About 5 years ago, I started helping my mom with her finances. She asked me to help, not because she was concerned about her investment performance or because she was uncomfortable making investment decisions on her own, she asked because she was constantly getting a pile of fund prospectuses on her doorstep.

Seriously, the thing that raised her concern was the amount of “junk mail”.

What’s Going On?

My first thought was that this was a mistake. Something had gone haywire in the system causing it to send her the same stuff over and over. My mom’s accounts were with a very reputable large company and she had signed up for an advisor to manage her investments. Something seemed strange.

I took a look at her portfolio and I was shocked to see how many mutual funds she had – there were dozens.

I then noticed that there was a good amount of trading going on…swapping one fund for another and adjusting allocations amongst funds.

While this wasn’t alarming in the sense that she does not pay for trades and there are no commissions involved so I know this isn’t costing her money directly, but it was concerning that there was so much movement.

And the prospectus mystery was solved. The fund company is required to send a prospectus for a new position in a fund. There were lots of new positions, so lots of prospectuses. Bad news for her mailman who has to schlepp these things to her doorstep.

Diversification

Any of us who have done any reading on managing our own investments has likely come across the term diversification. Basically it means don’t put all of your eggs in one basket.

I my opinion, if you stick with my definition above, you’ll be much better off than if you use a more industry-standard definition. We’ll talk about why in a bit. Stick with us. It’ll be worth it.

Here’s what Investopedia has to say.

It’s a really long article that gets into exciting topics like analyzing the correlation coeffficient and assessing standard deviation.

If you’ve just woken up after reading that last sentence, let’s catch you up. I believe diversification is, simply put, not putting all of your eggs in one basket. The investment industry will ask you to believe it is much more complex which will cause you to either.

- Give up completely and not invest

- Decide you need to pay a professional to handle this for you

I believe diversification is important, but I also believe it is not that complicated.

Don’t Put All Your Eggs in One Basket

We’ve all heard this expression a million times – usually from our moms or teachers. It’s a risk management strategy, and a good one. Put your eggs in multiple baskets. If you loose one basket or you drop a basket, you still have some remaining eggs in other baskets. Brilliant.

So, the Investopedia guys and I are pretty well aligned through their first 3 bullets.

We both believe in a wide variety investments in order to reduce portfolio risk.

I’ll say it again: Reduce portfolio risk.

A diversification strategy is implemented primarily to reduce portfolio risk. There is a secondary goal to ensure we take advantage of opportunities across the spectrum of investment classes, categories and regions, but we’ll save that for another day.

Today, we’ll talk about diversification as a means of reducing our portfolio risk.

Portfolio

We all have a portfolio. It may consist of a wad of bills tucked in our dresser or some money squirreled away in a high yield savings account, but that’s a portfolio.

Hopefully we’ve also got a 401k and maybe a brokerage account. You may own a house. That’s an investment and part of your portfolio. A house is something we buy with an expectation that it will be worth more in the future. Take a minute to think about where your money is invested. That’s your portfolio.

Just as a footnote, that new car you just bought is not an investment. Even though the dealer may try and sell you an extended warranty to “protect your investment”, no one believes that their new car will be worth more in the future. Shiny as it may be, it is not an investment.

Asset Allocation

The first step in diversification is asset allocation. You can read more about asset allocation here. Simply put, asset allocation is deciding how much of your portfolio will be in cash v. fixed income v. equity.

Cash is really good for paying our bills, but not so good for funding our retirement. We need an emergency fund to protect us from blowing our budget and savings goals, and we need money in cash to fund our monthly budget. Cash is important.

Fixed income does exactly what the name says. It is an instruments like a bond that pays us a fixed interest rate and then returns our full investment at some point in the future. They’re less volatile than equities, but they’ve historically provided a lower long-term return compared to equities.

Equities are stocks or stock mutual funds. With equities, we become part owners of a business. There is more risk, but more potential reward.

If all of my money is in my sock drawer or in a high-yield savings account, I have an asset allocation strategy. I’ve chosen not to invest in fixed income or equities. This may or may not be a good strategy, but I have one.

Asset allocation is an important first step in a diversification strategy. We protect the assets we’ll need in the near future by keeping it in cash. We use fixed income and equities for investments that we can allow to generate income and grow over longer periods of time

Geography

Bear with me…this isn’t the class from high school…we’ll make it quick and easy.

What happens if we have all of our equity assets in US companies and the US goes into a deep recession? The equity piece of our portfolio will suffer.

In the eggs & basket approach, it seems we’d want to spread our equity investment across the world.

This is a little more complicated so let’s talk about some key points. First off, as the world becomes more global, our economies become more and more aligned. Recently, when we went through skyrocketing inflation here in the US, a good chunk of the rest of the world experienced high inflation as well. In my opinion, this lessens the need to diversify geographically to lower our risk.

Secondly, companies themselves are more global. McDonalds, Starbucks, Amazon, Visa, Apple…almost every company in the S&P 500 (the largest US publicly traded companies) has a large presence across the globe. A lot of times we’ll see that companies are reporting that strength in one geographical region offsets weakness in another. These multinational companies have geographical diversification baked-in.

Thirdly, diversification is first and foremost a risk mitigation strategy (remember eggs & basket). We want to reduce the risk to our portfolio by making sure we have some variability in our holdings.

This week, South Korean stocks seesawed all over the place as martial law was declared, then it was suspended, then there was talk of ousting the president. Crazy stuff. While things seem to have stabilized a bit today, who knows what will happen next?

I Don’t Know Risk

The South Korea excitement was a complete surprise to me. I had no idea the country was in turmoil. This highlights a very important (to me) risk that is rarely called out by investment professionals. It’s the “I don’t know what the heck is going on” risk.

This is a real risk. After the US presidential election this year, the market went on a tear. Most of us in the US were aware that an election was taking place, and many weren’t that surprised about the market reaction because the market likes certainty and the market generally believes that republicans will create legislation that is favorable to business.

The point is we are here in the US – physically. We are getting information constantly about the US economy. I’m not as plugged in to South Korea or China or Burma. This creates a risk if I choose to invest in companies in those countries.

I’m not saying we should avoid investment outside the US. I am saying that we need to acknowledge the risk that we are likely less informed about the politics and the economies so we need to balance that risk with the potential benefits.

Mutual Funds

My comments about asset allocation and geography apply to mutual funds as well, but there are some extenuating circumstances related to funds.

Let’s go back to my mom. Holding a lot of funds with different names isn’t always diversification. While their strategies may sound different, take a look at the top 10 holdings. This is easy to find on Yahoo finance.

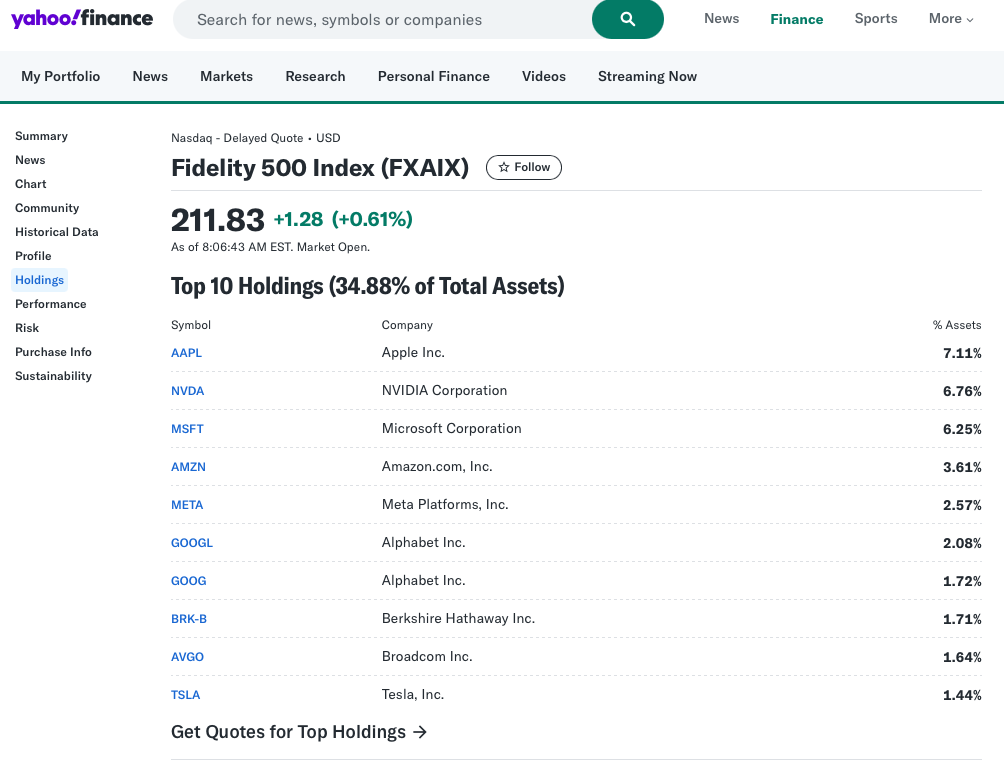

Here are the top 10 holdings for an S&P 500 Fund

You will see these same companies listed in the top 10 holdings of many of the most popular large cap funds and ETFs. My mom had quite a few funds that were invested in the same companies. Lots of funds does not necessarily equal diversification.

And the same geographical risk exists with mutual funds. While the fund may have a manager who is expert in that particular region, the fund’s prospectus may limit it to investment in that region. So while the fund manager may see risk coming, the fund must still invest only in that region.

Company Size

Investment professionals will almost always tell us that we need to diversify across company size. We need some small-caps and mid-caps to balance our large-caps. While I somewhat agree with this, I also want to be sure we balance this with the risks involved.

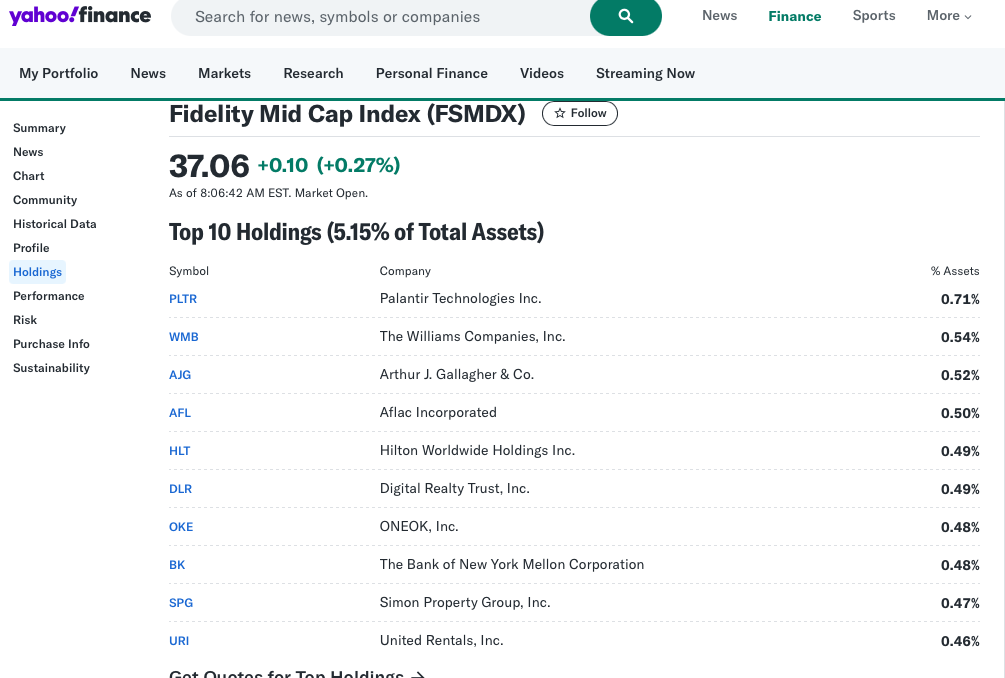

Let’s look at the I Don’t Know risk. Here are the holdings of a mid-cap index fund.

I see some companies I recognize. But how often do we see a headline on CNBC about The Williams Companies? How often do we see one about Apple, Amazon or Alphabet? Like geographic risk, there is a risk that it is more difficult to keep up on these companies. We don’t read a lot about them and we need to make a conscious effort to follow them.

I own shares of Aflac, and I hold shares of a small-cap and mid-cap index fund. My Aflac position is small and I haven’t read about it in a long time. I’m making a note now to refresh my thesis.

Remember the eggs & basket. A diversification strategy is meant to reduce risk, not necessarily to swap one risk for another.

Wrap-Up

Diversification is important to reduce risk in our portfolio. We shouldn’t have all of our eggs in one basket.

Our asset allocation strategy is our first step in diversifying across asset classes. Depending on our portfolio size and our spending needs and savings goals, we’ll need to proactively manage the allocation across cash, fixed income and equity.

Within each asset class, we may need to diversify. I love Amazon and it is by far my largest holding, but I won’t let it get beyond 5% of my equity portfolio. When Amazon hits a rough patch, and it inevitably will, I can’t have it wiping out a huge chunk of my equity investment.

I agree that we need to be diversified outside of the US. As the world becomes more connected and our US-based companies become multi-nationals, we see Starbucks and Proctor & Gamble getting a large portion of their revenue from non-US customers.

Many of our companies have geographic diversification built in. Same for our mutual funds. Check out the top 10 holdings and see where those companies get their revenue.

Every investment has risk. My biggest fear is the I don’t know risk because there is a lot that I don’t know. I believe that I can achieve diversification without getting myself invested in things I’m not comfortable with.

Diversification without assessing all risks is diworseification.