I was watching a YouTube video by Hugh Hewitt called Hugh’s “Hierarchy of Trouble” and why you should flee Fidelity Investments.

My wife mentioned to me that we may want to consider leaving Fidelity because of this clip she watched. She admitted she didn’t watch the whole clip but I said I’d look into it.

A Long and Winding Road

I love the Beatles version, but not so much for the Hugh Hewitt version. This video is 10 minutes and 36 seconds. It starts with a statement that this particular problem is low on the hierarchy of trouble for him, but it could be higher for others.

Next comes a lengthy discussion of the hierarchy of trouble which covers worrying about teenagers on bikes doing wheelies, irritants like his Fidelity experience, crises like an illness, and then tragedies like the plane crash in Washington DC.

Finally he describes his interactions with Fidelity, which seem to consist of some scripted and unhelpful phone support, long wait times on the phone to close accounts, and perceived threats in the communication from Fidelity.

The threats seem to have come in the letters he received in the mail as well as in the phone communication with the Fidelity rep. The letter informed him that his accounts could become unclaimed property and be taken by the state and he needed to call within 30 days. The rep used some language that sounded threatening.

I recommend you listen to the YouTube clip to get the full context.

Recap:

There is a lot here, so let’s take a quick recap.

- Hugh got a letter regarding his accounts being classified as unclaimed property and he needed to respond within 30 days

- Hugh contacted Fidelity about the letter and was unhappy with the responses given

- Hugh decided to close accounts with Fidelity over the phone and was unhappy with the inefficiency of the process

Should I Flee Fidelity?

Back to my wife’s question after seeing a few minutes of the video. Do we need to get out of Fidelity? Are our assets at risk of being taken by the state?

I don’t think so, and let’s go through why.

Escheatment

I have a handful of sites I use to get information, the balance is one of them. Here’s what they say about escheatment.

Investopedia says:

Summary of Escheatment Facts

- When money lies dormant in a deposit account, and the financial institution is unable to make contact with the owner, the financial institution can’t keep the money

- The financial institution must turn the money over to the state for safe-keeping

- The rules vary by state and account type

- Each state, as well as websites like unclaimed.org and missingmoney.com offer the ability to search for unclaimed assets

What Does Fidelity Have to Say?

I checked the Fidelity website to see what they had to say about this. You can see for yourself here.

The page begins with.

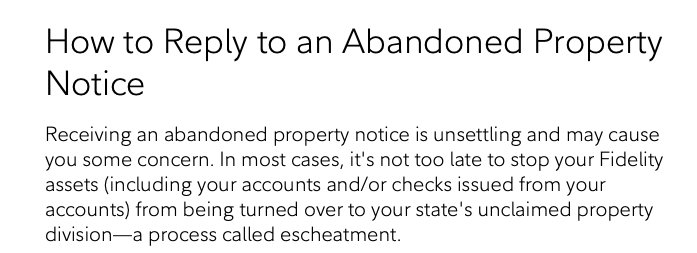

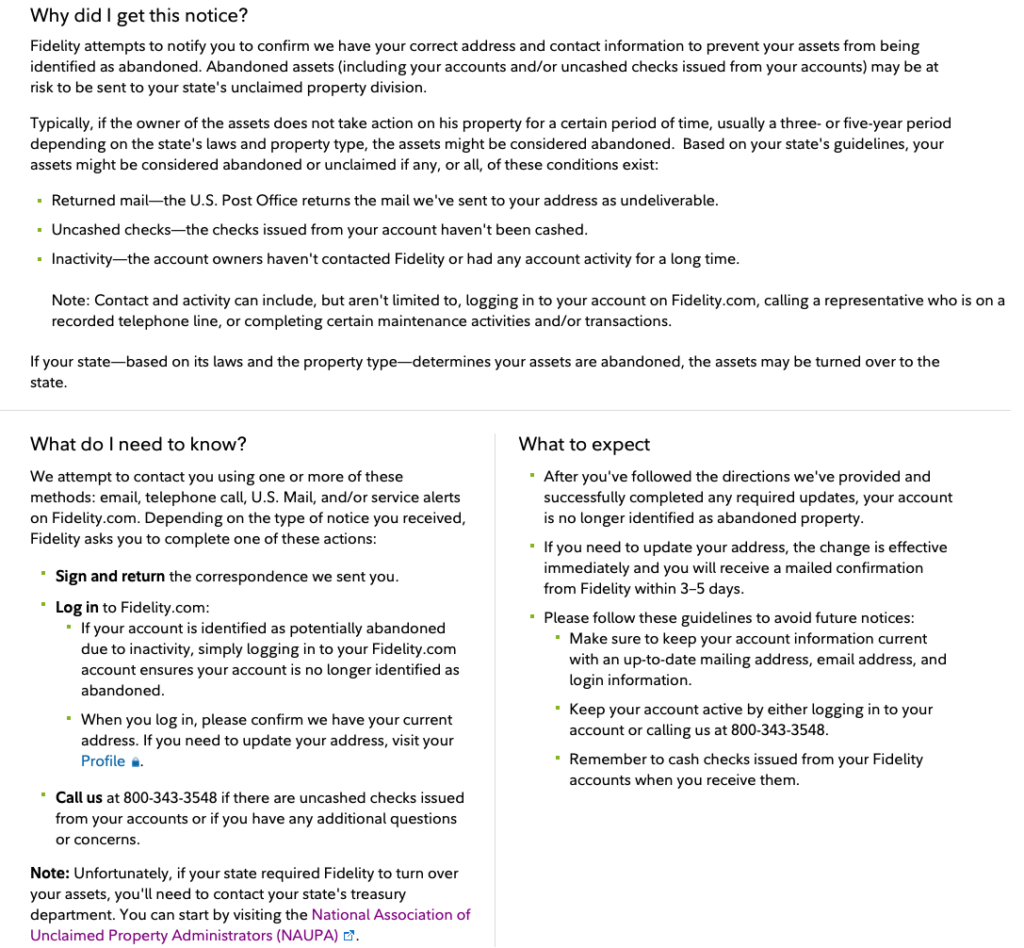

The page goes on to describe how things like returned mail, uncashed checks and inactivity can flag an account as abandoned. Rather than paraphrasing, I’ll show you what they have to say.

Why Would Fidelity Do This To Me?

Hugh says that he’s been a customer for many years, why would he be treated this way by Fidelity? He also says he’s a lawyer and that he doesn’t think there are laws requiring the turnover of assets to the state.

I am not a lawyer and I can only go by what I’ve read but it seems clear that there are rules to ensure abandoned assets are turned over to the state. Fidelity seems to be transparent about how this works.

I also wondered whether other banks and brokerages had similar policies.

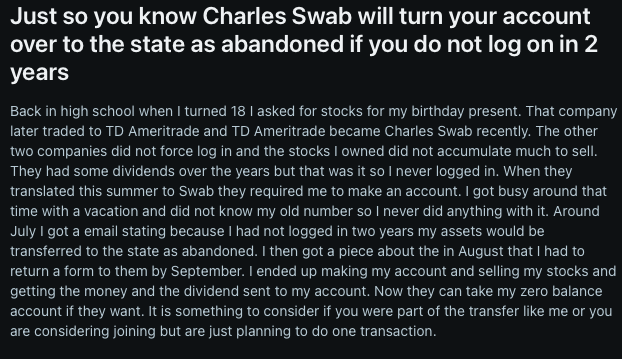

I couldn’t find an explicit policy on the Schwab website, but I did find an angry redittor who had an experience with this. Read here.

And again, no explicit policy that I could find for Vanguard, but I saw a post about it on the bogleheads forum.

So looks like all the kids are doing it.

How Long Do I Have to Get It Back?

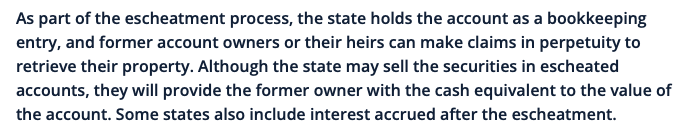

Let’s say that my account is flagged as abandoned and the property is turned over to the state. How long do I have to get it back?

According to investor.gov, there is no time limit. See below:

Wrap-Up

So I learned a lot about escheatment today.

- Financial institutions are required to monitor accounts and turn over assets in abandoned accounts to the state

- The state keeps these assets and will disburse them to the owner if they can make a valid claim

- There is no time limit on making a claim

- There are a number of websites people can visit to search for abandoned assets to aid them in making a claim

The big area of confusion I see in the posts and the YouTube video is the perception that these assets are forfeited once the state takes them. While I have a healthy suspicion of all government entities, from what I’ve read, this process seems to work. Asset recovery may be a topic for another day.

So, I don’t see any compelling reason to flee Fidelity Investments. The escheatment process seems to be similar whether my assets are at Fidelity, Schwab, or Vanguard, or any other financial institution.

I tend to log in regularly so I’ve never gotten a letter about pending escheatment, but I’m confident that I could recover assets from Massachusetts if ever one of my accounts went dormant and my financial institution were unable to contact me and turned the assets over to the state.

Customer Service

Hugh makes a number of comments about the customer service he received. Clearly he wasn’t pleased with the canned response on the abandoned accounts, or on the difficulty in closing his accounts. While Fidelity is very clear that “Receiving an abandoned property notice is unsettling,” Hugh feels that the interaction was poor and the statements made by Fidelity were threatening. He recommends we get out of Fidelity because it is run by machines.

I’m not sure exactly what he went through, but I fully understand poor customer service and I would support anyone’s decision to take their business elsewhere if they feel they are being treated poorly.

But that said, I feel like saying that we should all flee Fidelity Investments is a bit of over-reach.

Final Note

In the spirit of transparency, I want readers to know that I worked at Fidelity Investments for 19 years. I retired in 2020.

While I am no longer affiliated with Fidelity in any way and I don’t receive any compensation from them, my wife and I have brokerage and retirement accounts at Fidelity.

Those who have read the about page and have looked at my linkedin profile may be aware, but for those who haven’t, I wanted to be sure you knew.

Final Final Note

I went to unclaimed.org and found missing assets for myself, my mom and my wife. I submitted a request online and got a reply email from the Massachusetts state treasury with next steps. Oh boy!

I’ll keep you updated.

Good read & informative, thanks for sharing!