could be 10%, it could be 2%, it could be 20%. The way I think about it is that the S&P500 is an index of the 500 largest US companies. It contains Amazon, Apple, Microsoft, Walmart, Home Depot, Fedex, General Motors, Starbucks, McDonalds, Coca-Cola, and lots more.

The bull case

We seem to keep having babies. That’s good for Proctor & Gamble and Kimberly Clark that make diapers and formula. Also good for Walmart and Target that sell them along with car seats and carriers and all the other stuff that babies need. I sat at Starbucks last week and saw an astounding amount of $8 drinks go out the door – not one looked a thing like a coffee. It seems that any time of day, there is a line at the drive-through at my local McDonalds. And I can’t drive down the street without swerving to avoid an amazon van pulled over to make a delivery. This tells me that our economy is continuing to grow. Now this is very imprecise. I supplement my “boots on the ground research” with listening to a few earnings calls, and finding a few investing websites and podcasts to follow. This helps me get a good feel about what businesses are projecting for their own, as well as the US economy’s growth.

Wrap-up

Back to compounding. The CD example above is a simple demonstration of the concept. The Al & Peg story and the penny doubling demonstrate the magic that happens with compounding over long periods of time. It would be great to be the Youtube guy that made a million overnight on bitcoin, but the odds are long on this. With compounding and time, the odds are strongly in your favor.

* There are plenty of compound interest calculators out there – go to Google and search if you’d like to verify the Al and Peg numbers or if you want to forecast the impact of your own savings over time.