One of my first posts was on credit cards. I love using credit cards for the convenience, the rewards and for the automated transaction monitoring and alerts. Using credit cards also gives me an inventory of all my expenses, which I wouldn’t get by using cash. I can better track where my money goes.

Credit Cards, however, are a double-edged sword. The interest charged on balances and the late fees can easily eat into any savings we may have. I recommend reading the post here, to better understand how credit cards work, the benefits and the risks.

Rewards

I spent a period of time where I was getting a new credit card every few months in order to get travel rewards. Sometimes it was airline miles, sometimes free stays at hotels, or even rental car points. My wife and I took some inexpensive trips using the rewards from these cards.

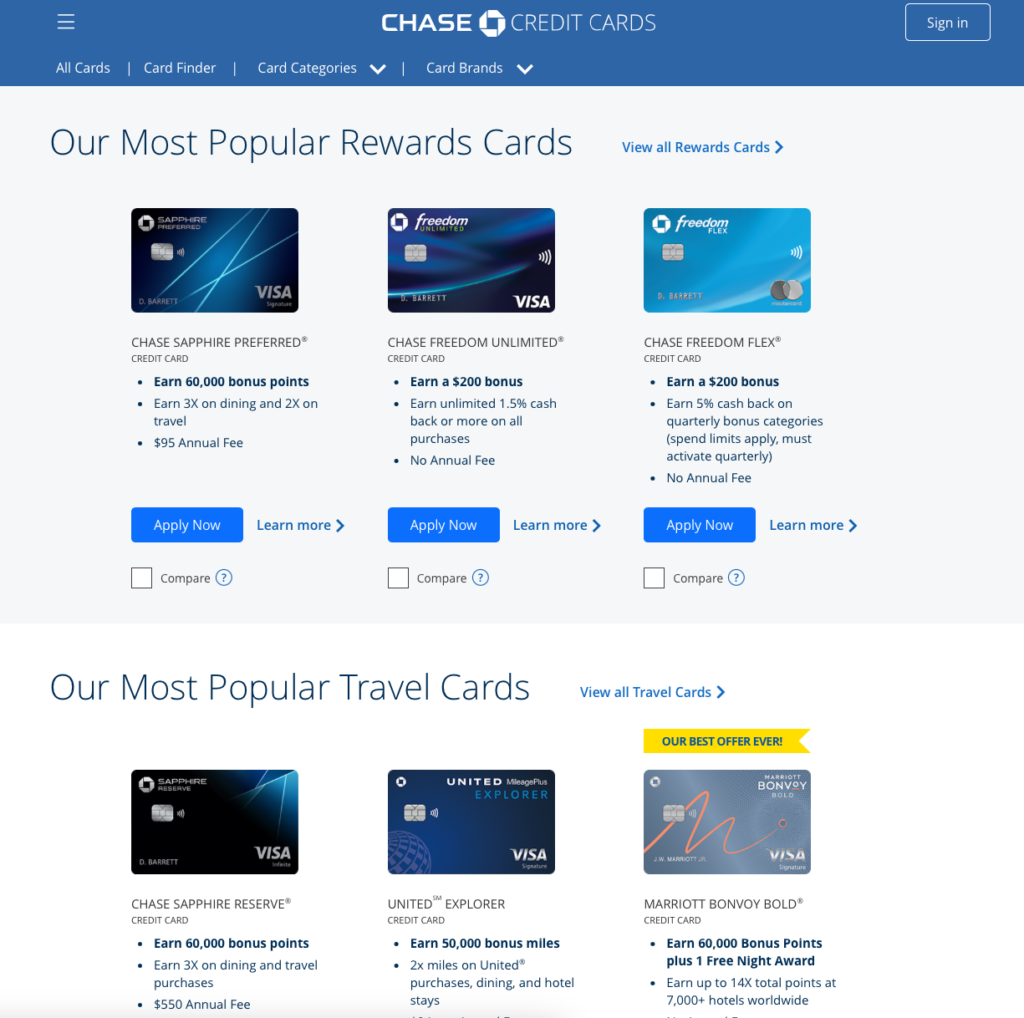

The cards tend to advertise the big rewards. If you go to the Chase site, you’ll see:

My current cards are:

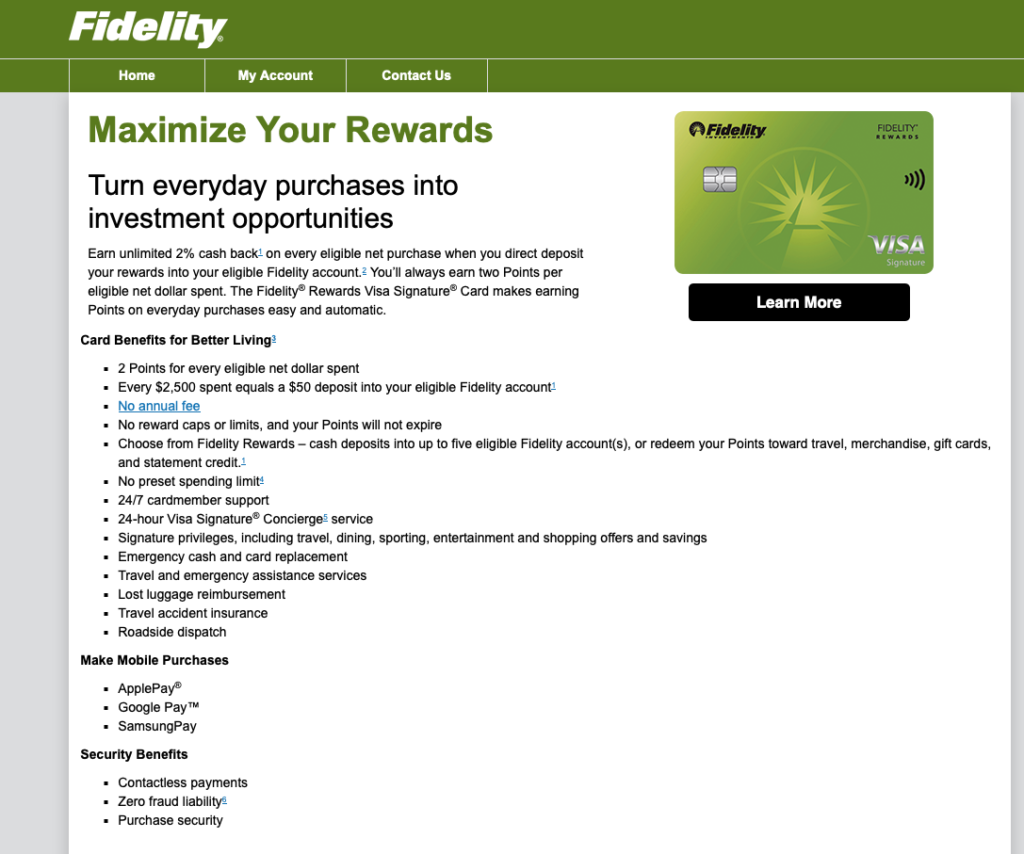

- Fidelity Signature Visa – this is my primary. I get 2% cash back on EVERY purchase

- Wells Fargo Active Cash – my back-up. Also 2% cash back

- Discover It – for special rewards. Every quarter they announce a category that gets 5% cash back. I use it only for the 5% deals

- Amazon Prime Visa – we’ll talk more about this in a minute

Headline Benefits

For my Fidelity Signature Visa, the headline is the 2% cash back. This is awesome. I put everything on my card so I get a mystery gift deposit into my account every month. Last year, it was hundreds of dollars. This goes into my brokerage account and I invest it.

The headline benefit of 2% cash back makes the card worthwhile.

But Wait, There’s More

I had to do some hunting for the other benefits.

I found this page:

I tried the concierge services once and was not impressed, but you can call the number and have them help with travel arrangements, restaurant reservations, concert tickets or other items.

Roadside dispatch works like AAA. They’ll dispatch help to you, but you’ll need to pay for services.

Your card probably has lots of benefits like this. Some may be worthwhile.

For the Fidelity Signature Visa, the big benefit I found was the free Norton Lifelock coverage. I had to do a lot of digging to find this. You won’t see it on the page above.

The standard Lifelock plan costs $11.99 per month. Now, I probably wouldn’t have bought the plan on my own, but I like that I can add my name, SSN, emails, credit card #’s and account numbers and Norton will continuously search for breaches related to them and provide me with a report. I typically ge a monthly email saying everything is OK, but this month I was notified that I was part of the National Public Data Breach.

I’ve also used the rental car insurance benefit on this card, and saved some money when someone hit my rental car, but I believe that benefit has been removed.

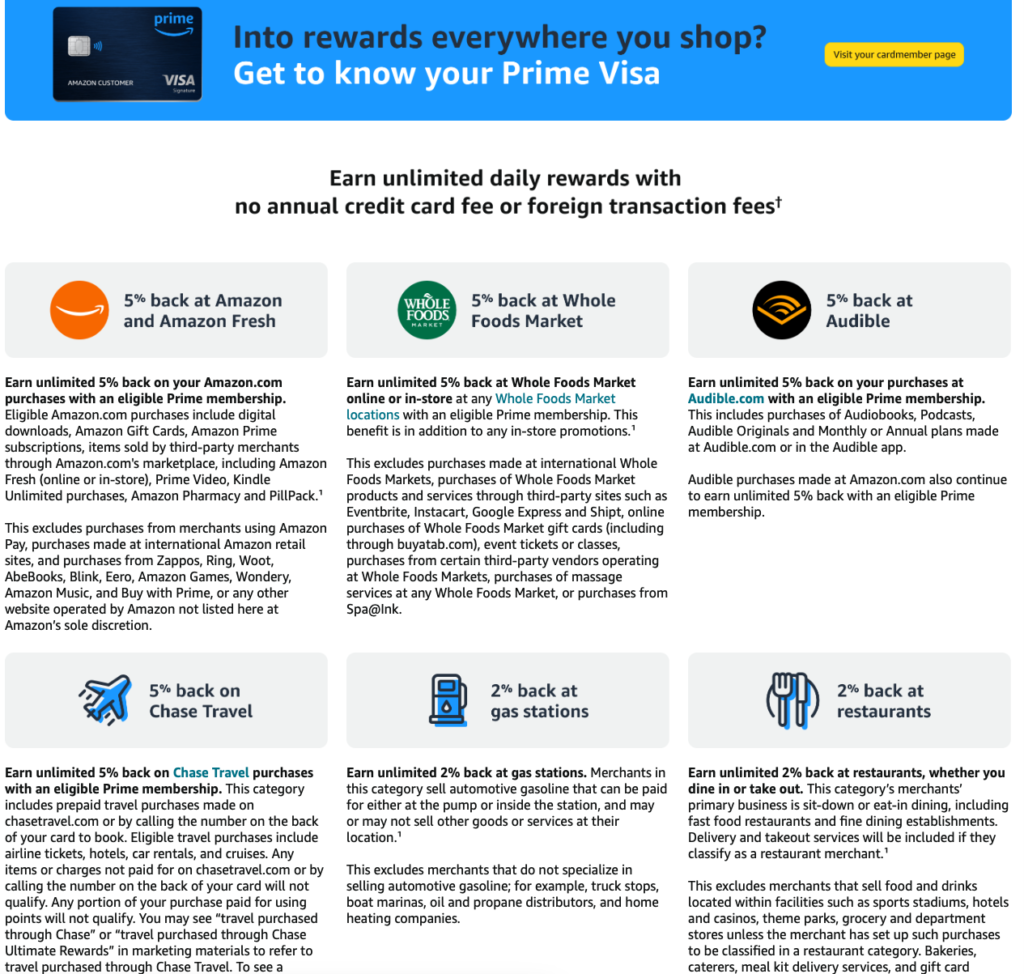

Amazon Prime Visa

Amazon Prime Visa has a ton of rewards. The biggee is the 5% off at Amazon and Whole Foods. I buy everything at Amazon. the 5% cash back reward more than pays for my annual prime subscription. Not only do I get prime Visa rewards, I get the Amazon prime rewards like Amazon Prime Video, Amazon Music, free Grubhub (yes it’s free to prime members, who knew). Read here for a full list. Prime is a fantastic deal if you take advantage of all the benefits.

Back to the Prime Visa. Check this out:

I couldn’t fit the whole page, but beyond the headline 5% cash back, you have:

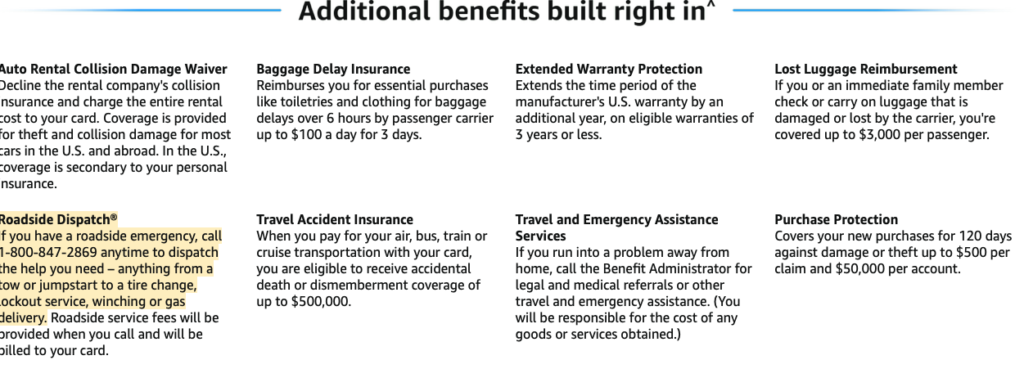

Here’s the rental car coverage. The signature Visa dropped it, so when I rent a car, I use my prime Visa. Extended warranty is cool. Buy something with the card and get an additional year of warranty. Cool. I’ve never known anyone to use this. Most people don’t know it’s there.

Wrap-Up

First of all credit cards can be dangerous. If we maintain an outstanding balance and pay interest at 29% Gulp! and we pay an occasional late fee of $35, we will eat up any savings that the rewards provide.

However, if we pay off the balance each month and we use auto-pay to pay on time, while monitoring payment amounts to ensure accuracy, we could get some huge savings.

With Prime Visa alone, we could cancel Netflix and use the free prime video, and we could cancel apple music and use free amazon music. That alone could save us $30 or more each month.

While these aren’t necessarily hidden rewards, they are often lurking in dark places so you’ll need to hunt a bit to find them.

My daughter and her husband work from home and while visiting, I noticed on several days they used Grubhub to order lunch. Not too long after, I was reading that Amazon Prime added free Grubhub to its long list of perks. I told Jess and she told all her friends. This saves them a few bucks on every delivery.

Let me know what you think, and share any exciting perks you’ve found.