I use the term conviction quite a bit when I talk about evaluating companies. Before I choose to invest my hard earned money a company, I want to have conviction, but what does that mean?

According to dictionary.com, conviction is a fixed or firm belief. It’s the act of convincing a person by argument or evidence. I like this. If you read my post on creating an investment thesis, I talk about the research we need to do in order to provide the arguments and evidence required to convince ourselves that an investment idea is an appropriate one for us.

I’ve thought a lot about this recently in regard to my investment decisions over the past several years and I realized that I’ve veered off-course a bit with some of my decisions. This started in 2018.

What Happened in 2018?

2018 was an unremarkable year in the stock market. The S&P 500 ended down for the year after many years of gains, so that was significant. It was also the year I began thinking about retirement. I decided I needed to change my investing strategy somewhat to move away (slightly) from growth stocks and have a larger percentage of my equity investment in income producing stocks (stocks with a high dividend yield).

This was a good idea, but my execution was flawed.

I looked at a lot of high dividend yield companies and then tried to make a case for why they might be a good investment. I didn’t look at the other side – why they might be a bad investment.

Conviction

That’s not to say that I wouldn’t have bought them. I may have decided to buy them anyway. At the time I bought shares, lots of analysts rated these companies a buy. Who am I to second guess the experts?

The problem, for me, is that I had no conviction towards these companies. They looked like an OK investment. They paid a high dividend yield. I expected some would increase in value and others would decrease, but I’d get a steady stream of income.

I extended this thinking to some of my stock picks. I used Appian’s software at work. It was groundbreaking. Non-technical users could configure an application using Appian’s software without having any coding skills. I read a few articles and bought shares. Same thing for Carmax. I worked there and liked their approach to selling cars. I still do. But, is this in itself a reason to buy?

I lacked conviction. For Apple, Amazon and Netflix, I had conviction. I read about them regularly. I was interested in their products and technology so I hunted for articles. I wanted to see how Netflix was transitioning from DVD by mail to streaming. I wanted to see how Amazon was building AWS and then a logistics company. I was always watching Apple’s next iPhone launch. I was looking at the product and technology announcements and comparing them with business results.

Lack of Conviction

I did not have that same conviction with a number of other companies, including Appian and Carmax.

Conviction and Investor Behavior

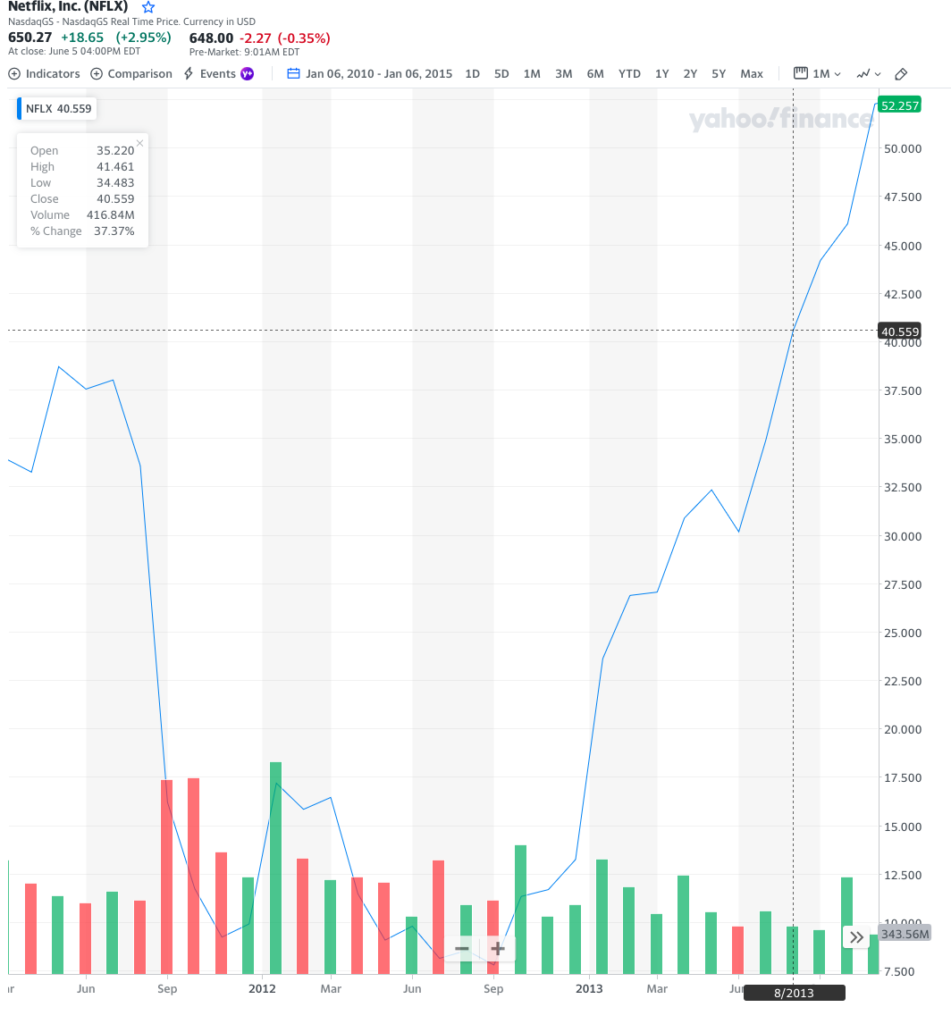

Netflix has a black mark on its history known as the Quickster Debacle. The company announced that it was splitting off its legacy DVD by mail from its new streaming business. Chaos ensued. Netflix responded to the uproar and quickly killed quickster, but the effect on its stock price was huge. A picture is worth 1,000 words.

I bought more shares of Netflix in 2012. It was clear to me that Netflix was a great company. Quickster was a debacle. It was a poor decision poorly implemented. But my conviction in the business caused me to buy more shares rather than question my logic in investing.

Same with Amazon after every earnings report 15 or 20 years ago. Investors would get excited about new technology, new business, warehouse automation…the news was filled with Amazon success stories. Then at quarterly earnings release, once again we’d see the company spending all the money earned on new ideas and none flowing to the bottom line. Again, this was an opportunity for me to buy more shares at a 10% or 20% discount. Conviction.

Easterly Government Properties

Easterly Government Properties; ticker DEA. Another not-bad idea. It’s a REIT that rents properties to the US government, a pretty stable and dependable tenant. It also pays an 8.72% dividend. That’s a pretty good story, I’ll buy some.

Can it continue to pay that dividend? Is it renting more space or less? Are its margins improving or deteriorating? I didn’t look closely so I can’t tell you. My approach was to buy a basket of high yield securities that would provide a regular stream of income with low-growth.

Was My Approach Valid?

Actually, it wasn’t a bad approach. My expectation was low growth. Some companies like DEA saw their stock price drop, some saw gains, but whether they went up or down, each paid a quarterly dividend. And that’s what I wanted. I thought.

It’s easy to say that was my approach, but when one or more of the companies that make up that basket of high yield securities is down 30%, my perspective changes. A 30% drop wipes out 5 or more years of dividend payments. Could it drop further? Wait a minute. I never really believed in this company in the first place. Maybe I should sell and put the money in a better investment, one in which I have a high level of conviction? Or maybe buy a low-cost S&P 500 index fund.

I Sold

In January, I decided to sell some of these companies. I wrote a post about it here.

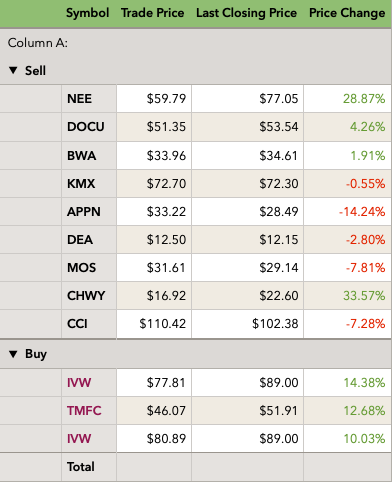

I did a little experiment when I sold. I took the proceeds from the sale and bought shares of 2 index funds. IVW tracks a growth-focused version of the S&P 500, and TMFC follows an index of Motley Fool stock picks.

Let’s see how they’ve done since I sold.

The table above shows the companies I sold, the price I sold at, the most recent closing price, and the % change in price since sale. In the lower section are the index funds I bought. IVW shows 2x because I bought on 2 different dates at different prices.

NextEra Energy (NEE) is way up and Appian (APPN) is way down. The index funds have done better overall.

What Did I Learn?

That’s the important thing, right? What did I learn from this?

Conviction is a must. It’s only been 4 months, so the numbers don’t mean a whole lot, but the fact that I didn’t see a 30% drop in the stock price of these companies as a buying opportunity means I probably should not have bought shares in the first place.

I will not always be right. Last year as I was basking in the glory of a $0 electric bill after installing solar panels, I researched a company called Enphase Energy (ENPH). The idea came from researching which inverters to buy for my panels. Enphase seemed to be the clear winner. Next came the assessment of the business of Enphase. I liked what I read and I bought shares in June of 2023, watched them drop 15% in a month and bought more. Today, the first purchase is down 30%, the second is down 12%.

I have a high level of conviction towards this purchase and I’m holding the shares I have. I have not bought more shares because I have a limit on how much money I’ll invest on a new unproven idea.

What Did I Do?

As I’ve been thinking through this over the last few months, I’ve read the annual reports for companies whose shares I own, that were on my low-conviction list. See here and here for some thoughts in reading company annual reports. Some like Fastenal moved to high conviction, some like Crown Castle moved to lower conviction and I sold my shares to focus my energy on high conviction companies.

Wrap-Up

Conviction is important. It allows me to hold tight when the going is rough and to have the confidence to buy more shares when there is a pull-back. Conviction comes from knowing the company and the people who run it. I know a lot about Apple, Amazon and Netflix. I’m interested in the companies and the folks who run them and probably read something about each at least once a month. I match technology and product results to business results. I do this because I’m interested.

If I find I’m not doing this with a company I own, maybe I’m better off not owning it. It never hurts to have more shares of a low-cost S&P 500 fund.

Let me know what you think.