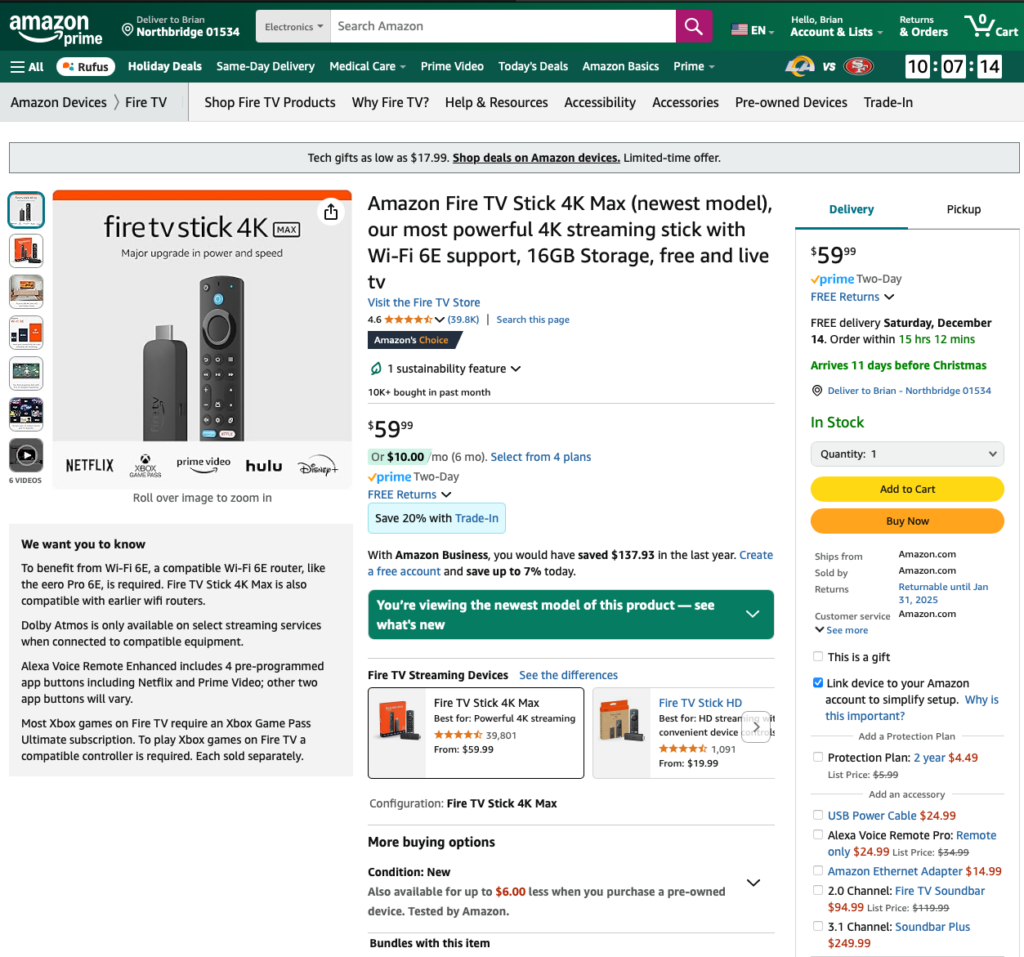

It seems like everything I shop for offers some sort of protection plan or extended warranty. I just booked a 3 day trip to Nantucket. Expedia offered me trip protection for about $50. I looked at the Amazon Fire TV Stick. It’s $59.99. I can protect my purchase for 2 years for $4.49, which is a deal, because it is usually $5.99.

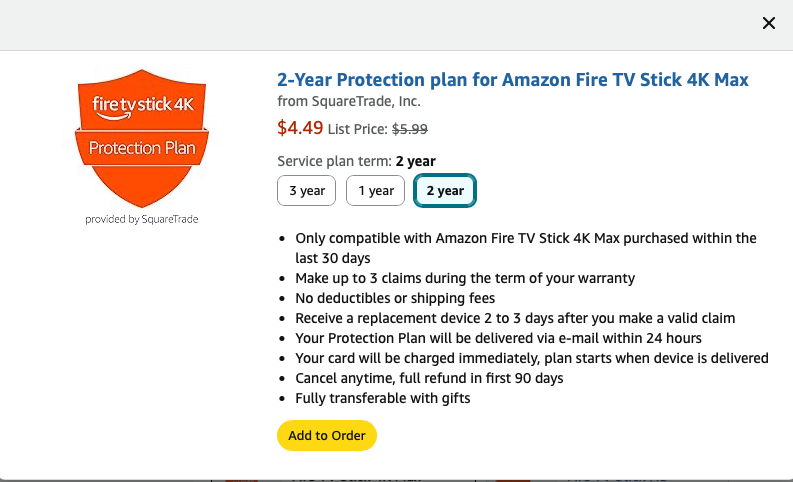

Here are the details.

Is This Worthwhile?

That’s the big question. $4.49 is not a lot of money. And for 2 years, I can get a replacement device within 2-3 days after a valid claim. Pretty sweet

Wait, What’s a valid claim?

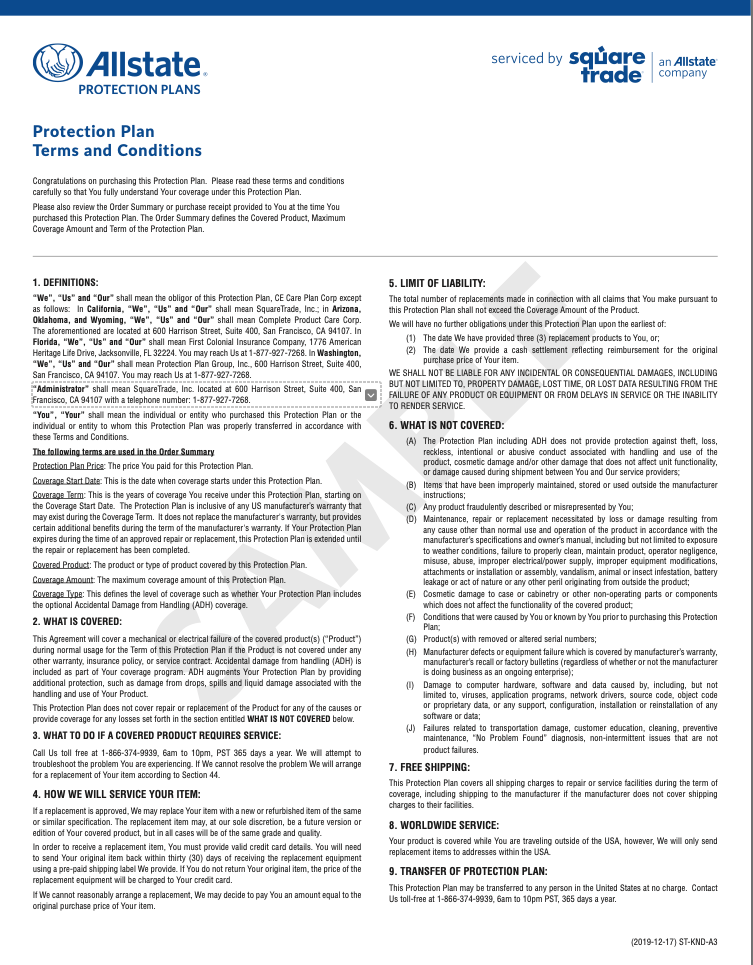

Read the Details Here

There are 2 more pages but I’ll spare you those.

But, Is It Worthwhile?

Not for me. Here’s why. This particular example is paying about $5 to protect something that costs $60. We’ll get to the value of that in a second, but most importantly, if we’re paying for protection, we want to understand what’s covered. Reading through this info, it is really hard to tell. I’m a fairly intelligent person, but there is a lot here. Should I have a lawyer review?

I’m being a bit facetious, but we shouldn’t even consider paying for something unless we understand what we’re buying. We’ll come back to this later. as well.

When to Buy Protection

My general rule is that if it is going to be impossible, or extremely painful to replace the item, and, it is something I really need to replace, then extended protection may be worthwhile.

In the case of the Fire TV Stick, I would be unhappy if it stopped working, but I could pretty easily afford another $60 to replace it. I could also live without it. I could watch TV on my phone or iPad. $4.49 isn’t a lot of money, but there are other things I’d be happier spending $4.49 on.

Insurance

I look at protection plans like insurance.

Many of us have car insurance. My wife and I pay over $1,500 per year to insure our cars. Over the past 20 years, we’ve spend about $30,000 on car insurance. We’ve had several car accidents, but only 1 was our fault. It cost $8,000 to repair, which the insurance company covered. So, we’ve paid $30,000 and go $8,000. Sounds like a bad deal.

But our experience is similar to most folks. My mom, my brothers, my daughter…none of us have had a big claim. We’re all paying for very little benefit.

But, what we’re really paying for is protection against catastrophic loss.

Catastrophic Loss

If my car were totaled, and I needed to replace it on my own, it would cost me about $40,000. If I decided that I could live without the BMW, but I had to have basic transportation, I could probably get by with about $20,000 out of pocket.

But either way, that’s creeping into catastrophic territory. I probably wouldn’t have to sell my home and be out on the street, but even $20,000 is many month’s worth of my budget. That’s a big hit.

That’s why I have insurance.

Do I Need Protection?

Protection is nice. Knowing that if I drop my phone and the screen cracks I can get a replacement. Or knowing that if my Fire TV Stick drops out of my pocket into a puddle, I can get a new one in 2 days.

But do I need it? That’s a personal question, but I feel like in either of these cases, I can live without. My wife and I are pretty careful with our stuff. My wife dropped a phone once and broke the screen and we paid $150 to get it fixed. In 15 years, that’s the only phone incident. Being careful is a good mitigation.

We are also in a place, financially, where we can handle the cost of a phone replacement, a washing machine repair, or a new Roku device without seriously impacting our budget.

And on the trip to Nantucket, that money is spent. It would be a huge bummer to miss the trip, but the insurance is an additional cost. If something unexpected happens and the trip is canceled, that’s a shame, but paying for insurance to get my money back doesn’t seem to make financial sense to me.

So, this is the thought process that I go through when considering protection.

But Sometimes It Is Worthwhile

I hate to pay for stuff I won’t use and insurance is a great example. Hopefully I’ll never have to use it, but I know that I need it to cover catastrophic loss.

In that regard, I do see value in some protection plans.

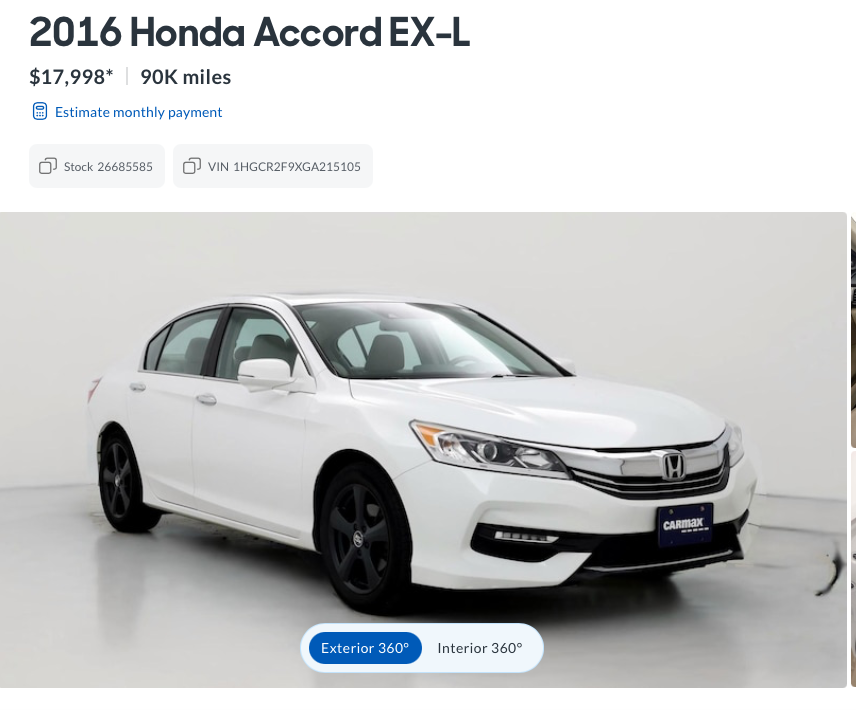

In my brief stint as a used car salesman, we offered extended warranties on many of the cars we sold. My daughter needed a new car and she came I and bought a 3 year old Jeep Grand Cherokee. It was a beautiful vehicle. Low mileage, well-maintained, but I encouraged her to purchase an extended warranty.

I don’t know the details of my daughter’s financial situation, but she’s in her early 30’s, married, 2 kids, has a home with a mortgage. She and my son in law both have good jobs.

What happens if the transmission goes, the infotainment system – which controls most of the vehicle – fails? What will it mean to her family budget if she needs to come up with a couple of thousand dollars for a repair on top of paying her regularly monthly car loan?

For many people, it’s just not possible to absorb an expense of this magnitude. In that case. it may be worthwhile to consider an extended warranty.

Mid-Term Wrap-Up

Just to quickly summarize where we’ve been. Protection plans are everywhere. We can protect our phone screen, our TV, washing machine, and our earbuds. often the cost is small dollars, but not an insignificant percentage of purchase price.

In addition, it can be challenging to determine what is actually covered, and the process for getting reimbursed.

We should all have a strategy for determining whether this cost is worthwhile. Thinking about things like the urgency of replacement, replacement cost and impact on our monthly budget can help us set that strategy.

Extended Warranties & Protection Plans

So, let’s say we decide to buy an extended protection plan. Whether it is for a vehicle or a dishwasher, ;et’s talk about the considerations.

Who Is Offering the Benefit?

This is the first question to ask. Carmax may be selling the extended warranty on the vehicle, or Amazon may sell you the protection plan on its website, but the issuer, the corporation that provides the benefits is often a different company.

If you look at the Carmax Warranty page and scroll to the very bottom, you’ll see:

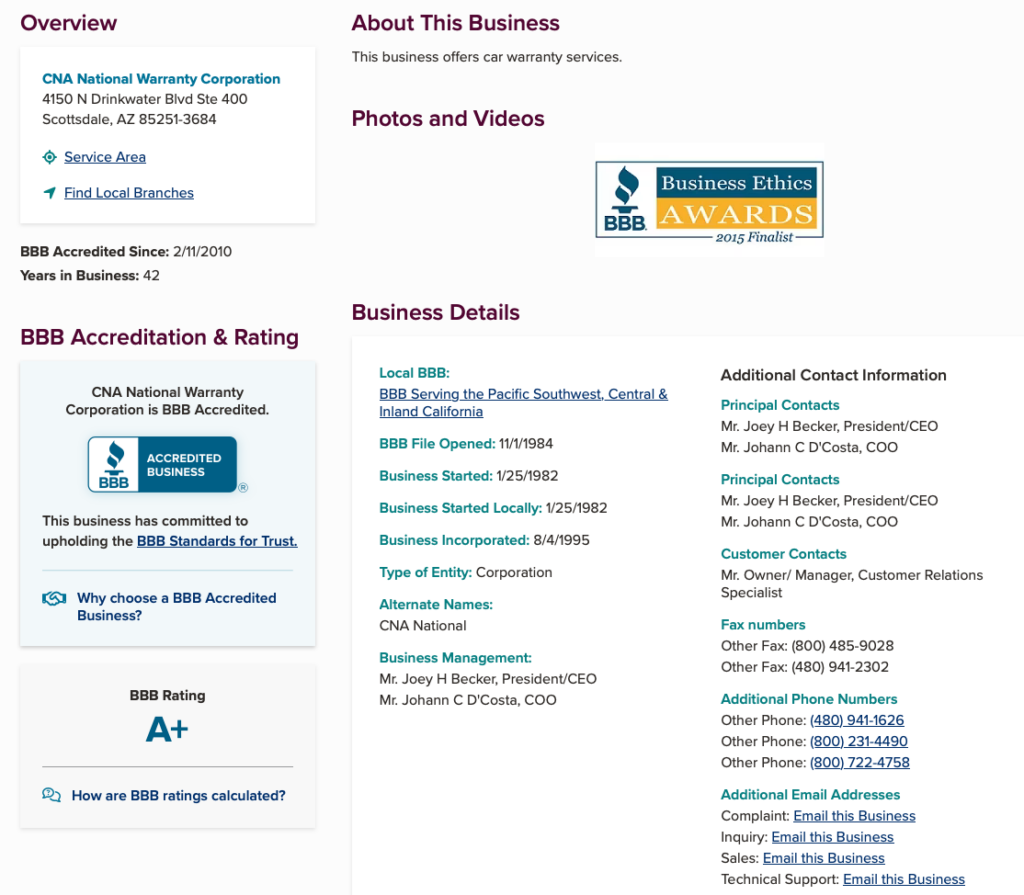

Do some research before signing on the dotted line. The better business bureau is a great place to start. Let’s look at CNA:

CNA has committed to upholding the BBB standards for trust and it has an A+ rating. That’s a good start, but make sure the company is financially sound and check out some reviews.

Amazon’s protection plan for the Fire TV Stick is offered by Allstate. I’d look into them a bit before paying the $4.49 for protection.

This may sound like crazy talk, but if we’re paying for a benefit, we want to know that the company that we are contracting with is reputable and financially stable. Maybe not so important for the Fire Stick, but quite important for the car warranty. And if it’s not that important for the Fire Stick, maybe we don’t need the warranty?

What are the Details

What’s covered?

Will they cover that expensive infotainment system? Will they pay for a rental car if my car is in the shop for an extended period? Can I bring it to my own mechanic who I trust or do I need to bring it to a specific repair shop?

Get a copy of the contract. Know exactly what you’re paying for. Some plans cover maintenance, like oil changes. Do you need that? Is that worth paying extra for? And if it’s included, make sure you get the free oil change.

What do I need to do to keep the contract in force? What happens if I decide to skip the brake flush that is specified in the owner’s manual? Is my contract now null and void? Worse yet, what if I forget? Do I need to keep receipts to prove I’ve had all services done? And I typically do my own oil change to save money. Is that OK?

We’ll pay a lot of money for this protection. If we choose to do so, we need to be sure we understand the commitments we’ve made to keep the contract in force.

And we’ll want to understand what all the benefits are and how we take advantage.

Is This A Good Financial Decision?

That’s the tough question. If a buy a 5 year contract and my car has no problems, did I make a bad decision? Hard to say.

If I skip the contract and my infotainment system dies and it costs me $3,000 to fix it, it is pretty clear that I made a bad financial decision.

Unfortunately, as with most financial decisions, certainty comes after the fact.

For me, the decision is about whether I need to insure myself against a potential catastrophic loss. I can’t afford to pay for a $2,000 repair in addition to the $800 I’m paying for my car loan. The result is my car sits broken in my driveway and I need to get a ride to work.

Or, in my case, I don’t work, and my wife and I could share a car. She’s retired as well. I could let it sit while I save up to pay for the repair.

What are the Cost Implications?

Carmax does a nice job of showing the potential cost of the plan compared to the costs of some common repairs.

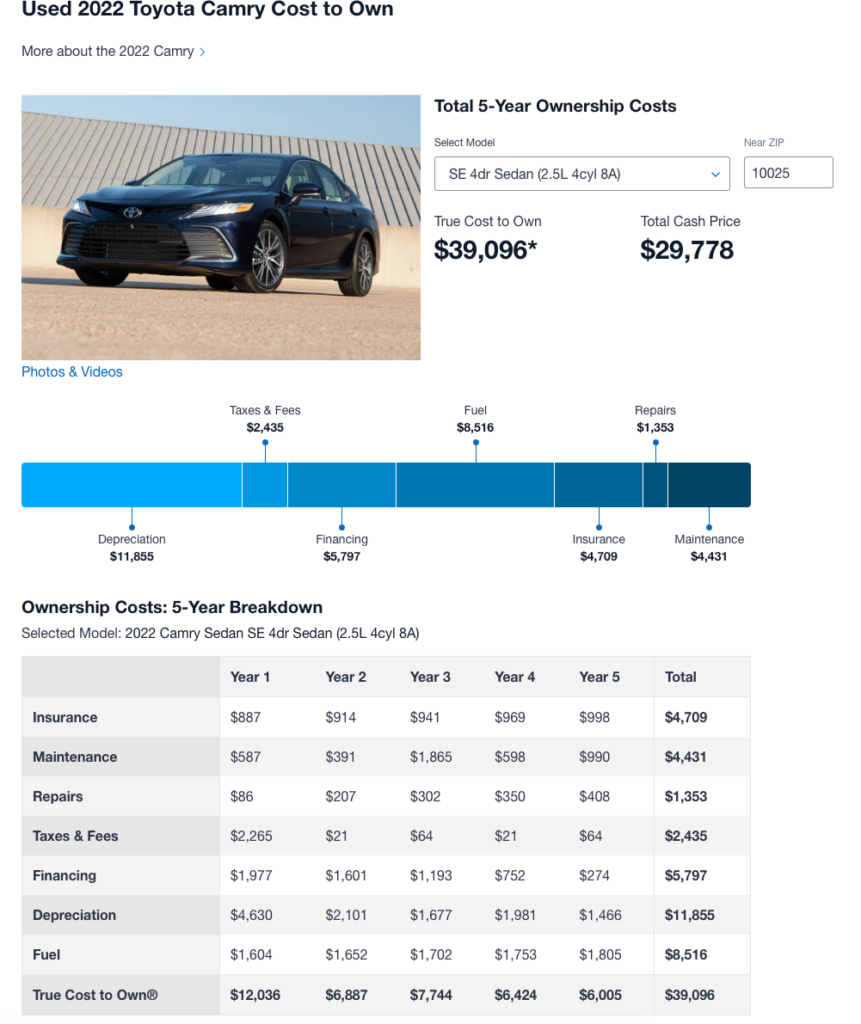

When I had customers who were struggling with this decision, we’d search for the total cost of ownership for their vehicle and compare it to the cost of the warranty. Here’s an example from edmunds.

I’d look at the repair line. Over the next 5 years, I’m likely to spend $1,353 in repairs. What would I pay for a 5 year extended warranty?

Cost/Benefit

Looking at a reliable car like a Toyota Camry, it may not be worth it. But, having driven a BMW for the last 20 years, I wouldn’t even think about buying one without an extended warranty.

Edmunds will tell you the 5 year repair cost on a used BMW 5 series is $7,625. And remember that is an average. Many owners have no, or low repair costs. I had to replace a leaking gasket once and it cost me $1,500. I can’t imagine what a transmission, infotainment or engine problem would cost, but those quickly approach the catastrophic level.

Wrap-Up

Aside from a vehicle, where the repair and replacement costs can be huge, for me, I am very unlikely to purchase any sort of protection plan.

And because a vehicle repair expense can set me back significantly, I’m more likely to purchase one.

But before I do, I make sure I understand the terms. With BMW, I like their certified pre-owned program. I have bought several certified pre-owned cars which come with an extended dealer warranty. I have had several major items repaired at no charge and I feel like it is worth the additional cost. The extended warranty comes with the vehicle, but I could get the same vehicle at a 3rd party used car dealer (without the extended warranty) for less.